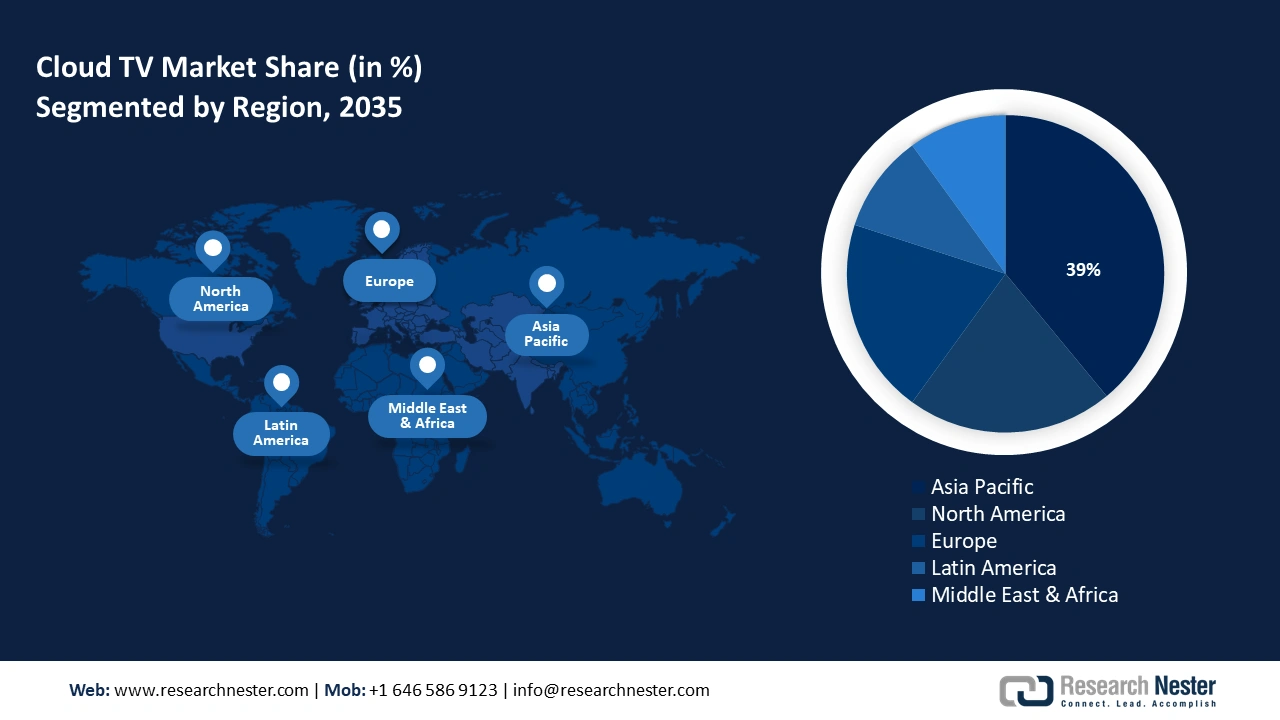

Cloud TV Market - Regional Analysis

APAC Market Insights

APAC market is projected to hold a leading revenue share of 39% throughout the anticipated timeline. The growth of the regional market is favorably impacted by a large consumer base, driving the demand for cloud-based streaming services. In addition, major streaming providers who are actively creating region-specific content, and the heightened 5G deployment trends are expected to fuel market growth in the coming years.

The China cloud TV market is poised to hold a leading revenue share in APAC, with the market growth fueled by the surging adoption of IaaS by domestic enterprises. The market benefits from significant investments in digital infrastructure along with China’s push to provide country-wide ultra-fast internet connection. The proliferation of internet users has created a conducive environment for cloud TV services. A key data highlighting the potential expansion of revenue opportunities in the China market is the leading number of 5G base stations deployed and a whopping 466.0 million 5G subscribers.

In India, the market is expected to register rapid growth during the forecast period owing to rising purchasing power and exposure to advanced technologies. As per the reports by the Ministry of Information and Broadcasting (MIB), India has one of the oldest and most dynamic media and entertainment landscapes, and the M&E sector is expected to register a CAGR of 7% in the coming years. This is expected to fuel demand for smart TVs and cloud TVs in the future.

|

Segment |

2024 (USD billion) |

2025 (USD billion) |

2026 (USD billion) |

2027 (USD billion) |

|

Digital Media |

9.66 |

10.88 |

12.10 |

13.30 |

|

Television |

8.18 |

8.15 |

8.08 |

8.03 |

|

|

3.13 |

3.16 |

3.18 |

3.22 |

|

Online Gaming |

2.79 |

3.13 |

3.47 |

3.81 |

|

Filmed Entertainment |

2.25 |

2.36 |

2.46 |

2.57 |

|

Animation & VFX |

1.24 |

1.36 |

1.57 |

1.77 |

|

Live Events |

1.22 |

1.43 |

1.71 |

2.01 |

|

Out-of-Home Media |

0.71 |

0.80 |

0.88 |

0.95 |

Source: MIB

North America Market Insights

North America market is poised to exhibit rapid growth and expand at a CAGR of 9.8% throughout the forecast timeline, owing to the presence of major industry players such as Amazon Prime Video, Hulu, and Netflix. The companies have been at the forefront of adopting cloud-based technologies to provide high-quality content to the regional audience. Additionally, the region is populated with consumers having high disposable income rates, creating lucrative opportunities for the continued adoption of cloud TV services. For instance, in 2023, the U.S. Bureau of Economic Analysis (BEA) stated that the highest per capita disposable incomes in the U.S. were in USD 76,114 in Connecticut and USD 76,107 in Massachusetts, indicating strong consumer spending potential.

U.S. is projected to maintain its growth in the market throughout the forecast timeline, with a larger section of consumers moving from traditional cable TV to cloud-based streaming services. According to a May 2022 report by the U.S. Department of Commerce, the Biden-Harris administration has rolled out a USD 45 billion Internet for All program aimed at expanding access to affordable and reliable high-speed internet across the United States. The U.S. market also benefits due to the early adoption of cloud TV services.

U.S. OTT Subscriptions & Investments

|

Category |

Key Insights |

|

Subscriptions |

~245.3 million OTT users as of 2025 |

|

Investments |

$13.3B VC; major content and live-sports deals; high-profile startup funding |

Europe Market Insights

In Europe, the cloud TV market is anticipated to account for 25.1% of the global revenue share throughout the forecast period, underpinned by high-speed connectivity and rising demand for subscription-based video services. Other factors, such as rapid expansion of data-center and cloud infrastructure, increasing OTT consumption, and smart TV penetration, are expected to fuel market growth during the forecast period. Leading countries, including the UK, Germany, and France, are focused on innovation in cloud TV through sustainable streaming, multilingual content delivery, and GDPR-compliant service models.

In Germany, key platforms like Zattoo, Joyn, and Sky Deutschland are leveraging cloud infrastructure to deliver live TV, on-demand programming, and AI-powered personalization. Notably, in April 2024, ProSiebenSat.1’s Joyn migrated 3.4 petabytes of media archives to Amazon’s AWS using Snowball appliances, resulting in a 3× larger storage catalog at the same cost, and enabling scalable VoD delivery. Additionally, DAZN Germany implemented a cloud-native delivery architecture coupled with its own Edge Network to stream the FIFA Club World Cup 2025 with low latency and high concurrency for German viewers.

The France market is expected to register rapid growth during the forecast period, owing to rising demand for VoD and streaming services, high internet penetration, and availability of better networks and devices. Several companies are heavily investing in R&D activities as consumers are increasingly expecting on-demand content, personalization, and catch-up services. This is expected to fuel the demand for cloud TVs in the coming years.