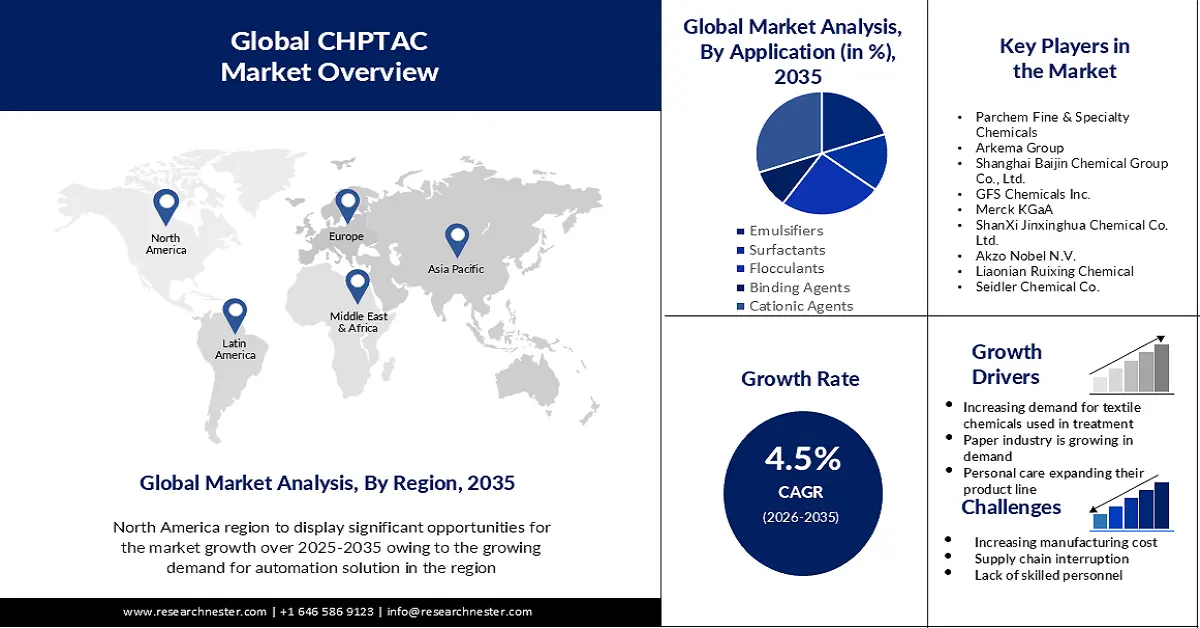

CHPTAC Market Outlook:

CHPTAC Market size was valued at USD 267.91 million in 2025 and is likely to cross USD 428.16 million by 2035, expanding at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CHPTAC is assessed at USD 279.48 million.

CHPTAC is used as a major raw material for the manufacture of Cationic Guar gum, which is often used in textile chemicals. In textile production processes, cationic guar gum is used for sizing, printing, and finishing. The demand for textiles chemicals and CHPTAC is also being driven by the increasing textile sector, especially in emerging economies. By 2022, that amount had increased to about 113.8 million metric tons, nearly quadrupling. The manufacturing volume of natural fibers, such as cotton and wool, was 25.2 million metric tons, while the remaining 87.6 million metric tons were produced by chemical fibers.

Furthermore, the etherification process was successfully modified by using CHPTAC for the cationization of cellulose in textile fibers and other polysaccharides, such as agarose or the polysaccharide backbone of tamarind kernels, among others, as a result of improvements and analyses of paper properties. The growing end-use industries are expected to increase demand for CHPTAC during the projection period.

Key CHPTAC Market Insights Summary:

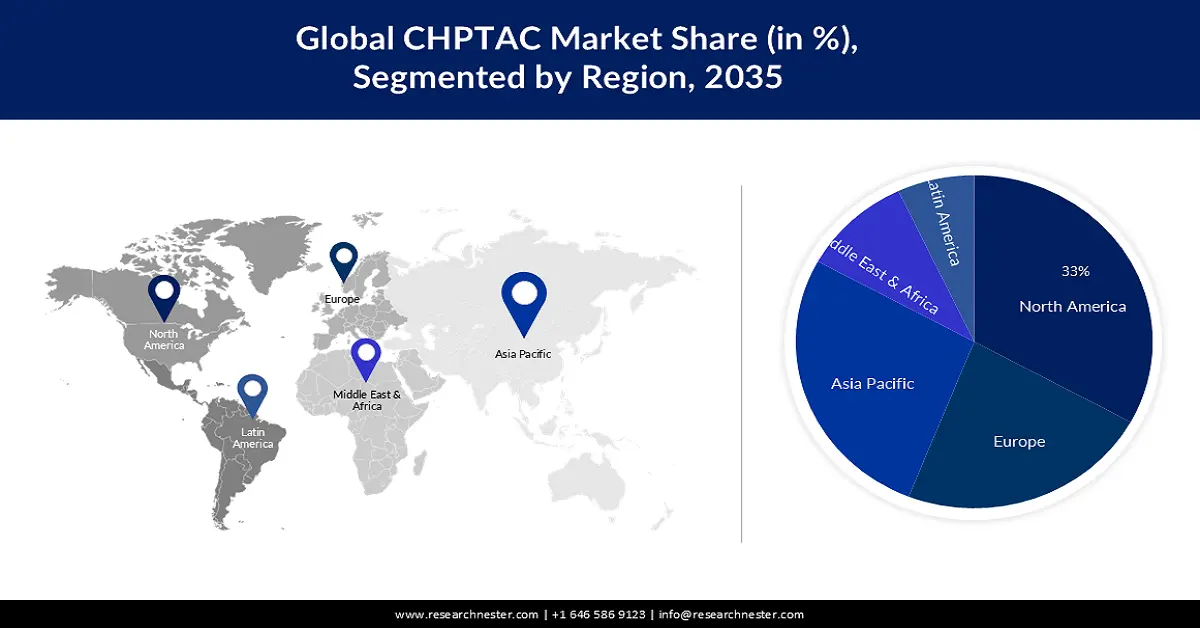

Regional Highlights:

- North America’s chptac market will dominate more than 32% share by 2035, driven by the prominent position of the US paper and textile industries boosting demand for CHPTAC.

- Asia Pacific’s market will capture a 27% share by 2035, driven by presence of many international CHPTAC producers and increasing wastewater treatment plants.

Segment Insights:

- The cationic agent segment in the chptac market is forecasted to hold a 30% share by 2035, driven by increasing demand in various end-use industries like cosmetics and water management.

- The paper industry segment in the chptac market is expected to capture a 28% share by 2035, attributed to the rapid increase in demand for paper and its products.

Key Growth Trends:

- Increasingly Used in Water Treatment

- Expanding the Product Line of Personal Care

Major Challenges:

- Increasing manufacturing costs

- The developed economies' deficiency in technological understanding would also hinder the rate of market growth.

Key Players: Parchem Fine & Specialty Chemicals, Arkema Group, Shanghai Baijin Chemical Group Co., Ltd., GFS Chemicals Inc., Merck KGaA, ShanXi Jinxinghua Chemical Co. Ltd., Akzo Nobel N.V., Liaonian Ruixing Chemical, Seidler Chemical Co..

Global CHPTAC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 267.91 million

- 2026 Market Size: USD 279.48 million

- Projected Market Size: USD 428.16 million by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

CHPTAC Market Growth Drivers and Challenges:

Growth Drivers

-

Increasingly Used in Water Treatment- CHPTACs are widely used for the removal of contamination in water treatment facilities. For wastewater treatment in urbanized and emerging countries, such as the US or China, Cationic Modified Flocculent CHP is mostly preferred. China invested USD 81.6 billion in its municipal sewage system between 2015 and 2020, including new sewage treatment facilities, sewage pipeline construction and maintenance, rainwater sewage diversion systems, sludge mitigation, reclaimed water, and first treatment, according to the Chinese National Bureau of Statistics. China is planning to build or improve 80,000 km of sewer collection and treatment networks over the period from 2021 to 2025, in order to increase its capacity by 20 million cubic meters per day. CHPTAC facilitates the removal of impurities and suspended particulates, thereby improving the clarity of water. Demand for CHPTAC is expected to grow in the water treatment sector due to rising water pollution and increasing demand for effective water treatment solutions. This is why an increase in the use of CHPTAC in wastewater treatment plants is expected to fuel market expansion.

-

Growing Demand in Paper Industry- CHPTAC is an important client of the paper industry. In the paper industry, its use as a cationic starch modifier has resulted in an increase of demand for CHPTAC. The properties of cationic starch treated with CHPTAC improve the strength, retention, and drainage characteristics leading to higher paper quality and increase in demand for Cationic Starch. Increasing demand for papers and their products, as well as the most rapid expansion of the paper industry, are among the key sectors driving the CHPTAC market. The molecular weight of CHPTAC is 188.10 and it has become an essential ingredient in the paper industry. The use of CHPTAC is capable of providing for the production of soluble starch, a binder, and paper reinforcement that is required within the paper industry in order to give rise to high dry strength. As a result, the expansion of this paper sector is expected to create an opportunity for CHPTAC.

- Expanding the Product Line of Personal Care- For the manufacture of hair care and skincare products, for example, conditioners, shampoos, or hairdressing products, color cosmetics CHPTAC is used. It's a conditioning agent, providing antistatic properties to the hair. The demand for CHPTAC in hairdressing products is anticipated to increase, due to the continued growth of the personal care industry worldwide.

Challenges

-

Increasing manufacturing costs- The major challenges that affect the growth of CHP TAC are rising raw material prices and increasing logistic costs. In addition, the development of this substance may result in dangerous waste that is likely to pose a threat to the environment. However, as the stability of this market improves and a number of rules are expected to be introduced in the coming days, that position may become even more precarious. The risk to health and the environment from this market could be reduced by developing more efficient material handling techniques.

-

Supply chain interruptions can pose difficulties for producers and impede the expansion of the market.

- The developed economies' deficiency in technological understanding would also hinder the rate of market growth.

CHPTAC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 267.91 million |

|

Forecast Year Market Size (2035) |

USD 428.16 million |

|

Regional Scope |

|

CHPTAC Market Segmentation:

Application Segment Analysis

The cationic agent segment in the CHPTAC market is attributed to hold largest revenue share of about 30% by the end of 2035. Due to increasing demand in various end-use industries, the cationic reagent segment has been chosen as a preferred application. An effective cationic reagent used to alter organic and synthetic polymers to synthesize quaternary ammonium compounds with a wide range of applications in the fields of chemical processing, personal care products, cosmetics, pulp and paper, textiles, and water management sectors. For example, in 2021, the average Australian woman spent about USD 3,600 a year on cosmetics and personal care items, according to financial comparison service provider Mozo. The growth of the market will be supported by several emerging sectors and an increased focus on the production of cationic reagent, as well as ongoing technological innovations during the forecast period.

End Use Segment Analysis

The paper industry is anticipated to hold 28% share of the global CHPTAC market during the forecast period. The market is being driven by an increase in demand for paper and its products, with the rapid growth of the paper industry as a major factor. CHPTAC contains a molecular mass of 188.10 and is widely used in the paper industry. An effective way to improve the properties of paper is to use chemical additives. The CHPTAC for the cationisation of cellulose, textile fiber, and various types of polysaccharides has proved to be successful. In 2021, 417 million tons of paper and paperboard were consumed worldwide. It is anticipated that consumption will increase during the next ten years to 476 million tons by 2032. Production of paper and paperboard is mostly focused on packaging worldwide.

Our in-depth analysis of the global CHPTAC market includes the following segments:

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CHPTAC Market Regional Analysis:

North American Market Insights

CHPTAC market in the North America industry is estimated to hold largest revenue share of 32% by 2035. As the United States occupies a prominent position in the paper industry, North America is expected to remain dominant over the forecast period. The textile industry has seen a significant increase in demand for CHPTAC as a result of the effectiveness of a liquid cationic etherification agent. The US is a very important market for North America's textile industry. The global textile industry exported over 41% of its value to North America in 2019 as a whole. CHPTAC is increasingly used as a fortifier in the water treatment industry. Hence, the lucrative market is expected to grow as the demand for water treatment equipment increases opportunities.

APAC Market Insights

CHPTAC market in the Asia Pacific region is projected to hold the second largest market share of about 27% by the end of 2035. The growth of the market in this region is due to the presence of a large number of international CHPTAC producers in that region, the Asia Pacific market for CHPTAC is expected to grow over the forecast period. As a result of the strong growth, China's sludge treatment chemical market is growing. A number of wastewater treatment plants that are integrated into other production plants. Increasing use of CHPTAC as flocculating agent in the water treatment sector is foreseen to lead to a number of market opportunities. Demand for water treatment plants is projected to rise globally, which will open up lucrative market opportunities in Asia Pacific Region.

CHPTAC Market Players:

- Jiangsu Jinshan Chemical Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parchem Fine & Specialty Chemicals

- Arkema Group

- Shanghai Baijin Chemical Group Co., Ltd.

- GFS Chemicals Inc.

- Merck KGaA

- ShanXi Jinxinghua Chemical Co. Ltd.

- Akzo Nobel N.V.

- Liaonian Ruixing Chemical

- Seidler Chemical Co.

Recent Developments

- Merck, a leading science and technology company, is significantly expanding its global production capacities and optimizing its manufacturing processes for effect pigments. Investment program will expand production capacity in personal care and enhance manufacturing processes.

- Arkema announces an investment in CMC (Crackless Monomer Company), a joint venture between Bostik and Taiwanese company Cartell Chemical Co, a leading supplier of cyanoacrylate solutions, to accelerate the development and production of high value-added engineering adhesives.

- Report ID: 5494

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CHPTAC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.