Chronic Obstructive Pulmonary Disease Market Outlook:

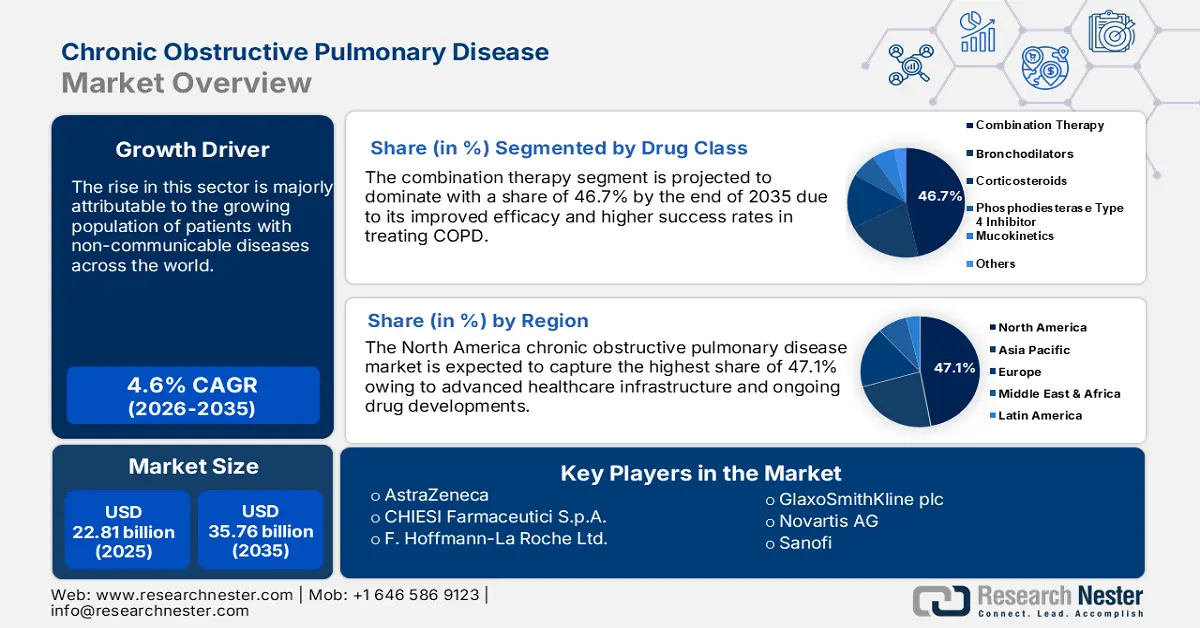

Chronic Obstructive Pulmonary Disease Market size was valued at USD 22.81 billion in 2025 and is set to exceed USD 35.76 billion by 2035, expanding at over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chronic obstructive pulmonary disease is estimated at USD 23.75 billion.

In 2020, the COPD presence among both men and women was 10.6% globally, pertaining to 480 million cases approximately. This has accounted for innumerable hospital visits, and surging medical expenses. For instance, a study conducted on COPD patients in Canada denoted the total cost per patient to be USD 4,147. This, however, is projected to increase to USD 60.5 billion by 2029, overall. Additionally, treatment and diagnostic-based cost is also projected to affect the global economy, which is poised to be USD 4.326 trillion by 2050.

With urbanization and the aging of the population, chronic respiratory diseases are projected to become the ideal cause of mortality. According to a report by the National Vital Statistics System - Mortality Data 2022, a total of 147,382 people died globally due to chronic respiratory diseases. Besides, 90% of COPD deaths occur in those under the age of 70 years, especially across developing nations. Increasing consumption of tobacco, exposure to indoor and outdoor air pollution, frequent infections such as haemophilus influenza, pseudomonas aeruginosa, streptococcus pneumonia, staphylococcus aureus, and moroxella catarrhalis, alpha-1 antitrypsin deficiency (a genetic condition), and asthma are risk factors that lead to the development of COPD.

Furthermore, the rise in respiratory diseases is also giving a boost to employment worldwide. For instance, as per the U.S. Bureau of Labor Statistics, there was a 0.5% rise in employment, with a total of 129,750 employees in the respiratory therapeutics field in the United States in May 2023. As many as 133,900 respiratory therapy jobs were available in the same year. It further predicts an employment change of 17,500 (13%), which is much faster than average, from 2022 to 2033. Nearly 8,200 respiratory therapists’ job openings are anticipated on average each year, over the decade. The majority of these openings are an outcome of the need to replace workers transferring to different occupations or retiring. This rise in employment also gives way to the expansion of the chronic obstructive pulmonary disease market by driving production and accessibility of treatments.

Key Chronic Obstructive Pulmonary Disease Market Insights Summary:

Regional Highlights:

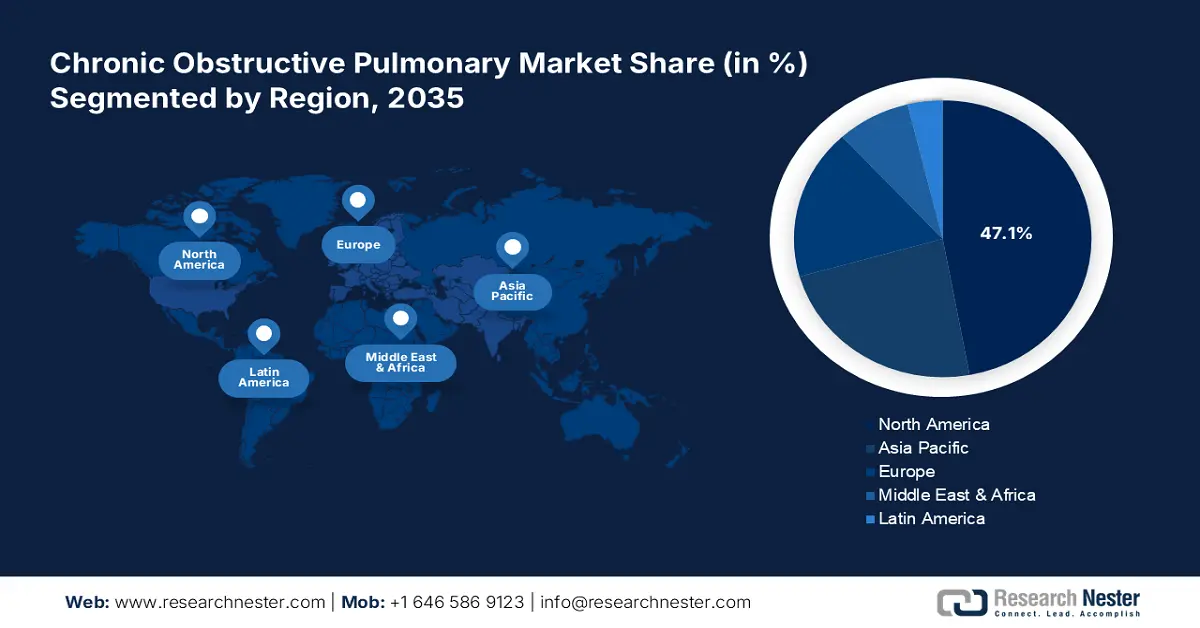

- North America dominates the Chronic Obstructive Pulmonary Disease Market with a 47.1% share, driven by smoking status, demographics, and rising COPD prevalence, ensuring strong growth through 2026–2035.

Segment Insights:

- Chronic Bronchitis segment is expected to dominate by 2035, propelled by increased cigarette smoking and air pollution driving disease prevalence.

- Combination Therapy segment is projected to capture more than a 46.7% share by 2035, driven by its ability to address multiple COPD components with complementary modes.

Key Growth Trends:

- Exposure to biomass fuel

- Increase in awareness of COPD

Major Challenges:

- Low- and middle-income nations

- Accurate diagnosis in health systems

- Key Players: Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd, Abbott, Pfizer, Genentech.

Global Chronic Obstructive Pulmonary Disease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.81 billion

- 2026 Market Size: USD 23.75 billion

- Projected Market Size: USD 35.76 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Chronic Obstructive Pulmonary Disease Market Growth Drivers and Challenges:

Growth Drivers

- Exposure to biomass fuel: Biomass smoke is a rising factor that develops airflow obstruction and COPD, across developing countries. On a global basis, 50% of the world population utilizes biomass fuel for heat, light, and cooking, wherein there is poor availability of ventilation. For example, in India, the exposure of biomass fuel in an enclosed space has become a rising concern for the spread of COPD. Especially, women tend to suffer from biomass smoke and increasingly are in need of supplementary oxygen. Their lungs get more exposure to wood-based smoke that causes less emphysema and intense bronchiolitis.

- Increase in awareness of COPD: A global initiative by the Chronic Obstructive Lung Disease (GOLD) in association with COPD patients and healthcare personnel has resulted in the organization of World COPD Day. Every year organizers from over 50 nations carry out activities for spreading awareness about the disease, since the initial World COPD Day. In November 20, 2024, the theme was “Know Your Lung Function” that highlighted lung functionality. The importance of utilizing spirometry as a tool to diagnose COPD was the main objective of the awareness program.

Challenges

- Low- and middle-income nations: COPD has posed a public health challenge worldwide, with its 10% prevalence globally. Low- and middle-income nations are severely affected by COPD and constitute 85% of the burden of the disease. Additionally, COPD-based mortality and morbidity take place in these nations and this results in socio-economic burden. To overcome this, the Global Initiative for Chronic Obstructive Lung Disease (GOLD) provides an evidence-based annual update and strategy for the prevention, management, and diagnosis of COPD.

- Accurate diagnosis in health systems: COPD is caused by airflow obstruction that is irreversible and symptoms included are dyspnea, sputum production, and chronic cough. Approximately, 50% of the 24 million adults in the USA with COPD are undiagnosed. Factors such as limited awareness of COPD symptoms, consequences of smoking and aging, asthma, and inadequate healthcare personnel tend to contribute to inaccurate diagnosis. Familiarity with COPD guidelines and treatments along with identification of patients with enhanced COPD risks will ensure effective diagnosis.

Chronic Obstructive Pulmonary Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 22.81 billion |

|

Forecast Year Market Size (2035) |

USD 35.76 billion |

|

Regional Scope |

|

Chronic Obstructive Pulmonary Disease Market Segmentation:

Drug Class (Combination therapy, Bronchodilators, Corticosteroids, Phosphodiesterase Type 4 Inhibitor, Mucokinetics, Others)

Based on the drug class, the combination therapy segment is set to hold chronic obstructive pulmonary disease market share of more than 46.7% by 2035. Combination therapies address several components of COPD using complementary modes of action. For instance, triple therapy – a combination of anticholinergic, inhaled corticosteroid, and long-acting β2-agonist (LABA) ensures clinical advantages for COPD treatment. The Efficacy and Safety of Triple Therapy in Obstructive Lung Disease (ETHOS) trial in January 2023 reported that Triple Therapy reduced severe exacerbations by 25% and decreased mortality by 42% in comparison to LAMA-LABA.

Type (Chronic Bronchitis, Emphysema)

The chronic bronchitis segment is anticipated to dominate the chronic obstructive pulmonary disease market during the forecast period attributable to an increase in cigarette smoking and air pollution. It is a type of cough that occurs more than 3 months in a span of 2 years. As per Medline Plus 2024, 75% of people within the age limit of 40 years suffer from chronic bronchitis mainly due to smoke which is a rising risk factor. The treatment for this COPD type can be achieved by pharmacological interventions including bronchodilators, glucocorticoids, antibiotic therapy, and phosphodiesterase-4 inhibitors.

Our in-depth analysis of the global chronic obstructive pulmonary disease market includes the following segments:

|

Drug Class |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chronic Obstructive Pulmonary Disease Market Regional Analysis:

North America Market Statistics

North America in chronic obstructive pulmonary disease market is expected to capture around 47.1% revenue share by the end of 2035. Smoking status and amount, and demographics are essential factors of COPD. In 2020, the COPD prevalence in North America was 16.8% and it is expected to increase among males by 2050, in comparison to females. According to the American Lung Association, in 2024, an estimated 11.7 million adults residing in North America are affected with COPD and the treatment cost is approximately USD 50 billion.

The U.S. COPD market is one of the sixth leading causes of death. As per the CDC, in 2022, approximately 11.6%, that is 28.8 million U.S. adults are addicted smokers which is a rising concern for the increasing COPD prevalence. Besides, 25% of U.S. adults suffer from COPD even though they do not smoke. Hence, strategies need to be implemented for COPD prevention, especially for 75-year-old people and rural areas. For example, rural areas have limited access to pulmonologists. Therefore, COPD programs need to be implemented in the rural community to address the challenges associated with the disease.

The chronic obstructive pulmonary disease market in Canada is witnessing significant growth as it is one of the second-leading causes requiring health checks, after childbirth. According to NCBI 2023, inhaled short-acting bronchodilators (SABDs) provide quick relief of COPD symptoms and this is recommended for patients suffering from the disease. It is also estimated that more than a million people are affected by the disease without knowledge of it. Canada is subjected to environmental risk factors due to emitting fumes that cause 80%-90% COPD within the region.

Asia Pacific Market Analysis

The chronic obstructive pulmonary disease (COPD) market in Asia Pacific is gaining traction and is poised to witness lucrative growth during the forecast timeline. Almost 2.3 million deaths from COPD are caused each year by cancer-sticks usage in the region as reported by the Asia-Pacific Heart Network. This further denotes nearly half of the 5 million cancer-sticks deaths each year. According to the Australia Institute of Health and Welfare 2024, approximately 638,000, that is 2.5% of the population in Australia suffered from COPD in 2022.

The chronic obstructive pulmonary disease market in India is expecting substantial growth due to an increase in elderly residents, active smokers, and other environmental pollution. A study conducted by Lung India in 2021 with a pooled sample of 8,569 individuals, stated that the COPD prevalence in India was 7.4%, especially among the adult population. Moreover, several community-based cross-sectional studies among the same lot reported that the presence of COPD in the rural area was 5.6% and in the urban area was 11.4%. In November 2023, Lupin declared the launch of Vilfuro-G in India for the efficient management of COPD under the approval of the Drug Controller General of India for the Dry Powder Inhaler (DPI).

The COPD market in China is gaining traction due to the presence of medical facilities, especially for the geriatric population suffering from the disease. In 2019, the Chinese government made an investment of USD 12 billion to enhance air quality. Additionally, the government has also taken precautions to prevent the disease in alignment with the WHO global action plan. There have been investments to make COPD care services accessible. For instance, in October 2021, China implemented the national COPD screening along with the expertise of the WHO Collaborating Centre (WHO CC) China-Japan Friendship Hospital.

Key Chronic Obstructive Pulmonary Disease Market Players:

- Boehringer Ingelheim International GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd

- Abbott

- Pfizer

- Genentech

- Mylan N.V.

- Alkermes

- Sunovion Pharmaceuticals

- Grifols S.A.

- Vectura Group plc

- Almirall S.A

- Astellas Pharma

Companies dominating the chronic obstructive pulmonary disease market are rapidly gaining exposure owing to the encouragement of people to avail medical assistance at the very first sign of distress. The key goal is to make reductions in risks associated with exacerbations from a futuristic perspective. In September 2024, Australia witnessed the launch of a care standard for COPD. It was an online launch pertaining to the introduction of the Chronic Obstructive Pulmonary Disease Clinical Care Standard for the first time to provide care facilities for COPD.

Here's the list of some key players:

Recent Developments

- In September 2024, the US Food and Drug Administration (FDA) approved Dupixent by Sanofi as a biologic treatment among adults suffering from uncontrolled COPD and eosinophilic phenotype.

- In March 2022, Sandoz, a Novartis division declared its acquisition of Coalesce Product Development Limited to initiate growth opportunities in complex and respiratory generics.

- Report ID: 7051

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chronic Obstructive Pulmonary Disease Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.