Clot Busting Drugs Market Outlook:

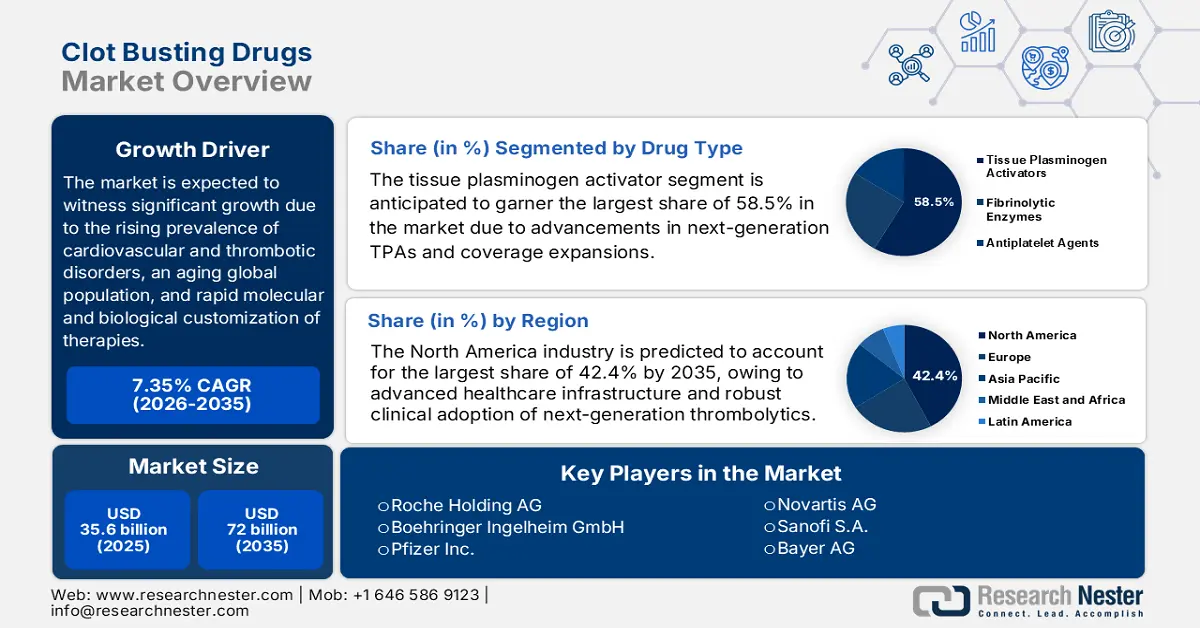

Clot Busting Drugs Market size was valued at USD 35.6 billion in 2025 and is projected to reach USD 72 billion by the end of 2035, rising at a CAGR of 7.35% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of clot busting drugs is assessed at USD 38.2 billion.

The market is gaining immense exposure owing to its large consumer base. One trend is the emergence of targeted anticoagulants, such as the factor XI inhibitors milvexian and abelacimab, which aim to prevent harmful blood clots without the serious risk of excessive bleeding common to typical clot-buster therapies. Another trend has been the advancements in mechanical thrombectomy devices, notably the new milli-spinner thrombectomy device. This trend proudly announces improvement in clot-removal strength for ischemic stroke, pulmonary embolism, and other clot-related complications. Injectable formulations have remained preferred delivery methods, especially in emergency care situations, and even though oral-formulated versions are currently being developed, we have yet to see and determine if they will have equal efficacy in clot remediation.

Additionally, there is an increasing emphasis on personalized medicine. Pharmaceutical manufacturers have developed a variety of clot-buster drugs based on genetic and clinical profiles, designed specifically for each patient to improve clot-remediation effectiveness and safety. Overall, fueled by an increase in thrombotic events, along with these advancements, presents ample opportunities for both traditional companies and up-and-coming biotech manufacturers, to provide an evolving healthcare response. However, there are challenges, as drug costs are high in emerging markets and the regulatory process is long in many jurisdictions. Overall, the market landscape is favorable with an improvement/demand for medical device technology.

Key Clot Busting Drugs Market Insights Summary:

Regional Insights:

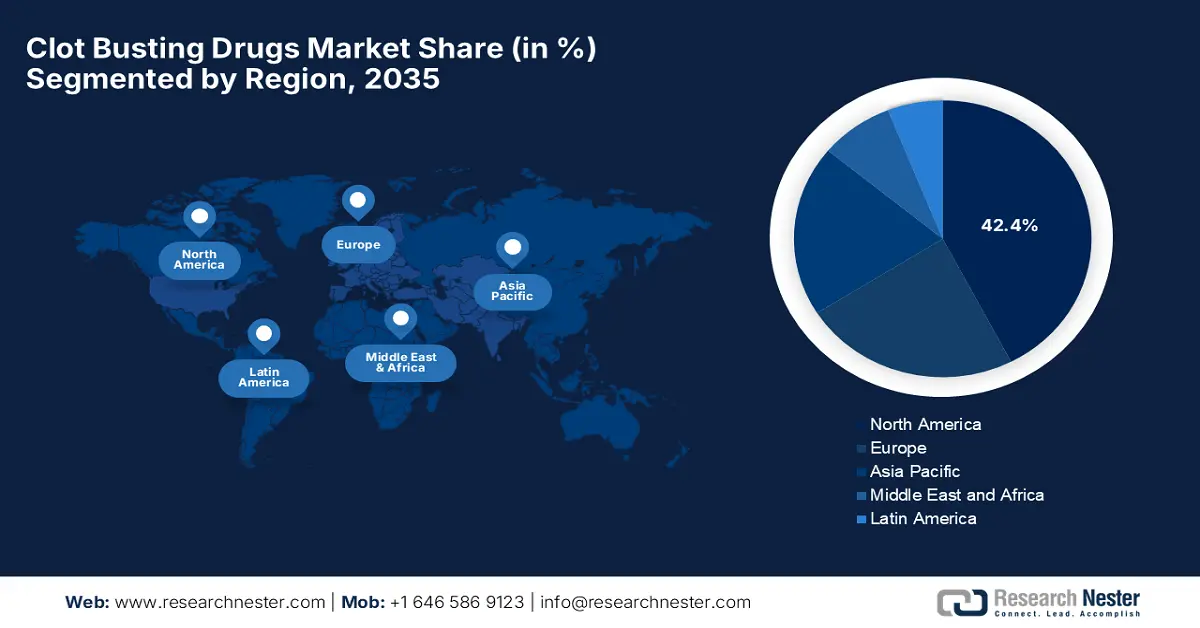

- North America’s Clot Busting Drugs Market is anticipated to hold the largest share of 42.4% by 2035, owing to advanced healthcare infrastructure and strong clinical adoption of next-generation thrombolytics.

- The Asia Pacific region is poised to register the fastest growth during 2025–2035, propelled by rising stroke incidence, biosimilar uptake, and progressive healthcare reforms.

Segment Insights:

- The tissue plasminogen activators segment in the Clot Busting Drugs Market is projected to command a 58.5% share by 2035, reinforced by the global adoption of next-generation TPAs and favorable clinical safety evidence.

- The ischemic stroke segment is expected to capture a 47.3% share by 2035, bolstered by expanding patient pools, standardized clinical protocols, and enhanced emergency care accessibility.

Key Growth Trends:

- Rising prevalence of cardiovascular and thrombotic disorders

- Advancements in drug development and delivery

Major Challenges:

- Rising barriers in affordability

- Delayed administrative approvals

Key Players:Roche Holding AG (Switzerland), Boehringer Ingelheim GmbH (Germany), Pfizer Inc. (U.S.), Novartis AG (Switzerland), Sanofi S.A. (France), Johnson & Johnson (U.S.), Bayer AG (Germany), AstraZeneca plc (UK), Merck & Co., Inc. (U.S.), GlaxoSmithKline plc (UK), Dr. Reddy’s Laboratories Ltd. (India), Cipla Limited (India), Hikma Pharmaceuticals plc (UK), CSL Limited (Australia), Celltrion, Inc. (South Korea).

Global Clot Busting Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.6 billion

- 2026 Market Size: USD 38.2 billion

- Projected Market Size: USD 72 billion by 2035

- Growth Forecasts: 7.35% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Malaysia, Australia

Last updated on : 15 September, 2025

Clot Busting Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of cardiovascular and thrombotic disorders: According to the Centers for Disease Control and Prevention, 919,032 persons lost their lives to cardiovascular disease in 2023. That's one out of every three fatalities. Obesity, inactive lifestyle patterns, hypertension, and smoking are all lifestyle-related risk factors that are leading to an increase in thrombotic events seen globally. Cardiovascular diseases represent the leading cause of death reported by the WHO. The increase in disease burden leads to an increased sense of urgency for clinically effective thrombolytic therapies in urgent, emergent, and acute care settings. The awareness around early diagnosis and the utilization of clot-dissolving drugs is steadily increasing.

- Advancements in drug development and delivery: Pharmaceutical companies are consistently developing new formulations of clot-busting drugs to maximize effectiveness and minimize side effects, which is notably expanding market opportunity. Novel thrombolytics like tenecteplase and reteplase, safely administered as injectable formulations, provide more rapid delivery and improved clot-selectivity, significantly enhancing treatment outcomes. As injectable delivery systems streamline administration during a medical crisis (for example, STEMI and stroke), most studies and patients will prefer and embrace the change in practice.

- Aging population and higher risk demographics: A major contributor to the need for clot-busting medications is global elderly population growth. Older patients are considered to be at increased risk of thrombotic states as a result of decreased activity/mobility, chronic illness, and age-related vessel changes. As our global population lives longer in both developed and developing countries, the number of people who are at risk of stroke, pulmonary embolism, or heart disease increases, and many of these patients will advance to thrombolytic therapy. In addition, the population of patients requiring urgent and effective therapy is supplemented by patients who require a fast and effective thrombolytic treatment, including post-surgical and immobile patients, as well as genetically predisposed patients.

Challenges

- Rising barriers in affordability: Increased barriers to affordability greatly prohibit market expansion of the clot-busting medications, especially in low- and middle-income countries. Clot-busting medications, which include newer thrombolytics and biologics, are associated with high price tags that turn affordable access beyond a large segment of the population. In India, the cost of one treatment can be more than the existing income for several months for the average earners in the marketplace. Affordability problems are compounded by the lack of insurance coverage, and governments failing to subsidize usage in greater national markets, leaving far fewer cheap or affordable alternatives in underdeveloped geographies.

- Delayed administrative approvals: Regulatory regimes in several countries are known to have drawn out review processes, which can delay the introduction of new, and possibly more effective clot-busting drugs. This could happen if a company, for example, has had approval delayed by several months up to over a year in some places in Japan and parts of Europe, to introduce novel thrombolytic agents. Delays like this limit timely access to new treatments, limit the competitive pressure to innovate, and can discourage pharmaceutical investment.

Ischemic Stroke: Incidence and Prevalence Rates with Demographic Breakdown (2022)

|

Measure |

Category |

Number |

Key Statement |

|

Incidence |

Ages (all), Both sexes |

7,630,803 |

Over 7.6 million new ischemic strokes yearly; 62% of all incident strokes are ischemic |

|

|

Ages 15-49 |

865,723 |

Over 11% of ischemic strokes occur in people aged 15-49 years |

|

|

Ages <70 |

4,427,351 |

Over 58% of ischemic strokes occur in people under 70 years |

|

|

Men (all ages) |

3,445,762 |

45% of ischemic strokes occur in men |

|

|

Women (all ages) |

4,185,041 |

55% of ischemic strokes occur in women |

|

Prevalence |

Ages (all), Both sexes |

77,192,498 |

Over 77 million people living post-ischemic stroke globally |

|

|

Ages 15-49 |

14,480,207 |

19% of people living post-ischemic stroke are aged 15-49 years |

|

|

Ages <70 |

47,161,262 |

61% of people living post-ischemic stroke are under 70 years |

|

|

Men (all ages) |

33,216,442 |

43% of people living post-ischemic stroke are men |

|

|

Women (all ages) |

43,976,056 |

57% of people living post-ischemic stroke are women; women account for just over half (56%) overall |

Source: World Stroke Organization

Clot Busting Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.35% |

|

Base Year Market Size (2025) |

USD 35.6 billion |

|

Forecast Year Market Size (2035) |

USD 72 billion |

|

Regional Scope |

|

Clot Busting Drugs Market Segmentation:

Drug Type Segment Analysis

Based on drug type, the tissue plasminogen activators segment is anticipated to garner the largest share of 58.5% in the market during the forecast timeline. Advancements in next-generation TPAs, global adoption, and coverage expansions are the key factors reinforcing the segment’s dominance over this sector. Moreover, recombinant tPA-like alteplase and tenecteplase are efficacious as they specifically target blood clots and dissolve them rather quickly and efficaciously, reestablishing blood flow. They have been broadly adopted in clinical practice and have used safety profiles that provide confidence when administering tPAs, are FDA approved, and have demonstrated evidence of safety and effectiveness in major clinical guidelines for treatment of acute strokes and myocardial infarctions.

Application Segment Analysis

In terms of application, the ischemic stroke segment is projected to attain a considerable share of 47.3% in the clot-busting drugs market by the end of 2034. The segment’s growth originates from the expanded patient pool and clinical protocol standardization. Clot-busting medications, more specifically tPA (tissue plasminogen activator), are the preferred therapy in these cases, where a significant reduction in long-term disability could occur within a limited time of being treated. The increase in stroke prevalence globally, greater awareness of early intervention, and increased access to emergency care will continue to drive demand for thrombolytic medications.

Distribution Channel Segment Analysis

The global market for clot busters is dominated by hospital pharmacies because they are the frontline for acute and emergency care, where clot busters are needed most urgently. Clot busters are commonly given in high-stakes situations, such as sarcoma, myocardial infarction, or pulmonary embolism. Hospitals have the capacity, capability, and monitoring capabilities to safely administer positioning medications. Thus, hospital pharmacies are the most populous and safe method of distributing clot-busting drugs globally.

Our in-depth analysis of the global clot busting drugs market includes the following segments:

|

Segment |

Subsegments |

|

Drug Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clot Busting Drugs Market - Regional Analysis

North America Market Insights

North America’s clot busting drugs market is anticipated to dominate with the highest share of 42.4% during the assessed timeframe. The region’s leadership is subject to its advanced healthcare infrastructure and robust clinical adoption of next-generation thrombolytics. Moreover, the U.S. has high rates of cardiovascular and cerebrovascular diseases, which are the key indications for clot-busting drugs, so demand is strong. Favorable reimbursement conditions and increasing awareness of the role of early intervention for acute conditions are determining factors in this market. Finally, R&D activity and investment from leading pharmaceutical companies in North America provide an ever-constant pipeline of clot-busting therapies to the market, solidifying the region's leadership position.

The clot busting drugs market in the U.S. is remarkably growing, fueled by the Medicare expansion and stroke center mandates. Moreover, cardiovascular diseases and stroke are prevalent and are the leading causes of death in the nation. With the current healthcare system's advanced infrastructure and advanced medical technology promoting timely diagnosis and care, the demand for thrombolytics is very strong. In addition, strong government support, by means of healthcare policy, as well as reimbursement frameworks, is attracting manufacturers to develop and healthcare providers to use clot-busting drugs. Greater awareness regarding the importance of early treatment in acute ischemic events among patients and caregivers promotes the growth of this market.

The market for clot-busting drugs in Canada is flourishing due in part to the strong health care system, which upholds timely and effective treatment of patients suffering from cardiovascular disease and stroke. With the increasing incidence of ischemic stroke and other thrombotic disorders largely due to an aging population and various lifestyle risk factors, the market demand for clot-busting medications will only increase. Canada's universal health care coverage will provide equitable access and encourage more patients to be treated with various thrombolytic therapies.

APAC Market Insights

The clot busting drugs market in the Asia Pacific is likely to exhibit the fastest growth from 2025 to 2035. This growth is facilitated by the rising stroke incidence, biosimilar adoption, and government-led healthcare reforms. China dominates the overall region, holding a considerable share of 45.7% with expanded reimbursement policies. Japan follows this with the support of PMDA fast-track approvals and NHI coverage for these therapies. Furthermore, catheter-directed thrombolysis research in South Korea and telemedicine-based early diagnosis in Malaysia further propel upliftment in the region.

The market for clot-busting drugs in China is evolving at an incredible rate. The growth is being fueled by a huge population and the high burden of stroke and cardiovascular disease. Rapid economic development and an increasing share of the healthcare budget for drugs have improved access to medical treatments, including thrombolytic therapies. The Chinese government has prioritized improvement of healthcare facilities, stroke care, and rehabilitation efforts, which have improved stroke diagnosis and treatment rates. Increasing public knowledge regarding stroke and the acute treatment of stroke is also contributing to the increasing use of clot-dissolving drugs.

India is emerging in the clot-busting drugs market, which is driven by the reimbursements offered by the government schemes. In addition, the increase in awareness of the importance of early intervention in ischemic conditions is leading to more patients seeking timely treatment. Similarly, government initiatives to enhance the affordability of health care and insurance coverage are playing a definitive role in increasing access to the drug. The existence of domestic pharmaceutical manufacturers producing low-cost clot-busting drugs is allowing for the growing demand to be met across the country.

Europe Market Insights

Europe in the clot busting drugs market is expected to witness strong growth originating from rising stroke incidence, centralized procurement policies, and cross-border research collaborations. Countries such as Germany, UK, and France are experiencing growing levels of stroke and thrombotic events, which are significant contributing factors to high thrombolytic drug demand. The region as a whole is positively positioned based on the early diagnosis capabilities, the development of viable emergency care services, and the sufficient capacity of dedicated stroke centers. Additionally, most European countries have supportive healthcare policies and reimbursement systems to help provide access to new therapies.

Germany is projected to lead the clot busting drugs market in Europe, highly driven by the AMNOG implemented value-based pricing and the substantial annual spending for these therapeutic drugs. Germany has a high prevalence of thrombotic conditions like ischemic strokes and myocardial infarctions, as the population is aging and lifestyle-related risk factors are increasing. New government funding aimed at stroke research ensures innovation and the availability of clot-busting drugs in the marketplace. Finally, the overall emphasis on early intervention and patient education in Germany further supports the market for clot-busting drugs.

France is facing a large burden associated with cardiovascular diseases and ischemic strokes, especially within its aging population, which continues to contribute to a demand for thrombolytic therapies. With the government having established awareness campaigns and national prevention strategies for simple strokes, the original emphasis on evolving early diagnosis and treatment has quickly created a prevalence of clot-busting agents. At the same time, the government is focusing on prioritizing medical research and implementing advanced new therapies in hospital protocols, which supports the consideration of a larger market. Furthermore, providing reimbursement for thrombolytic treatments will help patient uptake and physician prescribing of thrombolytic drugs.

Key Clot Busting Drugs Market Players:

- Roche Holding AG (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim GmbH (Germany)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Sanofi S.A. (France)

- Johnson & Johnson (U.S.)

- Bayer AG (Germany)

- AstraZeneca plc (UK)

- Merck & Co., Inc. (U.S.)

- GlaxoSmithKline plc (UK)

- Dr. Reddy’s Laboratories Ltd. (India)

- Cipla Limited (India)

- Hikma Pharmaceuticals plc (UK)

- CSL Limited (Australia)

- Celltrion, Inc. (South Korea)

The worldwide clot busting drugs market is oligopolistic in nature, with Roche, Boehringer Ingelheim, and Pfizer dominating with the maximum market share. The U.S. and Europe-based firms dominate with biologic innovation, whereas Asia-based pioneers such as Dr. Reddy’s and Celltrion are leveraging biosimilars. The companies are also emphasizing mergers and acquisitions to secure their market positions, where Pfizer announced the acquisition of Thrombolex in 2023 to enhance the catheter director therapies.

Here is the list of some key players operating in the global market:

Recent Developments

- In March 2025, Roche Holding AG received FDA approval for TNKase (tenecteplase), a clot-dissolving agent, for the treatment of acute ischemic stroke (AIS) in adults for the second time. TNKase is administered as a single five-second intravenous (IV) bolus, whereas Activase requires a 60-minute infusion. The drug was created to be administered more rapidly than Roche's Activase (alteplase), the current standard-of-care stroke treatment.

- In May 2025, A medical device firm that was born out of a partnership between the College of Engineering and the School of Medicine carried out its first clinical trial on humans for its clot-breaking ultrasonic technology. With little blood loss and pictures indicating the preservation of venous valves, the System has shown in the early examples that it can remove intravenous clots in a single treatment session.

- Report ID: 7893

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clot Busting Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.