Chitosan Market Outlook:

Chitosan Market size was valued at USD 11.97 billion in 2025 and is expected to reach USD 60.04 billion by 2035, expanding at around 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chitosan is evaluated at USD 13.86 billion.

The global chitosan market is expected to witness substantial growth due to increasing demand from the food and beverages sector, attributed to supportive regulatory measures in developed economies and rising awareness of the health benefits associated with the product. The product's increasing popularity as a food stabilizer and preservative has also fueled chitosan market expansion. The product's surging use as a thickening agent in drinks, a clarifying agent in juices, and a packaging agent for food items is also expected to drive demand.

Furthermore, demand for eco-friendly and biodegradable materials is rising as sustainability initiatives and environmental awareness gain traction. This is met by chitosan, which is derived from natural sources such as krill, shrimp, crab, and squid. Chitosan's commercial expansion is further fueled by its biocompatible and biodegradable qualities, establishing it as an eco-friendly substitute for synthetic chemicals.

Also, the opulence of shrimp shells, crab shells, and squid pens, which are rich in chitin – a precursor to chitosan – ensures a steady supply chain, reducing production costs and promoting large-scale manufacturing. Therefore, the trade of shrimp, crab shells, and squid pens is a major driver of the chitosan market, as these seafood by-products serve as the primary raw material for chitosan production.

The table below indicates the global trade of shrimp in 2024:

|

Country |

Export Value of Shrimp (100o tons) |

Country |

Import Value of Shrimp (100o tons) |

|

Ecuador |

619.96 |

China |

483.17 |

|

India |

337.98 |

USA |

351.34 |

|

Vietnam |

146.80 |

Japan |

92.79 |

|

Indonesia |

98.51 |

Spain |

81.67 |

|

China |

79.48 |

France |

55.57 |

|

Thailand |

65.70 |

Republic of Korea |

49.87 |

|

Denmark |

49.01 |

Denmark |

44.68 |

Source: Food and Agriculture Organization (FAO)

Key Chitosan Market Insights Summary:

Regional Highlights:

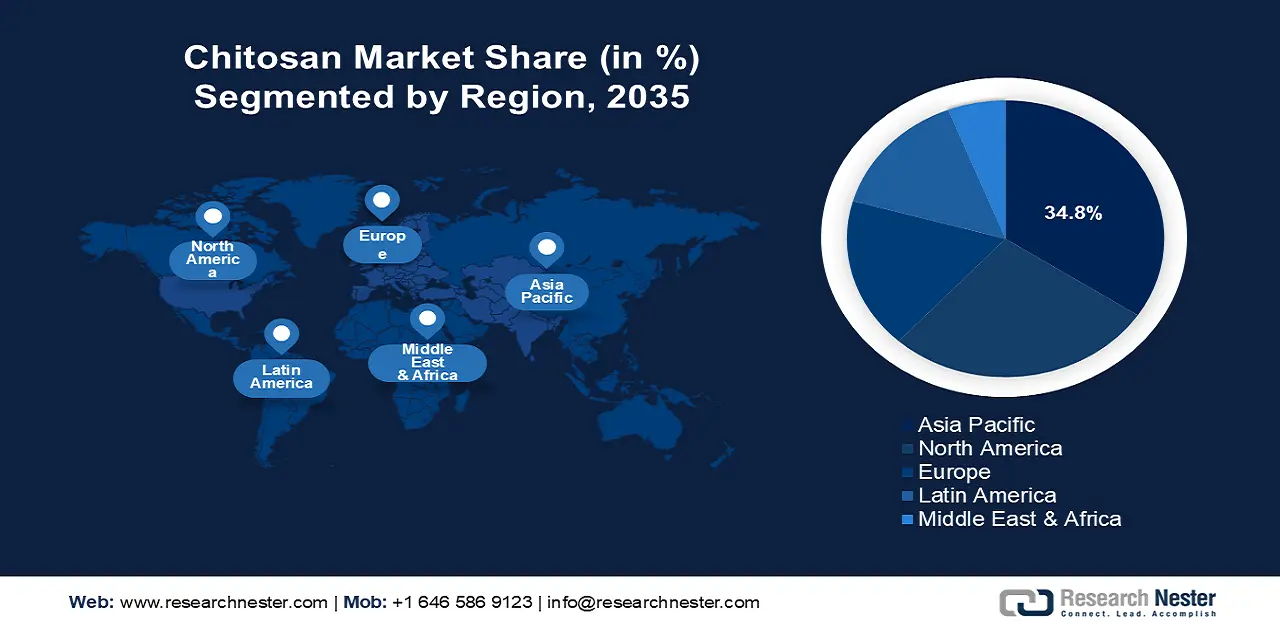

- Asia Pacific commands the Chitosan Market with a 34.8% share, fueled by the abundance of raw materials in coastal regions and a strong base of market participants, driving growth through resource availability during 2026–2035.

- North America’s chitosan market is expected to see significant growth by 2035, driven by regulatory support from FDA and advanced manufacturing capabilities.

Segment Insights:

- The Industrial Grade segment is projected to secure over 43.2% share by 2035, fueled by increasing demand in textiles, paper, and energy sectors.

Key Growth Trends:

- Increasing water treatment innovations

- Surging demand in medical applications

Major Challenges:

- High production costs

- Limited availability of raw materials

- Key Players: Golden Shell Pharmaceutical Co., Ltd., Qingdao Yunzhou Biochemistry Co., Ltd., Panvo Organics Pvt., Ltd., CuanTec Ltd., Fraunhofer Institute for Interfacial Engineering and Biotechnology (IGB), Advanced Biopolymers AS, Meron Biopolymers, Tidal Vision, Milliken & Company, Heppe Medical Chitosan GmbH.

Global Chitosan Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.97 billion

- 2026 Market Size: USD 13.86 billion

- Projected Market Size: USD 60.04 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Chitosan Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing water treatment innovations: Water pollution has grown to be a major issue on a global scale as a result of modernization, industrialization, and population growth. The World Health Organization (WHO) reported that at least 1.7 billion people worldwide consume water tainted with human waste in 2022. Microbiologically polluted drinking water is thought to be responsible for about 505,000 diarrheal deaths annually and can spread illnesses like cholera, dysentery, typhoid, polio, and diarrhea. Therefore, as a result of its versatility, chitosan has a wide range of potential uses, and hydrogels based on chitosan can be created with several unique properties for many high-value applications across numerous industries. The possibility for novel approaches in wastewater cleanup has expanded with the use of biodegradable, inventive, and bio-derived resources to create effective and affordable adsorbent materials.

Chitosan-based hydrogels' biodegradability, affordability, abundance, adsorption capabilities, and reusability strongly defend against various water contaminants. Due to their 3D network shape, chitosan-based hydrogels are recyclable and appropriate for numerous practical uses. These adsorbents' exceptional adsorption capacity, ease of reuse and recovery, and improved mechanical, thermal, and chemical stabilities are their primary benefits for wastewater treatment.

Furthermore, there has been an influx of interest in using chitosan-based hydrogels for purposes other than treating industrial wastewater. Their uses stem from the remarkable mechanical, chemical, antibacterial, and mucoadhesive qualities of chitosan, including its high mechanical strength, pH sensitivity, antibacterial effect, low immunogenicity, enzymatic biodegradability, mucoadhesiveness, swelling ability, and resemblance to host tissues. - Surging demand in medical applications: Chitosan’s biocompatibility, biodegradability, and antimicrobial properties have made it a valuable material in the medical field, driving significant growth in the chitosan market. It is widely used in wound healing, as it accelerates tissue regeneration and prevents infections, reducing recovery time. In drug delivery systems, they serve as a carrier that enhances the bioavailability and controlled release of medications, particularly in cancer treatment and gene therapy. Additionally, its application in tissue engineering, where it acts as a scaffold for cell growth, is advancing regenerative medicine. With the growing demand for biocompatible materials and innovations in healthcare, the expanding use of chitosan in medical applications is fueling chitosan market growth, positioning it as a key component in modern healthcare solutions.

- Accelerating investments in chitosan production growth: Several companies are substantially investing in chitosan production capacity, thereby driving the chitosan market’s expansion. In January 2025, Tidal Vision, a biotechnology business that uses chitosan-based chemistries to change vital sectors, secured an oversubscribed USD 140 million Series B fundraising round. The corporation is creating new infrastructure in Europe, Texas, and Ohio to increase its footprint. Similarly, Milliken & Company, a global diversified manufacturer, announced its investment and relationship with Tidal Vision, a global biomolecular technology firm that harnesses the potential of chitosan to produce scalable solutions for vital industries.

Additionally, in May 2024, CuanTec, a bioscience firm located in Scotland, commenced the production of high-quality Chitosan at its manufacturing site in Glenrothes. Cuantec's consumers will benefit from high-quality goods created from sustainable raw resources, as well as the expertise of a competent workforce. These strategic investments bolster the supply chain and stimulate innovation and application development across various industries, propelling the chitosan market.

Challenges

-

High production costs: Chitosan is produced in a series of sophisticated stages, beginning with the extraction and purification of chitin from marine sources and ending with the deacetylation process. These procedures can be costly, necessitating specific equipment and skills. Chitosan's high production costs can limit its affordability and prevent widespread adoption, particularly in price-sensitive areas.

-

Limited availability of raw materials: Alkali deproteinization is one of the harsh processing stages used in large-scale extraction from crustacean sources, which can have negative environmental effects and reduce the availability of raw materials. Due to the limited availability of raw materials, fungus-based chitosan manufacturing is typically expensive. Production costs may be impacted by the erratic availability of chitosan raw materials, impeding the growth of the market

Chitosan Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 11.97 billion |

|

Forecast Year Market Size (2035) |

USD 60.04 billion |

|

Regional Scope |

|

Chitosan Market Segmentation:

Grade (Food Grade, Industrial Grade, Pharmaceutical Grade)

Industrial grade segment is anticipated to dominate chitosan market share of over 43.2% by 2035. The segment is expanding owing to its increasing demand for textiles, paper, and energy. Chitosan of industrial grade often contains a large number of hydroxyl groups as well as carbon, hydrogen, and oxygen atoms. It is easy to combine them with proteins and lipids. Industrial-grade chitosan is a structural component of cellulose-based cells and can be used to temporarily store energy. Therefore, the increasing government assistance in many nations to support the textile industry is escalating the market growth.

Application (Food & Beverages, Medical & Pharmaceuticals, Cosmetics, Water Treatment, Agrochemicals)

The food & beverages segment in chitosan market is poised to garner a significant share during the assessed period. Chitosan, a naturally occurring polymer primarily derived from chitin found in crab shells, has garnered significant attention due to its extensive applications across various industries. Among these, the food and beverage sector emerge as a key driver in the chitosan market, leveraging its unique properties to enhance product quality, prolong shelf life, and augment health benefits.

Chitosan exhibits exceptional efficacy against a wide range of bacteria, fungi, and viruses, along with possessing noteworthy antibacterial properties. This makes it an excellent ingredient for maintaining the nutritional integrity of perishable foods. Chitosan is essential for filtration and clarifying in wine, beer, and fruit juice. For the metal ions in the drinks, chitosan serves as a chelating agent. It aids in the removal of heavy metals from drinks. Chitosan offers health benefits and is also utilized as a nutritional component in food items.

Our in-depth analysis of the global chitosan market includes the following segments:

|

Source |

|

|

Application |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chitosan Market Regional Analysis:

APAC Market Statistics

Asia Pacific chitosan market is estimated to account for revenue share of more than 34.8% by the end of 2035. Due to the abundance of raw materials found in coastal regions, Asia-Pacific is home to a sizable number of small and major market participants. Shell waste needs to be processed right away since bacteria tend to quickly start lowering the chitin concentration. However, freezing the shells can prolong the chitin content's retention. Therefore, drying or freezing techniques are used to protect the shells during the export and import of shell trash. The manufacturing of agricultural-grade chitosan is the primary emphasis of Thailand's major market participants.

In China, chitosan-based goods are becoming popular due to government laws that promote organic and sustainable farming. For instance, in March 2022, the Board of Executive Directors of the World Bank authorized a loan of USD 320 million to support rural development and green agriculture in the Southwest Region of China. In addition to improving biodiversity protection and restoration and lowering greenhouse gas emissions (GHG) from farming and agricultural plastic pollution, this support will strengthen local governments' institutional capacity to incorporate environmental goals into government rural revitalization plans and investments.

As part of a larger industrial foundation, China treats industrial sludge with chitosan, which lowers water pollution and helps the country adhere to strict environmental standards. To meet the increasing demand for safer and better-quality food, the Chinese food industry uses chitosan, which has antibacterial qualities, to prolong the shelf life of food goods.

Furthermore, with a booming seafood sector, India has abundant raw materials such as shrimp and crab shells, essential for chitosan production. India shipped 12,068 shipments of crab between March 2023 and February 2024, according to Volza's India Export data. 379 Indian exporters sold these goods to 1,143 buyers, representing a 57% increase over the previous 12 months. Moreover, the surging demand for eco-friendly solutions, especially in water purification and biodegradable packaging, is further propelling the market. Additionally, the pharmaceutical sector’s rising interest in chitosan’s biocompatible properties for drug delivery and wound healing is creating new growth opportunities.

North America Market Analysis

North America chitosan market is expected to grow at a significant rate during the projected period. North America's regulatory framework permits the use of chitosan in a range of products, including medications and food additives. Industry use of chitosan is promoted by regulatory agencies such as the Food and Drug Administration (FDA), which offer precise rules that streamline the licensing procedure for new goods utilizing chitosan. Businesses can effectively manufacture and market chitosan products owing to North America's strong industrial base. The chitosan market is more competitive due to the existence of significant competitors in the region and sophisticated manufacturing techniques.

The chitosan market is expanding in the U.S. as a result of the food industry's increasing need for natural preservatives and packaging materials. It is anticipated that the use of chitosan as a natural substitute for plastic packaging and artificial preservatives will rise as customers grow more environmentally concerned and health conscious. Additionally, the FDA has authorized the use of chitosan in the agriculture sector, giving producers additional chances to create cutting-edge goods that satisfy consumer demand.

In November 2022, the Environmental Protection Agency (EPA) announced the inclusion of a material commonly known as chitosan, or poly-D-glucosamine (CAS No. 9012-76-4), in the list of active ingredients permitted for use in minimum-risk pesticide products. This category of products is exempt from registration and other requirements under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). The EPA's decision clarifies that this listing encompasses chitosan salts derived from the reaction of chitosan with acids that are classified as inert or active components suitable for use in low-risk pesticide formulations.

Key Chitosan Market Players:

- Golden Shell Pharmaceutical Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Qingdao Yunzhou Biochemistry Co., Ltd.

- Panvo Organics Pvt., Ltd.

- CuanTec Ltd.

- Fraunhofer Institute for Interfacial Engineering and Biotechnology (IGB)

- Advanced Biopolymers AS

- Meron Biopolymers

- Tidal Vision

- Milliken & Company

- Heppe Medical Chitosan GmbH

Key competitors in the fiercely competitive chitosan market are always coming up with new ways to enhance the sustainability and quality of their goods. Businesses are highly investing in R&D to investigate potential new uses for chitosan, including in the pharmaceutical and biomedical sectors. Furthermore, several stakeholders prioritize sustainability, with initiatives underway to develop chitosan from sustainable sources and minimize waste throughout the production process.

Recent Developments

- In September 2024, CuanTec completed its first sale of Chrystal Chitosan powder. This transaction was made to an international customer, who plans to employ CuanTec's Chitosan in the rapidly increasing Biomedical market, where Chitosan has demonstrated therapeutic benefits for Advanced Wound Care.

- in May 2024, researchers at the Fraunhofer Institute for Interfacial Engineering and Biotechnology (IGB) created a biobased and functionalized flocculant for treating complicated wastewater. Furthermore, hazardous phenols are eliminated from water using the enzyme laccase in a chitosan matrix.

- Report ID: 7285

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chitosan Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.