Coating Thickness Gauge Market Outlook:

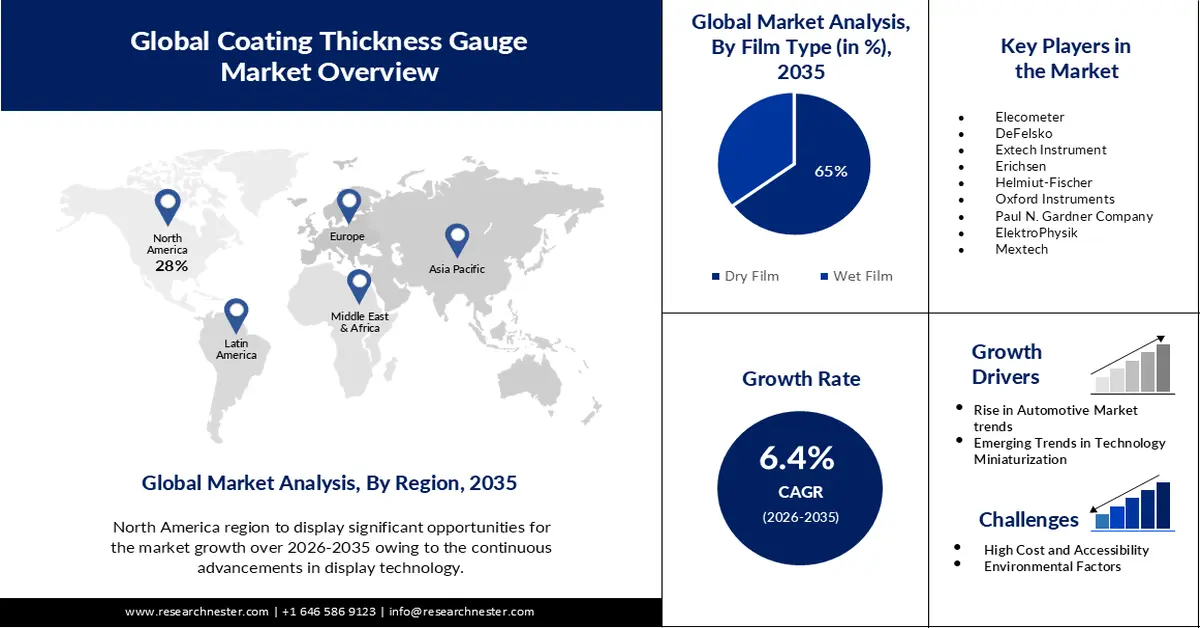

Coating Thickness Gauge Market size was over USD 661.91 million in 2025 and is poised to exceed USD 1.23 billion by 2035, growing at over 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coating thickness gauge is estimated at USD 700.04 million.

The market growth is owing to factors like increased thin film usage in various industries such as electronics, automotive, packaging, and medical devices. The semiconductor sector, in particular, has driven demand for precise film thickness monitoring instruments as integrated circuits and electronic components become smaller and more intricate. Furthermore, new gauges offer remarkable accuracy exemplified by models like Elecometer 456 which can achieve an impressive accuracy of +/- 2.5µm or 1.3% and deliver up to 70 readings per minute enhancing efficiency and productivity in various applications

In addition to these, rising attention to quality control and product performance has led to a surge in demand for advanced coating thickness monitoring tools. Manufacturers recognize the pivotal role of film thickness in product functionality and durability, driving the need for accurate measurement solutions to enhance competitiveness and ensure superior quality.

Key Coating Thickness Gauge Market Insights Summary:

Regional Insights:

- By 2035, North America is projected to secure a 28% share in the coating thickness gauge market, supported by advancements in high-resolution display technologies and rising adoption of connected vehicles.

- By 2035, the Asia Pacific region is expected to attain a 21% share as stringent corrosion-prevention requirements in coastal environments intensify the reliance on precise coating thickness measurement systems.

Segment Insights:

- By 2035, the dry film segment in the coating thickness gauge market is anticipated to command about 65% share, bolstered by its broad industrial utilization and the increasing emphasis on quality control in protective coating applications.

- The semiconductor segment is projected to hold nearly 25% share by 2035, underpinned by the essential need for accurate layer-thickness measurement across critical semiconductor fabrication processes.

Key Growth Trends:

- Rise in Automotive Industrial Trends

- Emerging Trends in Technology Miniaturization

Major Challenges:

- High Cost and Accessibility

Key Players: Elecometer, DeFelsko, Extech Instrument, Erichsen, Helmut-Fischer, Oxford Instruments, Paul N. Gardner Company, ElektroPhysik, Mextech, Rex Durometers.

Global Coating Thickness Gauge Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 661.91 million

- 2026 Market Size: USD 700.04 million

- Projected Market Size: USD 1.23 billion by 2035

- Growth Forecasts: 6.4%

Key Regional Dynamics:

- Largest Region: North America (28% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 28 November, 2025

Coating Thickness Gauge Market - Growth Drivers and Challenges

Growth Drivers

- Rise in Automotive Industrial Trends: The increase in competition within the automobile industry, coupled with the emergence of new market entrants, has led to a shift in customer preference towards used vehicles. This trend is further fueled by the enhanced quality and reliability of pre-owned cars, which has consequently boosted both the used vehicle and coating thickness gauge markets. Reports show that the used cars industry grew from 932 billion in 2021 to around 997 billion USD in 2022 worldwide. Furthermore, contrary to previous years, today’s buyers and inspectors evaluate a vehicle’s value based on the quality of its paint finish and validate its reported history. Consequently, there has been a growing reliance on digital and electronic coating thickness gauges among buyers.

- Emerging Trends in Technology Miniaturization: The surge in technology miniaturization and cost optimization drives the demand for coating thickness measurement solutions. Critical in various industries, these measurements ensure thin material layers meet quality standards, serving purpose like insulation, wear resistant and diffusion barriers. Vital for specific applications, accurate film thickness measurements are essential to achieve the intended functionality. Additionally, advancements in sensor technology and data analytics are enhancing the capabilities of these gauges, enabling real-time monitoring and analysis of coating thickness across various industries. Overall, the trend toward technology miniaturization is driving innovation in the coating thickness gauge market, leading to more efficient and reliable solutions for quality control and process optimization.

Challenges

- High Cost and Accessibility: High costs associated with advanced coating thickness gauges can be a barrier to adoption, particularly for small businesses. Improving affordability and accessibility while maintaining quality and accuracy is a challenge for manufacturers in the coating thickness gauge market.

- Environmental factors such as temperature, humidity, and surface roughness can affect coating thickness measurements. Ensuring reliable performance of coating thickness gauges under varying environmental conditions is a challenge.

- Maintaining accuracy and consistency in coating thickness measurements is essential for quality control and compliance with industry standards, which sometimes can be hard and time-consuming.

Coating Thickness Gauge Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 661.91 million |

|

Forecast Year Market Size (2035) |

USD 1.23 billion |

|

Regional Scope |

|

Coating Thickness Gauge Market Segmentation:

Coating Type Segment Analysis

The dry film segment in the coating thickness gauge market is estimated to gain the largest revenue share of about 65% during forecast period. The segment growth can be attributed to the widespread applications in industries such as packaging, electronics, automotive, and aerospace. The versatile use of dry films across multiple sectors is poised to bolster its market share. Furthermore, dry films serve as coatings for various functional purposes, including anti-reflective coatings and corrosion protection. The demand for film thickness measuring instruments tailored for dry films is propelled by the necessity for stringent quality control in coating applications. The dry film thickness is the most essential measurement made during the implementation and examination of protective coating and gauges like the CES-103 DFT has been crucial in the field, with the measuring range of 0 to 2000 µm and accuracy of+/- (3%+ 1µm) and the highest resolution is up to 0.1 µm. CES-103 with only one button, and it’s easy to use.

End Users Segment Analysis

The semiconductor segment in the coating thickness gauge market is estimated to gain a significant share of about 25% by 2035. This can be attributed to its critical role in producing integrated circuits (ICs) and other semiconductor devices. The revenue in the semiconductor industry in the US is estimated to reach 78 billion USD by the end of 2024. Accurate control over layer thickness is imperative for semiconductor manufacturing processes including photolithography, deposition, and etching. The precise measurement of film thickness is indispensable for ensuring the quality and functionality of semiconductor components.

Our in-depth analysis of the global coating thickness gauge market includes the following segments:

|

Type |

|

|

Technology |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coating Thickness Gauge Market - Regional Analysis

North American Market Insights

Coating thickness gauge market in North America region is anticipated to hold the largest revenue share of about 28% by the end of 2035. The market growth can be attributed to continuous advancements in display technology often led to the development of high-resolution panels with pixel densities that demand precise control over layer thickness. Instruments for measuring film thickness play a vital role in ensuring uniformity and consistency in this state-of-the-art display. Besides that, the rise of connected cars and intelligent transportation systems further boosts regional coating thickness gauge market growth. According to reports connected cars are advancing technologically and becoming more powerful, it is estimated that by 2027 around 176 million US drivers will be using connected cars. Additionally, with the increasing demand from the medical sector and significant advancements in semiconductor manufacturing are anticipated to fuel further growth in the regional market.

APAC Market Insights

The Asia Pacific coating thickness gauge market is estimated to the second largest, revenue share of about 21 % by the end of 2035. Asia Pacific is recognized for its diverse environment, encompassing humid and coastal areas where corrosion of car components is a significant concern. And most of Southeastern Asia Pacific being a coastal region, countries like India losses worth USD 110 Billion occur every year due to corrosion in projects across different sectors. To ensure adequate protection, coatings applied to vehicles for corrosion prevention must undergo precise thickness control, highlighting the critical importance of film thickness measurement equipment. As automobile production increases, so does the need for thicker and more durable coatings to protect the vehicles from corrosion. According to the China Association of Automobile Manufacturers (CAAM), vehicle sales and production in China reached 2.556 million and 2,383 million units as of December 2022.

Coating Thickness Gauge Market Players:

- Elecometer

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DeFelsko

- Extech Instrument

- Erichsen

- Helmut – Fischer

- Oxford Instruments

- Paul N. Gardner Company

- ElektroPhysik

- Mextech

- Rex Durometers

Recent Developments

- Elcometer supplied the Royal Navy with a number of digital Inspection kits, distributed across Portsmouth & Devonport naval bases. The digital inspection kits, which include surface profile, dry film thickness and climatic condition gauges were required to be included within the new anti-corrosion containers.

- Helmut and Ficher GmbH released its new revolutionary DMP instrument series for tactile and non-destructive coating thickness measurement. With the new DMP instrument, they are putting an exclamation mark on tactile and non-destructive coating thickness measurement of magnetizable and non-magnetizable base materials. The DMP instruments feature a robust and modern design and are equipped with digital probes and new software for comprehensive evaluations.

- Report ID: 5802

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coating Thickness Gauge Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.