Chronic Granulomatous Disease Market Outlook:

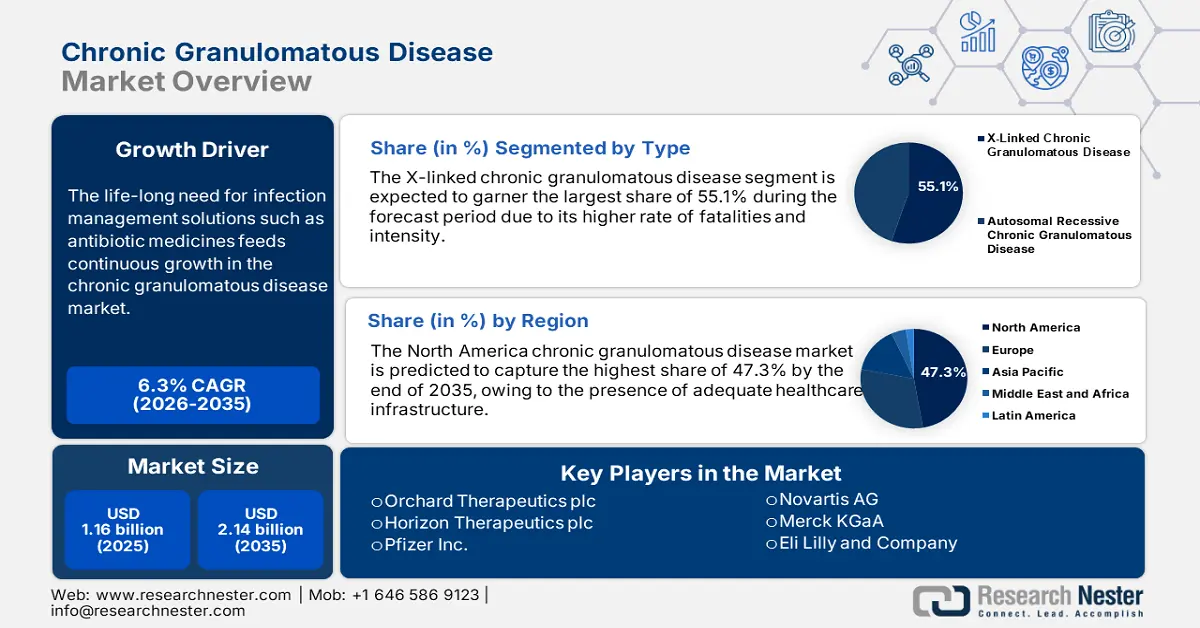

Chronic Granulomatous Disease Market size was valued at USD 1.16 billion in 2025 and is likely to cross USD 2.14 billion by 2035, expanding at more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chronic granulomatous disease is assessed at USD 1.23 billion.

The life-long need for infection management solutions such as antibiotic medicines feeds continuous growth in the chronic granulomatous disease market. Despite being one of the rare genetic disorders, its severity and mortality rate among children and adults are dragging the focus of public healthcare organizations in further development. Thus, they are heavily investing in this sector to ensure accessible care, particularly for the rising risk of bacterial infections across the world. According to a WHO report, published in March 2023, globally antimicrobial-resistant infections cause over 1.2 million deaths each year, where 1 child dies every 3 minutes for MDRO sepsis infection. The report further estimated the extensive cost of medical care for such conditions to reach USD 1.0 trillion by 2050.

In addition, the growing trend of globalization in the antibiotic industry is also contributing to a large portion of the revenue in the chronic granulomatous disease market. The heightened risk and incidences of infectious events in patients with this disease are driving the demand for such drugs and therapeutics, creating an uninterrupted supply-demand loop in this sector. According to the 2022 OEC data, the value of the worldwide bulk trade of antibiotics nes accounted for USD 6.8 billion, evidence of a well-established marketplace. The report further identified the top import-export leaders to be China, India, the U.S., and Italy, attributable to the significant usage for treating bacterial infections.

Import-Export Data for Bulk Antibiotic nes (OEC 2022):

|

Country |

Export Value (in million) |

Import Value (in million) |

|

China |

USD 2,420.0 |

USD 360.0 |

|

India |

USD 574.0 |

USD 734.0 |

|

The U.S. |

USD 364.0 |

USD 423.0 |

|

Italy |

USD 626.0 |

USD 789.0 |

Key Chronic Granulomatous Disease Market Insights Summary:

Regional Highlights:

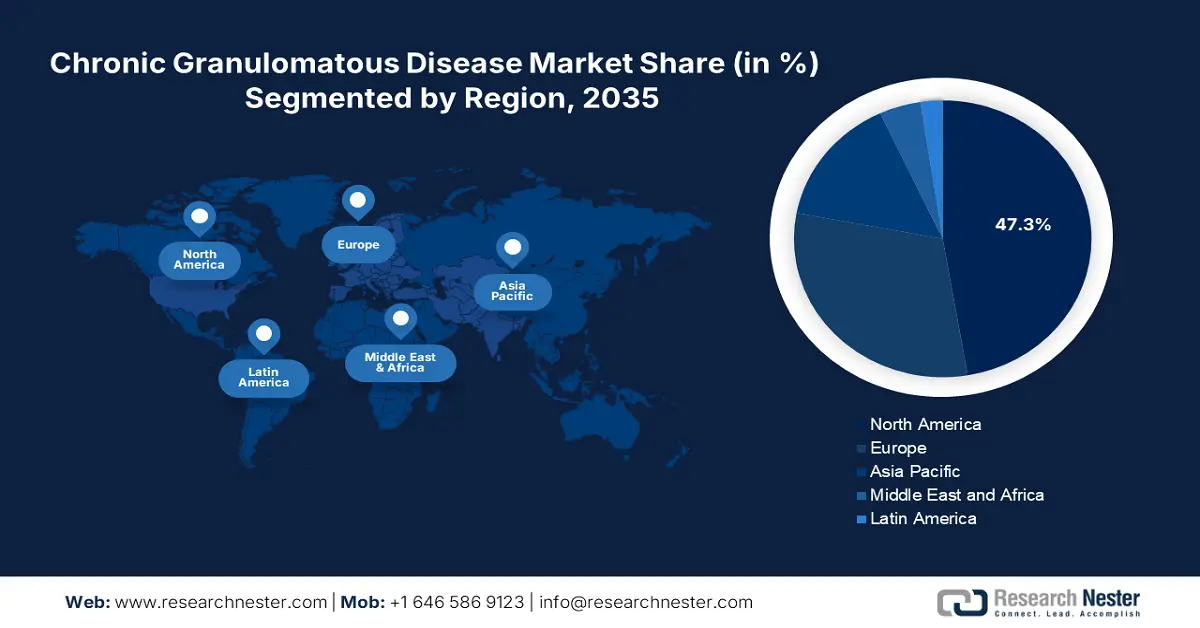

- North America dominates the Chronic Granulomatous Disease Market with a 47.3% share, fueled by a developed healthcare infrastructure and strong presence in genetic testing and diagnosis for CGD, driving growth through 2026–2035.

- Asia Pacific’s chronic granulomatous disease market is poised for significant growth by 2035, fueled by rising domestic and foreign investment in pharma and innovative CGD treatments.

Segment Insights:

- The X-linked Chronic Granulomatous Disease segment is expected to hold a 55.10% market share by 2035, fueled by higher fatality rates and the increasing prominence of gene therapy.

Key Growth Trends:

- Global participation and investments in genomic R&D

- Governmental support for rare genetic diseases

Major Challenges:

- Limited patient population and scope of investment

- Absence of absolute treatment and adequate infrastructure

- Key Players: Clinigen Group plc, Orchard Therapeutics plc, Horizon Therapeutics plc, ViroMed. Co. Ltd., Bellicum Pharmaceuticals, Inc., Pfizer Inc., Hoffmann-La Roche Ltd., Novartis AG, Lonza, GlaxoSmithKline plc, Eli Lilly and Company, Johnson & Johnson Services, Inc., Merck KGaA.

Global Chronic Granulomatous Disease Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.16 billion

- 2026 Market Size: USD 1.23 billion

- Projected Market Size: USD 2.14 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Chronic Granulomatous Disease Market Growth Drivers and Challenges:

Growth Drivers

-

Global participation and investments in genomic R&D: The importance of understanding the genetic mechanism of the condition has captivated both academic and pharmaceutical interest. This has further increased activities in research, widening the range of the chronic granulomatous disease market. According to the NLM report, total substantial government investment in genetic sequencing from 14 countries across the world was valued at over USD 4.0 billion during 2016-2019. The increased number of clinical trials in this category is also evidence of development potential in this sector. Further, the competitive demographics of this sector are driven by the lowered cost of the whole process.

Government/Private Genomic Initiatives (2020 IQVIA Data):

|

Initiative |

Type |

Genome Number |

|

Genomic England |

Government |

5.0 million (target) |

|

Million Veteran Program |

Government |

1.0 million (target) |

|

‘All of Us’ Precision Medicine Initiative |

Government |

1.0 million (target) |

|

China Nanjing Project |

Government |

1.0 million (target) |

|

Dubai Genomics |

Government |

3.4 million (target) |

|

Turkish Genome Project |

Government |

1.0 million (target) |

|

Ancestry.com |

Private |

15.0 million (current) |

|

AstraZeneca-MedImmune |

Private |

2.0 million (target) |

|

23andMe |

Private |

10.0 million (current) |

|

Genomic Health Inc. |

Private |

1.0 million (current) |

- Governmental support for rare genetic diseases: Governments across the globe play a pivotal role in raising awareness about rare diseases, promoting the chronic granulomatous disease market. Their efforts to enhance healthcare systems for better treatment accessibility and accurate diagnosis have leveraged the speed of adoption in this sector. For instance, in March 2021, the government of India issued the National Policy for Rare Diseases (NPRD) to offer financial assistance for getting treatment for rare disorders. The policy provides coverage up to USD 57758.3 for each patient with the listed rare disease, getting treated at the notified Centers of Excellence (CoEs). The policy also allocated USD 4.0 million for CoEs to procure required equipment.

Challenges

-

Limited patient population and scope of investment: The number of patients in the chronic granulomatous disease market is constrained due to being rare. This results in a lack of awareness about the condition, forcing pharma companies to rethink before investing. The confined consumer base also affects the strategies for chronic granulomatous disease market expansion due to limitations in commercial incentives and health insurance coverage. Moreover, this may dilute the interest in bringing innovations in this sector, hindering development.

- Absence of absolute treatment and adequate infrastructure: The chronic granulomatous disease market majorly depends on the revenue from available infection retardant solutions. The definite treatment method for this disease is still absent, creating uncertainty about the elongated effectiveness of existing antibiotics. Additionally, the rising burden of antimicrobial-resistant infections often requires an extensive range of medications and therapies, which falls under out-of-pocket healthcare expenses. This may limit the product diversity and reach in low-income regions.

Chronic Granulomatous Disease Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 1.16 billion |

|

Forecast Year Market Size (2035) |

USD 2.14 billion |

|

Regional Scope |

|

Chronic Granulomatous Disease Market Segmentation:

Type (X-Linked Chronic Granulomatous Disease, Autosomal Recessive Chronic Granulomatous Disease)

Based on type, the X-linked chronic granulomatous disease segment is expected to hold over 55.1% chronic granulomatous disease market share by the end of 2035. Its higher rate of fatalities and intensity are the major driving forces in the market. The presence of gene therapy has become more prominent than ever in this segment. Moreover, the proven benefits of these solutions in treating X-linked CGD are propelling demand for new therapeutics. For instance, in January 2025, the commencement of phase ½ trial of base editing for mutation repair in hematopoietic stem and progenitor cell therapies to treat X-CGD was announced. This clinical trial is funded by the National Institute of Allergy and Infectious Diseases (NIAID) to manage infections in these patients.

Treatment (Infection Management, Trimethoprim, Sulfamethoxazole, Itraconazole, Interferon-gamma, Stem Cell Transplantation)

In terms of treatment, the trimethoprim segment is estimated to dominate the chronic granulomatous disease market by the end of 2035. Frequent use of this component in treatment strategies for CGD patients is garnering a surge in this segment. The inflated demand has also attracted many pharma companies to introduce convenient ways of administration for this drug to make the whole process easier. Furthermore, the efficacy of this treatment method in preventing severe infections such as pneumocystis jirovecil, which are commonly found in individuals with CGD has inspired them to innovate more. For instance, in November 2022, ANI Pharmaceuticals received Abbreviated New Drug Application (ANDA) approval from the FDA for Trimethoprim Tablets USP, 100 mg.

Our in-depth analysis of the global chronic granulomatous disease market includes the following segments:

|

Type |

|

|

Diagnosis |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chronic Granulomatous Disease Market Regional Analysis:

North America Market Analysis

North America in chronic granulomatous disease market is expected to capture around 47.3% revenue share by the end of 2035. It has become a primary target for pharma companies to outstretch their business overseas due to the ease of trading. Additionally, the accepting culture of this marketplace towards genetic innovations has influenced international pharma suppliers to invest in this landscape. According to the 2020 IQVIA Genomic Database, North America ranked at the top in the genomic analysis industry, capturing a 72% share. It is further poised to sequence 2.2 million whole exomes by 2025, having high medical value for bringing innovations in this sector.

The continuous expansion of the chronic granulomatous disease market in the U.S. is pledged with the developed healthcare infrastructure, allowing people with such disorders to get proper diagnosis and treatment on time. Besides, the country is highly prioritized for getting CGD treatment based on its excellence in genetic testing spectrum. According to NLM, by November 2022, the number of performed genetic tests was registered at 129,624 in the country. In the same year, the number of newly introduced genetic tests in the U.S. was 3097 an 90% of them are eligible for clinical diagnosis.

Canada is augmenting the chronic granulomatous disease market by making hefty investments in drug availability and development. The governing bodies of this country are actively taking part in improving healthcare access to its citizens, particularly for rare disease cases. For instance, in March 2023, the government of Canada allocated a fund of USD 1.5 billion over three years to empower its National Strategy for Drugs for Rare Diseases. This financial support was dedicated to strengthening the affordability and accessibility aspects of effective medicines to treat patients with rare disorders such as CGD.

APAC Market Statistics

Asia Pacific is determined to register a significant growth rate in the chronic granulomatous disease market during the period between 2026 and 2035. The pharmaceutical progress in this region is among the largest contributors to this sector. The presence of domestic giants and the rising interest of foreign forces in this landscape is earning lucrative revenues. This is further encouraging other crucial component suppliers in this sector to elevate their marketing strategies to solidify their footprint. For instance, in October 2021, Intas Pharmaceuticals extended its anti-fungal pipeline by launching Super Bioavailable Itraconazole-SB 100mg under the brand name, Itaspor-SB Forte/Subawin.

India is utilizing its pharma expertise to captivate leadership in new drug development in the chronic granulomatous disease market. The country’s drug pioneers are meticulously investing their resources to gain traction in this sector by bringing innovative CGD management approaches. For instance, in January 2021, Lupin Limited gained acceptance from the FDA to launch its Sulfamethoxazole and Trimethoprim Oral Suspension USP, 200 mg/40 mg per 5 mL commercially. The alternative of Bactrim Oral Suspension, 200 mg/40 mg per 5 mL is capable of treating and preventing a broader range of infections in CGD patients.

China is also enlarging its supply networks in the chronic granulomatous disease market with its unmatched manufacturing capabilities. The country is pushing its boundaries to increase domestic production of associated medications, embarking its significance as one of the largest pharmaceutical suppliers in the world. According to the 2022 OEC data, China was positioned at the top of the list of global antibiotic exporters by generating an export value of USD 4.5 billion. The country has acquired a vital place in some of the emerging marketplaces of this sector such as India, the U.S., and Italy.

Key Chronic Granulomatous Disease Market Players:

- Clinigen Group plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Orchard Therapeutics plc

- Horizon Therapeutics plc

- ViroMed. Co. Ltd.

- Bellicum Pharmaceuticals, Inc.

- Pfizer Inc.

- Hoffmann-La Roche Ltd.

- Novartis AG

- Lonza

- GlaxoSmithKline plc

- Eli Lilly and Company

- Johnson & Johnson Services, Inc

- Merck KGaA

- Prime Medicine, Inc.

By understanding the importance of innovations in the chronic granulomatous disease market, global leaders are notably engaging their resources to develop new solutions. They are continuously investing in several R&D projects for new therapy, diagnostic technology, and medications to consolidate their presence in this sector. For instance, in June 2022, Apex Laboratories launched an advanced version of Itraconazole Capsules Supra Bioavailable 65 and 130 mg, containing abilities of delivering 90% active medicine to fight fungal infection. The upgraded oral therapeutic have potential to enhance infection management in CGD patients at a lower dose. Such key players are:

Recent Developments

- In April 2024, Prime Medicine received approval from the FDA for its Investigational New Drug (IND) application for PM359 in treating chronic granulomatous disease (CGD). This acceptance widened the pathway toward the company’s expansion by initiating a global Phase 1/2 clinical trial for commercialization in the U.S. marketplace.

- In January 2020, Orchard Therapeutics earned orphan drug designation from the FDA for its solely developed OTL-102. With this approval, the company gained the rights to market and manufacture its ex vivo autologous hematopoietic stem cell (HSC) gene therapy for treating X-CGD.

- Report ID: 7066

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.