Cloud Integration Migration and Optimization Market Outlook:

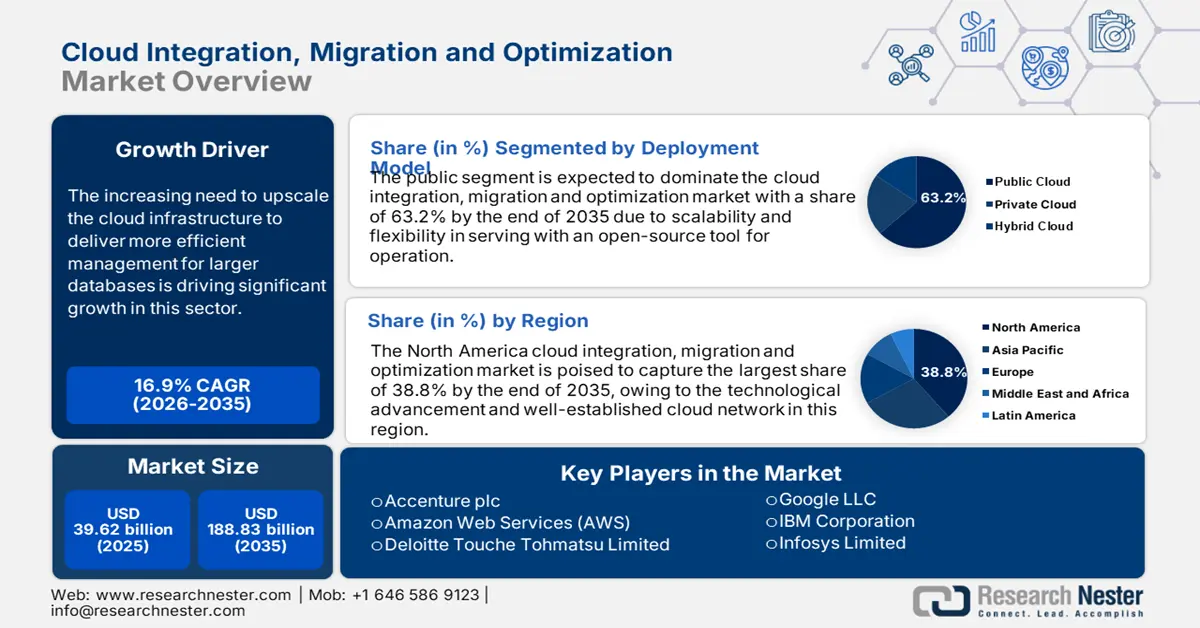

Cloud Integration Migration and Optimization Market size was over USD 39.62 billion in 2025 and is poised to exceed USD 188.83 billion by 2035, growing at over 16.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud integration migration and optimization is evaluated at USD 45.65 billion.

The increasing need to upscale the cloud infrastructure to deliver more efficient management for larger databases is driving significant growth in this sector. Integration and migration services help businesses gain flexibility for transitioning to new cloud environments. This ensures seamless adoption of changes or growths as per demand.

The cloud integration, migration and optimization market has encouraged organizations to supervise efficient team collaborations. For instance, in May 2024, Microsoft migrated its ServiceNow platform to Azure as an extension of their partnership. This new collaborative journey will help both companies enhance the capability and productivity of their products through innovation. Such events inspire other enterprises to follow the path of business transformation. This further inflates the demand for such migration services. The cloud-based tools are designed to operate remote and hybrid work models by ensuring a seamless connection between various platforms and devices. These services are also capable of moving sensitive data securely while complying with industry standards.

Key Cloud Integration, Migration and Optimization Market Insights Summary:

Regional Highlights:

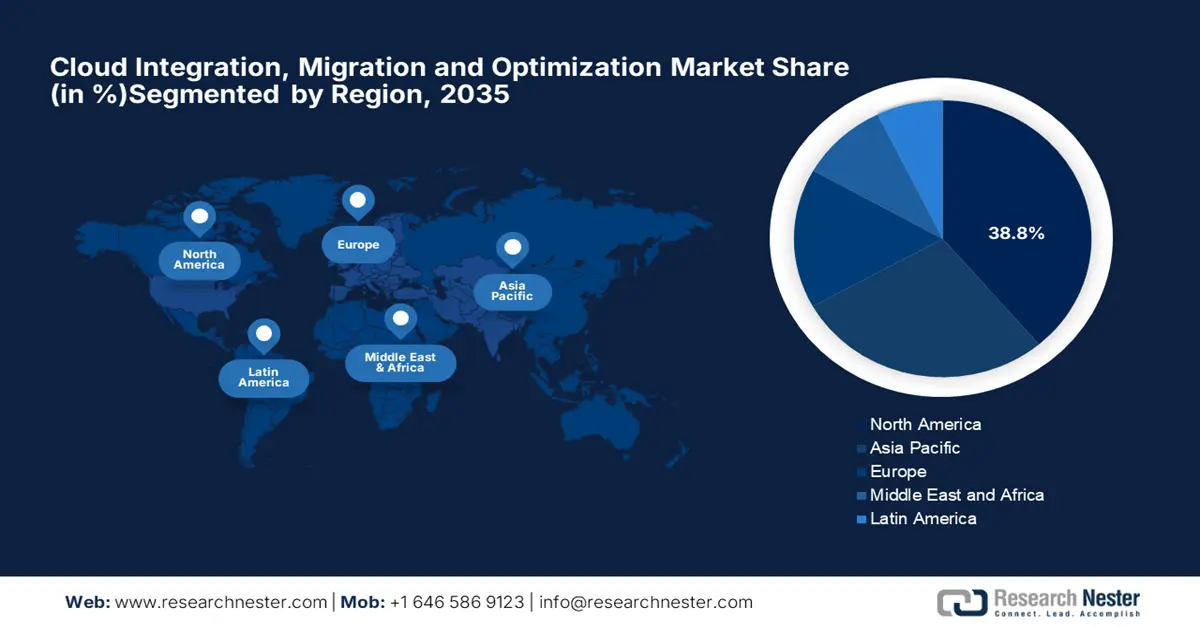

- North America's 38.8% share in the Cloud Integration Migration and Optimization Market thrives due to the region's advanced cloud infrastructure and innovation, driving growth from 2026–2035.

Segment Insights:

- The Optimization segment is poised to garner significant opportunities from 2026 to 2035, driven by its capability to improve cost-efficiency and maximize ROI through AI-powered features.

- The Public segment is anticipated to capture over 63.2% market share by 2035, driven by the scalability, flexibility, and cost-efficiency of open-source tools and pay-as-you-go models.

Key Growth Trends:

- Advancement in technologies

- Digital transformation initiatives

Major Challenges:

- Skill shortage for operations

- Concerns about security and compliance

- Key Players: Accenture plc, Amazon Web Services (AWS), Deloitte Touche Tohmatsu Limited, Google LLC, IBM Corporation, Infosys Limited, Microsoft Corporation, Oracle Corporation, Rackspace Technology, VMware (Broadcom), Wipro Limited.

Global Cloud Integration, Migration and Optimization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.62 billion

- 2026 Market Size: USD 45.65 billion

- Projected Market Size: USD 188.83 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Cloud Integration Migration and Optimization Market Growth Drivers and Challenges:

Growth Drivers

-

Advancement in technologies: Penetration of advanced technologies such as AI, machine learning, and IoT in cloud platforms is increasing demand in the cloud integration, migration and optimization industry. As companies focus on leveraging technologies for data analysis, predictive analytics, and automation, the need for cloud upgradation increases. These advancements allow businesses to maintain continuous improvement in data management. In March 2024, ClearScale launched a new cloud service delivery model, ClearScale Squads to optimize cloud projects of any scale. The tool will help organizations leverage cloud functionality to deliver maximized topline revenue and optimized bottom-line revenue.

-

Digital transformation initiatives: Businesses are considering digitalization as a way to enhance their productivity. They are showing interest in modernizing legacy systems to streamline operations. Such infrastructural transformations need secure and efficient integration tools or services to be conducted. The cloud integration, migration and optimization market can feed this concept with innovative solutions. Adoption of such technologies can eliminate the cost of on-premises infrastructures, escalating the demand for cloud integration. For instance, in May 2024, moved their Hadoop ecosystem to the Google Cloud Platform as a step to modernize data management, reducing the cost of tens of thousands of servers hosting around 1 exabyte data.

Challenges

-

Skill shortage for operations: The complex hybrid and multi-cloud environment needs skilled professionals to operate. A shortage of trained operators may hinder the management of intricacies related to the cloud integration, migration and optimization sector. This can further lead to magnified migration time, risk of errors, and difficulties in post-migration management. Further, it can discourage organizations from implementing such advanced technologies.

-

Concerns about security and compliance: Non-compliance can lead to data breaches, financial penalties, and reputational damage. Thus, many enterprises using legacy systems may refrain from transforming due to data security concerns. In addition, they may raise questions about the compliance of modern cloud tools with regulatory standards including GDPR and HIPPA. This may further create mistrust and a lack of understanding between customers and service providers.

Cloud Integration Migration and Optimization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 39.62 billion |

|

Forecast Year Market Size (2035) |

USD 188.83 billion |

|

Regional Scope |

|

Cloud Integration Migration and Optimization Market Segmentation:

Deployment Model (Private, Public, Hybrid)

Public segment is projected to hold more than 63.2% cloud integration, migration and optimization market share by 2035. The scalability and flexibility in serving with an open-source tool for operation have driven significant growth in this segment. The public cloud service providers allow businesses to scale up or down without requiring on-premises infrastructure. As a result, these pay-as-you-go models make data management affordable for users. Companies are now upgrading their public cloud services to integrate with new technologies. For instance, in October 2023, AWS launched Amazon EC2 Capacity Blocks to provide access for reserving GPU instances for deploying AI and ML models.

Service Type (Integration, Migration, Optimization)

Based on service type, the optimization segment is expected to garner great opportunities for the cloud integration, migration and optimization market during the forecast period. The segment is witnessing growth due to its capability to improve cost-efficiency in the cloud environment. Recent developments in technology have enabled tools for organizations to maximize the return on investment from these services. For instance, in June 2024, Harness launched three new AI-powered features for businesses seeking cost optimization. Cloud Asset Governance can automate the process of cost management, security, and compliance over multi-cloud environments. Its flexible integration allows access to governance through AWS, Azure, and Google Cloud Platform.

Our in-depth analysis of the market includes the following segments:

|

Deployment Model |

|

|

Service Type |

|

|

Enterprise Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Integration Migration and Optimization Market Regional Analysis:

North America Market Analysis

North America in cloud integration, migration and optimization market is projected to hold more than 38.8% revenue share by 2035. The region is accelerating in growth through its technological advancement and well-established cloud network. As businesses shift their IT infrastructure to the cloud, the need for assisted and secure migration and other services increases. The region holds global tech leaders such as IBM, AWS, Azure, GCP, and others, who are consolidating their position in the landscape through their efforts to bring innovation. For instance, in January 2024, Accenture acquired Navisite to offer scalable infrastructure management services. The new addition will help the company to modernize the business cloud environments across the region by integrating AI.

Leaders of the U.S. cloud integration, migration and optimization market are evolving their services according to the need for modernization. They are implementing strategies to establish their reach of hybrid and multi-cloud businesses. For instance, in November 2023, Broadcom acquired VMware to offer its enterprise customers a solution for modernizing and optimizing their private and hybrid cloud environments. In addition, Broadcom will utilize a wide range of VMware services to optimize its cloud and edge solutions.

Considering the increasing demand for cloud services, leaders of the market are willing to expand their reach in Canada. Companies are now developing new technology to meet the regulatory framework of this country. This has influenced many financial and other core institutions to adopt such technological upgradation. For instance, in June 2024, the National Bank of Canada extended its partnership with Kyndryl to propel its digitalization and cloud migration, enhancing operational agility.

APAC Market Statistics

Asia Pacific is fostering great investment opportunities for the cloud integration, migration and optimization market during the forecast period. Developing countries such as Japan, China, India, and South Korea are taking initiatives to leverage their cloud infrastructure through adopting these services or tools. Many tech companies are collaborating to promote the integration of new technologies into existing cloud systems, improving efficiency and scalability. For instance, in October 2024, Asteria and SendQuick partnered to integrate API technology to build a unified communication solution for Southeast Asia and Japan markets. The initial collaboration with Gravio will establish a secure and diversified connection between humans and technologies including AI and IoT.

India is paving the way for registering remarkable growth in the cloud integration, migration and optimization market in the upcoming years. Many domestic tech leaders are supervising new integrations for developing revolutionary cloud solutions. For instance, in May 2024, Tata Communications and Cisco collaboratively launched Webex Calling with a cloud Public Switched Telephone Network (PSTN) for businesses in India. The new service is built by integrating Cisco’s Webex Calling with the cloud voice services of Tata Communications GlobalRapide platform.

China is also transforming its cloud infrastructure to foster the scope of development in the market. Companies from different industries are collaborating with domestic tech leaders to escalate their development in the cloud environment. For instance, in 2021, Haitong Securities launched a cloud management platform by integrating OnePro’s cloud migration module in China, HyperMotion. The migration services are integrated in the form of REST API, which will allow simple configuration without downtime.

Key Cloud Integration Migration and Optimization Market Players:

- Accenture plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services (AWS)

- Deloitte Touche Tohmatsu Limited

- Google LLC

- IBM Corporation

- Infosys Limited

- Microsoft Corporation

- Oracle Corporation

- Rackspace Technology

- VMware (Broadcom)

- Wipro Limited

- Pythian

The current trend in the market is introducing methods or tools to support increasing workload due to AI integration in data processing. Companies are now developing new technologies to improve cloud performance. For instance, in November 2023, IBM collaborated with AWS to launch a new cloud database offering to optimize AI workloads. The collaboration allows Db2 customers to modernize or deploy hybrid cloud architecture by using Amazon RDS. The Db2 consumers can migrate their database to the cloud, automating the provisioning, backups, software patching, and monitoring. Such key players of the market include:

Recent Developments

- In September 2024, Pythian announced its new Oracle Database@Google Cloud Migration services for organizations. This service will ensure high-value and seamless migrations of the database from Oracle to Google Cloud’s infrastructure.

- In September 2024, Oracle partnered with AWS to launch a new offering, Oracle Database@AWS. This partnership will provide enterprises with a simplified solution to connect their data from Oracle database to applications running on Amazon cloud infrastructure.

- Report ID: 6709

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Integration, Migration and Optimization Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.