Cloud Logistics Market Outlook:

Cloud Logistics Market size was valued at USD 22.13 billion in 2025 and is expected to reach USD 77.14 billion by 2035, expanding at around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud logistics is evaluated at USD 24.78 billion.

The rapid adoption of advanced technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI) for logistics across various sectors, is expected to drive the cloud logistics market during the forecast period. The increasing need for scalable and flexible logistics solutions and the rising trend of digital transformation in the supply chain industry are also a few factors attributing to the market expansion, indicating plenty of opportunities for key players. In June 2024, Amazon announced that it intended to invest in Germany totaling USD 10.0 billion to foster innovation and provide support for expanding its cloud infrastructure and logistics network across the country.

Key Cloud Logistics Market Insights Summary:

Regional Highlights:

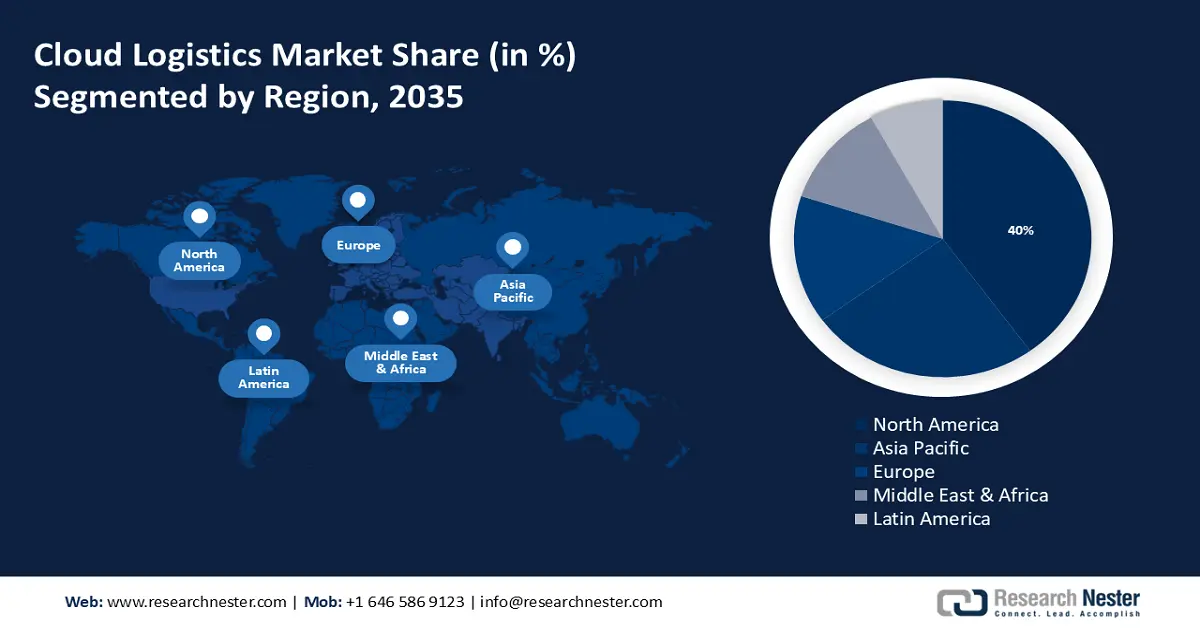

- The North America cloud logistics market is anticipated to capture 40% share by 2035, driven by well-developed cloud computing infrastructure, advanced technology use, and strong focus on innovation.

- The Asia Pacific market will account for 25% share by 2035, driven by rapid industrialization, increased e-commerce operations, and acceptance of digital technologies.

Segment Insights:

- The large enterprises segment in the cloud logistics market is projected to hold a significant share by 2035, influenced by adoption of predictive analytics and real-time tracking in logistics.

- The web-based os segment in the cloud logistics market is projected to hold a 53% share by 2035, driven by ease of access and real-time logistics visibility.

Key Growth Trends:

- Shifting pattern in logistics & transportation management systems (TMS)

- Product innovations led by a highly competitive landscape

Major Challenges:

- Increased dependency on the internet

- Standardization and interoperability issues

Key Players: Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Infor, Inc., Descartes Systems Group Inc., Manhattan Associates, Inc., JDA Software Group, Inc., Blue Yonder Group, Inc., Kinaxis Inc.

Global Cloud Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.13 billion

- 2026 Market Size: USD 24.78 billion

- Projected Market Size: USD 77.14 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 17 September, 2025

Cloud Logistics Market Growth Drivers and Challenges:

Growth Drivers

-

Shifting pattern in logistics & transportation management systems (TMS): The supply chain is changing rapidly and is moving toward ERP to provide control over logistics and visibility in supply chains. It offers resources and tools to all the supply chain stakeholders including suppliers, dispatchers, transportation, warehousing, finance, sales, purchasing, customer service, and executive management. An effective TMS facilitates immediate access to customer orders, helps in better decision-making, freight audits and payments, strategically managing costs, and mitigating the risks in the supply chain. The cloud-based logistics are online platforms that run on the provider’s cloud or single server and are used by multiple dispatchers.

Customers gain insights into ocean LCL/FCL, air LTL/FTL, road, and railways freight rates ascribed to visibility in outbound and inbound activities in supply chains with these multi-tenant solutions. Modern technology including Radio-frequency Identification (RFID) consolidates real-time tracking of cargo and inventory and cargo. In November 2023, Seagull Scientific launched BarTender Cloud, a de facto standard for RFID label production in the warehousing, manufacturing, logistics, and retail sectors. It has eliminated the on-premise hardware and associated support costs, thereby, aiding in cost management. -

Product innovations led by a highly competitive landscape: Transportation and logistics (T&L) is presently witnessing significant evolution owing to the penetration of new technology, market entrants, customer expectations, and new business models. The emergence of startups is exploring technologies such as platforms and crowd-sharing solutions to mitigate costly last mile of delivery. The market is fragmented with the entrance of startups and their collaboration with incumbents to diversify their service offers.

The current industry leaders compete for a dominant position by strategically acquiring smaller players and achieving scale by striving to consolidate with mergers. For instance, in April 2024, Titan Cloud acquired TRUEFILL to increase fleet utilization, reduce fuel supply costs and runouts, efficient carrier management, and lower freight costs. The acquisition solidifies Titan Cloud as a prominent player in the downstream fuel cloud logistics market and integrates end-to-end real-time monitoring of supply chains.

Furthermore, in March 2022, FedEx and Microsoft collaboratively introduced a cross-platform cloud logistics solution for e-commerce. The Dynamics 365 Intelligent Order Management leverages FedEx Surround solution, Microsoft Azure technology, and AI, catering to rising global trade and e-commerce. In October 2020, e2open and Uber Freight entered into a partnership to launch an application programming interface (API) for digital freight brokerage rates and streamline TMS. Major players are innovating machine-to-machine parcel-station unloading/loading for last-mile delivery. Rampant development of autonomous vehicles and emergence of virtual freight-forwarding business model is set to support the adoption of crowd-sharing platforms during the forecast period.

Challenges

-

Increased dependency on the internet: Companies relying on Internet connection for cloud logistics solutions are vulnerable to inherent risks associated with network outages and connectivity issues. Organizations may be reluctant to fully adopt cloud logistics solutions because they are concerned about the dependability and the potential negative impact of system downtime on their logistics operations and overall corporate success.

-

Standardization and interoperability issues: Cloud logistics adoption is restricted due to the lack of common protocols and interoperability since logistics stakeholders use different technologies and systems. This hinders capitalization on cloud-based logistics' potential by making it difficult to unify communication and data interchange across platforms.

Cloud Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 22.13 billion |

|

Forecast Year Market Size (2035) |

USD 77.14 billion |

|

Regional Scope |

|

Cloud Logistics Market Segmentation:

Type Segment Analysis

The public segment in the cloud logistics market is projected to account for 39% of the revenue share during the forecast period. This segment of the cloud logistics industry comprises Internet-based solutions offered by third-party providers. These providers host and maintain logistics software and infrastructure, giving firms scalable, on-demand logistics solutions without hardware or software expenditures.

SaaS solutions, which offer subscription access to cloud logistics systems, are gaining popularity in the public, allowing enterprises of all sizes flexibility and cost-effectiveness. This has further driven strategic collaborations in the cloud logistics market. For instance, in August 2023, logistics solution provider Shiprocket announced its partnership with Skye Air, a SaaS-based drone delivery solution provider, to revolutionize e-commerce in India and deliver shipments via drones. Therefore, giving a satisfying experience to the customer and propelling the cloud logistic market growth.

OS Type Segment Analysis

The web-based operating system (OS) segment will dominate the cloud logistics market with a revenue share of 53% during the forecast period. These systems provide effortless access to logistics management platforms, allowing for immediate tracking, inventory control, and cooperation among supply chain participants. An emerging trend in this field involves the incorporation of web-based OS with cloud-based logistics solutions to improve accessibility and scalability for users. A study conducted by Zebra Technologies in June 2024, revealed that organizations in America that possess real-time visibility have the potential to decrease product recalls by as much as 70%.

Enterprise Size Segment Analysis

By 2035, the large enterprises segment is expected to account for 74% of the cloud logistics market share. In the cloud logistics sector, large organizations are generally characterized as businesses that have vast operations and substantial logistical requirements. Large firms are now utilizing modern technologies such as real-time tracking and predictive analytics to optimize their logistics processes to make their operations more efficient, improve visibility in their supply chain, and enhance overall effectiveness.

For example, in April 2024 Easyship revealed that it entered into a agreement with FedEx. This agreement aims to provide small and medium-sized enterprises around the U.S. with a wider selection of prompt, cost-effective, and dependable shipping options. Easyship users will have exclusive access to new reduced shipping rates for all FedEx services thus increasing the cloud logistics sector expansion.

Our in-depth analysis of the cloud logistics market includes the following segments:

|

Type |

|

|

OS Type |

|

|

Enterprise Size |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Logistics Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 40% by 2035. The region possesses a well-developed infrastructure for cloud computing, extensive utilization of cutting-edge technology, and a significant emphasis on innovation. In addition, businesses in North America highly emphasize optimizing and improving the efficiency of their supply chains. This has led to an increased demand for logistics solutions that are based on cloud technology.

The U.S. dominance in the cloud logistics market is enhanced by prominent cloud service providers and tech giants, which attract investments and promote ongoing expansion. Furthermore, in February 2024, C.H. Robinson, a global logistics company, developed an innovative technology that significantly enhances the efficiency of freight transport or shipping. This technology eliminates the need for manually arranging appointments at the pickup and delivery locations of a load.

The extensive adoption of cloud logistics in Canada has been significantly shaped by the well-established e-commerce industry. Major industry participants, including Blockhead, BlueRover, Mavennet, Optel, and others, are embracing technology improvements in the cloud logistics market.

APAC Insights

Asia Pacific is expected to account for 25% of the global cloud logistics market share by 2035 owing to factors such as rapid industrialization, increased e-commerce operations, and increasing acceptance of digital technologies.

India’s extensive population and heterogeneous economy present potential for cloud logistics providers to cater to diverse supply chain requirements. In 2023, ITLN reports that 44% of Indian enterprises intend to implement cloud-based logistics service delivery asset tracking systems during the next three years. Cloud platforms facilitate the integration of various solutions into existing ecosystems and provide the capacity to scale and adapt easily. In addition, certain firms are now opting for on-premise systems for asset tracking.

China’s cloud logistics market is expected to experience heightened rivalry and consolidation as companies aim to provide more advanced and customized solutions to fulfill the constantly changing requirements of contemporary supply chain management. Notable transportation companies in China include Sinotrans, Toll Group, DB Schenker, DHL, SF Express, Deppon Logistics, JD Logistics, CN Logistics, Yusen Logistics, and others propelling the rise in the market.

In Japan, the increasing need for businesses to improve efficiency, scalability, and visibility in their logistics operations is likely to drive the demand for cloud-based solutions, leading to market expansion in the area. Yamato Holdings, Sagawa, Japan Post, and Amazon Japan are a few key players that accelerate the cloud logistics market expansion.

Cloud Logistics Market Players:

- Oracle

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jaix

- JDA

- Bwise

- IBM

- Microsoft

- C.H. Robinson

- MetricStream

- Trimble

The cloud logistics market is growing rapidly and employs cloud computing to improve supply chain management and logistics operations. Several key players use growth techniques like product releases and approvals and industry leader alliances to increase efficiency and provide real-time supply chain insight.

Recent Developments

- In February 2024, Oracle is enhancing the logistics capabilities of Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) to assist enterprises in improving the efficiency of their global supply chains. The enhancements made to Oracle Transportation Management and Oracle Global Trade Management, which are components of Oracle Cloud SCM, will assist clients in optimizing their logistics operations by enhancing visibility, minimizing expenses, automating regulatory compliance, and enhancing decision-making.

- In January 2021, IBM declared its intention to purchase Taos, a prominent provider of cloud professional and managed services. IBM is enhancing its ability to migrate and transform data to the cloud, which is a crucial part of its ambition to expand its hybrid cloud platform.

- Report ID: 6320

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.