Coagulant Market Outlook:

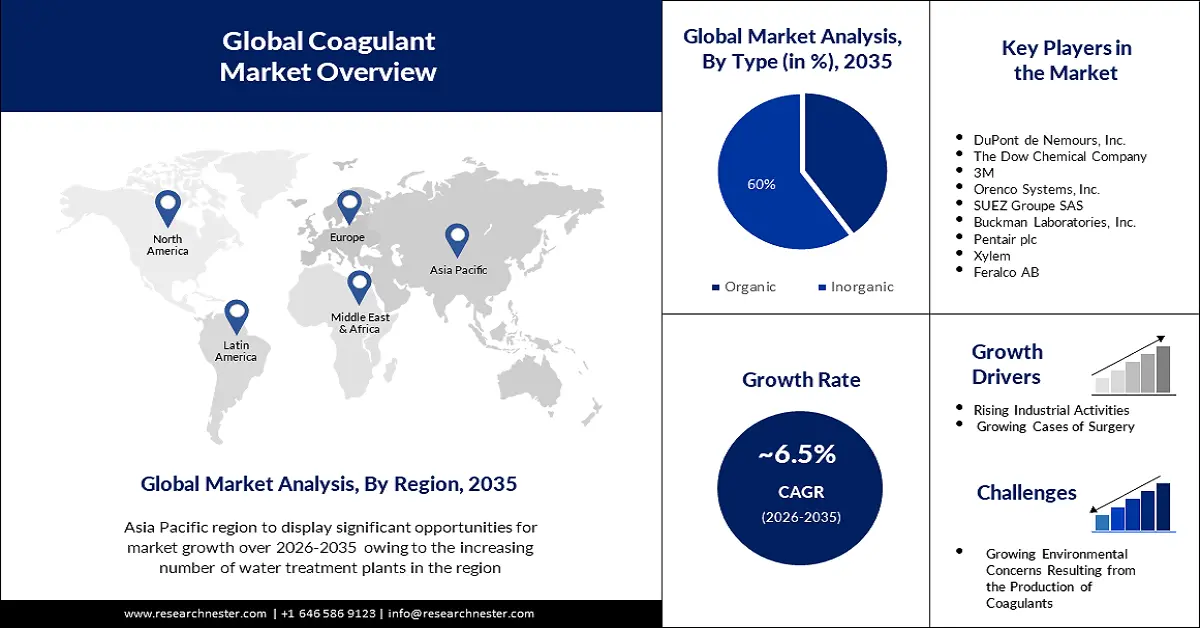

Coagulant Market size was over USD 8.42 billion in 2025 and is anticipated to cross USD 15.81 billion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of coagulant is assessed at USD 8.91 billion.

The reason behind the growth is impelled by the growing consumption of contaminated water across the globe. For instance, more than 2 billion people globally may become unwell owing to the unknown water quality of their rivers, lakes, and groundwater. As a result, there is an increased demand for wastewater treatment facilities to filter pollutants and suspended solids from wastewater. According to the World Health Organization (WHO), around 1.7 billion people worldwide used feces-contaminated drinking water in 2022.

The growing development of natural coagulants is believed to fuel the coagulant market growth. Plant-based coagulants are organic materials derived from natural sources, including the seeds, roots, and leaves of different plants are regarded as sustainable and environmentally beneficial substitutes for artificial substances. For instance, Hydrex organic coagulants are made from a renewable source of tree bark which is known to create around 48% less sludge than coagulants based on metal, leading to a reduction in the expenses and carbon footprint of disposal.

Key Coagulant Market Insights Summary:

Regional Highlights:

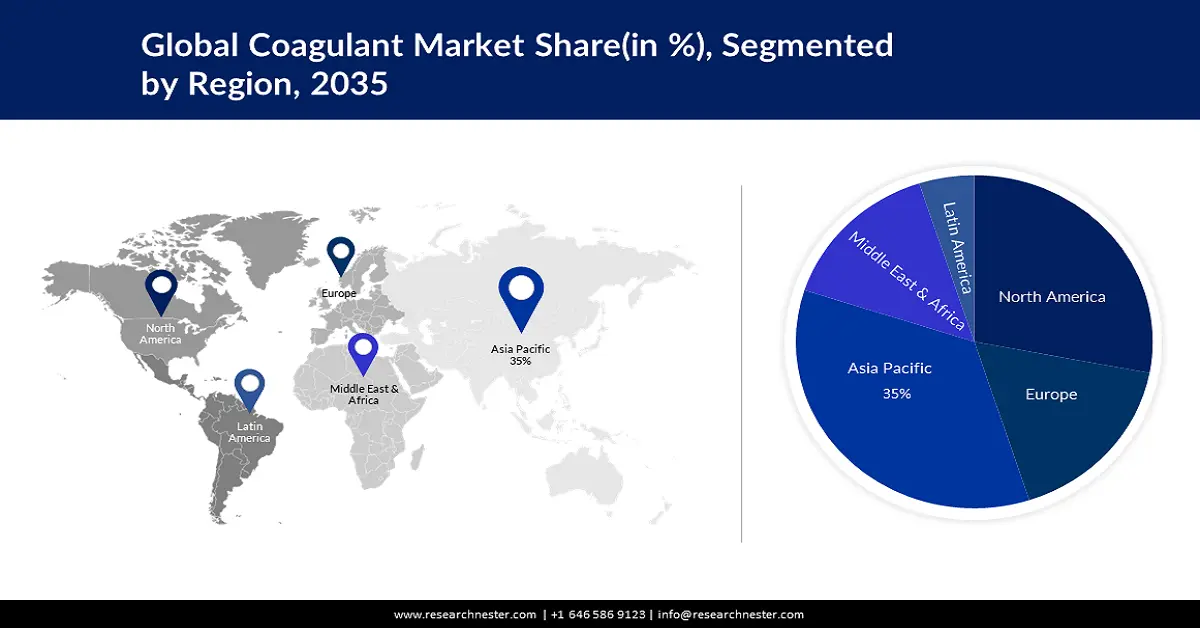

- Asia Pacific coagulant market is poised to capture 35% share by 2035, driven by the increasing number of water treatment plants in developing countries.

- North America market will secure the second largest share by 2035, driven by growing consumption of recycled water, particularly desalinated wastewater.

Segment Insights:

- The inorganic segment in the coagulant market is anticipated to hold a 60% share by 2035, propelled by the increasing use of inorganic coagulants in the water treatment industry.

- The water treatment segment in the coagulant market is anticipated to achieve a notable revenue share by 2035, attributed to the widespread use of coagulation in water treatment processes.

Key Growth Trends:

- Rising Industrial Activities

- Growing Cases of Surgery

Major Challenges:

- Rising Industrial Activities

- Growing Cases of Surgery

Key Players: BASF SE, DuPont de Nemours, Inc., The Dow Chemical Company, 3M, Orenco Systems, Inc., SUEZ Groupe SAS, Buckman Laboratories, Inc., Pentair plc, Xylem, Feralco AB.

Global Coagulant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.42 billion

- 2026 Market Size: USD 8.91 billion

- Projected Market Size: USD 15.81 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Coagulant Market Growth Drivers and Challenges:

Growth Drivers

- Rising Industrial Activities - Effective coagulation, is one of the most often employed water treatment chemicals in industrial processes, that can assist in stabilizing treatment performance despite the unpredictability of industrial activities.

- Growing Cases of Surgery - The escalating use of coagulants in the healthcare sector, to boost the blood clotting process in patients of surgery or accidents, is estimated to boost the coagulant market growth. The majority of blood tests and coagulation tests are identical since they determine how quickly and easily blood clots are to assist doctors in determining the risk of experiencing severe bleeding or thrombosis and keeping an eye on the patient. For instance, globally, more than 300 million major surgical procedures are carried each annually.

- Use of Coagulant in Pulp and Paper Industry- The pulp and paper sector is currently dealing with stricter regulations regarding wastewater discharge requirements and related licenses, which has resulted in an increasing usage of coagulants to treat pulp and effluent by controlling anionic waste. Moreover, large amounts of black liquors are produced as byproducts of both wood and non-wood pulping processes, which necessitate the use of electrocoagulation as an efficient, quick, and affordable method for treating black liquor.

Challenges

- Growing Environmental Concerns Resulting from the Production of Coagulants- About half of the sludge produced by chemical coagulation is produced by electrocoagulation which has certain negative effects on the environment and health. Chemical-based coagulants, such as poly-aluminum and aluminum sulfate, have produced extremely toxic sludge for a long time, which has had varying consequences on the environment and may result in neurological illnesses. Similarly, disposing of sludge might become difficult when inorganic coagulants are used as they produce massive amounts of metal-rich floc that need to be disposed of in an environmentally responsible way, which can raise the cost of disposal significantly. Besides this, the extremely caustic sludge produced by the metal-based coagulants and the sodium hydroxide, increases operational carbon emissions, in addition to being expensive.

- High Circulation of Generic Chemicals

- Competition with Flocculants

- Exorbitant Cost of Advanced Coagulants

Coagulant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 8.42 billion |

|

Forecast Year Market Size (2035) |

USD 15.81 billion |

|

Regional Scope |

|

Coagulant Market Segmentation:

Type Segment Analysis

The inorganic segment is predicted to capture over 60% coagulant market share by 2035, owing to the increasing use of inorganic coagulants in the water treatment industry. Inorganic coagulating agents including aluminum sulfate, poly aluminum chloride, ferric chloride, and others, are used for the treatment of industrial wastewater, as they are capable of absorbing impurities such as dirt, silt, and organic waste. Aluminum sulfate is a white, crystalline, hygroscopic salt with the formula Al2(SO4)3 that has no smell and is somewhat soluble in water, which makes it appropriate to be used as a coagulating agent. This inorganic salt is created when sulfuric acid and aluminum hydroxide neutralize one another and is considered as a highly effective coagulant, making it a useful ingredient for waterproofing building projects.

Poly aluminium chloride (PAC) is most commonly used in the water treatment industry as a coagulant and an alternative coagulant agent to alum which has a low generation of waste sludge in a wide pH range, even at low temperatures. Aluminum chloral-hydrate, or poly aluminum chloride, is a coagulant of more than 80% of basicity and is also considered as safer as compared to several different chemical coagulants. For many years, coagulants such as aluminum sulfate have been frequently utilized in the course of water treatment, since they reduce the amount of sludge byproducts and aluminum traces in the water dramatically.

Two popular "commodity chemical" coagulants that have been around for a while are ferric chloride and alum, which are capable of eliminating color, COD, and suspended particles from semi-aerobic landfill leachate at regulated pH. Ferric chloride, also called iron (III) chloride, is a chemical compound that is widely employed in many different industries particularly, useful in the water treatment industry where it is used as a coagulant to remove pollutants and impurities.

In addition, typically, sludge production and solid-liquid separation include the application of organic coagulants, which is a class of chemicals with carbon-based molecules that are often utilized in water treatment. These coagulants are biodegradable, renewable, less sludge-producing, nontoxic, and reasonably priced, and do not alter the pH of the treated water and have a broad range of effective dosages. For instance, utilizing natural coagulants derived from cassava peel as a substitute coagulant helps cut down on the use of chemical coagulants since metals and other contaminants in the water have a strong affinity for the molecular structure with big functional groups to coagulate with.

End-user Analysis

The water treatment segment in the coagulant market is set to garner a notable share shortly. Coagulation is a chemical water treatment process that is used in many water treatment plants to remove solids from water, dewatering, water clarification, lime softening, and sludge thickening. it promotes the formation of flocs, or clumps, by preventing the suspended particles from restraining one another.

Our in-depth analysis of the global coagulant market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coagulant Market Regional Analysis:

APAC Market Insights

By 2035, Asia Pacific region is estimated to account for coagulant market share of around 35% impelled by the increasing number of water treatment plants in developing countries, such as China, Japan, Taiwan, India, and others. The growing government initiatives in these countries to provide more and more people with safer drinking water are estimated to boost the coagulant market growth. As per a report by the Global Water Forum, 42% of the deaths associated with unsafe supply of water occurred in Asia in the past decade. In addition, growing mass awareness regarding water pollution is also a major driver for the regional market growth.

North American Market Insights

The North America coagulant market is estimated to be the second largest, during the forecast timeframe led by the growing consumption of recycled water, majorly desalinated wastewater. For instance, in the United States, around 3 billion gallons of water per day (bgd), or 13 million m3/d is reused. Currently, Californian farmers utilize more than 230,000 acre-feet of reclaimed water annually for a diverse range of crops. In addition, the presence of major pharmaceutical companies in the region, and the increasing development of drugs, are anticipated to propel the coagulant market growth.

Coagulant Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Nemours, Inc.

- The Dow Chemical Company

- 3M

- Orenco Systems, Inc.

- SUEZ Groupe SAS

- Buckman Laboratories, Inc.

- Pentair plc

- Xylem

- Feralco AB

Recent Developments

- Feralco Group, the leading supplier of inorganic coagulants, fully acquired Felacid, a producer of high-purity iron salts.

- Buckman International, announced the opening of a chemical innovation lab in Chennai, India. The lab is known as the Buckman Center of Excellence and opened at the International Center for Clean Water (ICCW).

- Feralco Nordic AB, a subsidiary of Feralco Group announced the acquisition of Vattenresurs Sverige AB, to expand its portfolio in treatment and restoration of lakes.

- Report ID: 3555

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coagulant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.