Coenzyme Q10 Market Outlook:

Coenzyme Q10 Market size was valued at USD 785.9 million in 2025 and is likely to cross USD 2.13 billion by 2035, registering more than 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coenzyme q10 is assessed at USD 860.17 million.

The coenzyme Q10 market has gained significant traction globally, assisted by the regulatory framework and policies implemented by government organizations. For instance, in September 2024, BPGbio, Inc., announced that the U.S. Food and Drug Administration (FDA) has granted Rare Pediatric Disease designation for BPM31510IV, the company's investigational treatment for primary coenzyme Q10 (CoQ10) deficiency. In addition, the advancements that supplements made in formulations to improve bioavailability with growing applications of CoQ10 from dietary supplement functional food place it at a higher spot in the health and wellness sector.

The coenzyme market has gained much traction lately owing to increased consumer awareness of preventive health. This has further spurred demand for natural supplements such as CoQ10 that increase energy, support cardiovascular function, and reduce oxidative stress. For instance, in July 2022, a meta-analysis of twenty-one randomized clinical studies in Frontiers Pharmacology argued that the use of Coenzyme Q10 as a supplementary treatment reduces the incidence of oxidative stress in many diseases. Besides, research has been adequate in establishing the therapeutic applications of CoQ10 in managing heart diseases and neurodegenerative disorders which contributes to higher credibility in its usage among clinical markets and the consumer market as well.

Key Coenzyme Q10 Market Insights Summary:

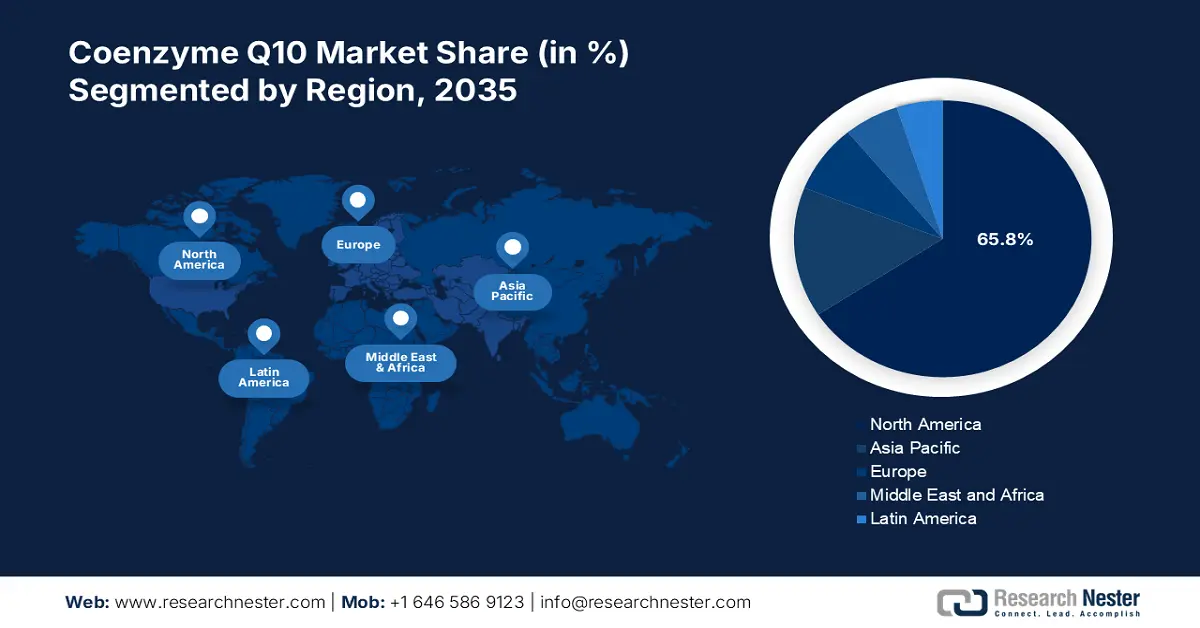

Regional Highlights:

- North America holds a 65.8% share in the Coenzyme Q10 Market, Cocoa, driven by technological advancements in Coenzyme Q10 production and increasing consumer focus on preventive medicine, fostering strong growth through 2035.

Segment Insights:

- The Dietary Supplements segment of the Coenzyme Q10 Market is forecasted to capture over 53% share by 2035, propelled by increasing consumer focus on preventive health and natural wellness.

Key Growth Trends:

- Increased focus on sports and nutrition

- Rising incidences of chronic disease

Major Challenges:

- Limited clinical evidence

- Consumer skepticism

- Key Players: Country Life, LLC, Natural Organics, Jarrow Formulas, NOW Foods, Pharma Nord, Inc., Doctor’s Best.

Global Coenzyme Q10 Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 785.9 million

- 2026 Market Size: USD 860.17 million

- Projected Market Size: USD 2.13 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (65.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: China, India, Brazil, Mexico, Japan

Last updated on : 13 August, 2025

Coenzyme Q10 Market Growth Drivers and Challenges:

Growth Drivers

- Increased focus on sports and nutrition: The growth in the coenzyme Q10 market is propelled due to the increased interest shown by athletes and fitness fanatics. This demographic group uses such supplements as they maximize endurance, reduce fatigue, and speed recovery after exercise. For instance, in December 2023, a newly published, ex-vivo study showed that CoQ10 Phytosome, Indena's UBIQSOME, presented scientific evidence for improving CoQ10 muscle absorption following oral administration. The only product available that could successfully improve both plasmatic and muscle CoQ10 levels after exercise. Thus, marketing strategies and innovative formulations and driving market expansion in sports-related health products.

- Rising incidences of chronic disease: A critical growth driver for the market, is the increasing recognition of its potential therapeutic benefits in managing chronic health issues such as cardiovascular issues and cancer. Across the world, the incidences related to chronic diseases are unfolding threats, thus spurring the need for such supplements for better healthcare and well-being. For instance, the journal of geriatric cardiology article that was published in June 2023, estimates that about 330 million people in China suffer from cardiovascular diseases, including 13 million strokes, 11.39 million coronary heart disease, 8.9 million heart failure, and 5 million pulmonary heart disease.

Challenges

- Limited clinical evidence: The market is further challenged by the lack of solid clinical evidence on its efficacy and safety in treating health conditions. This lack of robust clinical data deters the standardization of dosing guidelines and even regulatory approvals, thus directly affecting consumer confidence and market growth. As evidence-based practice among healthcare professionals increases, a demand for more rigorous clinical trials to validate the therapeutic benefit of coenzyme Q10 emerges, which is essential to move its acceptability in clinical as well as consumer markets.

- Consumer skepticism: A significant challenge for the market, mainly fueled by the spread of conflicting information about its benefits and effectiveness. Many potential consumers are skeptical about investing in dietary supplements because of doubts over marketing claims, especially in comparison with limited clinical evidence and different product quality. This skepticism is further exacerbated by anecdotal reports and unregulated endorsements that could easily mislead consumers. It is therefore critical that manufacturers gain trust through communication, without scientific validation, and adherence to quality standards.

Coenzyme Q10 Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 785.9 million |

|

Forecast Year Market Size (2035) |

USD 2.13 billion |

|

Regional Scope |

|

Coenzyme Q10 Market Segmentation:

Application (Dietary Supplements, Pharmaceuticals, Cosmetics, Others)

Dietary supplements segment is expected to capture over 53% coenzyme Q10 market share by 2035. Consumers are increasingly becoming keen on preventive health measures and natural wellness solutions. Hence, an active approach towards health implies that people are looking forward to dietary supplements that boost energy levels, support heart health, and fight against oxidative stress. For instance, in July 2023, Boryung Consumer Healthcare, a subsidiary of Boryung, introduced Q10 Max soft gel dietary capsules. The product contains Coenzyme Q10 100 mg as a functional ingredient for the homeostasis of antioxidant activity. Due to the varied formulations, suitable for all users' requirements, ensure dietary supplements remain the prime market application.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coenzyme Q10 Market Regional Analysis:

North America Market Statistics

North America in coenzyme Q10 market is expected to account for more than 65.8% revenue share by the end of 2035. Further, the growth in the technological advancements of Coenzyme Q10 production, formulation, and delivery systems are also driving the market growth. In addition, antioxidant properties and their ability to control cellular damage and enhance skin and overall health are fueling the market growth. Besides, the regional focus on preventive medicine along with the increased consumption of supplements is also expected to fuel the growth of the market across the region.

The U.S. market is exponentially growing attributable to its focus to pursue growth opportunities and value creation for its consumer healthcare business. In addition, it strives to create a strong market retention base by serving the growing needs of the market. For instance, in July 2023, Sanofi announced entering into a definitive agreement to acquire ownership of Qunol. This transaction will strengthen Sanofi’s Consumer Healthcare’s (CHC) Vitamin, Mineral, and Supplements (VMS) category, one of the largest and fastest-growing consumer health categories in the U.S., focusing on the active ‘healthy aging’ segment.

Canada coenzyme Q10 market is growing at a rapid pace, owing to the growing advancement in biomedical sciences especially in coenzyme Q10 to improve healthcare aids. In addition, partnerships between research institutes, companies, academia, and tech companies are fostering the landscape of coenzyme Q10 within the country. For instance, in September 2021, McGill University announced a license agreement with Clarus Therapeutics Holdings, Inc. to develop and commercialize a proprietary technology from McGill intended for the treatment of diseases or conditions associated with CoQ10 deficiency in humans.

Asia Pacific Market Analysis

The Asia Pacific coenzyme Q10 market is growing rapidly and is unfolding growth opportunities in various applications of coenzyme Q10. Moreover, several macroeconomic factors such as the growing geriatric population, growing GDP per capita, growing disposable income, and increasing per capita health care expenditure in the region are expected to drive the growth in this region over the forecast period. In addition, the growing use of coenzyme Q10 by pharmaceutical companies has helped the region reap advantages in diverse applications of coenzyme Q10.

China market will witness robust growth owing to its exceptional R&D capabilities in healthcare settings. Furthermore, these are being internationally recognized thus, pushing the country’s standard further onto the international stage, contributing significantly to the nutritional health food ecosystem. For instance, in July 2024, it was revealed in the study of the Health Products Association China that the Coenzyme Q10 gummies standard formulated by Sirio Health has successfully passed the review of United States Pharmacopeia and will be implemented officially globally. This is the 1st company from the country to participate in USP dietary supplement standards and achieve a milestone.

An upward indication for the growth of the market in India is predominantly due to the small-scale manufacturers in addition to the rising demand for cosmetics in the country. Furthermore, favorable regulatory guidelines with a positive outlook towards personal care product application are anticipated to drive coenzyme Q10 demand during the forecast period. Moreover, the rising awareness about the benefits of eye care and the treatment of cognitive diseases is expected to provide lucrative opportunities over the forecast period.

Key Coenzyme Q10 Market Players:

- Natural Organics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DSM

- SourceOne Global Partners, LLC

- Healthy Origins

- Vitamin Shoppe, Inc.

- NBTY, Inc.

- Pharmavite LLC

- QUTEN Research Institute LLC

- Tishcon Corp.

- Country Life, LLC

- Natural Organics

- Jarrow Formulas

- NOW Foods

- Pharma Nord, Inc.

- Doctor’s Best

- Xiamen Kingdomway Group

- GNC Holdings, Inc

- Nordic Naturals, Inc.

The companies in the coenzyme Q10 market have shaped the landscape of CoQ10 usage and its efficiencies through their continuous efforts toward innovation and discoveries. For instance, in April 2024, Beiersdorf announced that it had pioneered an anti-aging serum, Nivea Q10 dual action serum. Hence, the competition is high in the market due to industry fragmentation combined with price-based competition which is likely to influence demand for products over the foreseeable future.

Here's the list of some key players:

Recent Developments

- In December 2024, SCINQ Nuerocosmetics launched innovative formulations in various cream ranges that include clinically validated neuro ingredients that blend plant-based botanicals with advanced chemical science. The company addresses these concerns with tailored technology specifically for Indian skin.

- In December 2023, Bausch and Lomb announced the US launch of PreserVision AREDS 2 Formula soft gels plus coenzyme Q10. A first of its kind, this formula combines the nutrient formula recommended by the NEI to help reduce moderate to advanced AMD progression from AMD patients with CoQ10 to help support heart health.

- In January 2022, DSIM Nutritional Products, unrivaled nutritional science expertise innovated an enzyme and integrated it into the food & beverage operation structure. It has consolidated DSM's three nutrition areas i.e. food specialties, hydrocolloids, and nutritional products.

- Report ID: 6882

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coenzyme Q10 Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.