Coal Gasification Market Outlook:

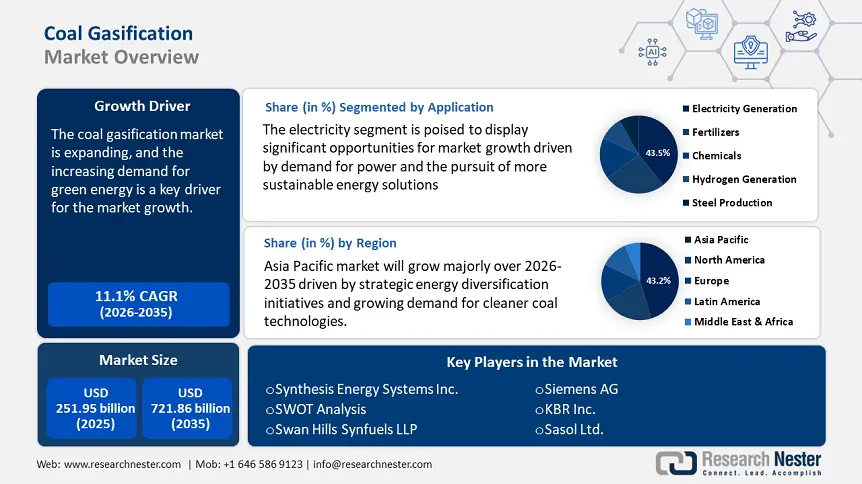

Coal Gasification Market size was valued at USD 251.95 billion in 2025 and is likely to cross USD 721.86 billion by 2035, registering more than 11.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coal gasification is assessed at USD 277.12 billion.

The coal gasification market is undergoing significant transformation due to various influencing factors. The increasing demand for green energy is a key driver of the market growth, as coal gasification is a process that converts carbonaceous materials including coal, petroleum, petroleum coke, or biomass, into carbon oxidation with oxygen, air, steam, or carbon dioxide under controlled conditions, coal is transformed into a fuel gas. This fuel, known as synthesis gas or syngas, is commonly utilized in chemical production, power generation, transportation, and other industrial sectors.

The global push to reduce greenhouse gas emissions has led many nations to explore cleaner and more efficient methods of using fossil fuels. Additionally, growing concerns over energy independence have prompted investments in coal gasification to maximize the efficient use of domestic coal reserves. Furthermore, the coal gasification market is experiencing notable growth opportunities, especially in developing regions where coal remains a readily available resource. The evolving synergy between coal gasification and renewable energy sources highlights the practical implementation of hybrid systems, leading to increased energy efficiency.

Enhancements in technology continue to pave the way for reducing the environmental impact of the coal gasification process, opening new opportunities for sustainable energy solutions. Additionally, innovative technology such as carbon capture and storage is positioning coal gasification as a viable method for future energy generation. Industry stakeholders are actively seeking to drive coal gasification market growth by transitioning to cleaner alternatives through strategic partnerships and collaborations.

Recent technological enhancements and emerging trends further underscore the rising focus on sustainability and the growing commitment to innovation in the sector. As industries increasingly emphasize environmentally responsible practices and usability considerations, there is a heightened concentration on diversifying energy sources and addressing sustainability challenges. Emerging technologies aimed at improving efficiency and reducing emissions are gaining momentum. This trend is bolstered by growing political support for environmental mitigation technologies, creating a more favorable environment for the coal gasification market.

Market dynamics and policy frameworks are poised to significantly influence the industry's trajectory in the coming years by facilitating further development and financing opportunities. For example, the FutureGen project in Illinois, a public-private partnership, aimed to build the world's first near-zero-emission coal-fueled power plan, illustrating the impact of supportive policies and funding on advancing clean coal technologies. All these underscore that the coal gasification process offers multiple benefits, including reduced emissions, improved efficiency, and the ability to use diverse feedstocks, thus driving the growth of the coal gasification market.

Key Coal Gasification Market Insights Summary:

Regional Highlights:

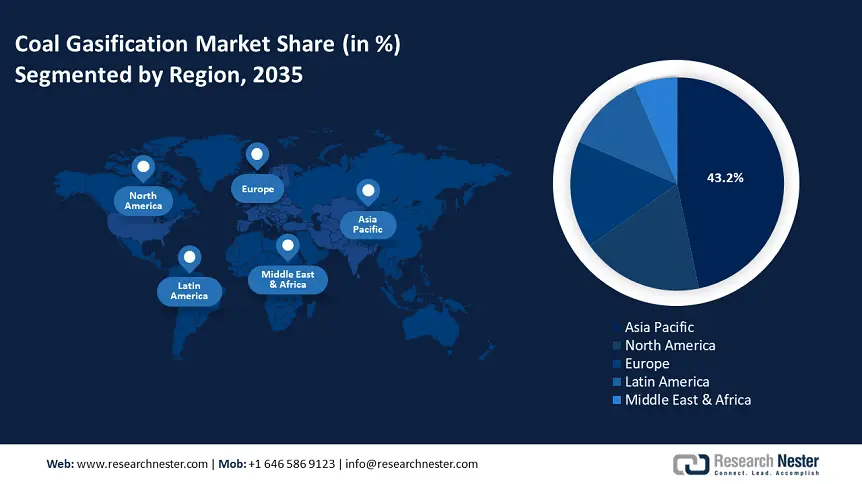

- Asia Pacific dominates the Coal Gasification Market with a 43.2% share, driven by China’s strategic energy diversification initiatives and growing demand for cleaner coal technologies, fueling robust growth prospects through 2026–2035.

Segment Insights:

- The Electricity Generation segment is forecasted to capture a 43.50% share by 2035, driven by escalating demand for power and the pursuit of sustainable energy solutions.

- The Fluidized bed gasifier segment of the Coal Gasification Market is expected to hold the largest share from 2026 to 2035, driven by high reaction rates and efficient mixing capabilities producing lower tar and hydrocarbons.

Key Growth Trends:

- Rising demand for clean energy solutions

- Environmental concerns hampering the market growth

Major Challenges:

- Environmental concerns hampering the market growth

- High costs for the construction of coal gasification Plant

- Key Players: Synthesis Energy Systems Inc., SWOT Analysis, Swan Hills Synfuels LLP, Siemens AG.

Global Coal Gasification Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 251.95 billion

- 2026 Market Size: USD 277.12 billion

- Projected Market Size: USD 721.86 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 12 August, 2025

Coal Gasification Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for clean energy solutions: The coal gasification market is experiencing significant growth, driven by escalating demand for cleaner energy alternatives. As global environmental concerns intensify, there is a concerted effort to minimize greenhouse gas emissions and minimize the carbon footprint associated with energy production. Coal gasification offers a viable solution by converting coal into synthesis gas (syngas), which can be further processed into cleaner fuels such as hydrogen or synthetic natural gas. This process not only facilitates carbon capture but also improves resource utilization efficiency compared to traditional coal combustion methods. For example, the Dakota Gasification Company's Great Plains Synfuels Plant in North Dakota has produced synthetic natural gas from lignite coal and captured carbon dioxide for use in enhanced oil recovery.

As countries strive to achieve carbon neutrality by mid-century, investments in coal gasification technologies are increasingly, supported by evolving regulatory frameworks that favor cleaner energy production methods. The versatility of syngas, which can be used in power generation, chemical production, and transportation fuels, positions coal gasification as a pivotal player in the transition to sustainable energy solutions. Stakeholders in the energy sector recognize the economic benefits of integrating coal gasification technologies into their portfolios, thereby reinforcing its role as a sustainable alternative in the rapidly evolving energy landscape.

Technological advancements in gasification processes: The goal gasification market is propelled by the advanced use of technologies in the gasification process resulting in enhanced efficiency, reduced emissions, and improved economic viability. Increasing global focus on clean and efficient energy sources, along with efforts to reduce dependence on fossil fuels and natural gas, is accelerating the adoption of coal gasification technologies. Rapid urbanization and industrialization further contribute to the growing demand for coal-derived energy solutions.

Moreover, the widespread adoption of Underground Coal Gasification (UCG) is transforming the sector by enabling the conversion of coal into valuable gases without traditional mining, enhancing efficiency, reducing emissions, and improving economic viability. These trends collectively underscore the expanding role of coal gasification in meeting the evolving energy demands of industrial and commercial sectors.

Innovation in process optimization, carbon capture, and reactor design have enabled higher conversion rates and lower operational costs. The China GreenGen project in Tianjin uses enhanced coal gasification technology to produce both hydrogen and electric power with reduced emissions, demonstrating the practical application of such innovations. These technological enhancements have attracted increased attention from investors and governments seeking to implement cleaner and more efficient energy systems to meet rising energy demand.

Challenges

- Environmental concerns hampering the market growth: Though coal gasification provides cleaner energy, still there are lots of issues regarding the environmental effects of coal mining including water contamination and habitat loss. The process generates various air pollutants, including sulfur dioxide, nitrogen oxides, particulate matter, and volatile organic compounds, which contribute to smog, acid rain, and respiratory issues.

Furthermore, coal gasification releases methane, a greenhouse gas far more potent than carbon dioxide potentially emitting up to 20% more methane than traditional coal combustion. These environmental risks have led to stricter regulations and increased scrutiny, potentially hindering market expansion.

- High costs for the construction of coal gasification Plant: The coal gasification market growth is hindered due to the high cost of the coal gasification plant. Despite the continuous use of traditional coal-fired power plants, the expansion of coal-based thermochemical processes has been limited due to significant capital and operational expenses.

Integrated Gasification Combined Cycle (IGCC) power plants, a major application of this technology, are estimated to be 35% more expensive than conventional coal-fired plants. For example, according to the International Renewable Energy Agency (IRENA), gasification technologies, including fluidized bed and fixed bed systems, have incurred installed capital costs ranging from around USD 2,000 to USD 6,700 per kW.

Coal Gasification Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 251.95 billion |

|

Forecast Year Market Size (2035) |

USD 721.86 billion |

|

Regional Scope |

|

Coal Gasification Market Segmentation:

Application (Fertilizers, Electricity Generation, Chemicals, Hydrogen Generation, and Steel Production)

Electricity generation segment is predicted to capture over 43.5% coal gasification market share by 2035, driving escalating demand for power and the pursuit of more sustainable energy solutions. Coal gasification presents a viable and eco-friendly alternative to traditional coal combustion for electricity production. Hydrogen production methods significantly impact global carbon emissions. As of 2023, approximately 20% of the world's hydrogen is produced through coal gasification, making it the second-largest production method after natural gas-based processes. In China, coal gasification is the predominant method for hydrogen production, accounting for 60% of the country's hydrogen production. This method is associated with substantial Co2 emissions, producing approximately 18-20 kg of CO2 per kg of hydrogen.

Notably, IGCC power plants, which use coal gasification, have demonstrated higher efficiency rates compared to conventional coal-fired plants. For instance, studies have projected that IGCC systems with catalytic coal gasification and pressurized Solid Oxide Fuel Cells (SOFC) can achieve efficiencies up to 60%, whereas traditional coal-fired power plants typically operate at efficiency around 37% to 40% efficiency. Additionally, the syngas produced through coal gasification contain hydrogen, which has diverse industrial applications, including chemical processing and fuel cell utilization.

The steel production segment is anticipated to experience rapid growth during the forecast period, driven by the increased adoption of coal gasification processes in steel manufacturing. This method converts coal into synthesis gas (syngas), a cleaner and more efficient fuel utilized in steel production. Implementing cost-effective coal gasification techniques enables steelmakers to enhance production efficiency and reduce environmental impact. For instance, Jindal Steel and Power Limited (JSPL) has pioneered the use of coal gasification at its Angul plant in Odisha, India, allowing the company to use indigenous coal resources while lowering its carbon footprint. This approach aligns with India's broader strategy to promote coal gasification aiming to reduce reliance on imports and support domestic industries.

Gasifier (Fixed Bed, Fluidized Bed, and Entrained Flow)

The fluidized bed segment is predicted to gain the largest coal gasification market share during the projected period. This is primarily due to their high reaction rates and efficient mixing capabilities. These gasifiers are especially advantageous as they produce lower levels of tar and heavy hydrocarbons compared to other gasification techniques. In India, Bharath Heavy Electrical Limited (BHEL) has pioneered a domestic method for producing methanol from high-ash Indian coal. In September 2021, BHEL commissioned a pilot plant in Hyderabad capable of producing 0.25 metric tons per day of methanol with a purity of over 99%. This innovation not only promotes the use of methanol as a transportation fuel but potentially blends it with gasoline and also supports the nation's initiative to adopt cleaner technologies and reduce crude oil imports.

BHEL's expertise in this domain includes the design of Pressurized Fluidized Bed Gasifiers (PFBG) suitable for high-gas Indian coal, with coal throughput capacities of approximately 2,600 tons per day at operating temperatures of around 950 degrees Celsius and pressures up to 30 bar. These gasifiers can generate syngas sufficient for producing 750 tons per day of methanol or 2,000 tons per day of ammonium nitrate in a single-train mode.

The entrained flow gasifier segment is projected to secure a significant coal gasification market share during the forecast period, driven by its high efficiency and adaptability to various coal feedstocks. These gasifiers can process nearly any type of coal and produce clean, tar-free syngas. Additionally, the fine coal feed can be introduced in either dry or slurry form, enhancing operational flexibility. These benefits are expected to drive the growth of the entrained flow gasifier market in the forecast period.

Our in-depth analysis of the global coal gasification market includes the following segments:

|

Application |

|

|

Gasifier |

|

|

Feed Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coal Gasification Market Regional Analysis:

Asia Pacific Market Statistics

In coal gasification market, Asia Pacific region is expected to capture over 43.2% revenue share by 2035, driven by China's strategic energy diversification initiatives and growing demand for cleaner coal technologies. China's commitment to balance energy security with environmental sustainability has resulted in substantial investments in coal gasification projects. According to the National Energy Administration of China, the country aims to expand its coal-to-gas production capacity to 40 billion cubic meters. In line with this vision, China Energy Engineering Group recently announced a substantial investment of approximately USD 24 billion to construct an integrated large-scale coal-to-oil project in Xinjiang, reinforcing the region's focus on enhancing this technology.

India is emerging as a key player in the Asia Pacific coal gasification market, with the government actively promoting coal gasification to reduce reliance on imported oil and gas. The country's extensive coal reserves position it as a strong candidate for large-scale adoption of this technology. According to India's Ministry of Coal, the nation aims to gasify 100 million tons of coal during the forecast period. Aligning with this objective, Reliance Industries Limited has announced plans to invest in coal gasification projects, focusing on converting coal into hydrogen for clean energy.

Japan and South Korea are bolstering the region's prominence in coal gasification through their advanced technological capabilities and emphasis on efficiency improvements. Both nations have shown particular interest in IGCC power plants, which provide higher efficiency and lower emissions compared to traditional cost-fired facilities.

North America Market Analysis

North America is witnessing significant growth in the coal gasification market, driven by a strong emphasis on clean coal technologies and the region's abundant coal reserves. The U.S. in specifically, is making substantial investments in enhanced gasification projects to reduce emissions while leveraging its vast coal resources. According to the U.S Energy Information Administration, as of 2020, the U.S. has demonstrated coal reserves of approximately 250 billion short tons. In alignment with these efforts, Peabody Energy recently announced a partnership with ArcLight Capital Partners to build a coal gasification project in Illinois, aimed at producing low-carbon hydrogen and other valuable byproducts from coal.

Canada is actively contributing to the growth of the North America coal gasification market by leveraging its substantial coal reserves for clean energy production. The nation is exploring innovative applications of coal gasification technology, including the production of synthetic natural gas and hydrogen. According to Natural Resources Canada, as of 2022, Canada possessed 6.6 billion tons of proven coal reserves. In line with this potential, SaskPower has been at the forefront of integrating carbon capture and storage (CCS) technologies with coal-based energy production. Notably, SaskPower retrofitted Unit 3 of the Boundary Dam Power Station with a CCS system capable of capturing 90% of Co2 emissions and 100% of So2 emissions, marking a significant advancement in minimizing greenhouse gas emissions while maintaining energy security.

Key Coal Gasification Market Players:

- Synthesis Energy Systems Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Swan Hills Synfuels LLP

- Siemens AG

- SEDIN Engineering Co. Ltd.

- Sasol Ltd.

- Regius Synfuels Ltd.

- Mitsubishi Heavy Industries Ltd.

- McDermott International Ltd.

- Larsen and Toubro Ltd.

- KBR Inc.

- Johnson Matthey Plc

- Ergo Exergy Technologies Inc.

The coal gasification market is highly dynamic and competitive, with a diverse range of industry players striving to strengthen their market position. Companies are actively pursuing strategic initiatives such as collaboration, mergers, and acquisitions, and leveraging political support to expand their presence and improve their competitive edge.

Recent Developments

- In May 2024, Underground coal gasification (UCG) was led by Coal India in collaboration with Bharat Heavy Electricals Limited (BHEL) and GAIL (India) Limited. This initiative represents a significant advancement for India. With an allocated budget of Rs 70 crore, the pilot project aims to convert coal into chemicals and syngas, offering a practical alternative to traditional mining techniques. The project aspires to achieve a production target of 100 million tons of UCG by the year 2030.

- In February 2024, Bloom Energy, a provider of fuel cell technology, enhanced its energy servers to monitor loads, allowing them to adjust to the fluctuating demand and supply within microgrids and utility systems. The ' Be Flexible' initiative operates on 'both sides of the meter' and is applicable for data center operators as well as other enterprises within microgrids. Additionally, utilities can implement this solution to address generation shortfalls from alternative sources.

- Report ID: 7387

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coal Gasification Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.