Coal to Liquid Market Outlook:

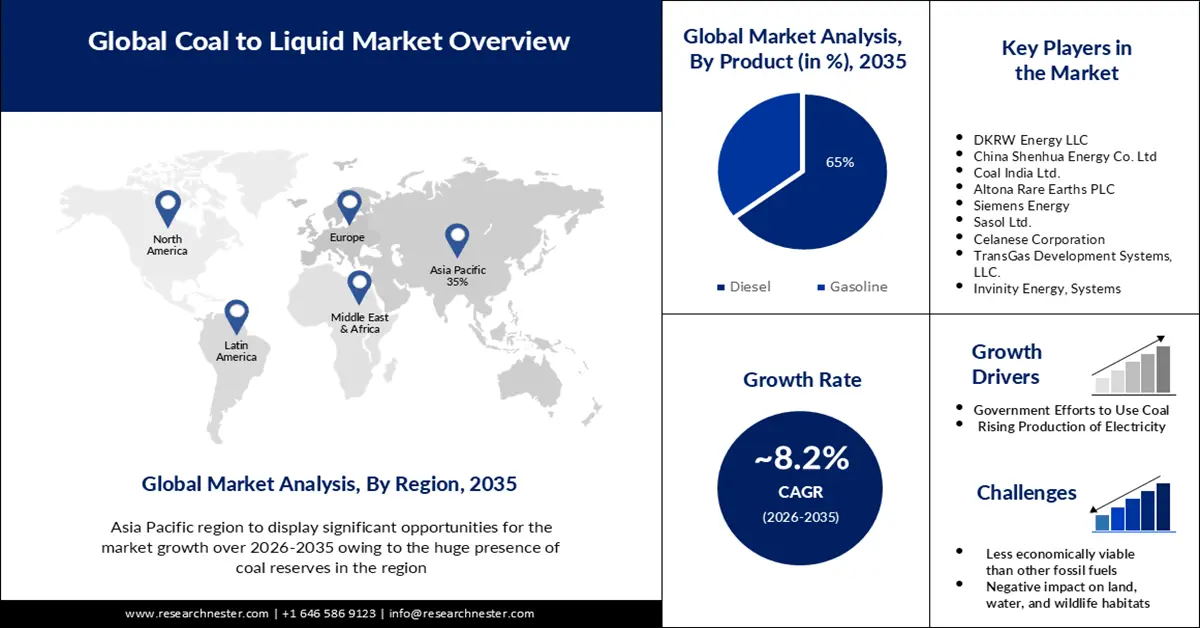

Coal to Liquid Market size was over USD 5.09 billion in 2025 and is projected to reach USD 11.19 billion by 2035, witnessing around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coal to liquid is evaluated at USD 5.47 billion.

The reason behind the growth is impelled by the growing number of automobiles. It is expected that the rising demand for fuel for running the transportation sectors is likely to augment the market growth. It is believed that over 1 billion passenger automobiles cruise the world's streets and roadways today. Moreover, as of April 2023, around 27 million cars have been produced in the world.

The increasing need to lower the carbon footprint is believed to fuel market growth. In comparison to other fossil fuels, coal has much lower carbon emissions thus making it a source of better fuel. Presently the globe emits approximately 50 billion tons of CO2e every year. This is more than 40% more than 1990 emissions, which were estimated to be roughly 35 billion tons.

Key Coal to Liquid Market Insights Summary:

Regional Highlights:

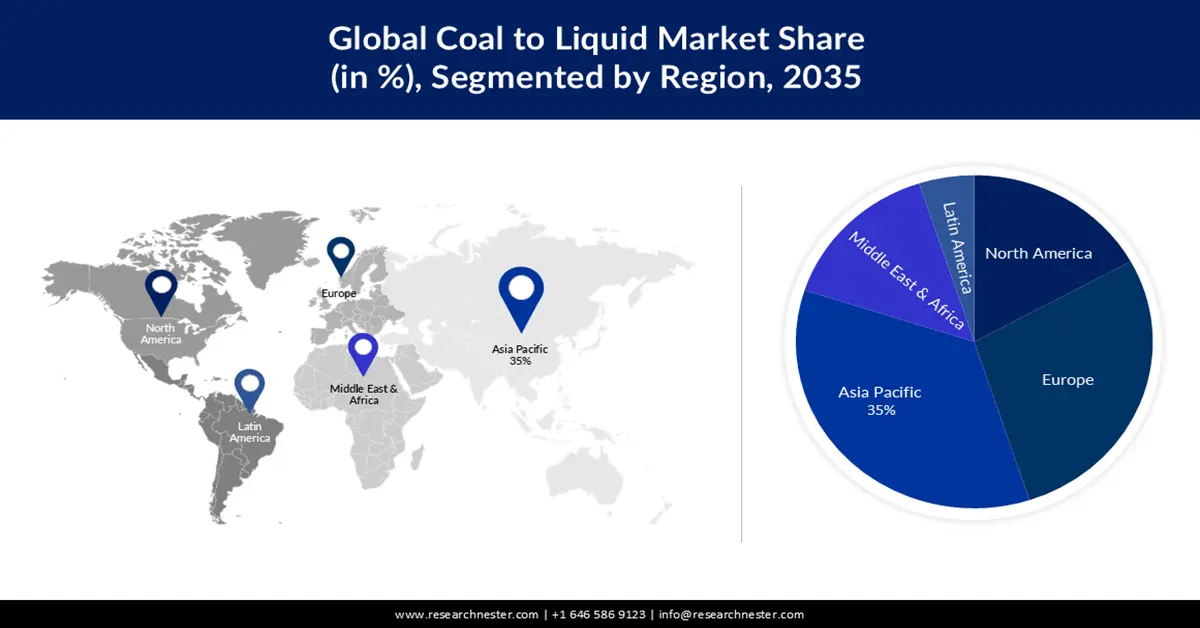

- By 2035, the Asia Pacific region is projected to command a 35% revenue share of the Coal to Liquid Market, impelled by the extensive availability of coal reserves in the region.

- By 2035, Europe is expected to remain the second-largest regional contributor, underpinned by rising coal production that encourages further investment in coal-to-liquid technologies.

Segment Insights:

- By 2035, the diesel segment is projected to capture 65% share of the Coal to Liquid Market, supported by its suitability for compression engines and expanding diesel-dependent transportation fleets.

- By 2035, the indirect coal liquefaction electronics segment is expected to secure a 60% share, boosted by its higher fuel energy density and lower-cost, lower-emission operating profile.

Key Growth Trends:

- Government Efforts to Use Coal

- Rising Production of Electricity

Major Challenges:

- Less economically viable than other fossil fuels

- Negative impact on land, water, and wildlife habitats

Key Players: Linc Energy Systems, DKRW Energy LLC, China Shenhua Energy Co. Ltd, Coal India Ltd., Altona Rare Earths PLC, Siemens Energy, Sasol Ltd., JSW Steel, Celanese Corporation, TransGas Development Systems, LLC., Invinity Energy, Systems, BHP Group plc.

Global Coal to Liquid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.09 billion

- 2026 Market Size: USD 5.47 billion

- Projected Market Size: USD 11.19 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Australia

- Emerging Countries: Indonesia, South Africa, Vietnam, Turkey, Brazil

Last updated on : 10 September, 2025

Coal to Liquid Market Growth Drivers and Challenges:

Growth Drivers

- Government Efforts to Use Coal – The Department of Energy of the United States has announced an USD109.5 million investment in the economic development of coal and power plant communities. Furthermore, USD 19.5 million was awarded in funding for key mineral extraction from coal along with waste streams. This, as a result, would lead to the development of coal-to-liquid technology and as well as increase the demand for CTL.

- Rising Production of Electricity - The majority of power plants used in centralized power generation are thermal power plants, which means they use fuel to heat steam, which then rotates a turbine and generates electricity. Despite a recent boom in renewable energy use, coal remains the primary source of electricity generation worldwide. Global energy generation has expanded dramatically over the past three decades, going from less than 11,000 terawatt-hours in 1990 to over 27,000 terawatt-hours in 2022, and from 2022 to 2025, it is predicted that global electricity demand would increase by more than 2% year on average.

Challenges

- Less economically viable than other fossil fuels - Coal to liquid is generally considered to be more expensive in comparison to other liquid fuel sources, such as petroleum, biofuels, and gas to liquid. CTL required a significant investment in technology and infrastructure, therefore the overall cost of producing CTL is generally higher than other fuels.

- Negative impact on land, water, and wildlife habitats

- Technological limitation as it is relatively new technology

Coal to Liquid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 5.09 billion |

|

Forecast Year Market Size (2035) |

USD 11.19 billion |

|

Regional Scope |

|

Coal to Liquid Market Segmentation:

Product Segment Analysis

The diesel segment is estimated to account for 65% share of the global coal to liquid market in the coming years. The process of turning coal into liquids, such as diesel or petrol, is known as coal-to-liquids (CTL), which is regarded as one of the technological solutions to lower petroleum usage in on-road transportation as a diesel alternative. In conventional engines with compression, CTL diesel fuel can be utilized in pure form or as a useful addition to a mixture to improve intermediate distillate streams which has the highest quality in all of these areas. Diesel presently has around 30% market share. In addition to this, every day, nearly 2 million buses travel on Indian highways, and the majority of them are powered by diesel.

Liquefaction Segment Analysis

Coal to liquid market from the indirect coal liquefaction electronics segment is set to garner a notable share of 60% shortly. Liquid fuels generated from coal using indirect coal liquefaction technology have a higher energy density than coal. Therefore, it makes the fuel more convenient to transport and use, and it potentially improves the fuel efficiency in power plants and vehicles. On the other hand, the ICL has a lower impact on the environment as it produces lower greenhouse gas emissions and pollutants that direct coal liquefaction. Moreover, the operational cost of the indirect procedure is much lower than the direct procedure as they operate at low temperatures and pressures.

Our in-depth analysis of the global market includes the following segments:

|

Liquefaction |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coal to Liquid Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 35% by 2035, impelled by huge presence of coal reserves in the region.China possesses proven reserves that are more than 34 times as much as its yearly usage, ranking second in the world after the United States. This, as a result, may lead to a higher supply of coal in the region and make coal an attractive option as a source of fuel for various purposes. In 2020, China's proven coal reserves were estimated to be over 143 billion metric tonnes.

European Market Insights

The Europe coal to liquid market is estimated to be the second largest, during the forecast timeframe led by increasing production of coal. Germany is Europe's top coal producer. Germany extracted around 107 million metric tons of lignite in 2020. In comparison, Poland was the largest and one of the few producers of hard coal that year, with around 54 million metric tons. As a result, there is a huge availability of coal which would attract more investment in coal to liquid technology in the region.

Coal to Liquid Market Players:

- Linc Energy Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DKRW Energy LLC

- China Shenhua Energy Co. Ltd

- Coal India Ltd.

- Altona Rare Earths PLC

- Siemens Energy

- Sasol Ltd.

- JSW Steel

- Celanese Corporation

- TransGas Development Systems, LLC.

- Invinity Energy, Systems

- BHP Group plc

Recent Developments

- JSW Steel acquired steelmaking coal business of Canada’s Teck Resources worth more than USD 1 billion.

- China Shenhua Energy Co. Ltd announced the launch of their-very own developed Coal Robot. It contributes to safe and convenient coal crushing, considerably decreasing labor intensity and potential worker safety concerns.

- Report ID: 4884

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coal to Liquid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.