Chip Resistor Market Outlook:

Chip Resistor Market size was over USD 1.35 billion in 2025 and is anticipated to cross USD 2.53 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chip resistor is assessed at USD 1.43 billion.

The market’s growth is expected to escalate owing to the rising demand for energy-efficient compact electronic devices. With consumers favoring portability, devices such as smartphones, tablets, and wearable consumer electronics proliferating day-to-day life, the demand for chip resistors is poised to remain steady. A major driver of the market is the proliferation of 5G networks worldwide, impacting the requirement for dense infrastructure which includes small cells, data centers, and base stations, and all of them rely on chip resistors. The table below highlights global 5G connections and the growth is correlated to the expansion of the market.

|

Particulars |

Details |

|

Estimated global 5G connections in 2023 |

1.9 billion |

|

Forecasted global 5G connection by 2027 |

6.8 billion |

|

New Connections added between 2023 and 2024 |

157 million |

Source: 5Gamericas

Moreover, the shift of the automotive sector towards electric vehicles (EVs) and advanced driver assistance systems (ADAS) drives the demand for compact, high-performance resistors to manage power distribution and sensor accuracy. The table below highlights the EV adoption trends, which correlate with the surging demand for chip resistors.

|

Particulars |

Details |

|

EV Sales in 2024 |

17 million and exhibited a continuous rise. |

|

First quarter sales figures in 2024 |

25% growth in comparison to the first quarter of 2023 |

Source: IEA

Additionally, the intersection of geopolitical support for tech self-sufficiency and climate-focused innovation creates a fertile environment for advancements in chip resistor technology. The key position of chip resistors in the evolving global electronics value chain is poised to drive opportunities within the sector by the end of 2037.

Key Chip Resistor Market Insights Summary:

Regional Highlights:

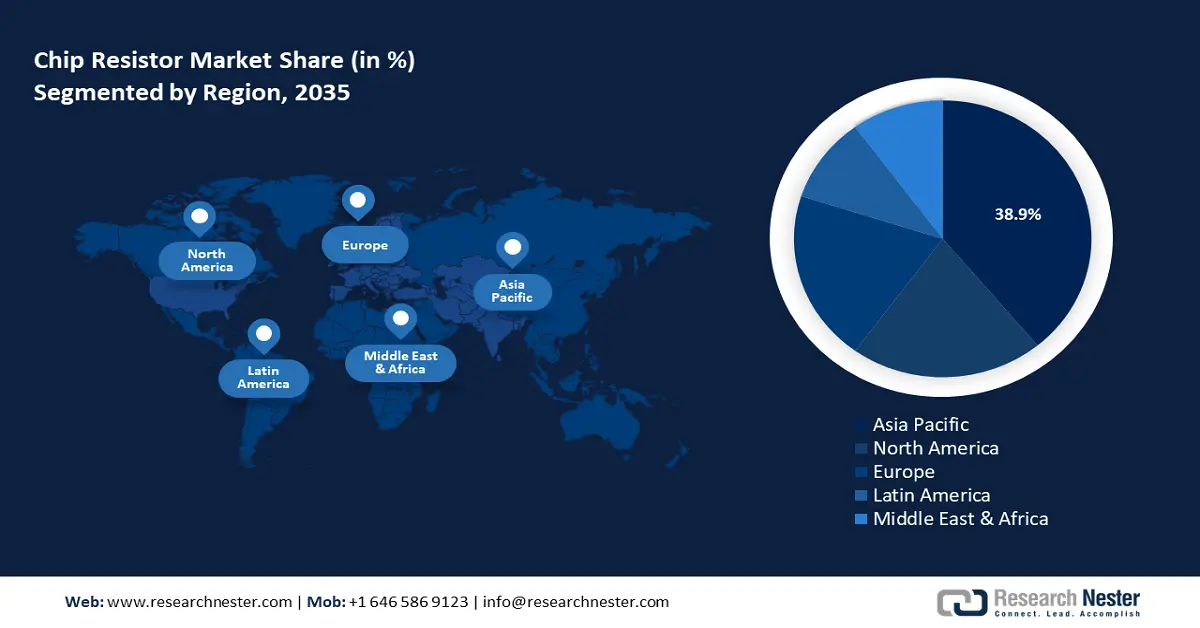

- Asia Pacific holds a 38.9% share in the Chip Resistor Market, propelled by electronics manufacturing and 5G adoption in the region, fostering robust growth prospects through 2035.

- North America’s chip resistor market is anticipated to experience rapid growth by 2035, driven by industrial automation, IoT proliferation, and 6G readiness.

Segment Insights:

- The Thick Film segment of the Chip Resistor Market is anticipated to capture a 59.50% share from 2026 to 2035, driven by its adaptability to high-volume manufacturing across industries like automotive.

Key Growth Trends:

- Expansion of data center architecture

- Proliferation of high-performance computing systems

Major Challenges:

- Overcapacity in semiconductor manufacturing facilities

- Geopolitical trade tensions and tariffs

- Key Players: Yageo Corporation, Walsin Technology Corporation, KOA Corporation, ROHM Co., Ltd., Panasonic Corporation, Vishay Intertechnology, Inc., Samsung Electro-Mechanics Co., Ltd., Murata Manufacturing Co., Ltd., Kyocera, Bourns Inc., Hokuriku Electric Industry Co., Ltd., TE Connectivity.

Global Chip Resistor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.35 billion

- 2026 Market Size: USD 1.43 billion

- Projected Market Size: USD 2.53 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Taiwan

- Emerging Countries: China, India, South Korea, Japan, Taiwan

Last updated on : 13 August, 2025

Chip Resistor Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of data center architecture: The chip resistor market benefits from the expansion of data center architecture. Datacenter constructions have surged over the years due to the proliferation of big data analytics. These facilities require vast amounts of electronic components including chip resistors to manage power distribution and ensure reliable operation of servers. Recent investments to expand data center architecture, including EDGNEX’s USD 20 billion investment in strategic entry to the U.S. market to deliver a 2000MW capacity announced in January 2025 and Brookfield’s decision to invest USD 20.8 million cross data centers and associated infrastructure sectors in France announced in February 2025.

- Proliferation of high-performance computing systems: Applications such as GPUs, CPUs, and FPGAs are expected to continue to drive the market for heterogeneous integration. High-performance computing systems require efficient power management which increases the demand for reliable chip resistors. Furthermore, public-private partnerships such as the European High-Performance Computing Joint Undertaking (EuroHPC) are favorable to bolster continued demand for chip resistors.

- Rise in the adoption of renewable energy systems: The push towards renewable energy systems and to improve the output from renewable sources, such as solar, wind, and smart grids is driving the demand for chip resistors in power converters, inverters, and energy storage systems. In 2023, the International Renewable Energy Agency (IRENA) report highlighted the critical role of advanced electronics in enabling efficient energy conversion. Major investments to expand smart grids along with the growth in manufacturing of power inverters are key trends assisting the growth of the chip resistor market. For instance, in January 2025, DTE Energy reported acceleration to smart grid technology with more than 450 new circuit automation devices commissioned in 2024 leading to a 70% improvement in customer time spent without power between 2023 and 2024.

Challenges

- Overcapacity in semiconductor manufacturing facilities: Recent trends forecast certain semiconductor manufacturing facilities are experiencing overcapacity. ASML, a major supplier of semiconductor equipment, adjusted its sales forecast stating that previous expansions during periods of high demand have led to current overcapacity. The overcapacity can lead to decreased orders affecting the entire supply chain and adversely impacting chip resistor production.

- Geopolitical trade tensions and tariffs: Recent geopolitical developments can be detrimental to the growth of the market. For instance, the proposed tariffs on chip imports by the U.S. administration that aimed to bolster domestic semiconductor manufacturing can disrupt existing supply chains. This can lead to increased costs for chip resistors and potential production delays.

Chip Resistor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.35 billion |

|

Forecast Year Market Size (2035) |

USD 2.53 billion |

|

Regional Scope |

|

Chip Resistor Market Segmentation:

Type (Thick Film, Thin Film, Others)

The thick film segment is projected to account for more than 59.5% chip resistor market share by the end of 2035. The growth is attributed to its adaptability to high-volume manufacturing across diverse industries. Applications in automotive, consumer electronics devices, and industrial equipment have grown over the years owing to their ability to handle moderate power loads and operate across broad temperature ranges. The largest application is poised to remain in the automotive sector in engine control units, infotainment systems, and LED lighting. Moreover, the Japan Electronics and Information Technology Industries (JEITA) whitepaper in 2023 highlights advancements in thick film materials such as ruthenium-based inks which have improved performance metrics.

The thin film segment is projected to expand its revenue share due to its low-temperature coefficient which makes it ideal for applications requiring minimal signal loss. Thin film resistors are experiencing high demand for use in medical devices and aerospace electronics. Key macro trends impacting the growth of the segment include the rising miniaturization of implantable medical devices which require thin film. Moreover, the International Telecommunication Union (ITU) Roadmap in 2023 highlights the opportunities for thin film resistors capable of handling GHz-range frequencies with minimal signal loss.

Application (Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Healthcare, Others)

The consumer electronics segment of the chip resistor market is expected to drive greater demand during the forecast period. The segment is characterized by the rising sales of laptops, wearables, gaming consoles, smartphones, smart home devices, etc. Consumer electronics products have had a significant penetration globally with many of the devices becoming indispensable to day-to-day life. For instance, in the fourth quarter of 2024, the smartphone shipment grew by 3% globally.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chip Resistor Market Regional Analysis:

APAC Market Forecast

APAC chip resistor market is expected to capture revenue share of over 38.9% by 2035. The market’s growth is attributed to the expansive electronics manufacturing industry in the region. APAC is positioned as a dominant manufacturing hub in consumer electronics and automotive components, which heavily utilize chip resistors. Moreover, the vast population density in APAC coupled with the rapid adoption of 5G has further escalated the demand for high-precision chip resistors. Additionally, China has established itself as a leading EV manufacturer in the global market, creating a strong supply chain for advanced chip resistors in power management.

The China chip resistor market is pivotal in APAC and is backed by a vast electronics manufacturing infrastructure. The nation has surged its transition to self-sufficiency in production, evident in rising investment in semiconductor production to maintain its leading position in supply chains worldwide. For instance, in May 2024, China set up its third state-backed investment fund to bolster its semiconductor industry with a capital of around USD 47.5 billion. Furthermore, China’s advancements in EV production necessitate a constant supply of high-quality chip resistors for various applications.

The Japan market is lucrative in APAC, and is likely to hold the second-largest revenue share after China. The high-value manufacturing ecosystem of Japan along with its focus on precision engineering ensures steady market growth. The Green Growth Strategy of Japan drives demand for ultra-stable resistors in powertrains and ADAS. Moreover, Japan has been at the forefront of installation industrial robotics which necessitates resistor usage in automation systems. For instance, in September 2024, the International Federation of Robotics published a report indicating 435,299 industrial robots functioning in factories across the country which is a 5% increase annually. The rising numbers of mobile cobots are poised to ensure the sector’s sustained growth.

North America Market Forecast

The North America chip resistor market is envisioned to register the second-fastest revenue growth by 2035. The market’s expansion is attributed to the surge in industrial automation in the region and the proliferation of IoT devices. Furthermore, the expansion of renewable energy projects requires power management solutions, further driving the need for high-quality chip resistors. The U.S. and Canada lead the revenue share in the region. For instance, the U.S. CHIPS and Science Act in 2022 and Canada’s Semiconductor Challenge Call in 2023 prioritize the domestic production of critical electronic components, strengthening the supply chain for chip resistors in the region. In October 2024, Climate Central highlighted that clean energy investment in the U.S. tripled from 2018 to 2023 with annual investment totaling almost USD 248 billion.

The U.S. market is anticipated to dominate the revenue share in North America. The market’s key features are initiatives to revitalize domestic semiconductor manufacturing which will boost the advancement of chip resistors. In May 2024, the Semiconductor Industry Association projected the U.S. to triple its semiconductor manufacturing capacity by 2032, exhibiting the fastest growth rate globally, and the trends directly benefit the growth of the chip resistor market in the country. Furthermore, potential improvements in thin-film resistors to support 6G are poised to build the market’s future in the U.S.

The Canada chip resistor sector is forecasted to expand during the forecast period. The market thrives due to the strategic alliances with the U.S. tech corridors and is backed by an advanced manufacturing sector. Investments in telecommunication and the nationwide rollout of 5G networks have led to sustained demand for chip resistors. For instance, in November 2024, the Government of Canada and Ericsson announced the signing of an expanded funding agreement leading to Ericcson investing upwards of 440.0 million to bolster 5G advanced, 6G, AI, etc. The proactive investment deals brokered and led by the government highlight lucrative opportunities within the Canada market.

Key Chip Resistor Market Players:

- Yageo Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Walsin Technology Corporation

- KOA Corporation

- ROHM Co., Ltd.

- Panasonic Corporation

- Vishay Intertechnology, Inc.

- Samsung Electro-Mechanics Co., Ltd.

- Murata Manufacturing Co., Ltd.

- KYOCERA

- Bourns Inc.

- Hokuriku Electric Industry Co., Ltd.

- TE Connectivity

The chip resistor market is poised to exhibit robust growth during the forecast period. Leading companies in the competitive market are actively expanding revenue shares through R&D investments to innovate high-precision and reliable chip resistors, catering to the evolving demands of industries such as automotive, consumer electronics, and telecommunications. Furthermore, the companies are establishing production facilities in key regions to optimize supply chains and meet regional market requirements. Yageo Corporation, a major player in the market, released its annual report for 2023 highlighting consolidated sales worth USD 0.8 billion.

Here are some key players in the market:

Recent Developments

- In December 2024, KYOCERA Corporation announced the release of the industry’s highest power 0603 resistor. The CR Series high-power chip resistors are non-magnetic qualified to MIL-PRF-55342 and are proven to provide high-reliability performance in a variety of high-frequency applications.

- In November 2024, Ruselectronics holding announced the development of a surface-mount ultra-precision chip resistor technology. The combined thin-film resistor structure used in the new products ensures thermal stability in multiple conditions.

- Report ID: 7228

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chip Resistor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.