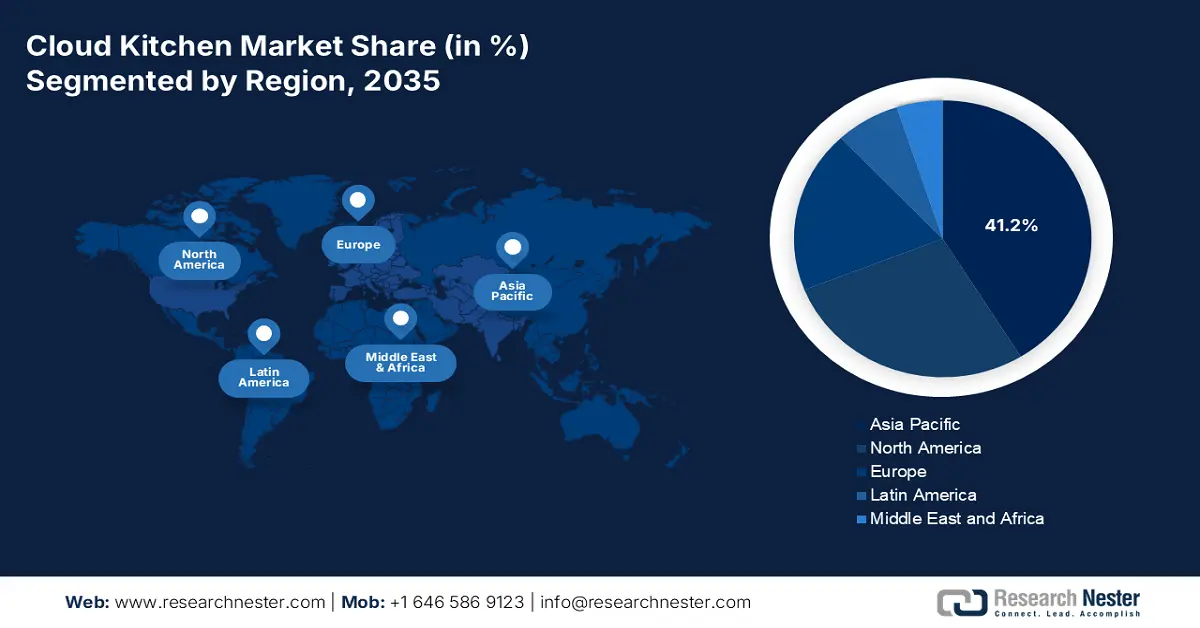

Cloud Kitchen Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the cloud kitchen market and is expected to hold the revenue share of 41.2% by 2035. The market is defined by the explosive demand, intense innovation, and a complex, multi-layered competitive landscape. This dominance is driven by a confluence of powerful self-reinforcing factors. The region’s massive digitally native and increasingly affluent urban population provides an unparalleled addressable market for food delivery. Second, the exceptionally high penetration of smartphones and the super app ecosystem has made ordering food online a daily habit for hundreds of millions. Third, supportive government initiatives aimed at digitalizing small and medium enterprises, formalizing the food sector, and creating a favorable environment for organized, scalable food service models.

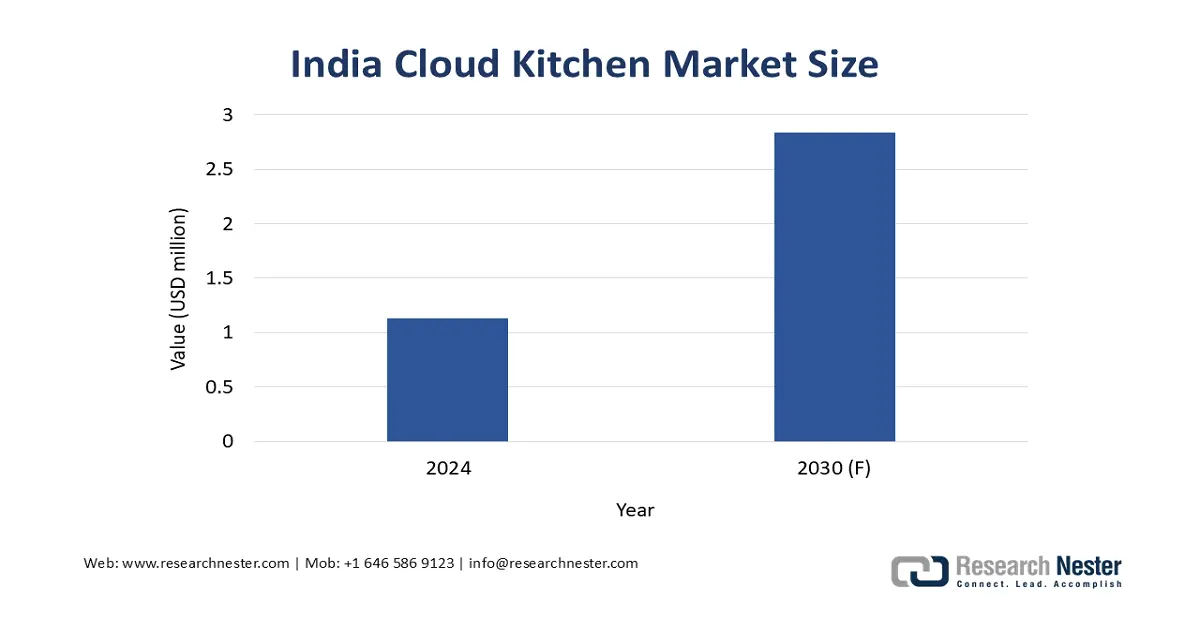

The India’s cloud kitchen market is expanding rapidly and is driven by the rising digital food ordering, cost-efficient business models, and supportive regulatory formalization. The report from the IBEF in August 2025 states that the 12% of the food delivery in the country is based on online services, and this share is projected to rise to 20%. The growth is supported by the increasing smartphone penetration, a growing middle-class population with higher disposable incomes, and sustained demand for convenience-led meal consumption. Post pandemic shifts have stimulated the cloud kitchen adoption beyond Tier 1 cities into Tier 2 and Tier 3 urban centers, improving the delivery density and scalability. With lower real estate and staffing costs compared to dine-in restaurants, cloud kitchens in India are well-positioned to scale via standardized menus, multi-brand operation, and platform-led distribution.

Source: IBEF August 2025

China cloud kitchen market is the most technologically integrated, defined by the dominance of its super app platforms such as Meituan and Alibaba’s Ele.me. The NLM study in July 2025 indicates that by the end of 2023, 49.9% of the internet users in China, which is over 500 million people, had used online food delivery services, making takeaway consumption a routine part of urban lifestyles. The market is defined by the high platform concentration, with Meituan Waimai and Ele.me are accounting for more than 90% of the food delivery transactions, providing cloud kitchens with immediate access to large, demand-dense user bases. Growth momentum is further stimulated during the pandemic period, reinforcing the delivery-first consumption habits that persist post pandemic. As China is expected to lead the global online food delivery revenue, cloud kitchens benefit from high order frequency, standardized menu execution, and platform-led logistics, positioning the country as the most scalable and competitive market globally.

North America Market Insights

North America is the fastest-growing cloud kitchen market and is poised to grow at a CAGR of 10.8% during the forecast period, 2026 to 2035. The market is defined by the maturity and consolidation transitioning from a fragmented landscape of independent operators to a strategy dominated by the major Quick Service Restaurants chains and food delivery platforms. The growth is propelled by the region’s high digital food spending, dense urban populations, ideal for delivery logistics, and the pursuit of capital-efficient expansion by established brands. The key trend is the scaling of enterprise-grade chain-operated ghost kitchens, which prioritize operational consistency and data-driven menu optimization over experimental virtual brands. The government influence is indirect but supportive; agencies such as the Small Business Administration in the U.S. provide financing pathways for operators.

The U.S. cloud kitchen market is consolidating, with growth driven by the major quick service restaurant chains leveraging cloud kitchens for capital efficiency and digital expansion. A primary trend is the professionalization of the space, moving from freelance virtual brands to enterprise-grade chain-operated facilities that ensure consistency and scale. This is supported by the robust digital spending. The report from the USDA August 2024 shows that the U.S. consumers spend 5.9% of their disposable personal income on food away from home in 2023, which is a rise of 5.6% from 2022. This data indicates an increased reliance on prepared and externally sourced meals. Cloud kitchens, which fall within the food away from home category, are structurally positioned to capture this demand via delivery only cost-efficient operating models. The trend reflects broader lifestyle factors, including time constraints and dual income households, reinforcing the U.S. market’s attractiveness for scalable standardized cloud kitchen expansion without dependence in dine in infrastructure.

Strategic relationships between kitchen operators and national supermarket or retail chains drive the Canada cloud kitchen market, which has a strong growth potential. The industry is closely tied to the urban delivery cost dynamics and consumer reliance on prepared food services. The Statistics Canada data in June 2024 shows that the prices for local messenger and delivery services, which include take-out food and grocery delivery, increased 3.6% YoY in April 2024, indicating a clear moderation in the last-mile delivery cost inflation. This easing cost environment supports improved unit economics for delivery-only kitchens operating in major urban centers. As the delivery expenses stabilize, the cloud kitchen operators gain a greater pricing flexibility and margin predictability, hence enabling scalable expansion without proportional increases in logistics costs.

Europe Market Insights

The Europe cloud kitchen market is evolving from a post pandemic delivery solution into a mature segment defined by strategic consolidation. The growth is driven by the sustained consumer demand for food delivery, high urban density, facilitating efficient last-mile logistics, and the need for traditional restaurants to expand digitally with lower capital expenditure. The key trends include the rise of integrated kitchen as a service platforms that provide infrastructure technology and operational support to multiple food brands and the expansion of large international operators via mergers and acquisitions. Further established quick service restaurant chains are increasingly adopting dedicated ghost kitchen models to enter new markets and serve digital only customer segment without the cost of a full dine-in location.

The Germany cloud kitchen market is characterized by the rapid adoption driven by a significant cultural shift towards food delivery and convenience in a traditionally dine-out-oriented culture. The growth is fueled by the high smartphone penetration, urban density, and the entry of international delivery platforms optimizing their local logistics networks. In Germany, the food service sales increased by 12.2% YoY to USD 91.3 billion in 2023, indicating a sustained rebound and expansion in out-of-home and takeaway food consumption, based on the USDA December 2024 report. This growth reflects on a changing consumer lifestyles including urban living, high workforce participation, and increasing reliance on convenient meal solutions. The cloud kitchen is well-positioned to capture this demand via delivery-focused standardized operating models that avoid high dine-in real estate costs common in German city centers. As the foodservice spending scales, the delivery-only kitchens benefit from improved order density and more predictable demand patterns.

Accommodation & Food Services Turnover (April 2022 vs Benchmarks)

|

Metric |

April 2022 vs March 2022 |

April 2022 vs April 2021 |

April 2022 vs Feb 2020 |

|

Real (price-adjusted) |

+2.6% |

+138.4% |

-24.0% |

|

Nominal (not price-adjusted) |

+3.6% |

Not specified |

Not specified |

Source: Destatis June 2022

Rising takeaway food prices alongside sustained consumer reliance on prepared meal is driving the UK cloud kitchen market. Its leadership is driven by London’s dense population, exceptionally high consumer acceptance of food delivery apps, and a competitive landscape of both agile startups and established quick service restaurant chains leveraging ghost kitchens for expansion. The report from the Office of National Statistics in May 2023 indicates that 3 in 10 fast food and takeaway items experienced an average price increase of 15% or more in the 12 months, highlighting persistent cost pressures across the foodservice sector. The demand for takeaway and delivered meals has remained resilient, suggesting limited short-term elasticity for the convenience-driven food consumption. For the cloud kitchens, this environment reinforces the importance of centralized production, standardized menus, and tight cost controls to mitigate input and pricing volatility.

Annual Rate for Fast Food and Takeaway Good Services

|

Name |

Annual Growth Rate (%) |

|

Takeaway fish and chips |

19 |

|

Takeaway or eat in burger |

17 |

|

Takeaway chicken & chips |

17 |

|

Takeaway cooked pastry |

15 |

|

Takeaway kebab |

14 |

|

Takeaway or delivery pizza |

13 |

|

Takeaway cold sandwich |

11 |

|

Takeaway coffee |

11 |

|

Takeaway tea |

10 |

|

Chinese takeaway, main-course |

10 |

|

Indian takeaway, main-course |

10 |

|

Takeaway soft drink |

10 |

|

Fast food and take away food service |

12.7 |

Source: Office of National Statistics May 2023