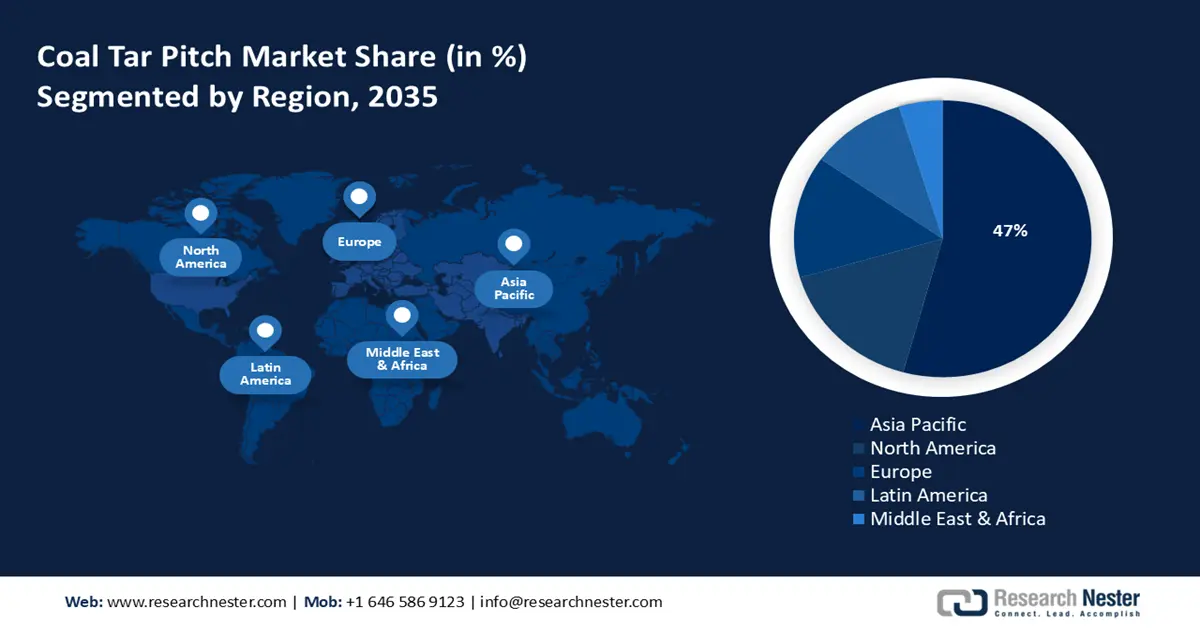

Coal Tar Pitch Market - Regional Analysis

Asia Pacific Market Insights

The coal tar pitch market within the Asia Pacific area is expected to secure a 47% revenue share by 2035, driven by rapid industrial expansion and the advancement of the aluminum and steel sectors. Government policies that emphasize environmental sustainability and the advancement of green chemical technologies play a crucial role in shaping market demand. Expansion results from the development of industrial infrastructures and increases in energy demand. Environmental regulations are prompting manufacturers to employ cleaner technologies. The region continues to be highly competitive, with integrated players realizing their supply capacities through economies of scale and technological advancement.

China is projected to lead the APAC market, capturing the largest revenue share by 2035. This growth is fueled by its extensive aluminum and steel manufacturing sectors, along with substantial government investments in green chemical production. China was the world’s largest crude steel producer in 2024 with a production of 1,005.1 MT. Technological upgrades are improving efficiency, while government-driven policies promote industrial modernization and environmental sustainability. Despite regulatory pressures, China remains a key global supplier, leveraging its scale to maintain cost advantages. Expansion of downstream applications continues to strengthen the country’s market position internationally.

India’s coal tar pitch market is being driven by the country’s progress in steel, aluminum, and construction. Significant construction developments and government support for industrialization are boosting demand for electrodes and refractories. There is also a heightened focus on domestic manufacturing, which has resulted in increased consumption in core heavy industry. Environmental compliance, sustainability requirements, and waste management are challenging for manufacturers. Investments in processing technology and partnerships are shaping the market’s long-term outlook, with opportunities in both domestic and export markets.

Crude and Finished Steel Production Between 2019-2024 in Million Tons

|

Item |

2019-20 |

2020-21 |

2021-22 |

2022-23 |

2023-24 |

|

Crude Production |

109.137 |

103.545 |

120.293 |

127.197 |

144.299 |

|

Finished Production |

102.621 |

96.204 |

113.597 |

123.196 |

139.153 |

|

Consumption |

100.171 |

94.891 |

105.752 |

119.893 |

136.291 |

|

Import |

6.768 |

4.752 |

4.669 |

6.022 |

8.320 |

|

Export |

8.355 |

10.784 |

13.494 |

6.716 |

7.487 |

Source: Steel.gov

North America Market Insights

By the year 2035, it is anticipated that North America will represent a 27% share of the coal tar pitch market, with notable contributions from both the United States and Canada. The primary drivers of this demand are the aluminum and steel sectors, which employ coal tar pitches in the production of electrodes and during the aluminum smelting process. Furthermore, governmental initiatives aimed at reducing carbon emissions and promoting sustainable manufacturing practices are influencing the market dynamics.

In 2025, the development of the aluminum industry, notably the trend of electric vehicle production and green infrastructure, will have a significant influence on the coal tar pitch market in the United States. The imposition of tough environmental regulations compels firms to invest in equipment for emission control and other measures to ensure compliance, thus increasing their operating costs. U.S. synthetic graphite production rose to 319,000 metric tons (t), valued at $1.45 billion in 2022. This compares to 259,000 t, valued at $1.16 billion in 2021. U.S. exports (limited to natural graphite) and imports of natural graphite were 9,500 and 89,200 t. This information represented an increase in exports of 10% and imports of 68% from those in 2021. U.S. exports and imports of synthetic graphite were 38,700 and 151,000 t, respectively. U.S. apparent consumption of synthetic graphite and natural graphite was 431,000 and 79,700 t, respectively. World production of natural graphite was estimated to be 1.68 million metric tons (Mt).

The coal tar pitch market in Canada is heavily dependent on the aluminum industry, particularly in Quebec, where most of the smelting activities take place. Investments in smelters are being driven by the growing need for aluminum in green infrastructure and electric vehicles. Primary aluminum smelting consumes about 70 GJ per tonne, making it highly energy-intensive, accounts for 4 % of global electricity use, with up to 70 % sourced from fossil fuels, mainly coal. Manufacturers are adopting emission control technologies as a result of strict environmental regulations. To ensure a steady supply of high-quality coal tar pitch, strategic alliances between pitch producers and aluminum manufacturers are growing more common.

Europe Market Insights

Europe is expected to hold approximately 11% market share of the market by 2035. Important factors are demand for graphite electrodes, rising aluminum production, and uses in the carbon fiber and construction sectors. Germany and Norway are significant contributors, utilizing coal tar pitch in aluminum smelting and carbon products. While environmental laws are calling for sustainable manufacturing methods, countries like Germany and Norway are important supporters.

Trade of Natural Graphite in Powder or in Flakes in 2023

|

Country / Region |

Trade Value (1,000 USD) |

Quantity (Kg) |

|

United Kingdom |

2,415.57 |

1,168,280 |

|

Germany |

25,167.88 |

12,193,500 |

|

France |

161.77 |

90,965 |

|

Italy |

316.45 |

176,682 |

|

Spain |

204.94 |

143,504 |

Source: WITS

Germany growth is driven by aluminum production, graphite electrodes for steel manufacturing, and applications in roofing and coatings. Germany's focus on sustainable manufacturing practices and environmental regulations encourages the development of eco-friendly production methods. Sustainability initiatives are prompting shifts toward eco-friendly production processes. The European Union produces 166.2 MT of crude steel overall, with Germany producing the most at 42.7 MT. Key players include Rheinbraun Brennstoff GmbH and Nexans, who are focusing on innovation and compliance with environmental standards.

The U.K. coal tar pitch market is driven by demand in aluminum production, graphite electrodes, and specialty applications. The market is influenced by environmental policies promoting sustainable practices and reducing emissions. Companies are investing in cleaner technologies and exploring alternative materials to meet regulatory requirements and market demands. In 2023, the UK exported 27,636 kg of coal tar pitch globally, valued at USD 38.15. The U.K.'s emphasis on green initiatives presents opportunities for innovation and growth in the coal tar pitch sector. Companies are adopting advanced manufacturing technologies to meet the evolving demands of these sectors.