Cloud PBX Market Outlook:

Cloud PBX Market size was valued at USD 17.07 billion in 2025 and is expected to reach USD 77.27 billion by 2035, expanding at around 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud PBX is evaluated at USD 19.57 billion.

The cloud PBX market is witnessing significant growth due to the rapid adoption of cloud-based solutions for their cost-effectiveness while delivering improved communication for businesses. Easy operations allow them to effortlessly add or remove users, phone lines, and features as needed, reducing the extensive cost of on-premises IT hardware. This is further inflating the demand in this sector. For instance, in July 2023, Aarenet released its own desktop client, a Desktop as an affordable alternative to traditional physical desk phones. The system complements Microsoft Teams embedded applet a Call to offer reduced costs for users in accessing cloud PBX features such as call distribution, interactive voice response, and voice mail.

The growing trend of remote work and geographically dispersed teams has driven the demand in the cloud PBX market. These solutions help companies to enable seamless communication and collaboration for employees to work from anywhere. Advanced features including video conferencing, voicemail, and instant messaging attract businesses to adopt these systems. Moreover, the scalability and flexibility of these solutions are further preferred notably for establishing proper connections in remote work and distributed teams, inspiring tech leaders to invest. For instance, in March 2024, CallHarbor acquired PBX Systems to consolidate its position at the forefront in streamlining operations for remote work environments.

Key Cloud PBX Market Insights Summary:

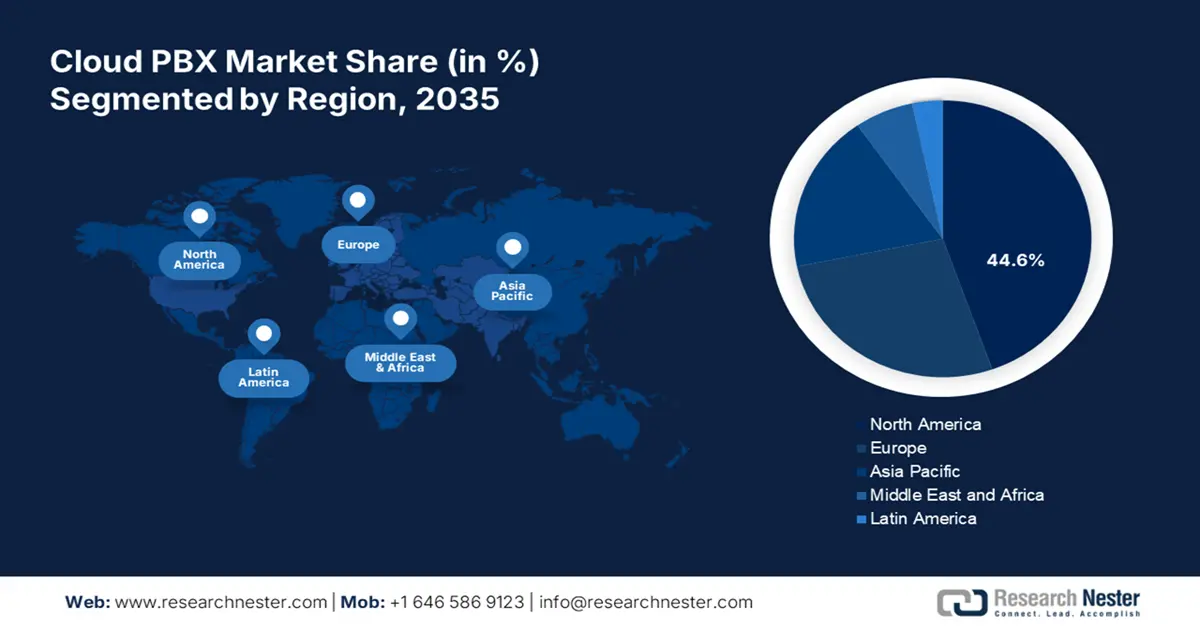

Regional Highlights:

- North America holds a 44.6% share of the Cloud PBX Market, driven by robust cloud infrastructure and rising cross-border enterprise demand, ensuring market leadership through 2026–2035.

- The Asia Pacific Cloud PBX Market is set for rapid expansion by 2035, propelled by demand from telecom services and multinational enterprise expansion.

Segment Insights:

- The Professional Service segment is expected to hold a significant market share by 2035, fueled by the diverse range of assistance and operations required by businesses.

- The Large Enterprises segment of the Cloud PBX Market is projected to hold over 73.1% share by 2035, driven by the increasing prevalence of dispersed employment enabling scalable communication solutions.

Key Growth Trends:

- Worldwide expansion of the cloud industry

- Enhanced performance due to advancements

Major Challenges:

- Data security and privacy concerns

- Limitations in integration and reliability

- Key Players: Microsoft Corporation (Skype), Nextiva Inc., RingCentral Inc., Avaya Inc., Barracuda Networks Inc. (CudaTel), Vonage America Inc., Cisco System Inc., D-Link System Inc., Allworx Corporations, BullsEye Telecom Inc., Mitel Networks Inc.

Global Cloud PBX Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.07 billion

- 2026 Market Size: USD 19.57 billion

- Projected Market Size: USD 77.27 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Cloud PBX Market Growth Drivers and Challenges:

Growth Drivers

- Worldwide expansion of the cloud industry: The accelerated shift towards cloud infrastructure has driven remarkable growth in the cloud PBX market. The improved work efficiency compared to the traditional on-premises phone systems is making these solutions and services preferred for business communicative operations. The advanced PBX systems are designed to offer more agile and cost-effective alternatives, increasing adoption across SMEs. For instance, in February 2024, Telviva partnered with Vodacom Lesotho to launch a cost-effective cloud-based UC&C platform, Vodacom One Connect for local small and medium enterprises. The cloud-based PBX offering can synchronize voice, video, and chat for both private and public sector customers.

- Enhanced performance due to advancements: The ongoing developments in cloud technology have propelled investments in the cloud PBX market. The upgraded services offer advanced features such as call forwarding, voicemail-to-email, analytics, and improved routing, creating a surge in this sector. In addition, the integration of AI, machine learning, and automation has further enhanced the performance of these systems. For instance, in September 2024, *astTECS announced its plan to launch the latest AI-powered tools at GITEX 2024 to revolutionize workforce optimization and business operations. The offerings include AI voicebots, AI chatbots, and docbots, leveraging its specializations in AI IP PBX.

Challenges

- Data security and privacy concerns: Emerging cyber threats are a major challenge for optimum adoption in the cloud PBX market. Raising concerns about data security such as hacking, data breaches, and denial-of-service attacks may restrict the progress in this sector. Ensuring robust security including encryption can be difficult to achieve for companies, as it is still under development. In addition, sensitive industries such as healthcare require compliance with regulatory frameworks such as HIPPA, which may hinder the integration.

- Limitations in integration and reliability: The quality of service in the cloud PBX market is highly reliable on the availability of the internet speed and latency. Thus, in urban areas with low internet connection and access, it may become difficult to deliver consistent quality. The cases of network downtime often impact consumer trust in their seamless performance, forcing them to switch to other competitor vendors. In addition, difficulty in integrating such advanced technologies with legacy systems may become a hurdle for companies to generate maximum revenue.

Cloud PBX Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 17.07 billion |

|

Forecast Year Market Size (2035) |

USD 77.27 billion |

|

Regional Scope |

|

Cloud PBX Market Segmentation:

Organization Size (Large Enterprises, SMEs)

Based on organization size, the large enterprises segment is projected to dominate cloud PBX market share of over 73.1% by 2035. The growth in this segment is driven by the enlarging amount of dispersed employment in these enterprises. In addition, the massive volume of consumers is attributed to the growing demand for reliable telephony systems in this sector. This is further inspiring companies to develop new technologies to support and ensure seamless connections between employees and consumers. For instance, in November 2021, Liquid Intelligent Technologies launched OneVoice in six markets in Africa for Cloud PBX, assisting businesses of any size in their telephony and collaboration needs.

Service (Professional, Managed, Network, IT, and Cloud)

In terms of service, the professional segment is estimated to capture a significant share of the cloud PBX market by the end of 2035. The diverse range of assistance and operations required from businesses are the major growth drivers in this segment. The key components such as consultancy, advisory, implementation, migration, customization, integration, training, maintenance, monitoring, and optimization are creating a new scope of business for global leaders. For instance, in June 2020, RingCentral announced the usage utilization of its cloud PBX to enable direct routing integration for Microsoft Teams. The service provides the Teams users access to a broader range of integrations, enhancing user productivity across the platform.

Our in-depth analysis of the global market includes the following segments:

|

Organization Size |

|

|

Service |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud PBX Market Regional Analysis:

North America Market Analysis

North America cloud PBX market is projected to dominate revenue share of around 44.6% by the end of 2035. The demand for these solutions has risen in this region due to its remarkable developments in cloud infrastructure. It has created a good trading environment for both consumers and service providers. This has further inspired many domestic tech companies to participate, enlarging the sector. For instance, in April 2024, Grandstream launched a secure, scalable, and powerful cloud PBX, CloudUCM for small-to-medium businesses, retail, hospitality, and residential. The new solution can provide a unified platform for voice and video calls, meetings, conferencing, chat, data, analytics, mobility, facility access, intercoms, video surveillance, and more.

The U.S. is a hub of technological advancement in the region, making it a profitable landscape for the global leaders in the cloud PBX market. Notable cross-border expansion of industries has raised the need for all-in-one communication systems to retain control over their operations. This further encourages companies to develop advanced technologies to support worldwide connectivity. For instance, in October 2024, Crexendo partnered with Symbio to launch an innovative cloud-based communications solution, AdvancedPBX to avail enhanced international VoIP services across North America.

Canada is following the path of advancement of its neighboring country, the U.S. to present great opportunities for the cloud PBX market. The country’s focus on digital transformation has further dragged the focus of domestic leaders to invest more. For instance, in September 2021, Mitel announced its strategic partnership with RingCentral for a seamless transition from on-premises systems to cloud platforms. In addition, the company invested USD 200 million to avail unique migration path to RingCentral’s Message Video Phone (MVP) cloud communications platform for its global consumer base.

APAC Market Statistics

The rapid transformation of industries, particularly in telecommunication services in Asia Pacific is propelling the demand in the cloud PBX market. The surging need for advanced communication solutions in developing countries such as Japan, China, and India has created a large consumer base for both domestic and international tech companies. The leaders are now showing interest in offering cloud-based tools to serve the purpose. For instance, in December 2022, Toku launched a cloud-based connectivity solution for Zoom Phone in 14 APAC territories. Its ability in PSTN interconnectivity across the region can expand Zoom Phone’s reach by allowing consumers to utilize Toku’s voice services network connected to the Zoom Phone cloud PBX software.

The growing and enlarging operations of multinational companies across India are creating opportunities for global leaders in the cloud PBX market. Many innovative telephony solutions are now being introduced, which are designed to meet country-specific needs. For instance, in October 2023, Zoom launched the country's first cloud PBX service, Zoom Phone for Multinational organizations and businesses, offering global native coverage in 50 countries and territories. It is licensed by the Department of Telecommunications (DoT) India and can provide MNCs a domestic presence with modern functionality for their distributed hybrid workforce.

China is securing its position among one of the fastest-growing countries in the cloud PBX market across the world due to the shifting consumer preferences and government. Many domestic leaders are now collaborating to supply the surge in global telecommunication services and tools. For instance, in July 2023, ALE China Co., Ltd extended its partnership with Epygi to ensure ease of connectivity and the best experience for ALE users. ALE aims to utilize Epygi's hosted PBX, ecQX solution for ALE M3/5/7/8 desk phones with the latest software version R140 to offer a complete set of features.

Key Cloud PBX Market Players:

- Microsoft Corporation (Skype)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nextiva Inc.

- RingCentral Inc.

- Avaya Inc.

- Barracuda Networks Inc. (CudaTel)

- Vonage America Inc.

- Cisco System Inc.

- D-Link System Inc.

- Allworx Corporations

- BullsEye Telecom Inc.

- Mitel Networks Inc.

- DIDWW Ireland Ltd.

- Momentum

The cloud PBX market is diversifying its applications and range of end users to generate maximum revenue. For instance, in September 2024, RingCentral collaborated with the world’s largest melanoma research and treatment facility, Melanoma Institute Australia (MIA) to streamline collaboration across 12 clinics. The five-year contract aims to migrate all MIA staff to the RingCentral platform in support of 20,000 patients each year. Many tech leaders are now participating in this competition to solidify their position in the telecommunication industry. The profitable portfolio of this sector has further encouraged other key players to invest more. Such key players include:

Recent Developments

- In December 2024, DIDWW launched an enhanced version of enhanced version of its cutting-edge cloud PBX, phone.systems v3.0 along with a dedicated app. The innovative features and improvements in the new PBX are optimized to offer business communications, integrations with CRMs, and additional functionalities.

- In January 2024, Momentum acquired Horizon Telecom to expand its footprint in the global voice and managed network. The strategic investment was made to offer a robust customer migration process for enterprise voice, Microsoft Teams, SD-WAN, and managed network solutions towards cloud-based services.

- Report ID: 6835

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud PBX Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.