Cloud-based Contact Center Market Outlook:

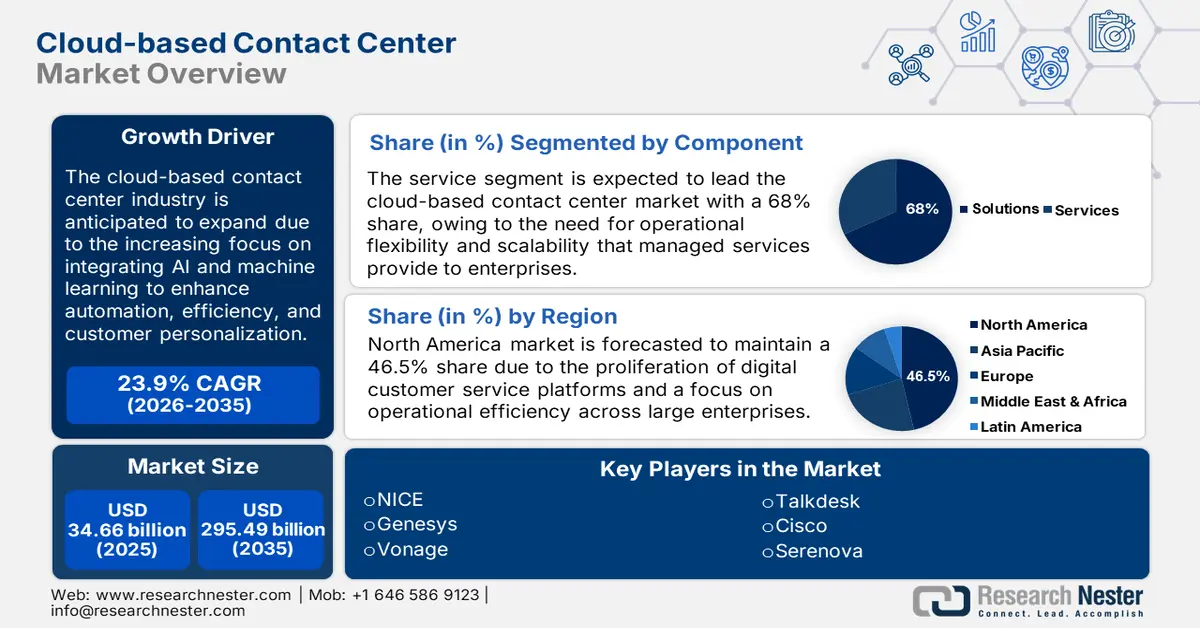

Cloud-based Contact Center Market size was over USD 34.66 billion in 2025 and is projected to reach USD 295.49 billion by 2035, growing at around 23.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud-based contact center is assessed at USD 42.12 billion.

The market is expanding steadily in recent years owing to the growing demand for convenient, highly effective tools to communicate with customers. Organizations are implementing these systems to provide integrated multichannel customer engagements that can help to reduce operational expenses. Also, the penetration of artificial intelligence and automation is facilitating the advancement and improvement of processes in the contact centers and increasing customer satisfaction. In December 2022, Lumen Technologies introduced Lumen Solutions for Contact Centre-Genesys Cloud, which has strengthened Lumen’s association with Genesys for more personalized customer communication tools. Such collaborations are anticipated to propel industry growth during the forecast period.

Governments are also playing a crucial role in the growth of cloud contact centers as they are promoting the use of IT solutions through digital transformation and the usage of secure communication technologies. Such a shift is more evident in industries like healthcare, public service, and the financial industry mainly because of regulation on data. For instance, Japan has heavily invested in developing its digital environment that pays much attention to secure data. Such measures have made corporations integrate cloud communication solutions in their working processes, adhering to the data protection laws and propelling the market.

Key Cloud-based Contact Center Market Insights Summary:

Regional Highlights:

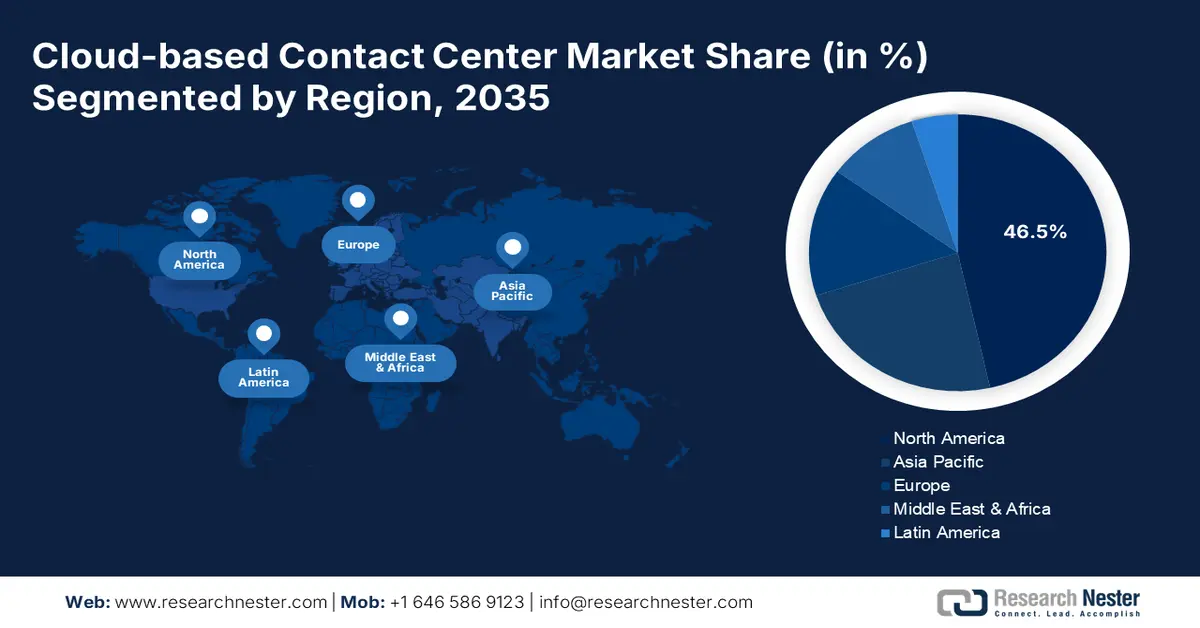

- North America dominates the Cloud-based Contact Center Market with a 46.5% share, fueled by rising investments in AI-powered solutions and omnichannel communication competency, driving growth through 2026–2035.

- The Asia Pacific region is seeing rapid growth in the Cloud-based Contact Center Market through 2026–2035, driven by increased investments in cloud technology and high digital transformation across industries.

Segment Insights:

- The Service segment is forecasted to capture a 68% market share by 2035, attributed to the rising demand for managed services offering scalable cloud solutions.

- Large Enterprises segment are projected to hold a 63.50% share by 2035, driven by the need for 24/7 customer support and managing distributed teams via cloud.

Key Growth Trends:

- Growing demand for omnichannel solutions

- Expansion of AI-enabled solutions

Major Challenges:

- Data security and compliance issues

- Infrastructure limitations in developing markets

- Key Players: NICE, Genesys, Five9, Vonage, Talkdesk, Cisco, Serenova, Content Guru, Aspect Software, and RingCentral.

Global Cloud-based Contact Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.66 billion

- 2026 Market Size: USD 42.12 billion

- Projected Market Size: USD 295.49 billion by 2035

- Growth Forecasts: 23.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Cloud-based Contact Center Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for omnichannel solutions: Increasing demand from organizations to integrate different channels like voice, email, and social media for communication-related purposes is one of the major factors that will influence the growth of the cloud-based contact center. In fact, customers are now looking at seamless experiences across devices, compelling organizations to move toward integrated systems of communication. In August 2022, Kyndryl announced an agreement for a global partnership with Five9 to deliver omnichannel experiences using personalization and to create adaptation in digital businesses. The shift is thus helping businesses enhance their customer engagement and overall operational efficiency.

- Expansion of AI-enabled solutions: AI is remodeling cloud-based contact centers by enabling better insights into customers, predictive analytics, and query handling in an effective way. AI-powered solutions are making it possible for routine tasks to be automated by businesses, therefore freeing human agents' time and energy to focus on complex issues. For example, RingCentral introduced RingSense in March 2023, where AI was used to convert insights from conversations into intelligent actions that a business can implement to improve productivity and customer interactions. This makes AI very relevant in improving contact center efficiency and customer satisfaction.

- Mobile integration and flexibility: Since both enterprises and contact centers are moving towards relying on mobile devices, it is expected that contact center solutions must easily integrate with mobile platforms to provide flexibility to remote workforces. Integration of mobiles allows customers and employees to reach contact centers from any location, further elevating the demand. In March 2023, LinkLive launched a native mobile app for healthcare and financial services industries that have securities in communications and compliance. This further indicates how mobile devices turns into a key solution in enhancing cloud-based contact center market reach.

Challenges

- Data security and compliance issues: Cloud-based contact centers continue to struggle with maintaining data privacy as well as compliance with continuously changing global regulations. Since organizations deal directly with sensitive information provided by the customer, they must adhere to strict regulatory frameworks such as the GDPR, HIPAA, and CCPA. Failure to comply leads to significant fines and also irreparable damage to the reputation. Furthermore, this growing trend of cyber threats will require advanced security features to protect customer information from breaches, unauthorized access, and data leaks by cloud contact centers.

- Infrastructure limitations in developing markets: Despite strong growth in developed regions, many emerging markets face infrastructure challenges that prevent the widespread adoption of cloud-based contact centers. These solutions' adoption can also be hindered by poor internet connectivity and underdeveloped IT infrastructure. A 2023 report shows that a number of countries in both Africa and Southeast Asia have restricted access to high-speed internet, which results in less effective deployment of cloud-based contact centers. Such deficiencies with infrastructure remain a stumbling block to growth in the less developed regions.

Cloud-based Contact Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.9% |

|

Base Year Market Size (2025) |

USD 34.66 billion |

|

Forecast Year Market Size (2035) |

USD 295.49 billion |

|

Regional Scope |

|

Cloud-based Contact Center Market Segmentation:

Component (Software, Service)

The service segment is anticipated to dominate the cloud-based contact center market, with a share of 68% by 2035. Managed services are garnering a considerable demand from businesses as companies search for assistance in implementing, maintaining, and optimizing their cloud-based systems. These services help organizations scale securely and meet dynamically changing industry standards. For instance, in May 2023, IBM introduced the IBM Hybrid Cloud Mesh, which is a SaaS solution addressing the need for hybrid multi-cloud architectures. Such innovations by companies have heightened the growing need for managed cloud services while enhancing contact center performance. As a result, these factors combined propel market growth.

Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)

The large enterprises segment is likely to drive the cloud-based contact center market, holding a share of about 63.5% by 2035. Large organizations have to deal with a significant volume of calls and complex interactions across different verticals like finance, healthcare, and retail. Due to growing globalization, large enterprises are considering cloud contact center solutions for managing distributed teams and offering 24/7 customer support. For example, EY announced a retail solution also termed smarter retail, on Microsoft Cloud to improve customer shopping experiences that launched in January 2023. Developments such as these indicate that large enterprises would grow more dependent on cloud-based contact centers during the forecast period.

Our in-depth analysis of the cloud-based contact center market includes the following segments:

|

Component |

|

|

Organization Size |

|

|

Deployment Mode |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud-based Contact Center Market Regional Analysis:

North America Market Analysis

North America industry is set to account for largest revenue share of 46.5% by 2035. Rising investments in AI-powered solutions and omnichannel communication competency further drive market growth. The dominant share is attributed to the advanced technological infrastructure in the region and a high demand for innovative customer service solutions. In addition, it is expected that the market will see rapid growth since businesses have focused on seamless customer experiences and require secure, scalable platforms. Cloud-based contact centers provide scalability and cost-effectiveness to the enterprise in verticals such as finance, healthcare, and retail.

The U.S. dominates in North America market substantially due to a higher penetration of cloud-based contact center solutions in the country. Firms in the U.S. continue to adopt AI, automation, and data analysis to improve customer interface and cut expenses. This trend also reflects the high interest of the U.S. market in adopting hi-tech solutions to enhance cloud contact centers. Additionally, the increased competitiveness of the business environment in the country promotes the development and implementation of advanced innovations.

Canada continues to witness expansion in its cloud-based contact center market, driven by the rapid adoption of digital transformation initiatives across verticals such as healthcare, government, and financial services. Businesses in the country are focusing more on secure and compliant cloud solutions to meet regulatory standards such as the Personal Information Protection and Electronic Documents Act (PIPEDA). A report by the Canada Internet Registration Authority, published in 2023, projects that 76% of Canadian organizations are adopting cloud services, out of which a considerable share depends on communication-related cloud platforms.

Asia Pacific Market Analysis

The cloud-based contact center market is poised to rise considerably in Asia Pacific during the period. Increased investments in cloud technology contribute to the high digital transformation growth seen across industries, hence driving the market. In terms of the adoption of cloud-based customer service solutions, India and China are registering a rapid growth rate as businesses are trying to enhance operational efficiency and customer experience. Government support for cloud adoption, especially in the public services and regulated industries, is also driving demand in the region.

The demand for cloud-based contact centers is gaining momentum in India, driven by IT, e-commerce, and growth in financial services. These industries are increasingly deploying these solutions to enhance customer service and communication processes. In March 2023, Exotel launched Ameyo XTRM, an omnichannel contact center in the cloud, with 99.5% uptime and a complete overhaul of customer service capabilities. This thus attests to the growing market for cloud-based contact centers in India.

China market is booming due to the digital service industry and e-commerce growth in the country. This increasing focus on customer satisfaction and seamless service delivery is encouraging businesses to implement advanced cloud-based contact center solutions. In December 2023, NICE announced the CXone Fall Release, placing a strong focus on investments in AI and automation for contact centers-driving demands for more effective, AI-driven customer service solutions in China. This development underlines the leadership of China in adopting advanced communication systems on the cloud.

Key Cloud-based Contact Center Market Players:

- NICE

- Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Genesys

- Five9

- Vonage

- Talkdesk

- Cisco

- Avaya

- Serenova

Competition is intense in the cloud-based contact center market, with leading players such as NICE, Genesys, Five9, RingCentral, Talkdesk, and Vonage driving the pace of innovation in the industry. These companies are constantly reinventing their suites through continuous integration of AI, automation, and omnichannel communication capabilities into their product suites, keeping pace with evolving enterprise requirements across various industry segments. As competition mounts, providers are offering customized solutions tailored toward verticals, including healthcare, retail, and finance.

In May 2024, RingCentral extended the strategic partnership with Avaya, Inc., by enhancing unified communications-as-a-service with Avaya Cloud Office powered by RingCentral. This further demonstrates competitive moves being made by these leading players to equip enterprises with integrated communication solutions that could reduce unnecessary complexities in operations and give customers high satisfaction. The company-to-company collaboration is promising a future for the market development, as companies are working on expanding their product portfolios to capture a larger market share.

Here are some leading players in the cloud-based contact center market:

Recent Developments

- In April 2024, Oracle announced an investment of over USD 8 billion in Japan over the next decade to meet growing cloud and AI infrastructure demands. The company plans to expand operations across Japan, enhance support for Japanese engineering teams, and address digital sovereignty requirements, with a focus on boosting cloud regions in Tokyo and Osaka.

- In January 2024, AWS announced a USD 15.5 billion investment to expand its data center portfolio in Japan, reflecting the region's surging demand. This major investment aims to capitalize on the anticipated boom in generative AI, positioning AWS to support a growing need for advanced cloud solutions.

- In March 2024, Vonage introduced Enhanced Noise Cancellation to its Contact Center platform, a feature powered by machine learning. This technology not only eliminating disruptive background noise but also cancels out echo, ensuring clearer communication between agents and customers. The result is a significant boost in agent productivity, a reduction in average handling time, and a marked improvement in the overall customer experience.

- In March 2024, Five9 launched GenAI Studio, a unique solution that enables organizations to customize generative AI models for contact center use. This innovative platform allows businesses to fine-tune AI models, such as OpenAI, to cater to specific customer service scenarios, leading to more personalized and effective interactions. With just a few clicks, businesses can integrate these AI tools, improving response times, enhancing customer engagement, and streamlining contact center operations.

- Report ID: 6616

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud-based Contact Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.