Chlorinating Agents Market Outlook:

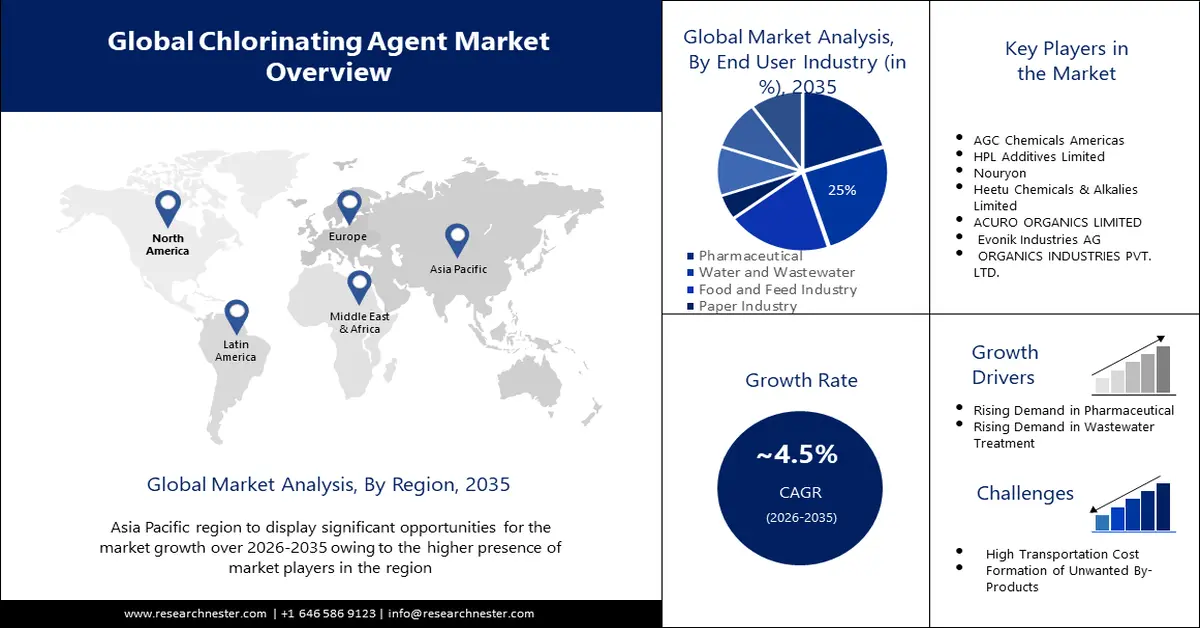

Chlorinating Agents Market size was valued at USD 5.7 billion in 2025 and is likely to cross USD 8.85 billion by 2035, expanding at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chlorinating agents is assessed at USD 5.93 billion.

Many governments, non-profit organizations, and businesses around the world have numerous projects to purify and filter water resources to provide safe and sanitary water to a variety of sectors, including residential, commercial, industrial, and recreational activities. The use of chlorine and chloramines in water treatment plants is permitted by EPA regulations. The need for safe and disinfected water supply for drinking and other purposes is one of the key drivers of increasing sales of these agents and is expected to support market growth. Rising demand for chlorinated water is expected to drive the chlorinating agents market during the forecast period. The World Health Organization has approved chlorine as a primary disinfectant. Chlorine can be added to water to disinfect and kill bacteria. Official standards assume that chlorine concentrations of up to 4 milligrams per liter in drinking water are safe for civil and industrial use.

Due to strong demand from end-use sectors such as water and wastewater treatment, pharmaceutical, food and beverage industry, etc., the chlorinating agents market is expected to significantly increased. In addition, the growing demand for food preservatives is also increasing the scope for the use of chlorinating agents and is acting as a critical factor for the growth of the market over the forecast period.

Key Chlorinating Agents Market Insights Summary:

Regional Highlights:

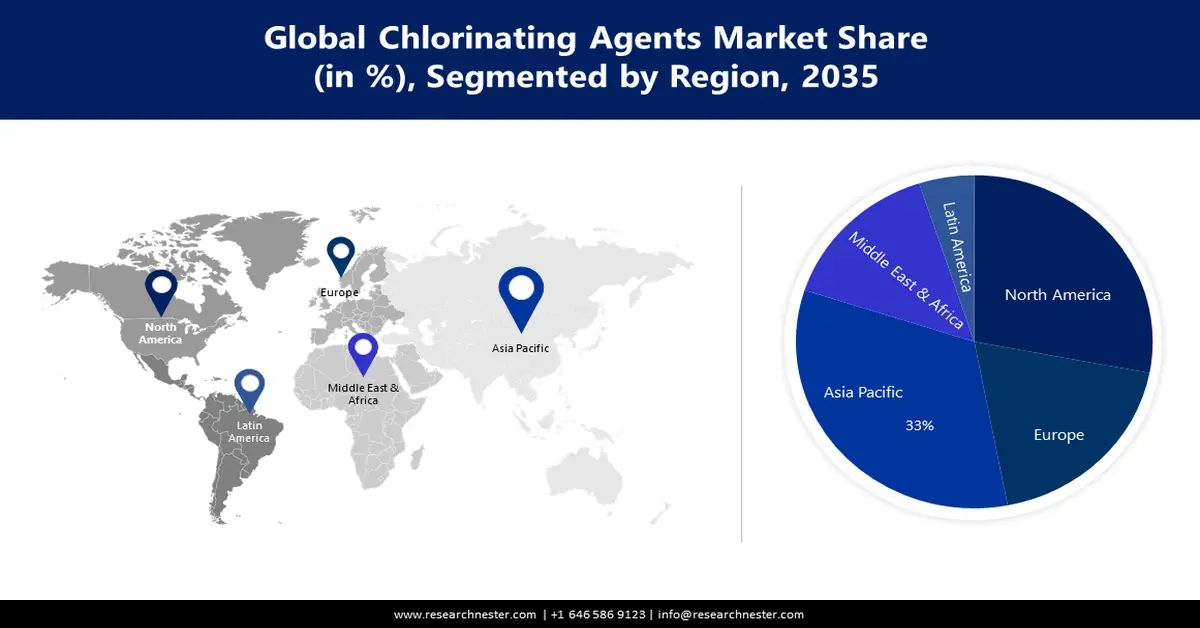

- Asia Pacific chlorinating agents market achieves a 33% share by 2035, attributed to urbanization and rising demand for water treatment.

- North America market will exhibit significant CAGR during 2026-2035, driven by growing demand for safe drinking water and strict quality regulations.

Segment Insights:

- The water & wastewater segment segment in the chlorinating agents market is forecasted to achieve a 25% share by 2035, driven by increased chlorine disinfectant usage in water treatment across developing nations.

- The calcium hypochlorite segment in the chlorinating agents market is anticipated to achieve the highest CAGR through 2035, influenced by demand from food & beverage, cleaning, and water purification industries.

Key Growth Trends:

- High Demand in Pharmaceutical Sector

- High Usage in Infrastructural Development

Major Challenges:

- Formation of Unwanted By-Products and High Transportation Cost

- Competition From Alternatives is Expected to Hamper the Chlorinating Agents Market Expansion in the Forecast Period

Key Players: of AGC Chemicals Americas, HPL Additives Limited, Nouryon, Heetu Chemicals & Alkalies Limited, ACURO ORGANICS LIMITED, Evonik Industries AG, ORGANICS INDUSTRIES PVT. LTD., Olin Corporation, PPG Industries, Inc..

Global Chlorinating Agents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 5.93 billion

- Projected Market Size: USD 8.85 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Chlorinating Agents Market Growth Drivers and Challenges:

Growth Drivers

- High Demand in Pharmaceutical Sector - In many industries, chlorine is recognized as an essential industrial ingredient. The pharmaceutical industry has placed a high demand on it because chlorine is an essential component of many medications. Drugs based on chlorine are used to treat anemia, inflammation, asthma, high blood pressure, and epilepsy. The need for novel medications rises in tandem with the global increase in health issues. The need for chlorine in the pharmaceutical sector is anticipated to create new market prospects for chlorinating agents. Furthermore, several insecticides contain chlorine as their primary ingredient, which is anticipated to fuel the chlorinating agents market expansion for chlorinating agents during the forecast period.

- High Usage in Infrastructural Development – Nowadays, along with urbanization the development of swimming pools, water parks, and recreational activities is rapidly growing this further is accelerating the growth of the chlorinating agents market in the projected period. Chlorinating agents are considered one of the most significant components in swimming pools and water park development. In the United States, there are 10.7 million swimming pools, according to statistics. 309,000 of the waters are public, while 10.4 million are residential.

Challenges

- Formation of Unwanted By-Products and High Transportation Cost - A wide range of compounds react with chlorinating agents. Ammonia, nitrogen dioxide, bromine, hydrogen sulfide, dissolved iron, and organic matter are among the substances found in the effluent. Because of this, in certain situations, more chlorine would be needed to inactivate wastewater treatment. Chlorine's reaction with impurities can sometimes improve the quality of the water, but other times it might result in unnecessary byproducts that are harmful to human health, such as trihalomethanes, which are carcinogens. Consequently, the market for chlorinating agents is constrained by this constraint. Conversely, chlorine is poisonous and dangerous despite having many uses. Therefore, a high degree of safety is needed to prevent such outcomes.

- Competition From Alternatives is Expected to Hamper the Chlorinating Agents Market Expansion in the Forecast Period

- Toxicity and Safety Issues Associated are Set to Pose Limitation on the Market Growth in the Projected Period

Chlorinating Agents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.85 billion |

|

Regional Scope |

|

Chlorinating Agents Market Segmentation:

End Use Industry Segment Analysis

In terms of end user industry, the water & wastewater segment in the chlorinating agents market is anticipated to hold the largest revenue share of 25% during the forecast period. The water & wastewater treatment segment is expected to hold the greatest share in the approaching years due to the increasing usage of chlorine disinfectants in swimming pools, well water treatment, and drinking water. An antimicrobial substance used to eradicate germs is chlorine. Because of these characteristics, it is widely used in municipal businesses. This category is growing, which is fueling the expansion of the chlorinating agent industry. Developing nations like China, India, and Africa are home to a growing amount of water treatment facilities.

Product Type Segment Analysis

Chlorinating agents market from the calcium hypochlorite segment is set to hold the highest CAGR by the end of 2035. An inorganic material called calcium hypochlorite is present in items like bleaching powder and chlorine powder. It is frequently applied in the cleaning of swimming pools, the purifying of water, and the whitening of fabrics and paper. Because of its durability and high chlorine content, it is used as a disinfectant in the treatment of water. Demand in the food and beverage industry is rising for this affordable, trustworthy sanitizing solution that maintains the freshness and flavor of carbonated drinks. Additionally, wineries use it to prevent infection, clean, and preserve product quality. The market for chlorinating agents as a whole is anticipated to rise as a result of the expanding need for calcium hypochlorite from the food and beverage, cleaning, water purification, and other industries.

Our in-depth analysis of the global chlorinating agents market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chlorinating Agents Market Regional Analysis:

APAC Market Insights

The chlorinating agents market in the Asia Pacific industry is predicted to dominate majority revenue share of 33% by 2035. The Asia Pacific region is rapidly becoming more urbanized and industrialized, which is increasing the pollution of the water and necessitating the use of efficient water treatment methods. India’s clean water scores accounts for 100/32. China and India are anticipated to be the main drivers of this region's market expansion. With China being one of the biggest users of chemicals for water treatment, the market for chlorinating agents is anticipated to increase significantly. The country's need for chlorinating agents is being driven by factors such as population growth, increased industrialization, and greater public awareness of water pollution. Additionally, the market for chlorinating agents is anticipated to expand in the region due to the presence of major players.

North American Market Insights

The chlorinating agents market in the North America region is set to grow significantly during the anticipated period. The growing demand for safe drinking water and stringent water quality regulations are driving the market for chlorinating agents in the United States. 10% to 15% of Americans, primarily in rural areas, rely on privately owned, unregulated drinking water sources that are not subject to government regulations. The country's infrastructure for water treatment is well developed and further underpins the growth of the market While environmental concerns do exist, the chlorinating agent industry is actively innovating to address them.

Chlorinating Agents Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DIC CORPORATION

- AGC Chemicals Americas

- HPL Additives Limited

- Nouryon

- Heetu Chemicals & Alkalies Limited

- ACURO ORGANICS LIMITED

- Evonik Industries AG

- ORGANICS INDUSTRIES PVT. LTD.

- Olin Corporation

- PPG Industries, Inc.

Recent Developments

- A report on a new method of aminoheterocycle domination for the production of novel drugs has been issued by Nature Chemistry in December 2021. This discovery is expected to create a new market segment for the sale of chlorinating agents worldwide.

- Olin Corporation announced that it plans to cease production of methylene chloride and chloroform at its facility in Stade, Germany, by the third quarter of 2023. Olin will continue to manufacture both products at its facility in Freeport, Texas. Olin Corporation is a vertically integrated global chemical products manufacturing and marketing company and a leading ammunition manufacturer in the United States. Chemical products manufactured include chlorine, caustic soda, vinyl, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester's main manufacturing facility manufactures and sells sporting ammunition, police ammunition, reloading parts, small caliber military ammunition and parts, and industrial cartridges.

- Report ID: 5572

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chlorinating Agents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.