Cloud-native Application Protection Platform Market Outlook:

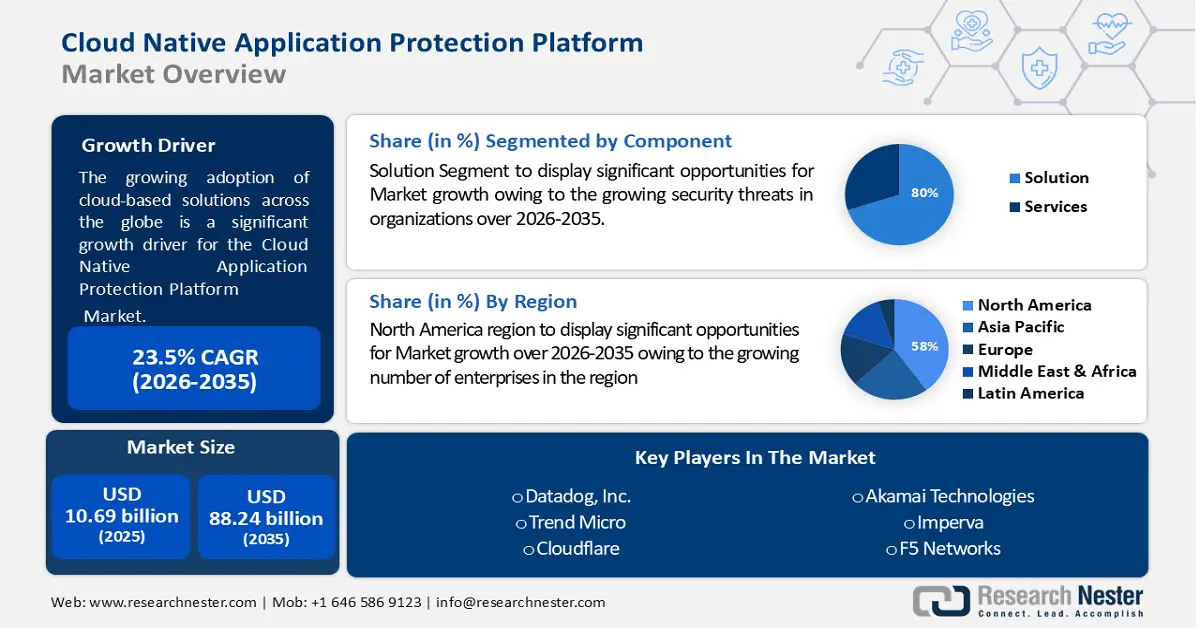

Cloud-native Application Protection Platform Market size was valued at USD 10.69 billion in 2025 and is likely to cross USD 88.24 billion by 2035, registering more than 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud-native application protection platform is assessed at USD 12.95 billion.

As enterprises use more cloud providers, applications, and resources, their cloud infrastructures have become even more complex. Furthermore, the market is expanding due to rising incidences of cyberattacks. The Lockbit ransomware attack, which caused six terabytes of data to be stolen in August 2021, has hit the worldwide IT consulting firm Accenture's network. Most security solutions do not have the end-to-end visibility needed to effectively assess risks and notify security teams of sophisticated cyberattacks, enabling them to manage them.

CNAPP stands out from the rest because of its ability to aggregate data and create end-to-end visibility across an organization's application infrastructure. It can prioritize alerts that could pose a risk to enterprises with an encrypted system for visibility and granular details of the technology stack, configuration, or identity. This factor is thus boosting demand for CNAPP market.

Key Cloud Native Application Protection Platform Market Insights Summary:

Regional Highlights:

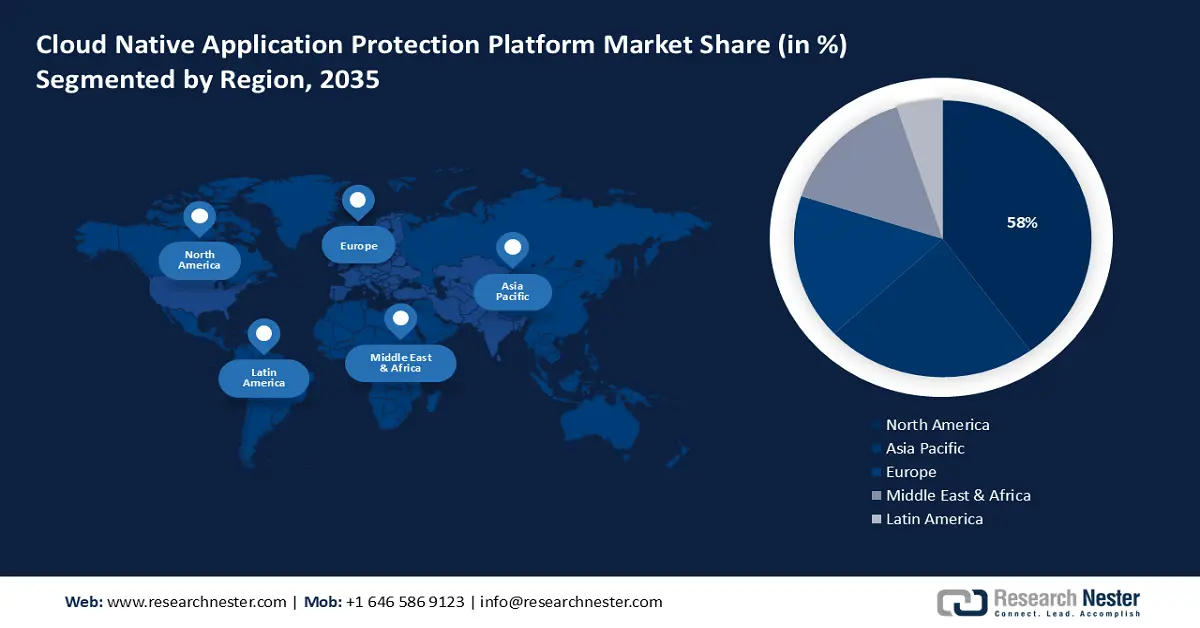

- The North America cloud-native application protection platform (CNAPP) market will hold more than 58% share by 2035, driven by presence of tech giants, strict data security regulations, and rising cybercrime cases.

Segment Insights:

- The hybrid cloud segment in the cloud-native application protection platform market is projected to see substantial growth through 2035, driven by improved business efficiency and strategic adoption of hybrid cloud infrastructure.

- The cloud security posture management segment in the cloud-native application protection platform market is expected to achieve a 30% share by 2035, driven by the need for better network security and multi-cloud management tools.

Key Growth Trends:

- Companies Using BYOD and Remote Working Substitutes

- Integration of Cloud Based Technologies

Major Challenges:

- Lack of Technical Education Availability

- Lack of skilled labor is expected to hamper the market expansion in the upcoming period

Key Players: Fortinet, Inc., Forcepoint LLC, Aqua Security Software Ltd., Radware Ltd., Zscaler, Inc., Sophos Group PLC.

Global Cloud Native Application Protection Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.69 billion

- 2026 Market Size: USD 12.95 billion

- Projected Market Size: USD 88.24 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (58% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 16 September, 2025

Cloud-native Application Protection Platform Market Growth Drivers and Challenges:

Growth Drivers

- Companies Using BYOD and Remote Working Substitutes - Cloud based technologies enable employees to work from home from their personal devices while at the same time being connected to office servers. Due to the growing popularity of Public Cloud solutions and BYOD legislation, businesses are beginning to shift their deployment paradigm. The Work from Home and Bring Your Own Device initiatives are rapidly being adopted by organizations. Remote employment helps to promote overall health and allows businesses to counter the loss of productivity.

- Integration of Cloud Based Technologies - The development of new machine learning and AI capabilities and the facilitation of more productive work is facilitated by cloud-based solutions. In order to protect endpoints and data centers, not cloud-native applications and services, traditional security methods and solutions have been developed. Security teams must be able to detect security problems and vulnerabilities at the earliest stage of development, rapidly solve them as well as guarantee reliable protection when using cloud technologies.

Challenges

- Lack of Technical Education Availability - For the deployment and maintenance of the CNAPP solution, technical expertise and experience are required. However, businesses have begun to employ security managers with insufficient training and experience over the last few years. Advanced cloud and security capabilities are more in demand than ever, but there is a severe shortage of certified, competent workers to support this shift, particularly in non-tech-related businesses, as per Forbes study from 2020 titled The Cloud Talent Drought Continues.

- Complexities associated with cloud-native application protection platform are expected to hinder the CNAPP market growth in the forecast period

- Lack of skilled labor is expected to hamper the market expansion in the upcoming period.

Cloud-native Application Protection Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 10.69 billion |

|

Forecast Year Market Size (2035) |

USD 88.24 billion |

|

Regional Scope |

|

Cloud-native Application Protection Platform Market Segmentation:

Type Segment Analysis

Based on cloud type, the hybrid segment is anticipated to hold 80% share of the global cloud-native application protection platform market by 2035. The increase in segmental activity can be attributed to the widespread implementation of hybrid cloud by various organizations around the world for improved business efficiency, user experience, and resource consumption. In order to improve business efficiency, resource consumption, cost-effectiveness, user experience, and application modernization while maximizing benefits, a growing number of companies are increasingly emphasizing the creation of hybrid cloud models and sophisticated strategies.

Component Segment Analysis

In terms of solution, the cloud security posture management segment in the cloud-native application protection platform market is anticipated to hold 30% of the revenue share by 2035. The growth is due to the increased use of CSPM by companies, as it provides more rigorous controls and a multi-cloud capability. In addition, companies are working towards integrating cutting-edge technology in CSPM so as to provide better network security solutions and systems which will likely be a driver for CNAPP market growth. Microsoft recently launched two new preview services for the Microsoft Defender cloud security platform, which are aimed at reducing security vulnerabilities and responding to attacks, in October 2022, called Microsoft Defender for DevOps and Microsoft Defender CSPM.

Our in-depth analysis of the global cloud-native application protection platform market includes the following segments:

|

Offering |

|

|

Cloud Type |

|

|

Vertical |

|

|

Organization Size |

|

|

Component |

|

|

Solution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud-native Application Protection Platform Market Regional Analysis:

North American Market Insights

The cloud-native application protection platform market in the North America industry is set to hold largest revenue share of 58% by 2035. This is due to the presence of major industry players and strict regulations, Innovation in this field, and the world's center of technology. In addition, there are some of the world's most important technology firms that have millions of sensitive data at their disposal and which serve as a catalyst for CNAPP use. The growing cases of payment security concerns and data breaches, as well as the increased compliance with Payment Regulation in the region, are some other important factors that contribute to CNAPP market growth for CNAPP. Ransomware, business email compromise, and cases involving cryptocurrencies, which reached an unprecedented level, were the most reported incidents and complaints in 2021. More than 800,000 cybercrime cases were reported in 2021 by the American public as per reports, from 2020 onwards, the increase will be around 7%, resulting in a loss of more than USD 6.5 billion.

APAC Market Insights

The cloud-native application protection platform market in the Asia Pacific region is set to grow notably during the forecast period. It could be that technological innovation is being driven by countries such as China, India, Japan and South Korea. The reliance on cloud computing, data analysis, and the Internet of Things is growing strongly in the region, in a rapidly evolving and dynamic business environment, where companies are taking advantage of new business opportunities. By using new technologies, companies are also focusing on cost benefits, business efficiency, and competitive advantages.

Cloud-native Application Protection Platform Market Players:

- Trend Micro, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Check Point Software Technologies Ltd.

- Palo Alto Networks, Inc.

- Crowdstrike Holdings, Inc.

- Fortinet, Inc.

- Forcepoint LLC

- Aqua Security Software Ltd.

- Radware Ltd.

- Zscaler, Inc.

- Sophos Group PLC

Recent Developments

- Palo Alto Networks has broadened its partnership with Google Cloud in order to bring the Prisma Access platform and BeyondCorp Enterprise of Google. This is going to aid organizations to get benefited from the performance scale, reliability of Google Cloud, and security expertise of Palo Alto Networks. For today's workforce, it will provide a secure zero trust environment.

- Zscaler disclosed Posture Control Solution made for giving endeavors with bound together Cloud-Native Application Protection Stage usefulness customized to secure cloud workloads. The posture control solution has been integrated with Zscaler Zero Trust Exchange, allowing security and DevOps teams to prioritize and effectively remediate risks associated with cloudnative applications during the early stages of development.

- Report ID: 5873

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Native Application Protection Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.