Closed Core Power Transformer Market Outlook:

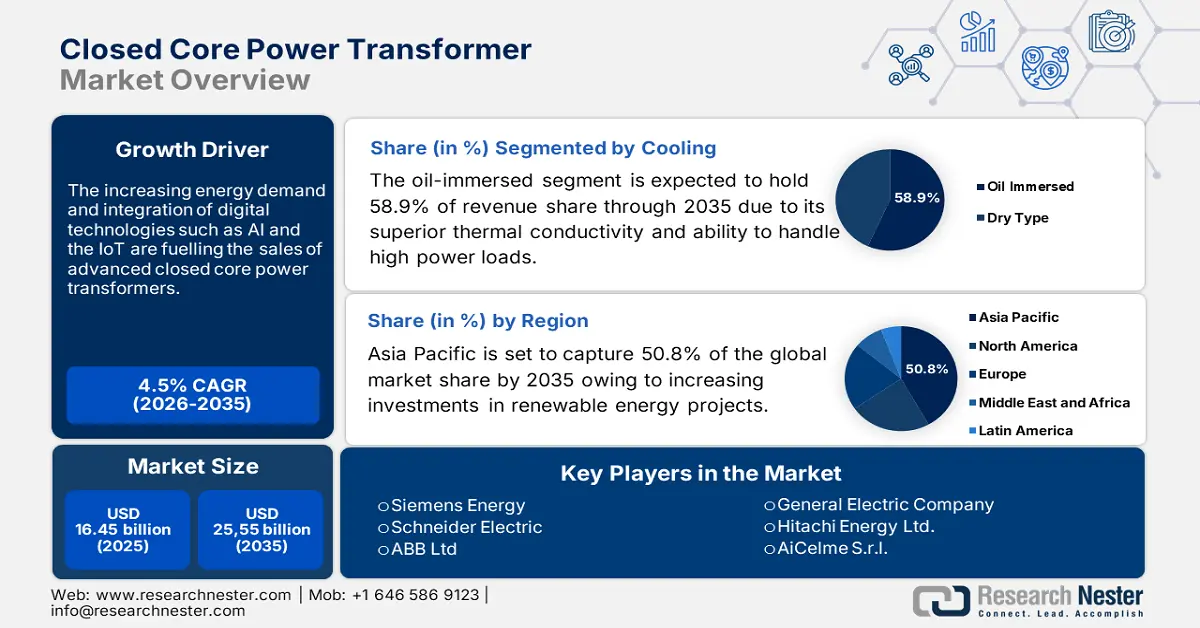

Closed Core Power Transformer Market size was valued at USD 16.45 billion in 2025 and is expected to reach USD 25.55 billion by 2035, registering around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of closed core power transformer is evaluated at USD 17.12 billion.

The global shift towards cleaner energy sources is significantly pushing the sales of closed core power transformers. Several economies are investing heavily in energy production due to the swiftly increasing electricity consumption rates. For instance, according to the International Energy Agency (IEA), in 2024, the global investment in clean energy is estimated to surpass USD 3 trillion.

Even though governments have a direct or indirect role in shaping capital inflows, the private sector is expected to drive energy investment decisions in the coming years. For instance, in 2023, the corporates held 48.0% of the total investments in the energy sector. The rapidly expanding energy demand is driving a high need for advanced power transformers to effectively and safely transmit and distribute electricity. Also, the rising grid infrastructure investments and well-managed tenders are generating lucrative opportunities for closed core power transformers in high-potential economies such as Africa. A recent study by IEA estimates that Africa invested over USD 40 billion in the clean energy field in 2024.

Key Closed Core Power Transformer Market Insights Summary:

Regional Highlights:

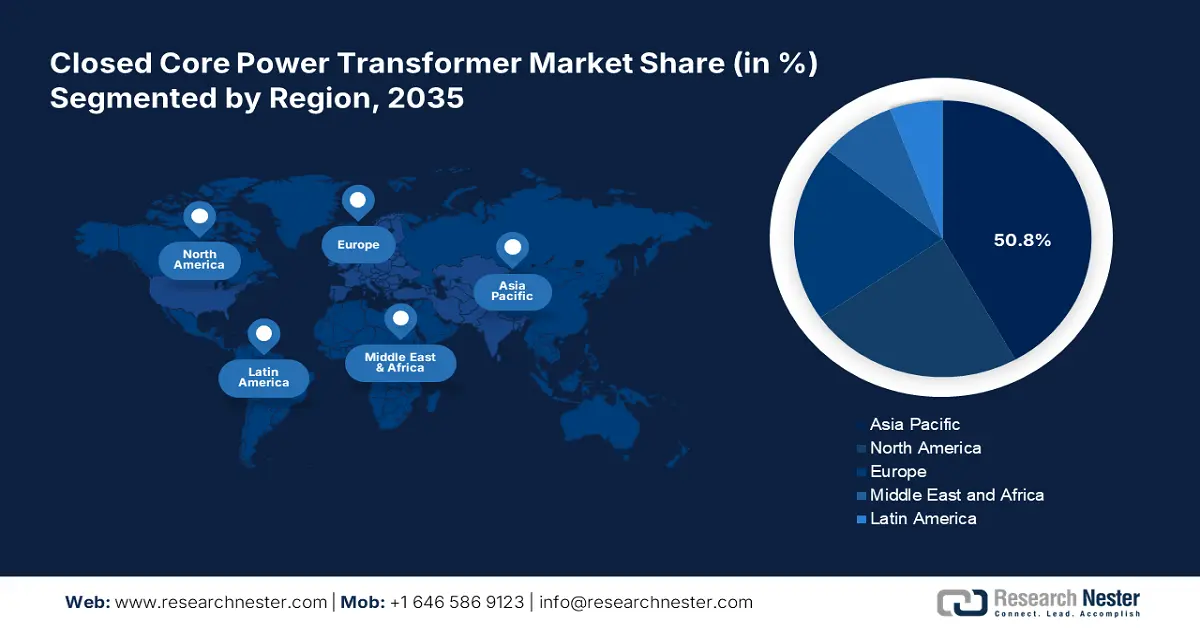

- Asia Pacific closed core power transformer market will account for 50.80% share by 2035, driven by renewable energy investment and industrial expansion.

Segment Insights:

- The oil-immersed segment in the closed core power transformer market market will capture a 58.90% share by 2035, driven by superior thermal conductivity and suitability for high-demand applications.

- The pad-mounted segment in the closed core power transformer market is anticipated to achieve significant growth till 2035, driven by high installation in underground power distribution projects.

Key Growth Trends:

- Digital technologies recasting power transformers

- Infrastructure development & industrialization growth

Major Challenges:

- High production and installation costs

- Supply chain disruptions

Key Players: Siemens Energy AG, General Electric Company, ABB Ltd., Schneider Electric SE, Hitachi Energy Ltd., Toshiba Energy Systems & Solutions Corporation, Mitsubishi Electric Corporation, Eaton Corporation plc, Hyosung Heavy Industries, Crompton Greaves Limited (CG Power).

Global Closed Core Power Transformer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.45 billion

- 2026 Market Size: USD 17.12 billion

- Projected Market Size: USD 25.55 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Closed Core Power Transformer Market Growth Drivers and Challenges:

Growth Drivers

- Digital technologies recasting power transformers: The integration of the Internet of Things and artificial intelligence (AI) into power systems is significantly enhancing the characteristics of power transformers such as reliability and performance. To maximize their Return on Investment (ROI) and operational efficiency, many users are widely seeking digitally enabled power transformers, generating high-profit opportunities for key market players. Advanced real-time monitoring, predictive maintenance and outage prevention, automated energy optimization, and enhanced cybersecurity are some of the key pointers fuelling the sales of digital closed core power transformers.

For instance, several studies reveal that predictive maintenance capabilities help in reducing downtime by up to 45% and breakdowns by up to 75%. This feature further aids in cutting maintenance costs leading to high ROI. - Infrastructure development & industrialization growth: The rising infrastructure development initiatives are augmenting the demand for advanced closed core power transformers, globally. The investments in new power plants and transformers to improve electricity access are fuelling the revenue shares of closed core power transformer market players. For instance, the Australia-Asia PowerLink is one of the largest solar plant projects across the world estimated to be completed by 2027. Growth in urbanization and industrial activities highly drives demand for extensive power distribution networks to ensure reliable and consistent electricity supply, which is leading to increasing adoption of modern power transformers.

Challenges

- High production and installation costs: Closed core power transformers need high capital costs due to the use of advanced materials and complex design. They require high-quality magnetic materials, which can be more expensive compared to conventional materials. Also, the construction of closed core transformers is more intricate which increases the complexity and labor costs associated with installation.

- Supply chain disruptions: Supply chain issues associated with raw materials often pose a challenge for closed core power transformers. Any disruptions due to geopolitical tensions such as the Russia-Ukraine war and the Isarel-Palestine war, natural disasters, or trade restrictions lead to shortages of raw materials, increasing the power transformer costs.

Closed Core Power Transformer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 16.45 billion |

|

Forecast Year Market Size (2035) |

USD 25.55 billion |

|

Regional Scope |

|

Closed Core Power Transformer Market Segmentation:

Cooling Segment Analysis

The oil-immersed segment is anticipated to capture 58.9% of the global closed core power transformer market share by 2035 owing to its superior thermal conductivity. The oil-immersed or oil-filled power transformers are set to exhibit widespread demand in the coming years due to their effectiveness in cooling the transformer temperature. Also, oil-immersed closed core power transformers can handle huge power loads compared to their counterparts, which makes them suitable for high-demand applications. Small-scale industries and renewable energy projects highly utilize ground oil-type transformers due to their energy efficiency and durability features.

Mounting Segment Analysis

The pad-mounted closed core power transformers segment in the closed core power transformer market is estimated to account for 40.7% of the revenue share through 2035 due to their high installation in underground power distribution projects. They are locked in a steel cabinet and mounted on a concrete platform to effectively and safely maintain voltage fluctuations and energy transmission. The pad-mounted power transformers are available in various phase designs such as single or three-phase, making them versatile to use in several applications. Furthermore, the integration of advanced materials and designs is improving the insulation and cooling techniques of pad-mounted transformers, leading to their high use in utility companies.

Our in-depth analysis of the global market includes the following segments:

|

Cooling

|

|

|

Insulation |

|

|

Winding |

|

|

Mounting |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Closed Core Power Transformer Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific closed core power transformer market is foreseen to hold 50.8% of the revenue share by 2035 owing to the high investments in renewable energy projects and rapidly increasing industrial activities. The high energy demand from the residential and industrial sectors is pushing the robust sales of power transformers in the region. For instance, according to the International Energy Agency, the national oil companies in Asia invested around USD 23 billion in the clean energy sector in 2023. Furthermore, to meet the COP28 goals, Southeast Asia witnessed a clean energy investment of around USD 26 billion in 2024.

China is a well-known manufacturing hub across the world, the increasing industrial investments in the country are driving high energy demand, ultimately fuelling the sales of closed core power transformers. For instance, as per the IEA analysis, in 2023, the energy demand surpassed 6.4% in China. The increasing manufacturing of solar PV modules and electric vehicles is also contributing to the closed core power transformer market growth in China.

India is witnessing high investment in solar energy projects to align with the sustainability goals, which is driving increasing demand for several advanced electrical technologies including the closed core power transformers. For instance, the country’s installed renewable energy capacity is anticipated to increase to around 170 GW in 2025 from 136.57 GW in 2023. Furthermore, the world’s biggest solar power plant Bhadla Solar Park is located in Rajasthan, India. With more than 2,245 megawatts of capacity, this solar project is boosting the revenue share of closed core power transformer manufacturers.

North America Market Insights

The North America market is foreseen to generate high-growth opportunities for closed core power transformer manufacturers in the coming years owing to the rapid digital shift in several sectors. The aging infrastructure in the region is increasing the need for new upgrades, fuelling the sales of advanced electrical systems including power transformers.

In the U.S., supportive government initiatives and incentives aimed at improving energy efficiency and reliability are driving investments in cleaner electricity, subsequently pushing the adoption of advanced transformer technologies. For instance, in 2024, the U.S. cleaner energy investment accounted for USD 315 billion to meet the COP28 goals.

Canada has the cleanest and most advanced renewable electricity systems among G8 countries. The country’s significant investment in hydroelectric power plants is augmenting the high demand for advanced and efficient power transformers for effective energy management and distribution and generating millions of job opportunities with over USD 125 billion in benefits.

Closed Core Power Transformer Market Players:

- Siemens Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- ABB Ltd

- Bharat Heavy Electricals Limited (BHEL)

- Hyosung Heavy Industries

- Hyundai Electric & Energy Systems Co., Ltd.

- JSHP Transformer

- CG Power & Industrial Solutions Ltd.

- Celme S.r.l.

- General Electric Company

- Hitachi Energy Ltd.

Key players in the closed core power transformer market are employing strategies such as new product launches, technological advancements, strategic collaborations, and regional expansions to earn high profits. Companies are investing in advanced materials and technologies to develop innovative and space-saving transformers. They are also forming strategic alliances with other players to expand their research and development leading to improved product offerings and market reach.

Some of the key players include:

Recent Developments

- In February 2024, Siemens Energy announced that it is investing USD 150 million to meet the shortage of power transformers in the U.S. The company is expanding its operations in North Carolina and is set to create more than 600 local jobs in the country.

- In January 2022, General Electric Company revealed the launch of a new series of digital power transformers. According to the company, their customers are finding these transformers more reliable and effective.

- Report ID: 6556

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.