Clinical Perinatal Software Market Outlook:

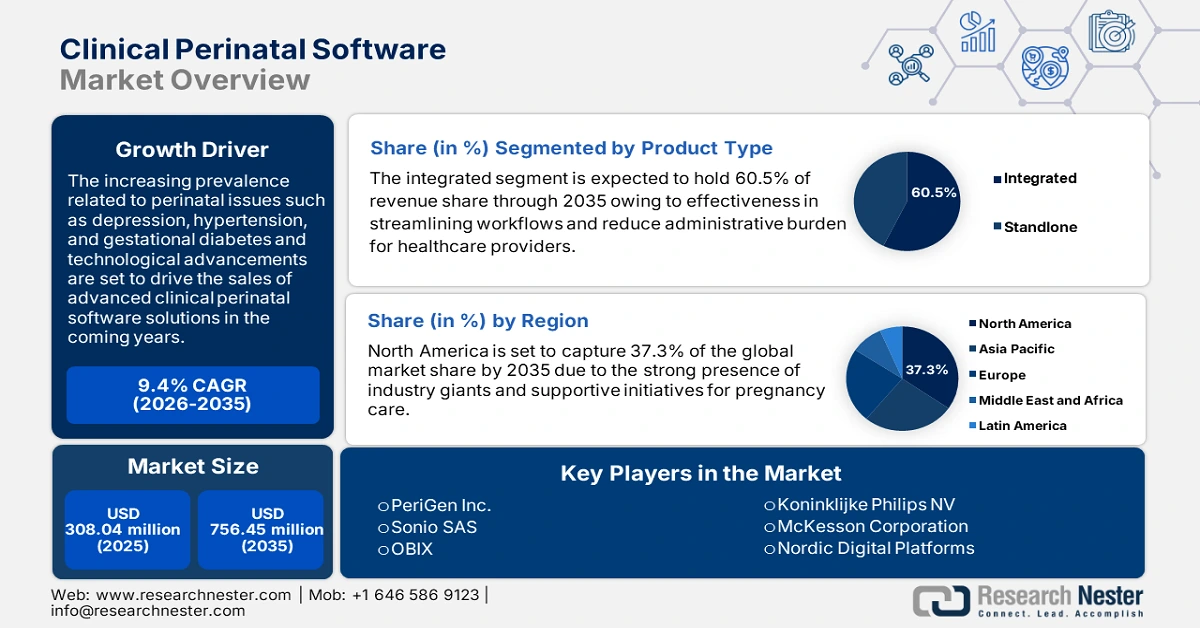

Clinical Perinatal Software Market size was valued at USD 308.04 million in 2025 and is set to exceed USD 756.45 million by 2035, registering over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of clinical perinatal software is evaluated at USD 334.1 million.

The increasing prevalence of complications during and after pregnancy and growing awareness of maternal health issues are driving a high need for advanced healthcare solutions including perinatal software technologies. Gestational diabetes, anxiety, perinatal depression, and hypertension are the major issues that are observed during pregnancy among women. According to the World Health Organization (WHO), around 10% of pregnant women and 13% of women who have just given birth experience mental issues such as depression, globally. The depression rate is much higher in women living in developing economies, accounting for 15.6% during pregnancy and 19.8% after birth.

Obesity and advanced maternal age are some of the prime factors contributing to the increasing incidence of gestational diabetes. Also, hypertension and preeclampsia that arise during pregnancy can lead to serious complications. For instance, the National Institutes of Health estimates that the prevalence of preeclampsia ranges between 2% to 20%, globally. These pregnancy-related issues result in high demand for advanced clinical perinatal software solutions that offer tools such as glucose tracking, reminders for dietary management, and regular communications between patients and healthcare providers.

Key Clinical Perinatal Software Market Insights Summary:

Regional Highlights:

- Europe dominates the Clinical Perinatal Software Market with a 51.2% share, driven by strong presence of key players and advanced healthcare facilities, ensuring robust growth through 2026–2035.

- Asia Pacific's clinical perinatal software market is forecasted to experience rapid growth through 2026–2035, attributed to supportive government initiatives and healthcare investments.

Segment Insights:

- The Hospitals segment is anticipated to hold a 73.2% market share by 2035, fueled by higher patient intake and access to advanced technologies.

- Integrated software segment is anticipated to achieve a 60.50% share by 2035, driven by streamlined workflows and reduced administrative burdens.

Key Growth Trends:

- Integration of digital technologies

- Telehealth services gaining traction

Major Challenges:

- Data privacy concerns

- High initial investment

- Key Players: PeriGen Inc., AS Software LLC, Sonio SAS, Trium Analysis Online GmbH, Nordic Digital Platforms, and OBIX.

Global Clinical Perinatal Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 308.04 million

- 2026 Market Size: USD 334.1 million

- Projected Market Size: USD 756.45 million by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

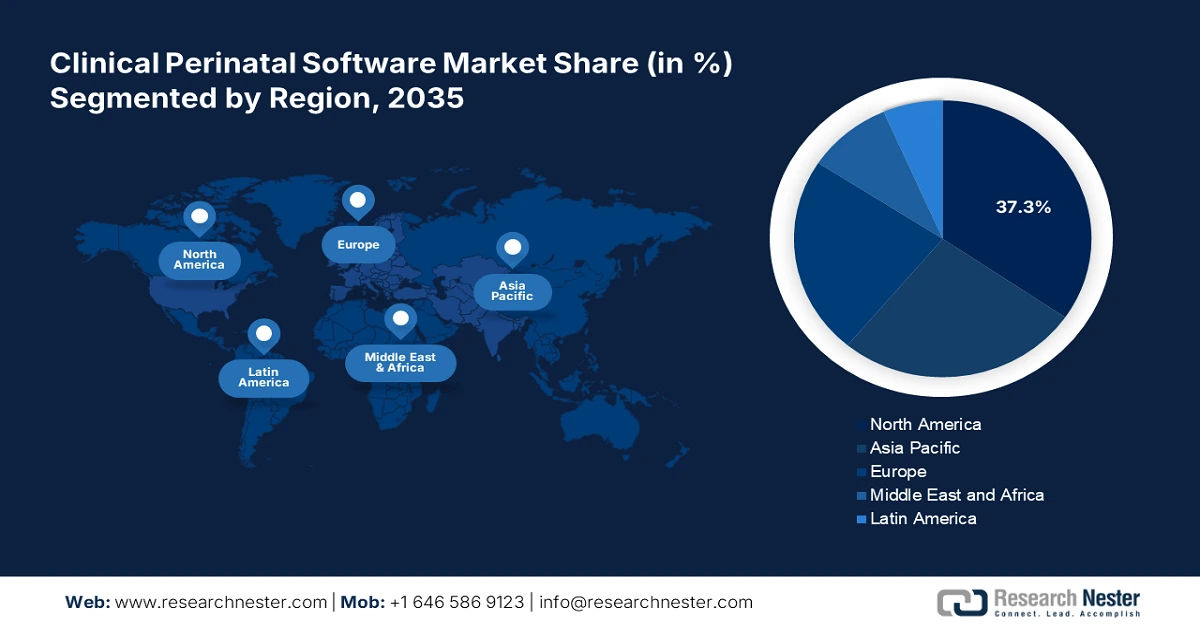

- Largest Region: Europe (51.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 14 August, 2025

Clinical Perinatal Software Market Growth Drivers and Challenges:

Growth Drivers

- Integration of digital technologies: Continuous innovations in software development, cloud computing, and mobile technology have significantly transformed clinical perinatal software capabilities. These advancements are enhancing the accessibility and functionality of software, leading to improved patient care. The integration of artificial intelligence (AI), machine learning (ML), and advanced analytic tools is aiding healthcare providers in real-time analysis and predicting outcomes based on historical data.

According to the ScienceDirect report, AI and ML algorithms effectively detect and provide data related to depression and anxiety among pregnant women, which aids in taking predictive measures. For instance, in July 2022, PreGen was applauded with the North America Product Leadership Award 2022 by Frost & Sullivan for its advanced perinatal software technologies for fetal monitoring and clinical decision support. - Telehealth services gaining traction: The increasing adoption of telehealth services is generating profitable opportunities for clinical perinatal software producers. Telehealth allows medical practitioners to monitor maternal and fetal health remotely, using devices that track vital signs, weight, and other critical metrics, aiding in the early detection of complications and timely interventions. Also, many software applications offer personalized recommendations based on individual health data, aiding mothers in following customized perinatal care guidelines.

Challenges

-

Data privacy concerns: Growing concerns over data security and patient privacy are expected to hamper the clinical perinatal software market growth to some extent in the coming years. Maternal and fetal health data is highly sensitive as it contains personal information that requires strict confidentiality. The potential for data breaches and cyber-attacks creates challenges for clinical perinatal software developers, and data privacy concerns among patients and healthcare providers.

- High initial investment: Several small healthcare facilities or those running on tight budgets can be deterred from adopting digital medical solutions, including clinical perinatal software due to the high initial investment required for software deployment and training. The associated hardware upgrades, along with the initial purchase, add to the overall costs, limiting clinical perinatal software market growth to a certain extent.

Clinical Perinatal Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 308.04 million |

|

Forecast Year Market Size (2035) |

USD 756.45 million |

|

Regional Scope |

|

Clinical Perinatal Software Market Segmentation:

Product Type (Integrated, Standalone)

Integrated segment is expected to account for more than 60.5% clinical perinatal software market share by the end of 2035, owing to the increasing need for workflow integration among healthcare professionals. The integrated systems streamline workflows by consolidating data from various sources, reducing administrative burdens and human errors. For instance, in January 2024, Sonio a software company announced that Pediatrix Medical Group, an advanced healthcare provider for women and children had adopted its cloud-based, AI-powered perinatal care reporting and practice management technology to simplify and streamline ultrasound workflow.

End user (Hospitals, Maternity Clinics)

By the end of 2035, hospitals segment is projected to account for more than 73.2% clinical perinatal software market share, owing to the large patient intake, rising availability of advanced medical solutions, and presence of skilled healthcare professionals. Technologically advanced perinatal software solutions aid in real-time access to patient data, track fetal development, and monitor maternal health. In June 2020, Philips launched a novel perinatal monitoring solution to support clinicians and expecting mothers during the coronavirus pandemic.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Deployment Mode |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Perinatal Software Market Regional Analysis:

North America Market Forecast

Europe industry is predicted to dominate majority revenue share of 51.2% by 2035, due to the strong presence of key market players and advanced healthcare facilities. The research and treatment organizations in the region are widely arranging perinatal pregnancy care awareness programs for comprehensive mother and baby care. Such initiatives are contributing to the increasing adoption of clinical perinatal software solutions for effective patient care.

In the U.S., the rising prevalence of perinatal issues is significantly influencing the sales of clinical perinatal software technologies. For instance, according to the report by the Centers for Disease Control and Prevention, in 2021, the perinatal mortality rate in the U.S. was 5.54. the increasing healthcare expenditure in the country, contributing to the sales of clinical perinatal software solutions. As per the analysis by the Centers for Medicare & Medicaid Services, the national health expenditure raised 4.1% to USD 4.5 trillion and accounted for 17.3% of GDP in 2022.

Followed by the U.S., the Canada market for clinical perinatal software is also expanding swiftly owing to the increasing adoption of digital health solutions and services. The strict guidelines for family-centered maternity and newborn care are generating lucrative opportunities for clinical perinatal software solution providers in the country.

Asia Pacific Market Statistics

The Asia Pacific clinical perinatal software market is expanding at a rapid pace owing to supportive government initiatives related to pregnancy care and increasing investments in healthcare infrastructure development. The increasing expansion of healthcare IT solution companies in the region is also augmenting the sales of clinical perinatal software solutions. The presence of advanced healthcare facilities and early adopters is fuelling the profits of clinical perinatal software solution developers in Japan and South Korea. China’s focus on taking bold steps to increase the birth rate is set to promote the adoption of clinical perinatal software solutions in the foreseeable future.

In India, the implementation of supportive maternal care initiatives is pushing the adoption of clinical perinatal software technologies. Launched in 2019, the Surakshit Matritva Aashwasan (SUMAN) Yojana aims to provide all necessary treatment at no cost to women and newborns visiting public healthcare facilities. The initiative focuses on zero tolerance for denial of services to end all preventable maternal and newborn deaths and morbidities and provide a positive birthing experience.

Key Clinical Perinatal Software Market Players:

- PeriGen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AS Software LLC

- Sonio SAS

- Trium Analysis Online GmbH

- Nordic Digital Platforms

- OBIX

- K2 Medical Systems Ltd

- Koninklijke Philips NV

- McKesson Corporation

- Clinical Computer Systems Inc

- GE HealthCare

- Glen Med Solutions

- Huntleigh Healthcare Limited

- Revvity

The global market is highly competitive, comprising key players operating at global and regional levels. These players are adopting several organic and inorganic marketing strategies to earn high profits. Industry giants are investing heavily in research and development activities to expand their product folio with innovative solutions. They are also forming alliances with other players and collaborating with research organizations to enhance the credibility of their solutions and reach a wider consumer base. Furthermore, they are employing mergers and acquisition strategies to add the latest technologies to their offering list. Some of the key players include:

Recent Developments

- In January 2024, OBIX and Nordic Digital Platforms partnered to offer AI-based perinatal solutions in the UAE and GCC region. This leadership is set to drive maternal services in these regions.

- In August 2023, PeriGen Inc. announced the launch of LaborWatch an AI-powered perinatal care solution for pregnant women. This platform uses AI for maternal-fetal assessments and provides real-time information through SMS.

- Report ID: 6585

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clinical Perinatal Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.