Chromatography Columns Market Outlook:

Chromatography Columns Market size was valued at USD 6.29 Billion in 2025 and is expected to reach USD 11.26 Billion by 2035, registering around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chromatography columns is evaluated at USD 6.63 Billion.

The significant expansion of the biopharmaceutical industry is a major growth factor in the chromatography columns market. As the efficacy and applications of these therapeutics grow, more pharma companies are showing interest in investing in accelerated biologic discoveries. The chromatography systems are an essential part of the associated evaluation and development process, which creates a surge for reliable tools, increasing demand in this sector. According to a study conducted by the global leader, Thermo Fisher Scientific, the global value of the biopharmaceutical industry is expected to reach USD 856.1 billion by 2030. The report further forecasted it to hold USD 22 billion in 2025, exhibiting a CAGR of 11%.

With the increment in demand for tailored therapeutics such as precise medicine and targeted therapy, the investment in the chromatography columns market has multiplied. This is due to its accuracy in customized separation techniques during the drug development process. Thus, the growth in this sector is remarkably proportionate to the enlargement of the precision medicine (PM) industry. Additionally, the capability of PM analytics to reduce investigational costs is attracting more participation in this sector. According to the NLM report, published in April 2022, the spending expenditure on genomic sequencing was reduced from USD 14 million in 2006 to USD 1000 in 2021 by conjugating PM. It also reported that PM was applied for more than 140,000 distinguished tests till 2022.

Key Chromatography Columns Market Insights Summary:

Regional Highlights:

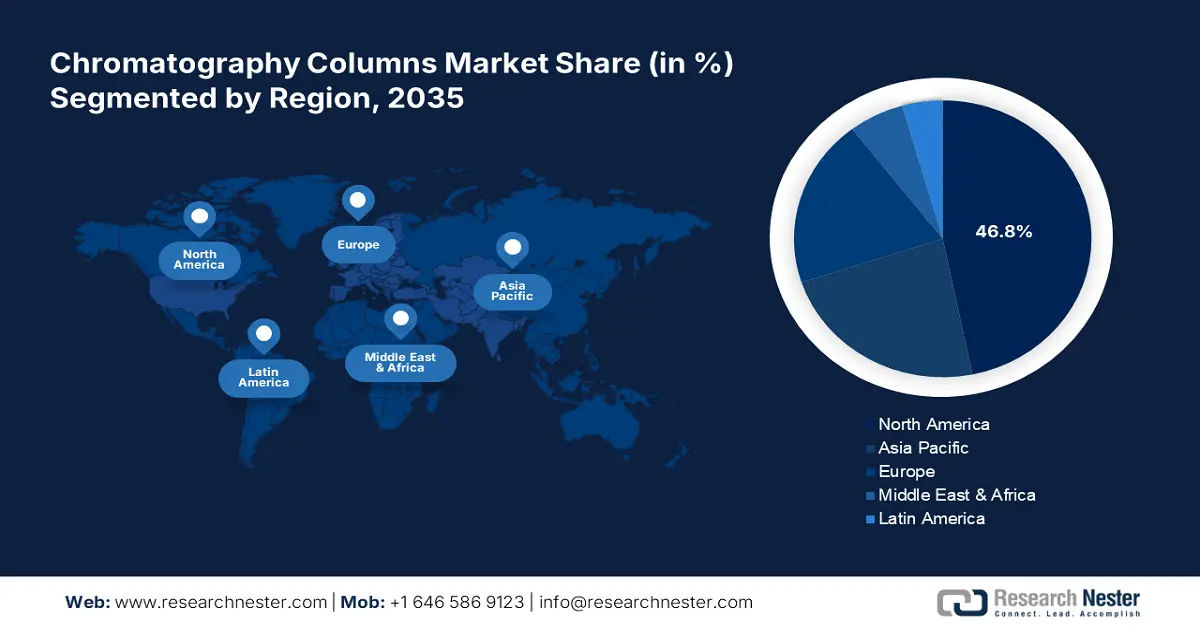

- North America dominates the Chromatography Columns Market with a 46.8% share, driven by strong lab infrastructure, presence of key column manufacturers, and biologics production, fostering growth through 2026–2035.

- The Asia Pacific chromatography columns market is expected to see rapid growth through 2035, driven by growing biopharma R&D, contract manufacturing, and global investment interest.

Segment Insights:

- Prepacked Chromatography Columns segment are anticipated to command a 55.2% share by 2035, propelled by their convenience and time-efficiency.

Key Growth Trends:

- Developments in chromatography technology

- Increased activities in R&D and forensic testing

Major Challenges:

- High developmental and production costs

- Market saturation and fragmentation

- Key Players: Merck KGaA, Thermo Fisher Scientific Inc., Agilent Technologies Inc., PerkinElmer Inc., Bio-Rad Laboratories Inc., Waters.

Global Chromatography Columns Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.29 Billion

- 2026 Market Size: USD 6.63 Billion

- Projected Market Size: USD 11.26 Billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Chromatography Columns Market Growth Drivers and Challenges:

Growth Drivers

-

Developments in chromatography technology: Enhanced analytical performance due to the use of advanced offerings from the chromatography columns market is rising in adoption. Moreover, the improved efficiency and specificity of innovative separation techniques such as high-performance liquid chromatography (HPLC) and ultra-high-performance chromatography (UHPLC) are boosting its usage in several research and industrial applications. It is further inspiring global leaders to introduce more effective solutions. For instance, in July 2023, Phenomenex unveiled the Luna Polar Pesticides HPLC column for robust ionic pesticide analysis. It features a proprietary phase to help fight challenges in regular food safety analysis.

-

Increased activities in R&D and forensic testing: The growing popularity of the chromatography columns market is notably attributable to its contribution to drug discoveries and substance detection. Thus, the inflated expenditure in R&D and other analytical laboratory operations is fueling this sector. According to an NLM article, released in February 2022, the estimated R&D cost per drug ranged from USD 113 million to USD 6 billion in 2018. It further, forecasted the range to be USD 318 million to USD 2.8 billion per drug for new molecular entities. Additionally, the proactive engagement in regulatory compliance for a range of industries is encouraging manufacturers to introduce more effective chromatography tools.

Challenges

-

High developmental and production costs: The manufacturing part of the chromatography columns market requires significant capital. The expense of accumulating sufficient materials such as silica may become an economic burden for manufacturers. This additional cost is carried further to the product pricing, making it expensive for consumers, particularly in price-sensitive regions. It may restrict adoption in smaller laboratories or budget-constrained production facilities.

-

Market saturation and fragmentation: The chromatography columns market is highly fragmented by the participation of giant laboratory essential suppliers. Their competitive pricing and quality may prevent newcomers from establishing their portfolio in this sector. Additionally, similarity in product functionality often tends to confuse consumers or may result in stringent vendor lock-in, making it harder for the market to expand or diversify.

Chromatography Columns Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 6.29 Billion |

|

Forecast Year Market Size (2035) |

USD 11.26 Billion |

|

Regional Scope |

|

Chromatography Columns Market Segmentation:

Column Type (Normal Phase Chromatography Columns, Prepacked Chromatography Columns, Automated Chromatography Columns)

The prepacked chromatography columns segment is likely to dominate chromatography columns market share of over 55.2% by 2035. The convenient and time-efficient function of this type of column is the main attraction for consumers to invest in. These ready-to-use solutions are a suitable match for optimized time management in both production and experimental setups. For instance, in June 2022, Bio-Rad Laboratories launched EconoFit Low-Pressure Prepacked Chromatography Column Packs for resin screening experiments. These easy-to-use and disposable columns are built to support protein purification workflow development by ensuring chromatography outcomes.

End user (Research Institutes, Pharmaceutical Biotechnology Companies, Food & Beverage Manufacturers)

Based on end user, the chromatography columns market is poised to witness significant growth in the pharmaceutical biotechnology companies segment by the end of 2035. This segment is fueled by the heavy investments from global pharma leaders in R&D projects. According to data released by the Congressional Budget Office of the U.S., in April 2021, the total R&D expenses of the pharma industry accounted for USD 83 billion in 2019. It further highlighted the number of approvals for drug commercialization during 2010-2019, which increased by 60% from the past decade. The increment in registration for clinical trials is evidence of the growing interest of these manufacturers to utilize this advanced separation technology in drug development.

Our in-depth analysis of the global chromatography columns market includes the following segments:

|

Column Type |

|

|

Chromatography Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chromatography Columns Market Regional Analysis:

North America Market Analysis

North America chromatography columns market is expected to capture revenue share of over 46.8% by 2035. This regional territory is empowered by the fluency in laboratory operations and the presence of established column manufacturers. The uniformity between skilled lab technicians and equipped infrastructure helps in attaining consistent and reliable results for each process, rising demand in this sector. Thus, the dynamic landscape of this region is a great marketplace for global leaders to generate profitable revenue. For instance, Waters Corporation secured revenue of USD 3 billion in 2022 with a 16% increment in the laboratory instrument division from 2021, including chromatography systems and columns.

The emphasized biologic production in the U.S. is a major development driver in the chromatography columns market. According to a report published in March 2022, the direct product output of this country in the biopharmaceutical industry surpassed USD 710 billion in 2020. With an additional USD 700 billion of output from suppliers and other economic sectors, the U.S. cultivated a total of USD 1.4 billion in the same year. The country is occupied by global pharma producers, who are well-known for their continuous innovations, signifying growth in demand for chromatology parts.

Canada is augmenting the chromatography columns market with extensive financial support from its government for biopharmaceutical R&D. The country is improving domestic manufacturing capacities to strengthen its healthcare services for withstanding any pandemic situation such as COVID-19. This boosts demand for laboratory tools and instruments, marking a surge in this sector. For instance, in October 2023, the government of Canada made an investment of USD 23 million in Edesa Biotech's USD 61 million project of producing monoclonal antibody therapy (EB05).

APAC Market Statistics

Asia Pacific is projected to be one of the fastest-growing regions in the global chromatography columns market by 2035. Emerging biopharma leaders such as Japan, China, and India are becoming the top destinations for conducting profitable business in this sector. Higher investment scope in this region is the major encouraging factor for global leaders to intervene with their innovative offerings. This large marketplace is also a lucrative option for globalization due to its enlarging therapeutic R&D capabilities.

India is dragging the attention of global leaders in the chromatography columns market with its remarkable trading environment. The country’s continuous efforts to garner resources to empower its own manufacturing capacity are driving demand in this sector. Thus, the progressing biotechnology of this country is contributing to this sector’s scope of profit. According to an IBEF report, updated in January 2025, the biotechnology industry of India is showcasing a potential for reaching USD 270-300 billion by 2030 and USD 150 billion by the end of 2025. The report further estimated its global biotech share to grow by 19% in 2025 at a CAGR of 22%.

With an accelerated pace of development in biopharma, China is presenting a promising future for the chromatography columns market. As the country targets this industry to levitate its economic value, the research activities for drug discoveries increase. According to an NLM report, published in February 2023, the research and experimentation expenditure from pharma manufacturers in China crossed USD 8.3 billion in 2019. It also indicated 122,720 R&D personnel and 32,296 projects in the same year. This further inflates the demand for advanced laboratory equipment, including chromatography systems.

Key Chromatography Columns Market Players:

- Merck KG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Biotage

- Waters Corporation

- KNAUER WissenschaftlicheGeräte GmbH

The heightened consumer expectations are escalating product standards in the market. Global leaders are bringing innovative solutions to satisfy their need for cost-effective and less time-consuming procedures. For instance, in July 2024, Thermo Fisher introduced a new pipeline of columns, Thermo Scientific SurePac Bio 550 SEC MDi for researchers at HPLC 2024. These analytical columns are designed to elevate separation proficiency by delivering faster results and greater analytical efficiency and scalability. This is further diversifying the product line of this sector, creating more scopes of generating profitable revenues. Such key players include:

Recent Developments

- In August 2024, Agilent Technologies brought advancement in its gas chromatography/mass spectrometry (GC/MS) column technology portfolio by launching Agilent J&W 5Q GC/MS Columns. It combined ultra-inert performance and ultra-low-bleed technology to deliver excellence in performance and durability.

- In April 2024, Waters unveiled GTxResolve Premier Size Exclusion Chromatography (SEC) 1000Å 3-micron (3 µm) Columns for the development of gene-based therapeutics, including cell & gene, mRNA, and LNPs. It is empowered with MaxPeak Premier High-Performance Surface (HPS) to assist scientists with higher resolution and sensitivity.

- Report ID: 7028

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chromatography Columns Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.