Coated Abrasives Market Outlook:

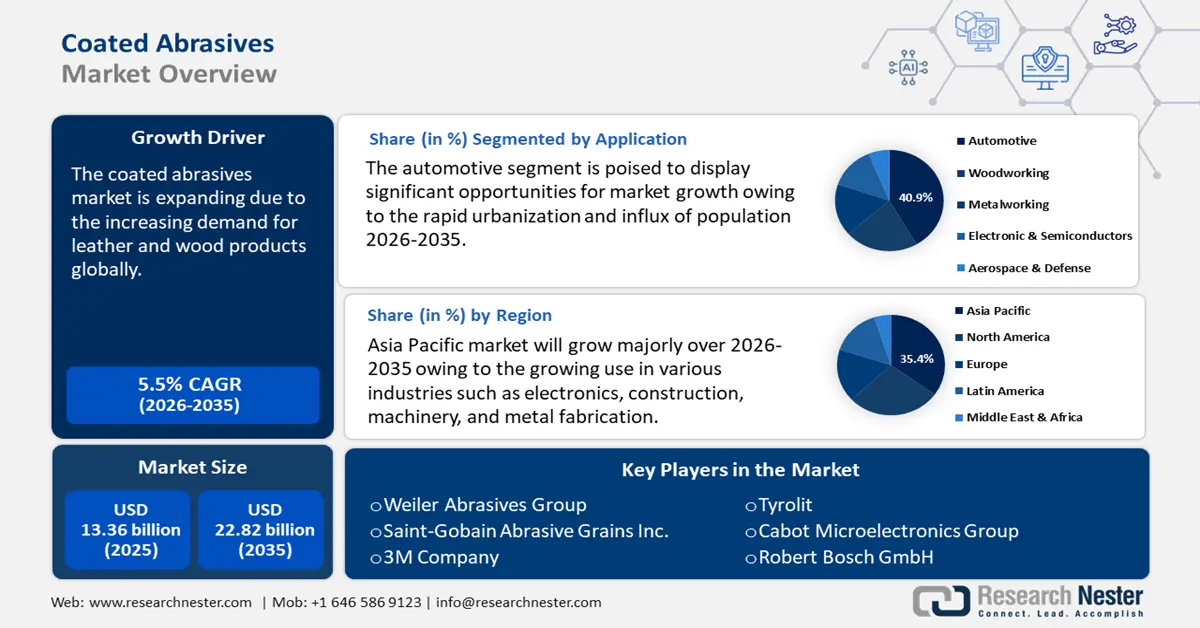

Coated Abrasives Market size was valued at USD 13.36 billion in 2025 and is expected to reach USD 22.82 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coated abrasives is evaluated at USD 14.02 billion.

The coated abrasives market is expanding due to the increasing demand for leather and wood products. Leather and wood products hold significant appeal for consumers who prioritize both quality and affordability, attributed to their esteemed durability and longevity. As time progresses, items crafted from leather, such as handbags and footwear, develop a noteworthy aesthetic evolution, acquiring a rich patina that enhances their overall allure. When appropriately maintained, wooden floors and furnishings can offer sustained performance alongside aesthetic beauty.

Moreover, customers possess the opportunity to assert their individuality through personalized and customized leather and wood products. The increasing popularity of bespoke furniture and tailored woodwork has contributed to a rising demand for these materials. Coated abrasives are instrumental in refining the appearance of wood and leather goods, utilized for processes including finishing, shaping, smoothing, and surface preparation. These abrasives facilitate the achievement of desired surface textures, finishes, and precision detailing, thereby ensuring the production of high-quality and visually appealing end products. A diverse array of coated abrasives enables manufacturers to adapt to evolving customer preferences and meet specific aesthetic requirements.

|

Country |

Export value of Wood Products (USD Billion) |

Country |

Import Value of Wood Products (USD Billion) |

|

China |

20.4 |

U.S. |

35.3 |

|

Canada |

20.1 |

China |

18.1 |

|

Germany |

13 |

Germany |

11.9 |

|

U.S. |

10.6 |

Japan |

11.8 |

|

Russia |

8.21 |

UK |

8.99 |

Source: OEC

According to the Observatory of Economic Complexity with a total trade of USD 188 billion in 2022, wood products ranked as the 18th most traded product globally. Wood product trade accounts for 0.8% of global trade. According to the Product Complexity Index (PCI), Wood Products is ranked 15th.

Key Coated Abrasives Market Insights Summary:

Regional Highlights:

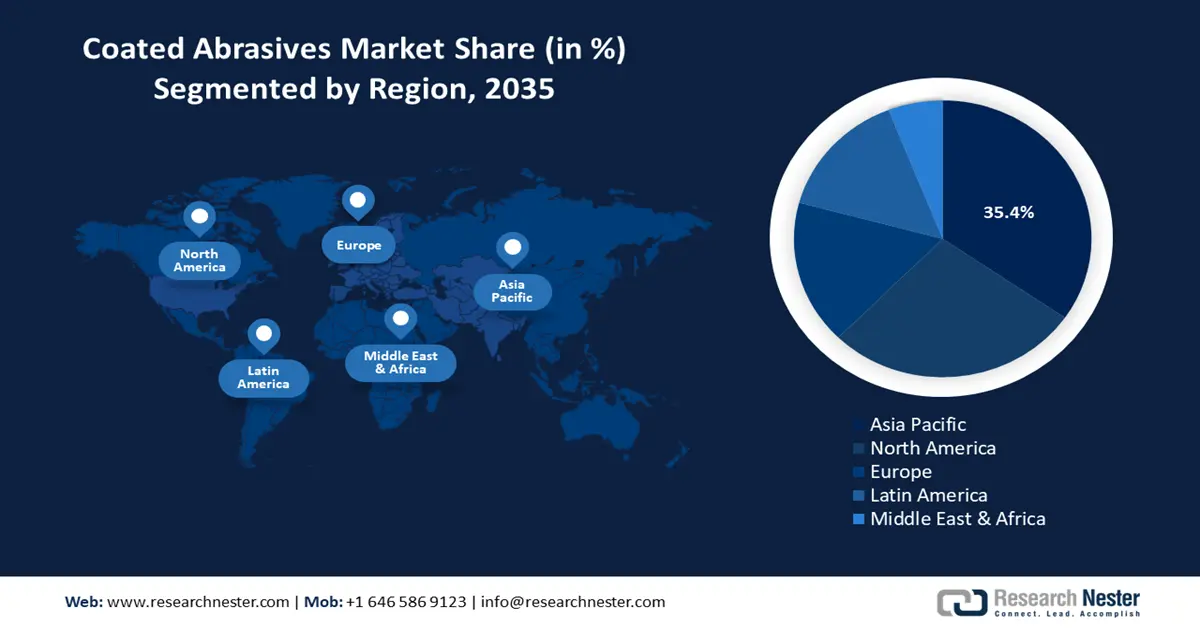

- Asia Pacific leads the Coated Abrasives Market with a 35.4% share, fueled by the region's strong industrial growth, rapid urbanization, and rise in manufacturing activity, supporting robust growth through 2026–2035.

Segment Insights:

- The Aluminum Oxide segment is poised for significant CAGR growth from 2026 to 2035, driven by its widespread use in orbital sanding and superior durability characteristics.

- The Automotive segment is projected to hold a 40.9% share by 2035, driven by rising urban population and increasing demand for transportation.

Key Growth Trends:

- Increased shift towards sustainable manufacturing processes

- Growing technological advancements

Major Challenges:

- Volatile raw material prices

- Improper or inadequate storage

- Key Players: Weiler Abrasives Group, Saint-Gobain Abrasive Grains Inc., 3M Company, Tyrolit, Cabot Microelectronics Group, Robert Bosch GmbH, DEERFOS Co., Ltd., sia Abrasives Industries AG, Carborundum Universal Limited, VSM Abrasives Corporation.

Global Coated Abrasives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.36 billion

- 2026 Market Size: USD 14.02 billion

- Projected Market Size: USD 22.82 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Coated Abrasives Market Growth Drivers and Challenges:

Growth Drivers

- Increased shift towards sustainable manufacturing processes: Sustainable methods and products are being promoted throughout industries by stricter legislation and increased environmental awareness. To comply with these rules, producers of coated abrasives are implementing eco-friendly materials, energy-efficient technology, and sustainable manufacturing techniques. For instance, Imerys, the world’s leading supplier of mineral-based specialty solutions, recently became a member of the Sustainable European Abrasive Manufacturers (SEAM) initiative, which aims to make the abrasive business more sustainable. The Federation of European Producers of Abrasives (FEPA), which represents more than 80% of the European producers of abrasive products, introduced SEAM on January 21, 2020.

Environmentally friendly items are becoming popular. This preference extends to consumer products, automotive, aerospace, and construction sectors that use coated abrasives. Businesses that produce sustainable coated abrasives are taking advantage of this expanding customer base and earning a competitive edge. Consequently, these factors are driving the coated abrasives market statistics. Improved waste reduction, energy efficiency, and resource management are frequently the results of sustainable practices. To achieve long-term cost reductions, such as decreased energy use and material waste, coated abrasive manufacturers are implementing sustainable practices. - Growing technological advancements: Coated abrasives must meet specific performance standards in several industries, including electronics, medical devices, automotive, and aerospace. These sectors require abrasives that provide durability, uniform finishing, and accurate material removal. As a result, producers are creating specialized and high-performing coated abrasives for these sectors. The use of micro-abrasives, precise bonding methods, and customized abrasive grains to improve the performance, efficiency, and surface quality of coated abrasives are some of the most recent developments in the coated abrasives sector.

The trend toward specialty-coated abrasives and excellent performance is facilitated by technological advancements. Consumers are looking for more specialized solutions to satisfy their unique application needs. Specialized coated abrasives with high performance enable modification to meet particular requirements. To meet the varied needs of their customers and increase the revenue from the coated abrasives market, manufacturers are providing flexibility and customization options. Better material removal rates, shorter processing times, and increased productivity are made possible by high-performance coated abrasives. High-volume manufacturing sectors like automotive and aerospace profit from the increased productivity brought about by the use of sophisticated coated abrasives.

Challenges

- Volatile raw material prices: Minerals (like silicon carbide and aluminum oxide), super abrasives (like synthetic diamonds and CBN), and natural abrasives (like garnet and emery) are some of the raw materials used to make abrasives. Several variables, including supply-demand dynamics, mining regulations, and geopolitical instability, can affect the price and availability of these raw materials. Price fluctuations for raw materials will inevitably have an effect on abrasive manufacturing costs, which will then affect product pricing and profitability.

- Improper or inadequate storage: Improper or inadequate storage is a major challenge affecting coated abrasives market growth, as it can lead to technical issues. Coated abrasives play a crucial role across various industries, including pre-engineered buildings, agriculture, and metal fabrication. To ensure their effectiveness and avoid technical problems, proper handling and storage are essential. Fluctuations in temperature and humidity can adversely affect the adhesive bond and backings, resulting in softening or excessive dryness, which can compromise flexibility and alter the product's shape. Two common humidity-related defects that may arise are concave and convex cupping. These issues occur when the backing reacts more quickly than the adhesive bond.

Coated Abrasives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 13.36 billion |

|

Forecast Year Market Size (2035) |

USD 22.82 billion |

|

Regional Scope |

|

Coated Abrasives Market Segmentation:

Type (Aluminum Oxide, Silicon Carbide, Zirconia Aluminum Oxide, Ceramic Aluminum Oxide, Garnet, Emery)

The aluminum oxide segment in coated abrasives market will expand at a significant rate during the projected period. Coated abrasives, particularly those crafted from aluminum oxide, are widely used across various industries due to their remarkable qualities, such as high toughness and long-lasting durability. Aluminum oxide is a synthetic grain derived from bauxite through a fusing process. In sanding applications, coated abrasives that utilize aluminum oxide are favored for tasks such as orbital sanding, where sanding discs, rolls, and sheets come into play. Among these, brown aluminum oxide is the most commonly used grain. Additionally, pure white and pink aluminum oxides, which feature enhanced crystalline structures, are also available, and their usage is expected to grow due to their superior performance characteristics.

Application (Metalworking, Woodworking, Automotive, Electronic & Semiconductors, Aerospace & Defense)

Automotive segment is projected to dominate coated abrasives market share of around 40.9% by the end of 2035. The need for transportation is rising as a result of the world's population growth. As urbanization continues to increase due to the influx of population into cities, there is a corresponding rise in the demand for reliable transportation options. The World Bank Organization reported that approximately 4.4 billion people, or 56% of the world's population, currently reside in cities. By 2050, the urban population is predicted to have more than doubled from its current level, with approximately seven out of ten people living in cities. Given that cities create over 80% of the world's GDP, well-managed urbanization can promote sustainable growth by boosting productivity and creativity. This trend significantly contributes to the growth of the automotive industry.

Maintenance of brake components is a crucial aspect of vehicle upkeep, involving the use of abrasives. Brake discs and rotors are susceptible to issues such as rust formation, uneven surfaces, and glazing deterioration. The optimal performance of braking systems can be achieved through processes such as brake rotor resurfacing and glazing removal, utilizing abrasive wheels, grinding stones, or pads. This factor is anticipated to be a primary driver of growth within the market, particularly with the expanding automotive sector.

Our in-depth analysis of the global coated abrasives market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coated Abrasives Market Regional Analysis:

APAC Market Statistics

Asia Pacific coated abrasives market is projected to hold revenue share of over 35.4% by the end of 2035. The need for coated abrasives is driven by the region's strong industrial growth, rapid urbanization, and rise in manufacturing activity. China, India, and South Korea are examples of emerging economies that are vital to the coated abrasives market's expansion. China, India, and South Korea are the top three exporters of coated abrasives worldwide. With 18,351 shipments, China is the world's top exporter of coated abrasives, followed by India (17,212 shipments) and South Korea (11,166 shipments). Furthermore, the automotive industry, which includes OEM production and the vehicle aftermarket, is a major user of coated abrasives for applications involving metal polishing, finishing, and grinding. The need for abrasives is growing as a result of other industries like electronics, construction, machinery, and metal fabrication.

Furthermore, in China, the need for coated abrasives has grown significantly across some industries, including metal production, agriculture, and pre-engineered buildings. The need for coated abrasives has been fueled by the industrialization and economic prosperity of China. Demand for the electronics sector has increased, due to the rising per capita income and the manufacturing of smartphones, electric vehicles (EVs), and charging stations for EVs. The International Energy Agency reported that, in 2023, there were 8.1 million new electric car registrations in China, a 35% increase over 2022. The overall car market, which expanded by 5% overall but shrank by 8% for conventional (internal combustion engine) cars, was mostly driven by rising sales of electric vehicles.

In India, the coated abrasives market is driving due to its strong industrial base, cost advantages, and ability to produce quality abrasives for diverse applications. Also, the nation has significant reserves of raw materials such as bauxite, silicon carbide, and zirconia, which are essential for abrasive production. This ensures a stable supply chain for export-oriented manufacturing. India shipped 2,113 shipments of coated abrasives between March 2023 and February 2024. These shipments, which were made to 130 buyers by 19 Indian exporters, represented a 14% increase over the previous 12 months. During this time, 151 shipments of coated abrasives were exported from India in February 2024 alone. The U.S., the United Arab Emirates, and Australia purchase the majority of India's exported coated abrasives.

North America Market Analysis

North America coated abrasives market is expected to grow significantly during the projected period. The regional market is accelerating due to the growing demand for products from the automotive, aerospace, and defense sectors. Despite the pandemic-related decline in 2020, the region's renewed focus on EV production and the resumption of aircraft manufacturing operations are expected to support coated abrasives market growth in the future.

In the U.S., there’s an increasing demand for super-coated abrasives in various sectors escalating the market growth. In terms of hardness and durability, diamond and cubic boron nitride (CBN) are super abrasives that perform better than common abrasives like silicon carbide and aluminum oxide. They are ideal for demanding machining and finishing applications in automotive, aerospace, energy, and medical device manufacturing due to their exceptional performance. Therefore, the expansion of these industries will drive the coated abrasives market in the country. According to the International Trade Administration, among all manufacturing sectors, the U.S. aerospace industry continues to generate the largest trade balance (USD 77.6 billion in 2019) and the second-highest volume of exports (USD 148 billion). Hence, the need for sophisticated abrasive materials, including super abrasives, is increasing as these sectors age and demand more accuracy, productivity, and efficiency.

Key Coated Abrasives Market Players:

- Weiler Abrasives Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Saint-Gobain Abrasive Grains Inc.

- 3M Company

- Tyrolit

- Cabot Microelectronics Group

- Robert Bosch GmbH

- DEERFOS Co., Ltd.

- sia Abrasives Industries AG

- Carborundum Universal Limited

- VSM Abrasives Corporation

The coated abrasives market will boom since major players in the industry are significant R&D investments to broaden their product lines. Important market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. coated abrasives market participants are also engaging in a range of strategic actions to broaden their presence. The coated abrasives sector needs to provide affordable products to grow and thrive in a more competitive and expanding coated abrasives market environment.

Recent Developments

- In August 2024, Weiler Abrasives, a leading provider of abrasives and power brushes for surface conditioning, introduced two enhancements to its high-performance Tiger 2.0 cutting, grinding, and combination wheels to meet the needs of demanding metal fabrication industries such as shipbuilding, pressure vessel manufacturing, and heavy equipment fabrication.

- In January 2023, Saint-Gobain Abrasive Grains, a global leader in the design, manufacturing, and distribution of ceramic abrasive materials, is committed to sustainability and has been implementing a Life Cycle Assessment (LCA) plan since 2021. The company released its first Environmental Product Declaration (EPD), which is consistent with its sustainability strategy.

- Report ID: 7071

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coated Abrasives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.