CNG Compressor Market Outlook:

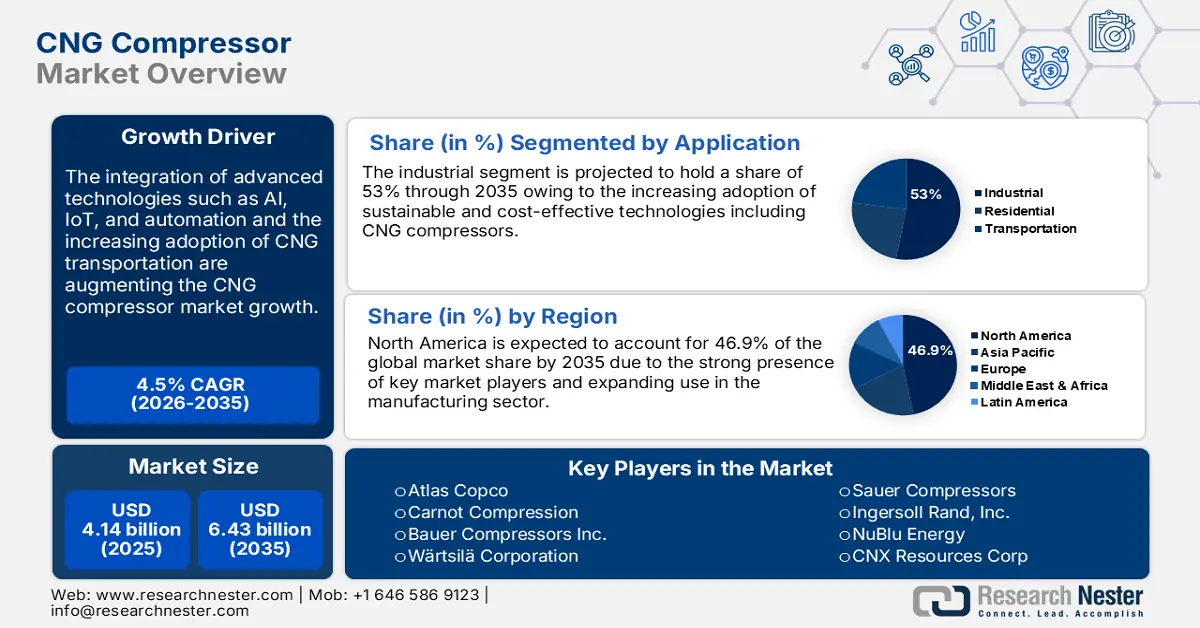

CNG Compressor Market size was valued at USD 4.14 billion in 2025 and is set to exceed USD 6.43 billion by 2035, expanding at over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CNG compressor is estimated at USD 4.31 billion.

The strict emission regulations and sustainability goals are primarily augmenting the CNG compressor market growth. Natural gas being a relatively low-emission fuel compared to gasoline or diesel aligns well with global efforts to reduce carbon footprints and pollution. The increasing adoption of CNG vehicles is set to propel the sales of compressors in the coming years. For instance, the U.S. Department of Energy estimates that there are more than 23 million natural gas vehicles operating across the world and over 1,75,000 vehicles in the U.S.

The transportation sector is the major contributor to carbon emissions around the globe. The International Energy Agency (IEA) revealed that the global transportation sector amounted to over 250Mt CO2 to nearly 8 Gt CO2, in 2022. To combat this issue, governments worldwide are implementing supportive initiatives to boost the adoption of cleaner transportation, creating lucrative opportunities for CNG compressor manufacturers. The use of CNG-based vehicles for public transportation is a significant driver contributing to the increasing revenue growth of market players. According to the analysis by the U.S. Department of Energy around 18,370 natural gas transit buses were operating in the U.S. in 2021. Thus, the rise in the adoption of natural gas public transit vehicles is set to directly push the demand for CNG compressors.

Key CNG Compressor Market Insights Summary:

Regional Highlights:

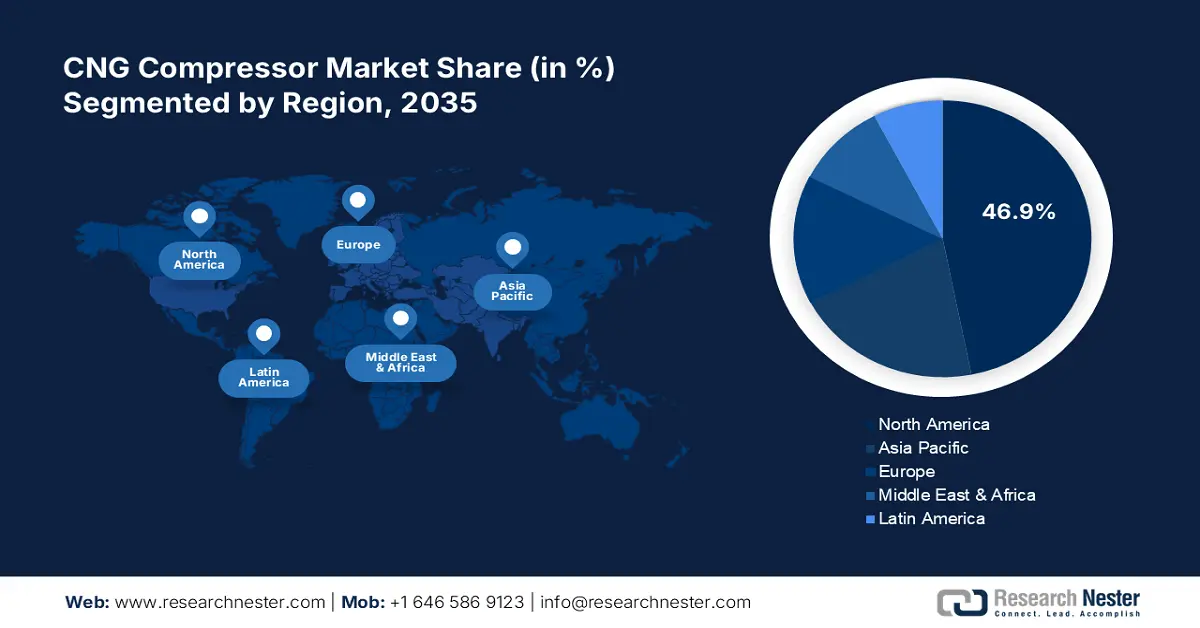

- North America's 46.9% share in the CNG Compressor Market is driven by strong presence of key players, marine sector tech use, and supportive green transport policies, ensuring dominance through 2035.

- The CNG Compressor Market in Asia Pacific is anticipated to grow rapidly by 2035, fueled by industrial growth, investments in manufacturing, and natural gas vehicle policies.

Segment Insights:

- The Industrial segment is anticipated to capture a 53% share by 2035, driven by increasing industrial activities and the adoption of CNG due to the clean energy trend.

- The Positive Displacement segment of the CNG Compressor Market is forecasted to dominate by 2035, driven by its efficiency, durability, and adaptability under harsh conditions.

Key Growth Trends:

- Technological advancements

- Emergence of start-ups

Major Challenges:

- Infrastructure limitations

- Competition from EVs

- Key Players: Atlas Copco, Carnot Compression, PC Mc Kenzie Company, J-W Energy Company, and Bauer Compressors Inc.

Global CNG Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.14 billion

- 2026 Market Size: USD 4.31 billion

- Projected Market Size: USD 6.43 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

CNG Compressor Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements: The continuous technological innovations aimed at enhancing the efficiency, durability, and energy consumption of CNG compressors are anticipated to augment the overall CNG Compressor market growth in the coming years. Advanced features such as improved compression efficiency, low noise emission, and automated control systems are enhancing the standards of CNG compressors. Furthermore, the integration of artificial intelligence (AI), the Internet of Things (IoTs), and machine learning (ML) for remote monitoring and maintenance of compressors is also gaining traction. The oil-free compressors, Cryogenic compression technology, and liquid piston technology are some of the emerging CNG compressor market trends.

For instance, in September 2023, INNIO Group and Detechtion Technologies collaboratively introduced the SKIDIQ product suite. This is an advanced digital technology for lease compression organizations and natural gas compressor operators. This solution mitigates operating expenses and increases uptime, with the help of engine analytics, and real-time compressor monitoring & optimization technology. Through technological innovation moves, companies are making their position stronger in the competitive landscape. - Emergence of start-ups: The rising urban activities particularly in developing economies are significantly contributing to the expansion of the CNG compressor business. The urban progression is booming the adoption of CNG vehicles, both passenger and heavy-duty vehicles, further driving the need for more refueling stations and advanced compressors. Considering this aspect, many new companies are entering the CNG compressor market to earn high profits.

Carnot Compression a U.S.-based start-up is scaling up its business by introducing advanced compression technologies. Its patented compression technology Carnot Compressor with robust design delivers low-temperature, oil-free compressed gas, minimizing the need for maintenance and increasing the operational life. Thus, the rise in the emergence of start-ups is set to influence the CNG compressor market growth in the coming years.

Challenges

-

Infrastructure limitations: The limited awareness, availability, and infrastructure are major challenges hindering the CNG compressor market growth. In many regions, CNG refueling stations are very limited, which creates a barrier to the adoption of CNG vehicles and ultimately compressors. Thus, the limited accessibility to the refueling infrastructure directly restraints the demand for CNG compressors.

-

Competition from EVs: The competition from other sustainable engines such as electric and hybrid automobiles is a barrier to CNG compressor market growth. The rapid increase in electric vehicle adoption owing to low battery costs and improved charging infrastructure is limiting the adoption of CNG vehicles, directly hampering the CNG compressor sales.

CNG Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 4.14 billion |

|

Forecast Year Market Size (2035) |

USD 6.43 billion |

|

Regional Scope |

|

CNG Compressor Market Segmentation:

Application (Industrial, Residential, Transportation)

In CNG compressor market, industrial segment is set to dominate revenue share of around 53% by the end of 2035. The rising industrial activities in both developed and developing economies are accelerating the adoption of CNG as an energy source owing to the clean energy trend. The modernization of industries and swift employment of cost-effective and sustainable solutions are creating lucrative opportunities for CNG compressors.

In the manufacturing industries, CNG compressors are used in various processes, where natural gas is needed as fuel or raw material. For instance, the global manufacturing industry is valued at USD 13.6 trillion in 2024. The National Association of Manufacturers revealed that the U.S. manufacturing market size was calculated at USD 2.5 trillion in 2021 with a presence of around 8.41% of the workforce. Furthermore, in textiles, food processing, chemicals, and glass manufacturing CNG compressors offer the required pressure to fuel burners to carry out the heating process.

Technology (Positive Displacement, Dynamic)

The positive displacement technology segment in CNG compressor market is projected to capture a dominant revenue share through 2035. The advancements in positive displacement CNG compressors are making them more efficient, durable, and capable of operation under harsh conditions, which is accelerating their adoption rates. The U.S. Environmental Protection Agency estimates that positive displacement compressors are widely used for industrial process refrigeration. The increasing industrial activities are set to boost the adoption of modern positive displacement CNG compressors in the coming years. Furthermore, the versatility of positive displacement compressors is also augmenting their demand across various industries such as utilities, transportation, and manufacturing.

Our in-depth analysis of the global CNG compressor market includes the following segments:

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CNG Compressor Market Regional Analysis:

North America Market Forecast

North America in CNG compressor market is set to account for more than 46.9% revenue share by the end of 2035. The strong presence of key market players, increasing investments in technological advancements, and high adoption of advanced technologies by the marine transportation sector are propelling the regional market growth. Supportive government policies on green transportation are also set to fuel the sales of advanced CNG compressors in the U.S. and Canada.

In the U.S., the rapidly expanding manufacturing sector is fueling the demand for modern CNG compressors. The U.S. Bureau of Labor Statistics (BLS) estimates that the pipeline transportation of natural gas, oil & gas extraction, merchant wholesalers, nondurable goods, machinery, equipment, and supplies merchant wholesalers, and fuel dealers are some of the top industries where the employment of gas compressor and operators is high. Furthermore, the rising use of natural gas in industries such as electric power (37.5%), industrial consumers (26.4%), and residential consumers (15.3%) is anticipated to propel the sales of CNG compressors in the coming years.

In Canada, the clean energy trend, increasing investment in CNG fueling station construction, and the existence of industry giants such as Sauer Compressors and Ingersoll Rand, Inc. are positively influencing the CNG compressor market growth. The increasing adoption of sustainable vehicles for public transportation is also pushing the CNG compressor sales.

Asia Pacific Market Statistics

The Asia Pacific CNG compressor market is foreseen to increase at the fastest pace during the projected period. The rapid industrial and urban activities, high investments in the manufacturing sectors, and supportive policies for natural gas vehicle adoption are propelling the sales of CNG compressors.

In China, the increasing adoption of dual fuel vehicles (oil and gas), particularly buses and taxis to mitigate the carbon footprint is positively augmenting the sales of CNG compressors. The rising industrial activities in chemical, marine, transportation, and construction are also contributing to the high adoption of CNG compressors in the country.

In India, the adoption of natural gas is exhibiting a boom owing to the rising prices of other fuels such as petrol and diesel. The continuous growth in the adoption of natural gas is set to boost the sales of CNF compressors in the country. For instance, in March 2024, the Ministry of Petroleum & Natural Gas revealed that the first Small Scale LNG Unit of GAIL and around 201 CNG stations were inaugurated in the country. Furthermore, the government estimates to expand the natural gas share in the primary energy basket to 15% by 2030. Such initiatives are making India a most lucrative marketplace for CNG compressor manufacturers

Key CNG Compressor Market Players:

- Atlas Copco

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carnot Compression

- Bauer Compressors Inc.

- Wärtsilä Corporation

- CIMC Enric

- Kobelco Compressors America Inc.

- Ariel Corporation

- PC Mc Kenzie Company

- J-W Energy Company

- Elliott Company

- Associated Compressor Engineers

- C&B Pumps and Compressors LLC

- Gas Compressor Consultants Inc.

- INNIO Group

- Detechtion Technologies

- Sauer Compressors

- Ingersoll Rand, Inc.

- NuBlu Energy

- CNX Resources Corp

The CNG compressor market is characterized by the presence of industry giants and the emergence of new companies. The start-ups are investing heavily in research and development activities to introduce innovative CNG compressors. Such moves aid them to stand out from the crowd and attract a wider consumer base. The key players are investing in several organic and inorganic activities such as new product launches, strategic collaborations & partnerships, mergers & acquisitions, and regional expansions to maximize their market shares. Collaborations with tech firms and other players are adding them to introduce AI-powered CNG compressors. Furthermore, by acquiring smaller or new companies, they are expanding their product offerings.

Some of the key players include

Recent Developments

- In April 2024, NuBlu Energy and CNX Resources Corp. collaboratively announced the launch of ZeroHP CNG and Clean mLNG solutions. These advancements are effectively lowering the cost and carbon footprint of compressed natural gas (CNG) and micro-scale liquefied natural gas (LNG).

- In February 2023, Sauer Compressors revealed the launch of new gas compressors SAUER Orkan series. These two high-pressure air compressors come with a final pressure of up to 5076 and 7250 psig respectively.

- Report ID: 6829

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CNG Compressor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.