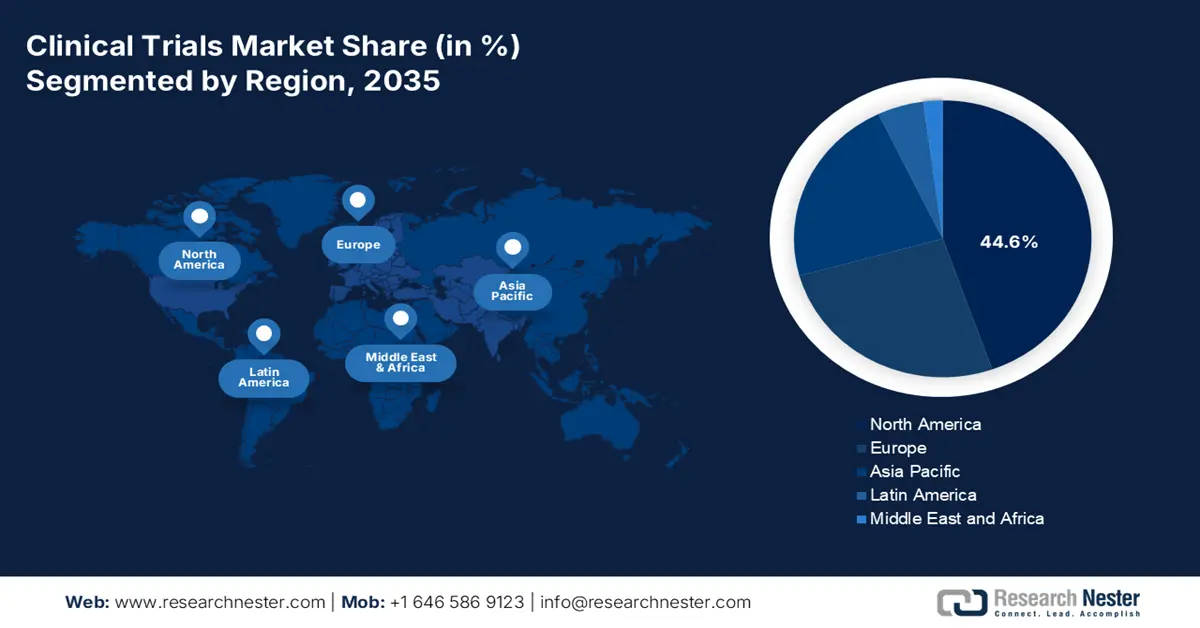

Clinical Trials Market - Regional Analysis

North America Market Insights

North America in the clinical trials market is anticipated to hold the largest share of 44.6% by the end of 2035. The market’s exposure in the overall region is highly driven by an increase in the patient pool and continuous oncology trials for total enrollments. The region’s impact on the market also extends beyond recruitment, as early-stage diabetes trials demonstrated a reduction in hospitalizations and saved patient lives. Besides, an article published by NLM in November 2022 indicated that the total population-based diabetes hospitalizations surged from 3,079.0 to 3,280.8 per 100,000 in the U.S., which positively impacts the overall market.

The U.S. is solidifying its leadership in the regional market with a strong government-backed capital influx, a large patient pool, and expansion in insurance coverage. This is further supported by a data report published by the KFF Organization in April 2022, which indicates that Medicare expenditure per person increased from USD 5,800 to USD 16,700 between 2020 and 2023, representing a 4.7% average yearly growth over the 3-year period. Besides, as per the August 2025 Medical Buyer article, the medical device regulatory affairs market is worth USD 6.7 billion, which is poised to surge to USD 18.3 billion by 2034, thus positively impacting the market’s exposure in the country.

The Canada clinical trials market is expanding at a steady pace and is bolstered by an increase in federal healthcare investments. According to the January 2025 Ontario article, the domestic government readily approved 18 latest Homelessness and Addiction Recovery Treatment (HART) centers to effectively support safer communities by generously allocating USD 529 million to develop an overall 27 HART facilities across the province, while also successfully banning drug injection centers from operating across 200 meters of licensed child-care centers and schools. Therefore, this denotes a huge growth opportunity for the market in the country.

APAC Market Insights

Asia Pacific is predicted to attain the fastest pace of growth in the global clinical trials market over the analyzed timeline. Its progress is primarily accelerated by cost-optimized recruitment, recent regulatory reforms, rising chronic disease occurrence, and the emergence of the pharmaceutical industry. Besides, in this landscape, countries are readily leading in precision medicine, with AMED investments, along with research and development (R&D) tax credits for chronic disease trials. Meanwhile, Malaysia and South Korea are effectively centralizing as notable innovation facilities by providing lower costs. This rapid expansion highlights the transformative and significant role of APAC in the sector's global expansion.

China is propagating the APAC market with dominance, accounting for the majority of the National Medical Products Administration (NMPA) in 2023 and deliberately slashing approval times. According to an article published by NLM in September 2024, the country’s overall health expenditure reached 8,532.7 billion yuan (USD 1,268.6 billion), further accounting for 7.0% of GDP. In addition, the per capita total healthcare spending in the country has been 6,044.0 yuan (USD 898.6) as of 2022, thus creating an optimistic outlook for the overall market’s exposure in the country.

India is emerging as a key player in the APAC clinical trials market, with its remarkable patient pool expansion and consistent growth in biologics production. The government is further pushing the country's capacity to extend its domestic resources for establishing a strong emphasis on the biopharmaceutical and medical instruments segment. As stated in the August 2024 PIB data report, the healthcare industry in the country readily caters to an overall 7.5 million people, and the public expenditure has been 2.5% currently, thus denoting a positive impact of the market’s development in the country.

2022 Healthcare Spending in the Asia Pacific

|

Countries |

% of GDP |

|

Australia |

9.9 |

|

China |

5.3 |

|

Indonesia |

2.6 |

|

Japan |

11.4 |

|

Malaysia |

3.9 |

|

Singapore |

4.9 |

Source: World Bank Organization

Europe Market Insights

Europe is estimated to experience a considerable growth in the clinical trials market between 2025 and 2037. Regulatory advancements and strong government support, including the EHDS initiative, which enhanced cross-border data sharing and streamlined approvals, are the major driving factors in this region. According to an article published by the EMA in July 2023, the EU Network is gradually transitioning, initiating 18 months after introducing the Clinical Trials Information System (CTIS). This included more than 1,700 clinical trial applications, which have been readily submitted in CTIS, and more than 700 clinical trials are authorized under the CTR, thus suitable for boosting the market’s development.

The UK is maintaining its leadership in the Europe clinical trials market by allocating the majority of its healthcare budget to trials in 2023, which reflects an increase over the past five years. According to an article published by the UK Government in July 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) has readily notified the essential step to achieve accessibility for localized patients to the newest medical technologies that are deliberately available in the region. Besides, the integrated system, introduced by the National Health Service (NHS), enables efficient recruitment, supporting the majority of active trials, thus making it suitable for the market’s growth.

Germany is augmenting the region's second-largest position in the global clinical trials market. This is significantly backed by an increase in Federal Ministry of Health (BMG) spending over the past four years to readily prioritize oncology and rare disease research. Besides, the country's robust trial ecosystem is also evidenced by an increase in the number of active trials on account of strong academic-industry collaborations, as stated by the German Medical Association. This strategic investment and collaborative framework continue to drive the nation's leadership in this sector, thereby bolstering the market’s exposure.

Historical Phase I to Phase 4 Clinical Trials Conducted in Europe

|

Phases/Years |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

Phase 1 |

84 |

88 |

105 |

86 |

82 |

97 |

138 |

132 |

110 |

122 |

8 |

|

Phase 2 |

266 |

239 |

229 |

255 |

258 |

305 |

330 |

271 |

214 |

236 |

14 |

|

Phase 3 |

316 |

316 |

269 |

314 |

310 |

350 |

344 |

305 |

311 |

284 |

14 |

|

Phase 4 |

70 |

81 |

51 |

48 |

44 |

48 |

52 |

46 |

25 |

32 |

7 |