Chronic Wound Care Market Outlook:

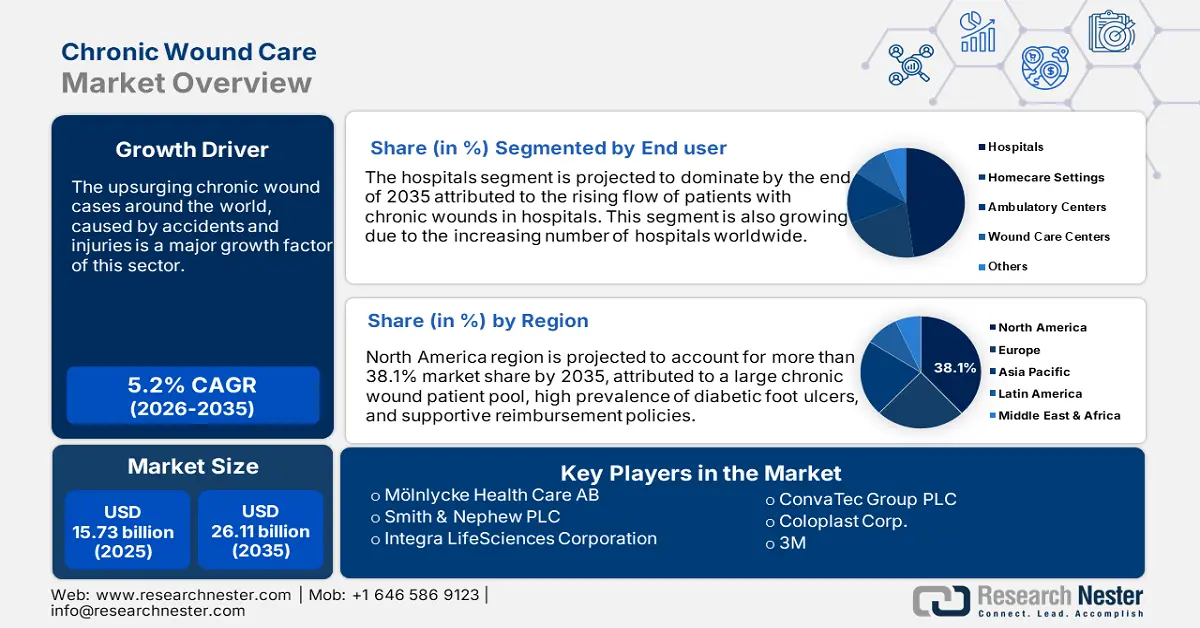

Chronic Wound Care Market size was over USD 15.73 billion in 2025 and is anticipated to cross USD 26.11 billion by 2035, growing at more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chronic wound care is assessed at USD 16.47 billion.

The growth of the market can primarily be ascribed to the worldwide upsurge in chronic wound cases, owing to accidents, injuries, and fatalities. Furthermore, there has been an increase in the number of accident cases across the globe, that is raising the demand for chronic wound care. Hence, these rising wound cases are expected to increase the utilization rate of chronic wound care which in turn, is projected to expand the global chronic wound care market. As per the reported data, more than 2% to 4% population of developed nations around the globe suffer from chronic wounds.

Moreover, high prevalence of chronic diseases such as autoimmune diseases, diabetes, and others is projected to boost the growth of the global chronic wound care market. According to the data reported, six in ten Americans in the United States live with at least one chronic disease. Moreover, these wounds require significant medical treatment as well as effective wound care supplies. In addition, there has been an increase in expenses for wound and patient care. It was observed in a clinical study that, P. aeruginosa and S. aureus are two of the bacteria which are most frequently found in infections of chronic wounds. Furthermore, when P. aeruginosa and S. aureus are cultivated together in a wound model, they have relatively high antibiotic resistance.

Key Chronic Wound Care Market Insights Summary:

Regional Highlights:

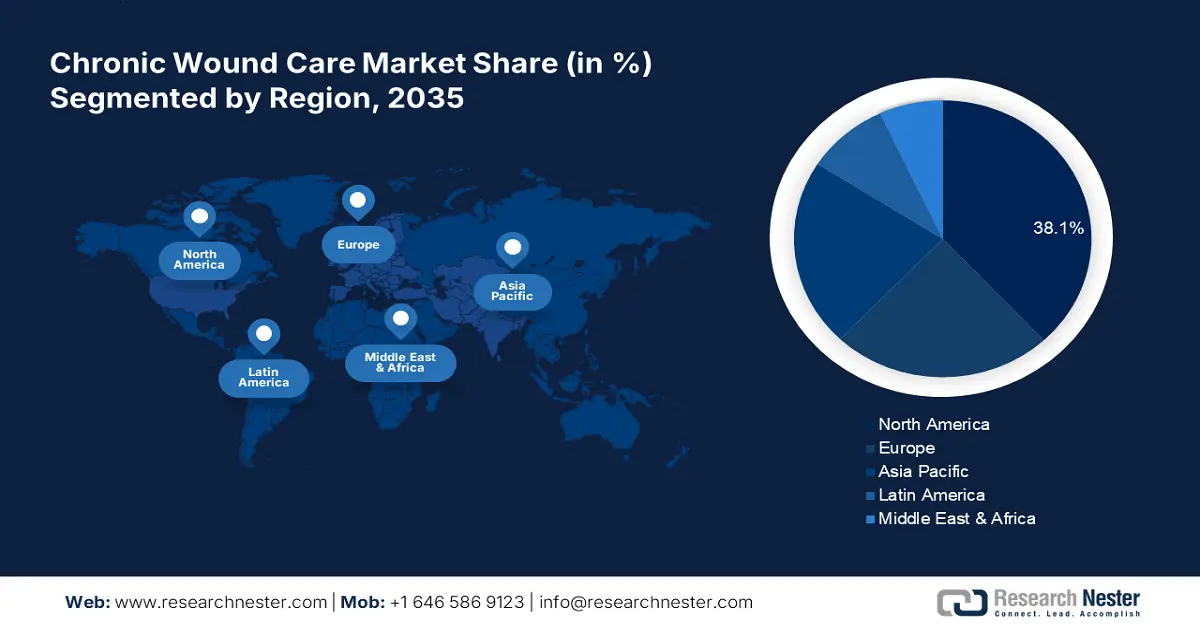

- The North America chronic wound care market will hold over 38.1% share by 2035, attributed to a large chronic wound patient pool, high prevalence of diabetic foot ulcers, and supportive reimbursement policies.

- The Asia Pacific market will achieve the fastest growth from 2026 to 2035, driven by rising diabetic population, rapidly increasing elderly population, and higher healthcare spending.

Segment Insights:

- The hospitals segment in the chronic wound care market is expected to exhibit noteworthy growth from 2026-2035, driven by increasing patient flow, rising surgeries, and growing hospital numbers.

- The advanced wound dressings segment in the chronic wound care market is anticipated to hold the largest share by 2035, driven by the cost-effectiveness and versatility in managing various wound types.

Key Growth Trends:

- Increase in Burn Injuries

- Escalating Ratio of Pressure Ulcers

Major Challenges:

- High Cost of Treatment of Chronic Wound

- Inadequate Compensation Policies in Emerging Nations

Key Players: Smith & Nephew PLC, Ölnlycke Health Care AB, ConvaTec, Inc., Integra LifeSciences Corporation, Coloplast A/S, Cardinal Health, Inc., Tissue Regenix Ltd, B. Braun Melsungen AG, MIMEDX, Inc., 3M.

Global Chronic Wound Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.73 billion

- 2026 Market Size: USD 16.47 billion

- Projected Market Size: USD 26.11 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Chronic Wound Care Market Growth Drivers and Challenges:

Growth Drivers

- Global Upsurge in Diabetes Among People - Diabetes mellitus, also known as diabetes, is a metabolic condition that initiates high blood sugar levels. If untreated, diabetes-related high blood sugar damages nerves, eyes, kidneys, and other organs. Diabetes is becoming more prevalent worldwide, resulting in open wounds that do not heal completely. Hence, it is expected to drive the growth of the global chronic wound care market in the upcoming years. According to the World Health Organization (WHO), there are 422 million diabetics worldwide, and diabetes is the leading cause of 1.5 million annual deaths.

- Increase in Burn Injuries – There are wounds that generally take more than 6 weeks and are slow to recover that are termed is chronic burn injuries. Furthermore, intensive care is provided through the use of chronic wound care products, and it is expected to rise the growth of the global chronic wound care market. According to the World Health Organization, nearly 11 million burn injuries occur every year around the globe. Moreover, approximately 180 000 people die as a result of burns annually, worldwide.

- Escalating Ratio of Pressure Ulcers – There has been an increasing incidence of ulcers that is raising the need for therapies in order to treat these wounds. Hence, it is projected to surge the market’s growth over the forecast period. For instance, the worldwide incidence of pressure ulcers has reached nearly 13%, with 9% occurrence of hospital-acquired pressure injury (HAPI).

- Spike in Venous Leg Ulcers - It is estimated that venous leg ulcers affect nearly 1 to 5% of the elderly population in the United States and Europe.

- Surging number of sport injuries- Chronic injuries generally develop with time and usually happen from overuse of one specific area of the body. Therefore, it is anticipated to rise the growth of the global chronic wound care market. In the United States, more than 3 million sports injuries occur each year.

- Advancement in Dressing Material to Treat Chronic Wounds – It was observed in research that, in managing outpatients with diabetic foot ulcers, silver-releasing foam dressings were found to be more successful than silver-containing cream, especially in the beginning stages of wound therapy. Moreover, it has been discovered that a thiolated biodegradable bandage loaded with ZnO nanoparticles improves tissue regeneration and speeds healing.

Challenges

- High Cost of Treatment of Chronic Wound – Chronic wounds require utmost attention for treatment with the help of high-quality products. Furthermore, the cost of these products is high such as wound care devices, advanced wound dressings, and others that makes its difficult for every class of people to opt for them for treatment. Therefore, it is expected to pose as a challenge to the market growth.

- Inadequate Compensation Policies in Emerging Nations

- Rising Concern Among Patients for Urgent Treatments

Chronic Wound Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 15.73 billion |

|

Forecast Year Market Size (2035) |

USD 26.11 billion |

|

Regional Scope |

|

Chronic Wound Care Market Segmentation:

End-user Segment Analysis

The global chronic wound care market is segmented and analyzed for demand and supply by end-user into hospitals, homecare settings, ambulatory centers, wound care centers, and others. Out of which, the hospitals segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the increasing patient flow in hospitals dealing with chronic wounds. Furthermore, there have been rising numbers of hospitals, followed by increasing numbers of surgeries, and patients across the globe that is further expected to drive the growth of the segment in the region. For instance, it is estimated that every year around 4.2 million patients in Europe suffer from chronic wounds, needing 25%-50% of intense hospital beds.

Product Segment Analysis

On the other hand, the global chronic wound care market is segmented and analyzed for demand and supply by product into advanced wound dressings, wound care devices, active therapy, and others. Out of these, the advanced wound dressings segment is expected to hold the largest market size over the forecast period. This can be attributed to its lower cost, and its capability to manage different types of wounds. Moreover, there has been an increase in the use of advanced wound dressings for sports, and burn related injuries, that is projected to expand the segment’s growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Product |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chronic Wound Care Market Regional Analysis:

APAC Market Insights

The Asia Pacific region is anticipated to witness the fastest growth in the upcoming years, backed by the rising number of diabetic patients along with the rapidly increasing elderly population. Moreover, there has been a surge in healthcare expenditure that is further expected to boost the market’s growth in the region.

North American Market Insights

North America region is projected to account for more than 38.1% market share by 2035, attributed to a large chronic wound patient pool, high prevalence of diabetic foot ulcers, and supportive reimbursement policies. For instance, in 2019, approximately 8 to 13 million people were affected by chronic wounds in the United States. Moreover, there has been a surge in the number of sports related injuries in countries such as the U.S., that is expected to drive the market’s growth in the region.

Chronic Wound Care Market Players:

- Smith & Nephew PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ölnlycke Health Care AB

- ConvaTec, Inc.

- Integra LifeSciences Corporation

- Coloplast A/S

- Cardinal Health, Inc.

- Tissue Regenix Ltd

- B. Braun Melsungen AG

- MIMEDX, Inc.

- 3M

Recent Developments

-

Smith & Nephew PLC has announced the efficiency of its GRAFIX Membrane which reduces diabetic foot ulcer recurrence by half as compared to other leading competitors.

-

Integra LifeSciences Corporation announced the positive clinical outcomes with its PriMatrix Dermal Repair Scaffold for the treatment of hard-to-heal diabetic foot ulcers (DFUs). This is the largest DFU RCT ever conducted. A per protocol analysis found that 60% of DFUs healed within 12 weeks when PriMatrix was used in conjunction with standard care (SOC), compared to 35% for DFUs that healed within 12 weeks when SOC was used.

- Report ID: 4450

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chronic Wound Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.