Clear Aligners Market Outlook:

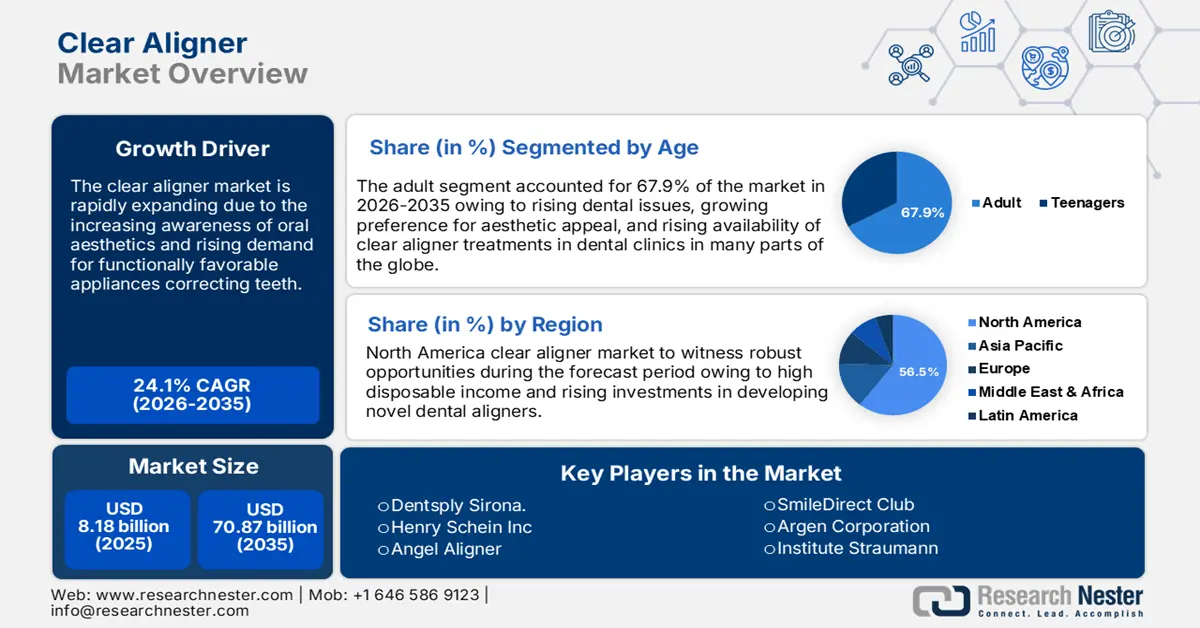

Clear Aligners Market size was valued at USD 8.18 billion in 2025 and is likely to cross USD 70.87 billion by 2035, registering more than 24.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of clear aligners is assessed at USD 9.95 billion.

In the last few years, the clear aligners market has largely been pioneered by digital dentistry, increased awareness of oral aesthetics, and especially, the growing popularity of orthodontics among adults. Prominent market players such as Align Technology, Straumann, and Henry Schein have strategized their investments toward research and development, marketing, and distribution to meet the current rising demand for clear aligners. For instance, in May 2024, the industry pioneer, OrthoFX received approval from U.S Food and Drug Administration (FDA) for its the new generation of advanced clear aligner polymer, NiTime Clear Aligners system.

Key Clear Aligners Market Insights Summary:

Regional Highlights:

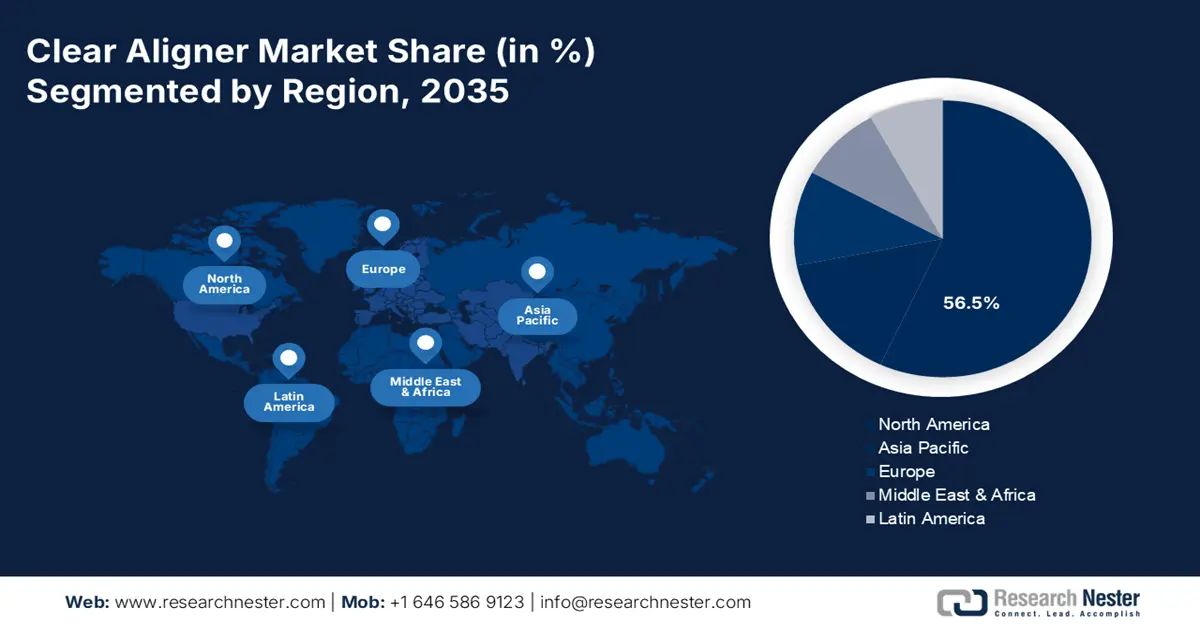

- North America clear aligners market is anticipated to capture 56.50% share by 2035, driven by high prevalence of dental disorders, aesthetic dentistry demand, and specialist focus on invisible orthodontic techniques.

Segment Insights:

- The adult segment in the clear aligners market is forecasted to capture a 67.90% share by 2035, fueled by growing awareness and demand for aesthetic dental treatments in adults.

Key Growth Trends:

- Increasing adoption by orthodontists and dentists

- Advancement in clear aligner material

Major Challenges:

- Complexity in treatment

- Limited insurance coverage

Key Players: Institute Straumann, Envista Corporation, 3M ESPE, Argen Corporation, Henry Schein Inc., TP Orthodontics Inc..

Global Clear Aligners Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.18 billion

- 2026 Market Size: USD 9.95 billion

- Projected Market Size: USD 70.87 billion by 2035

- Growth Forecasts: 24.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (56.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Clear Aligners Market Growth Drivers and Challenges:

Growth Drivers

- Increasing adoption by orthodontists and dentists: One of the major growth drivers is the increasing adoption of clear aligners by orthodontists and dental professionals. The clear aligner assists medical professionals with operational efficiency and ultimately enhances patient satisfaction. Additionally, advanced digital tools and software development have facilitated the designing, manufacturing, and monitoring of clear aligner treatments for more convenience, thus further increasing the adoption rate. Moreover, the increase in demand by patients for discreet and convenient orthodontic solutions has led most dental professionals to offer clear aligners as a premium treatment; therefore, driving revenue growth and practice expansion. Thus, clear aligners are to be a standard of care for patients.

- Advancement in clear aligner material: Material science development has played a significant role in the making of clear aligners that include flexibility, strength, and wear resistivity consequently making them more comfortable, durable, and efficient orthodontic appliances. For instance, clear aligners have been made more transparent, elastic, and less prone to cracking with the introduction of polypropylene and polyethylene thermoplastic materials. The integration of smart materials and shape-memory alloys, for instance, will further revolutionize the clear aligners market with appliances adaptive to the alterations of oral environments and send real-time feedback to patients and practitioners. The evolvement in material science has drastically enhanced performance in clear aligners and improved patient outcomes, which drives growth and innovation in this market.

- Rising disposable income: Key trends contributing to the growth of the clear aligners market include the rising consumer disposable income in emerging markets as well as developed countries. This trend is especially seen in emerging economies since the middle-income population has increased significantly and seeks advanced dental services. Moreover, sources of funds and insurance expenditures for orthodontic treatments are also on the higher side, which contributes to the broader acceptance of clear aligners to more consumers and thereby contributes to the market growth. This essentially implies that levels of spending will increase due to increased disposable incomes and eventually will lead to an increase in revenue growth and market size.

Challenges

- Complexity in treatment: Treatments involving clear aligners are sensitive, impelling minute planning and execution, thus it may be challenging for dental professionals with limited skill sets. Complexity in planning and designing a treatment can lead to errors, delays, and suboptimal outcomes of the treatment, eventually affecting patient satisfaction and treatment success. Further, many clear aligner treatments consist of multiple stages, each of which has to be carefully monitored and adjusted-often very time-consuming and labor-intensive.Apart from this, serious orthodontic anomalies, including heavy overbites or underbites, may present a challenge about the possibility of their correction utilizing clear aligners, requiring deeply developed skills and expertise from dental professionals.

- Limited insurance coverage: A major obstacle in the clear aligners market is the limited insurance coverage, most of the plans fail to cover the full cost of treatments. The reason for this limited coverage is clear aligner treatments have largely been considered elective or cosmetic rather than medically necessary treatments. Patients mostly rely on third-party financing providers to cover treatment costs. Lack of harmony between clear aligner manufacturers and dental professionals in teaching patients regarding the benefits and treatment costs, results in continuing to look for other alternative financial options in making clear aligner treatments available.

Clear Aligners Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.1% |

|

Base Year Market Size (2025) |

USD 8.18 billion |

|

Forecast Year Market Size (2035) |

USD 70.87 billion |

|

Regional Scope |

|

Clear Aligners Market Segmentation:

Age Segment Analysis

The adult segment will account for 67.9% reveue share by 2035 owing to the consequence of the growing awareness and demand for aesthetic dental treatments in adults, primarily between 20-40 years. It is proven that better dental care renders greater self-confidence and improves overall well-being. Working professionals having high disposable income are more likely to be inclined toward clear aligner treatments, raising the demand for comfortable orthodontic appliances.

Also, the adult age segment is expected to continue to drive the clear aligners market over the forecast period, due to an expanded availability of clear aligner treatments in dental clinics and orthodontic practices. With the increased demand from target customers, key market players such as Align Technology, Straumann, and Dentsply Sirona offer premium and customized clear aligner solutions to satisfaction fulfill customers' needs and, drive the market further. For instance, in April 2021, Align Technology announced that the Invisalign system has cracked the ten million mark including adults, adolescents, and children from the age of six. Out of the ten million patients, 2.6 million were teenage patients.

End users Segment Analysis

The stand-alone practice segment will dominate the clear aligners market with a share of 54.2% by 2035. This can be attributed to an increase in the adoption rate of clear aligner treatments in private dental practices, leading to greater demand for aesthetic dental solutions over convenient and discrete orthodontic treatments. Standalone practices are in a better position to give personalized care and attention to their patients and are relatively flexible to accommodate new technologies and treatment options.

Material type Segment Analysis

The polyurethane segment in the clear aligners market will hold a significant share of 76.9% by the end of 2035 owing to its unique characteristics such as flexibility, durability, and biocompatibility which makes it a competitive material preferred by customer to fit their needs of comfort and safety. Also, the material can be molded into varied shapes and designs, exhibiting a property that makes it ideal for utilization. Hence, as the growth in the clear aligners market evolves, it is poised for sustained growth in the future.

Our in-depth analysis of the clear aligners market includes the following segments:

|

Age |

|

|

Type |

|

|

Product |

|

|

Material Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clear Aligners Market Regional Analysis:

North America Market Insights

North America industry is predicted to hold largest revenue share of 56.5% by 2035. This domination is spurred by the range of factors such as specifically conducive to the adoption of the clear aligner, dental disorders that necessitate orthodontic treatment is malocclusion, and the specialist concentration in aesthetic dentistry in North America has led to patient needs being more towards the invisible and time-friendly orthodontic technique, which makes clear aligners a very appealing proposal to customers willing to line up their smiles.

The U.S. acts as a prominent player in the clear aligners market driven by the rising cases of malocclusion and a strong demand for aesthetic orthodontic solutions. In January 2024, Align Technology completed its acquisition of Cubicure, a polymer specialist and pioneer of direct 3D-printing technology based in Austria. Align uses 3D printing to create the molds for bespoke Invisalign trays, with the intention that the addition of Cubicure’s cutting-edge technology will allow it to print clear aligners directly, improving the efficiency and sustainability of the therapy.

Asia Pacific Market Insights

Asia Pacific is the fastest-growing region in the clear aligners market attributable to the rising incidence of aesthetic dentistry treatments, higher disposable income of people, and availability of a larger base of orthodontic patients. Asia Pacific is progressive in the curve due to growing demand for non-visible, comfortable orthodontic solutions. Dental healthcare infrastructure is also evolving within the region and more dental clinics and orthodontic practices are moving towards digital dentistry and CAD/CAM technology.

Furthermore, local players collaborate with global corporations to provide an even broader range of clear aligners for dentists and clients. Measures and funds made by the government towards the healthcare sector also contribute to the growth of the dental industry and are therefore favorable for the use of clear aligners. Therefore, rising demand, availability, and awareness levels regarding oral health, and mindful development in the Asia Pacific clear aligners market shall be witnessed in the upcoming years.

In India, the rapid growth in clear aligners can be witnessed due to the large pool of orthodontic patients. The country provides state-of-the-art infrastructure with high-tech solutions to render improved dental solutions and increased efficiency. Moreover, local government is promoting initiatives to assist the growth of industry and create a stable environment to compete with higher efficacy and provide maximum customer satisfaction.

Clear Aligners Market Players:

- Align Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dentsply Sirona

- Institute Straumann

- Envista Corporation

- 3M ESPE

- Argen Corporation

- Henry Schein Inc

- TP Orthodontics Inc

- SmileDirect Club

- Angel Aligner

The clear aligners market players are increasing their investments in the adoption of high-tech clear aligners to gain a competitive edge and strengthen their position in the global market. List on some prominent players is mentioned below-

Recent Developments

- In June 2024, 3D Systems announced an expanded focus and technology roadmap for the dental industry, with a direct printing technology for clear aligners set to be commercialized by late 2025.

- In October 2022, Mitsui invested in Signature Dental Partners Holdings LLC, the parent company to Signature Dental Partners LLC, a provider of dental practice management services with operations in over 8 western states of the U.S.

- Report ID: 6443

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clear Aligners Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.