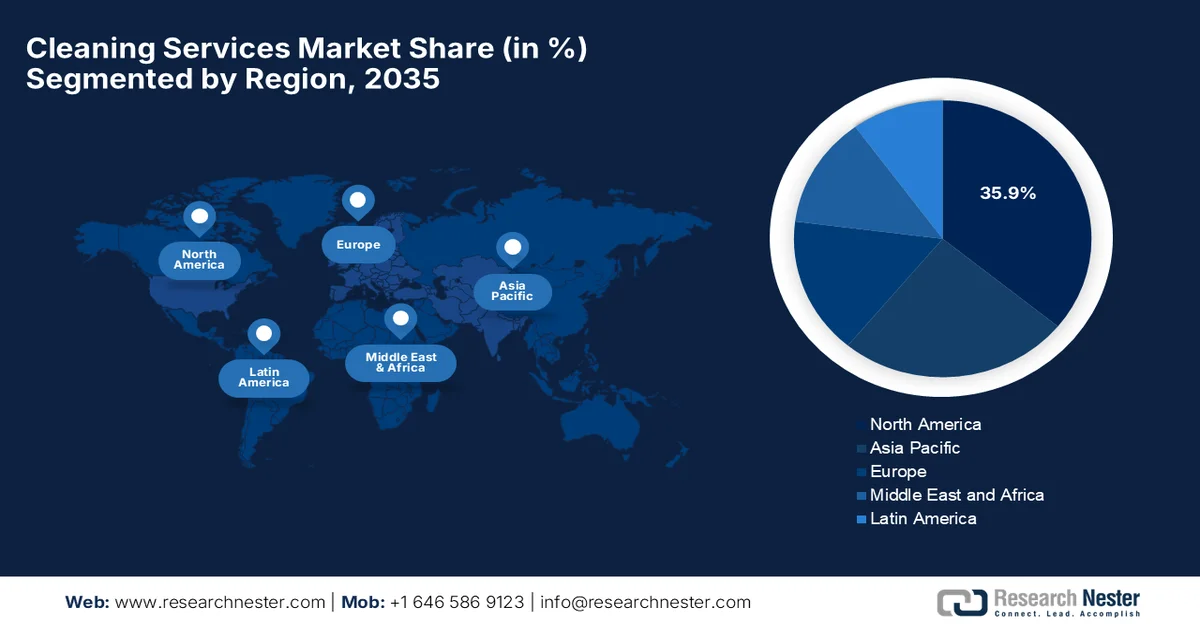

Cleaning Services Market - Regional Analysis

North America Market Insights

The North America cleaning services market is anticipated to hold the largest share of 35.9% by the end of 2035. The market’s upliftment in the region is mainly attributed to improvements in cleaning technologies coupled with a stronger focus on sustainability. Most of the corporate facilities in the region are outsourcing cleaning to specialized providers to enhance operational efficiency, whereas consistent growth in the hospitality sector and rising consumer expectations for cleanliness have boosted the need for professional cleaning solutions. In this context, iRobot made its largest-ever product launch in March 2025 with a new suite of advanced Roomba floor cleaning robots featuring higher suction, AI-based navigation, and enhanced mopping capabilities. The lineup includes innovative technologies such as DustCompactor, PrecisionVision AI, and AutoWash docks, thereby offering greater automation and convenience, hence benefiting the overall market growth.

The U.S. cleaning services market is showcasing tremendous growth owing to the heightened hygiene awareness and the effect of the COVID-19 pandemic. Government support, such as local grants for small cleaning businesses, competitive pay, and the rising adoption of eco-friendly cleaning practices, is also efficiently boosting the market development in the country. In this context, the U.S. EPA finalized updates to the Safer Choice and Design for the Environment (DfE) Standard in August 2024, thereby strengthening criteria for safer chemical ingredients in cleaners, detergents, and disinfectants to help consumers identify sustainable options without any compromise on performance. It also mentioned the key changes, which include a new certification for cleaning service providers, bans on PFAS in packaging, enhanced sustainable packaging with recycled content, do not flush labels on wipes, and optional energy efficiency incentives, hence driving innovation in safer products.

Government-Backed Employment and Wage Profiles for Janitors and Cleaners in Leading States, 2022

|

State |

Employment |

Employment per Thousand Jobs |

Location Quotient |

Hourly Mean Wage (USD) |

Annual Mean Wage (USD) |

|

California |

246,850 |

14.00 |

0.96 |

18.95 |

39,420 |

|

New York |

188,270 |

20.67 |

1.42 |

19.63 |

40,830 |

|

Texas |

176,800 |

13.61 |

0.94 |

13.82 |

28,740 |

|

Florida |

124,950 |

13.57 |

0.93 |

14.01 |

29,150 |

|

Illinois |

93,150 |

15.83 |

1.09 |

17.01 |

35,380 |

Source: U.S. Bureau of Labor Statistics

There is a huge opportunity for Canada market due to strong government backing, increased demand for sanitation, and the adoption of professional cleaning services. Increasing adoption is witnessed in commercial, residential, and institutional sectors in cities such as Toronto, Vancouver, and Montreal. In this context, the Correctional Service of Canada has issued a request for proposal (RFP 21120-26-5105955) for cleaning services at its Regional Treatment Centers in Bath and Millhaven, Ontario, which runs from April 2026 to March 2027 and has potential renewals. It also stated that this contract requires 7-day-per-week housekeeping to maintain sanitary and hygienic conditions in healthcare facilities for offenders, supporting CSC’s compliance with Health Canada and Accreditation Canada standards. Moreover, the solicitation is open to suppliers in the country, which includes indigenous businesses under the procurement strategy for indigenous business, and follows multiple trade agreements such as CFTA, CETA, and CPTPP, hence bolstering market growth in the upcoming years.

APAC Market Insights

The Asia Pacific cleaning services market is expected to represent consistent growth owing to the heightened demand for cleaning services fueled by rapid urbanization, industrial expansion, and growing public health awareness. Simultaneously, government initiatives across China, Japan, and India’s Swachh Bharat Abhiyan strongly emphasized the role of professional cleaning services, driving increased adoption in this field. In this context, in January 2026, the Japan Organization of Occupational Health and Safety issued a government procurement notice for building cleaning services at Akita Rosai Hospital, covering the time period from April 2026 to March 2029. It also mentioned that eligible suppliers must meet the qualifications that are set by the Ministry of Health, Labor and Welfare, which include prior experience and service grades in the Tohoku. Therefore, this multi-year contract highlights ongoing demand for professional cleaning services in institutional and healthcare settings in this region.

China cleaning services market is progressing on account of a rise in disposable income, government backing, and a structural shift from labor-intensive to tech-driven solutions such as commercial floor care, specialized disinfection, and smart, automated cleaning solutions. The country witnessed increased use of cleaning robots and AI-based, automated equipment, which is boosting efficiency in terms of services. Testifying this in April 2024, the Changchun Luyuan Economic Development Zone Management Committee issued a negotiation announcement for a 2024-2025 cleaning service project, which invites eligible suppliers to provide cleaning of domestic and construction waste, daily maintenance of park roads, and Fuxing Park within the zone. Besides, the procurement was conducted through the government procurement cloud platform, with a one-year contract and the possibility of renewal as well. Hence, such a project stimulates market growth, thereby creating a steady demand for professional cleaning services and encouraging the domestic service providers.

The cleaning services market in India is undergoing significant transformations owing to the rapid urbanization, expansion in terms of commercial and residential infrastructure, and awareness of hygiene and sanitation. Also, government initiatives and campaigns promoting cleanliness are an asset for the country’s market, thereby supporting extensive expansion. As per an article published by the PIB government of India in September 2024, Swachh Bharat Mission (SBM) has revolutionized India's sanitation, achieving ODF status through over 100 million toilets in rural areas during Phase I and advancing waste management in Phase II (2019-2025). Simultaneously, the urban efforts under SBM-U built 63 lakh households and 6.3 lakh public toilets by September 2024, whereas the rural progress includes 587,000 ODF Plus villages with solid/liquid waste systems and is successfully backed by Rs. 1.40 lakh crore (USD 16.87 billion) investment. Furthermore, the Swachhata Hi Seva 2024 campaign emphasizes sustained cleanliness with a prime focus on permanent hygiene nationwide.

Europe Market Insights

Europe cleaning services market has aquired prominent position in the worldwide landscape, which is primarily fueled by strict hygiene regulations, such as the hygiene of foodstuffs regulation have increased demand in food processing plants, healthcare facilities, and public spaces. In addition, the mutually profitable collaborations between players, acquisitions, and rising interest in eco-friendly cleaning, spurred by initiatives such as the European Green Deal, are also supporting market expansion. In August 2025, zvoove, a leading software and AI provider for staffing, security, and cleaning industries, announced that it had acquired CleanManager to expand into the Scandinavian and UK markets. Therefore, the acquisition strengthens Zvoove’s digital platform, complementing its existing tools such as fortytools in Germany, and supports AI-driven innovation in cleaning operations, hence denoting a positive market outlook.

Germany cleaning services market is making a shift from labor-intensive to technology-based solutions, wherein there is a strong demand in commercial, manufacturing, and transportation sectors for hygiene-focused cleaning services. The country is witnessing a strong trend toward sustainability, cleanliness campaigns, and automation, which is shaping the market upliftment. In January 2026, the official data from Berlin District Center reported that Berlin-Mitte's Mittemachtsauber 2025 campaign successfully boosted cleanliness through civil society clean-ups, educational events, and district office actions at sites such as Alexanderplatz, Soldiner Kiez, and Weinbergspark. Besides, 31 BSR neighborhood days collected 228 tons of bulky waste and 25 tons of reusables from 15,000 visitors, a waste festival at Leopoldplatz for 1,500 attendees, school competitions, a second waste summit, expanded bulky waste collections, CSD prevention measures, and a garbage task force issuing fines. Furthermore, the campaign continues in 2026 with citizen-administration collaboration to sustain neighborhood livability, thus denoting a positive impact on the market’s expansion.

The UK cleaning services market is also significantly growing as businesses and households are strongly prioritizing hygiene and maintenance. There has been a growth of offices, retail spaces, and healthcare facilities, increasing the commercial demand in this sector, whereas residential cleaning services see steady uptake from households. In addition, innovation is also efficiently shaping the country’s market, as digital tools, smart cleaning devices, and automation improve service quality. NHS Shared Business Services in November 2024 reported that it has launched three agreement frameworks for linen and laundry, grounds maintenance, and security services, with a main focus on streamlining soft facilities management across NHS estates. It also notes that these agreements provide pre-approved suppliers, which include SMEs, by ensuring efficient, safe, and sustainable operations while supporting NHS hygiene goals. These initiatives simplify procurement and promote environmentally conscious services, thereby highlight growing demand for professional cleaning and facilities services in the UK healthcare sector.