Cloud Data Center Market - Historic Data (2019-2024), Global Trends 2025, Growth Forecasts 2037

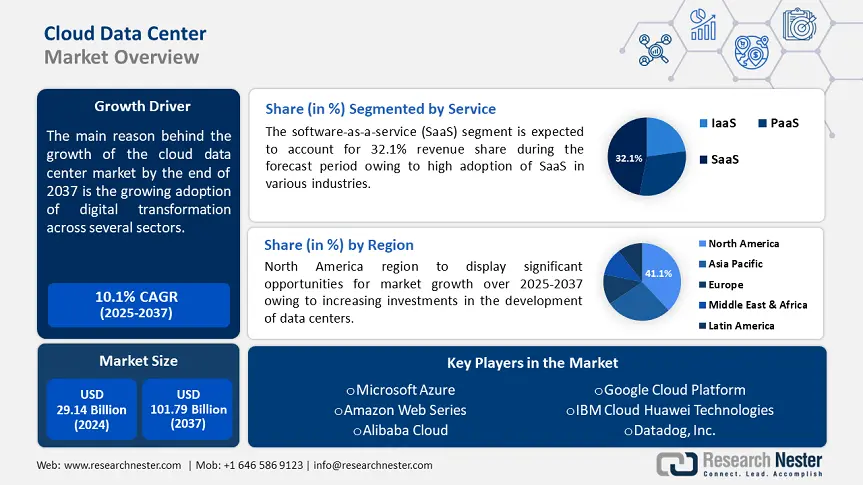

Cloud Data Center Market in 2025 is assessed at USD 31.49 billion. The global Market size was worth over USD 29.14 billion in 2024 and is poised to grow at a CAGR of more than 10.1%, reaching USD 101.79 billion revenue by 2037. North America is anticipated to attain USD 41.73 billion by 2037, driven by rising investments in data center development and advancements in cloud technology.

The cloud data center market growth is driven by the rising adoption of digital transformation across several sectors including IT and telecom, BFSI, energy, healthcare and pharmaceuticals, manufacturing, and governments. Organizations and businesses in these sectors are rapidly adopting advanced digital technologies to streamline and automate operations and improve consumer experience. There has been a significant increase in the adoption of data centers, including cloud services to store, process, and manage the large volume of data generated by businesses, digital services, IoT, and connected devices. Cloud data centers offer enhanced flexibility, scalability, cost-effectiveness, better collaboration, and disaster recovery.

Leading players are focused on developing new products and applications to support market growth. For instance, Google invested USD 1 billion in 2024 to develop new data centers to power its cloud and AI applications in the U.S. and abroad. The company is currently developing a cloud data center in Kansas City and plans to build a USD 576 million data center in Cedar Rapids.

Cloud Data Center Sector: Growth Drivers and Challenges

Growth Drivers:

Rising popularity of remote work and collaboration post-COVID-19 pandemic- The steady shift towards remote work and the use of several online platforms for collaboration has resulted in a growing demand for reliable and scalable cloud applications and services, accelerating the adoption of cloud data centers. With the use of cloud-based tools and applications, employees and collaborators can work on their projects from any location. Cloud data centers provide better bandwidth, computing resources, and storage, essential for seamless remote work.

High preference for cloud data centers due to cost-efficiency: Organizations and businesses across several sectors are inclining towards cloud data centers due to its cost-effectiveness. Cloud data centers provide a reliable and cost-effective alternative to conventional on-premise data infrastructure. This helps businesses to reduce their overall capital expenditure on hardware and infrastructure.

Challenges:

Infrastructure Complexity and Latency Issues: Most companies use a combination of public, private, and hybrid cloud solutions for optimizing their IT infrastructure. This often leads to increased complexity due to the requirement of data synchronization, interoperability, and multi-vendor management across various platforms. Thus, managing and integrating diverse cloud environments can be difficult. Along with this, issues such as network congestion due to high levels of traffic within the network, delays in data processing tasks, and use of low-quality or older hardware can affect the overall latency.

Cloud Data Center Market: Key Insights:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

10.1% |

|

Base Year Market Size (2024) |

USD 29.14 billion |

|

Forecast Year Market Size (2037) |

USD 101.79 billion |

|

Regional Scope |

|

Cloud Data Center Segmentation:

Service [Infrastructure-as-a-service model (IaaS), Platform-as-a-service model (PaaS), Software-as-a-service model (SaaS)]

Software-as-a-service model (SaaS) segment is likely to hold cloud data center market share of more than 32.1% by 2037 owing to the high adoption of SaaS across various industries such as healthcare, BFSI, retail, IT, and telecom. SaaS applications are easy to use and can be accesses without the need for extensive IT infrastructure. Moreover, it operates on a subscription model, thereby reducing the need for additional investments for software and provides greater flexibility and scalability to accommodate changing project requirements.

SaaS providers are focused on developing newer, advanced and cost-effective models. For instance, in February 2024, Klaviyo announced the launch of Klaviyo AI, a modern and intuitive SaaS platform, designed to help businesses leverage their consumer data effectively and create impactful marketing strategies. Predictive analysis, automated campaigns, and customized recommendations are some of the key components of Klaviyo AI.

Organization Size (Small/Medium Enterprises, Large Enterprises)

The large enterprises segment in cloud data center market is expected to account for largest revenue share between 2024 and 2037 owing to rising demand for cloud data centers in large enterprises to store and manage large amounts of data generated in these organizations. Large enterprises require substantial IT resources, to support their extensive operations. Cloud data centers provide better scalability and flexibility to handle large volumes of data and applications. Many businesses across various domains are investing in advanced cloud data centers due to better functionality, cost optimization, scalability, less maintenance, along with enhanced security and capacity.

End Use (BFSI, Colocation, Energy, Government, Healthcare, Manufacturing, IT & Telecom, Others)

The BFSI segment is expected to hold the largest market share in the global cloud data center market during the forecast period owing to the high usage of cloud-based services in banks, insurance companies, and other financial centers for better data storage, processing, management, and security tasks. According to the World Cloud Report 2023 by Capgemini, the BFSI sector has accelerated the use of cloud data centers and cloud applications in recent years and the rate has surged from 37% in 2020 to 91% in 2023. North America reported the highest deployment rate of 98% and 77% in the APAC.

Banks and financial institutions generate huge amounts of sensitive data at multiple locations. Cloud data centers help these centers scale their operations based on demand, ensuring they only pay for the resources they need. Moreover, it offers remote access for better collaboration, leading to enhanced security and cost savings on infrastructure. Other factors such as increasing number of banks and financial centers across the globe, growing awareness about the benefits of cloud data centers in the BFSI sector, and rising investments for deploying advanced cloud-based solutions and applications are expected to drive segment revenue growth during the forecast period.

Our in-depth analysis of the global cloud data center market includes the following segments:

|

Service |

|

|

Deployment |

|

|

Organization Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Data Center Industry - Regional Scope

North America Market Analysis

North America industry is poised to hold largest revenue share of 41% by 2037. owing to rising investments in the development of data centers and rapid advancements in cloud technology. According to recent data, there are 5,381 data centers in the U.S., the highest reported in any country worldwide as of March 2024. Other factors such as favorable government policies, presence of leading key players, and high adoption of cloud data center services across various sectors are expected to boost market growth in North America.

The cloud data center market in the U.S. is expected to register a staggering revenue CAGR between 2024 and 2037 owing to rapid technological advancements and digital transformation in this country. Companies and businesses across various industries are adopting advanced cloud-based solutions to enhance their operations and customer experiences and gain a competitive edge. Leading cloud providers such as AWS, Microsoft, Oracle, and IBM among others are heavily investing in security measures and other applications to enhance their services.

Asia Pacific Market Analysis

The cloud data center market in Asia Pacific is expected to hold a significant revenue share in the global market during the forecast period. One of the key factors driving cloud data center market growth in APAC is the rapid economic growth in countries such as India, China, South Korea, and Japan. Along with this, supportive government policies and schemes, a rising number of internet users, and expansion of local as well as global cloud providers are expected to foster market growth in this region in the coming years.

The cloud data center market growth in India is driven by government initiatives like Digital India to enhance online infrastructure and increase internet connectivity, rising number of cloud data center startups, and shifting focus on remote working and online education post-COVID-19 pandemic.

China’s robust economic growth, favorable government policies and support, the presence of Chinese technology companies like Tencent, Alibaba, and Huawei, and rising investments to develop enhanced cloud applications are some key factors boosting growth in this country.

Companies Dominating the Cloud Data Center Landscape:

- Microsoft Azure

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Series

- Alibaba Cloud

- Google Cloud Platform

- IBM Cloud

- Oracle Cloud Infrastructure

- Dell Technology

- Huawei Technologies

- VMware

- Cisco Systems

- OVHcloud

- HCL Technologies Limited

The cloud data center market is highly competitive consisting of key players operating at global and regional levels, focused on providing scalable, efficient, and secure data storage and computing services and solutions. These key players are focused on providing cost-effective solutions and are investing in energy-efficient technologies to reduce overall carbon footprint. They are also involved in forming strategic alliances, license agreements, and R&D investments to enhance their product base and retain their market position. Some of the leading players in the cloud data center market include:

Recent Developments

- In September 2023, HCLTech, a global technology company launched an advanced service, Shared Data Center as a Service (Shared DCaaS) to assist enterprises and businesses accelerate their hybrid cloud transformation. Some of its offerings include dedicated data centers, shared data centers, and regulated workloads in a catalog-based model.

- In March 2023, OVHcloud, the European cloud leader, announced the launch of its first ever data center in Mumbai, India as a part of its global strategic plan to build 15 new sites by 2024. The company plans to deploy additional data centers in Singapore and Australia by next year. The aim of global expansion is to provide open, trusted and sustainable cloud services and solutions to its customers to meet growing digital needs.

- Report ID: 6285

- Published Date: May 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert