Chip-on-Flex Market Outlook:

Chip-on-Flex Market size was over USD 1.81 billion in 2025 and is poised to exceed USD 2.84 billion by 2035, witnessing over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chip-on-flex is estimated at USD 1.88 billion.

The chip-on-flex technology is experiencing an increasing demand in automotive and healthcare applications as it is capable of operating reliably in harsh conditions. It is widely used in the automotive sector, particularly in advanced driver-assistance systems (ADAS), infotainment systems, and a broad range of sensors. Such applications require lightweight, compact, and robust components that should be capable of enduring vibrations, mechanical loads, and temperatures. In January 2023, Qualcomm introduced the Snapdragon Ride Flex, the next-generation automotive SoC, combining ADAS, ADS, infotainment, and connectivity capabilities. It plans out scale for features at price points and up to 700 TOPS for premium automotive architectures, targeting advanced automotive architectures.

The chip-on-flex technology plays a major role in the advancements of wearable medical devices and diagnostic tools and equipment. This technology is suitable for medical sensors including heart rate trackers, bio-patch devices, and glucose. Most of these devices need extended contact with the human body, therefore having to be made from robust materials that are suitable for use in conditions characterized by flexibility. For instance, in September 2022, VeriSilicon introduced VeriHealth, its customizable one-stop chip design platform. Implementing the company’s low-power IP series as well as advanced SoC customization technologies, the platform offers a complete wearable health monitoring solution from chip design to reference application development at a performance level.

Key Chip-on-Flex Market Insights Summary:

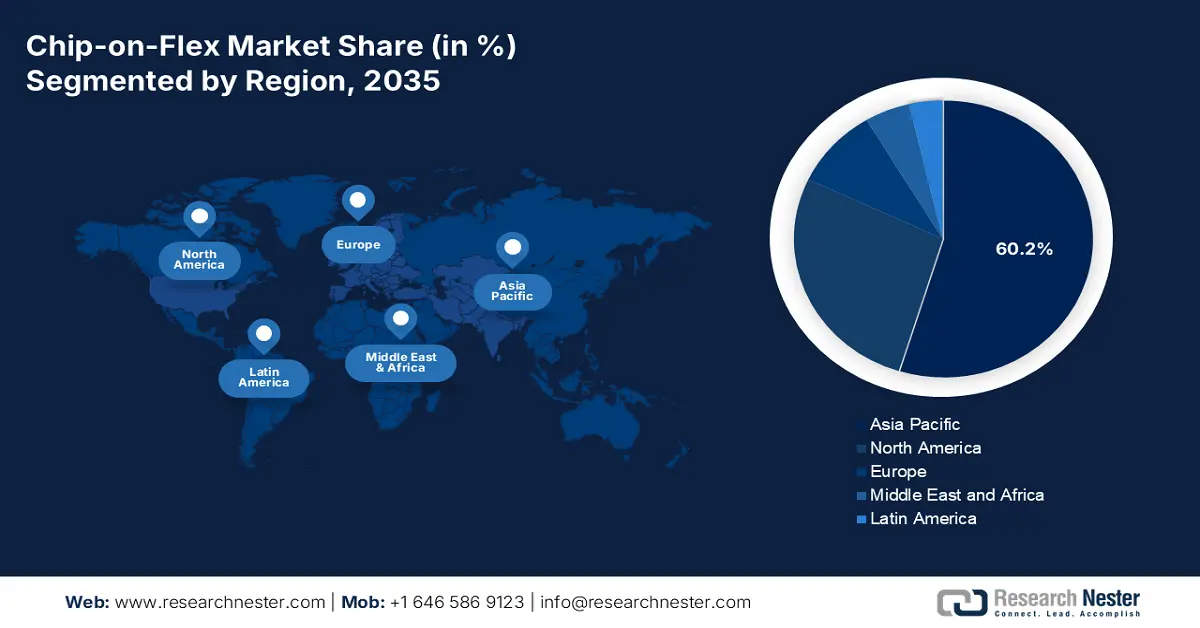

Regional Highlights:

- Asia Pacific dominates the Chip-on-Flex Market with a 60.2% share, driven by the region’s focus on electronics manufacturing and flexible display usage, positioning it as a global leader through 2026–2035.

- North America’s chip-on-flex market is expanding steadily through 2035, fueled by innovations in electronics, automotive, and IoT sectors.

Segment Insights:

- The Single Sided Chip segment is anticipated to achieve more than 59% market share by 2035, driven by its cost-effectiveness, simplicity, and reliability in static applications including display panels.

- The Static segment of the Chip-on-Flex Market is expected to experience rapid revenue growth from 2026-2035, fueled by demand for stable reliability and long-life in consumer electronics.

Key Growth Trends:

- Proliferation of wearable technology

- Advancements in flexible display technologies

Major Challenges:

- Complex manufacturing process

- Competition from alternative packaging technologies

- Key Players: LGIT Corporation, Stemko Group, Flexceed, Chipbond Technology Corporation, CWE, Danbond Technology Co. Ltd., and AKM Industrial Company Ltd.

Global Chip-on-Flex Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.88 billion

- Projected Market Size: USD 2.84 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, South Korea, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Chip-on-Flex Market Growth Drivers and Challenges:

Growth Drivers

- Proliferation of wearable technology: Wearable electronics such as fitness trackers, healthcare monitoring devices, and smartwatches, are key growth factors, boosting the demand for chip-on-flex technology. Wearable devices are compact and portable, designed to make durable and flexible components essential. The COF technology directly integrates chips onto flexible substrates, thereby providing the required compactness, power, and durability. Such devices, for instance, require components that are relatively rigid and capable of enduring continuous movement and bending while maintaining electrical integrity. The overall applicability of the enhanced material is ideal, which makes it handle the mechanical stress. Its lightweight nature enhances the user experience by ensuring that devices remain comfortable for long use. The continual expansion of the healthcare industry has also driven the requirement for wearable medical devices including cardiac sensors and glucose monitors, where reliability as well as accuracy are critical. The COF technology offers durability, flexibility, and miniaturization capabilities, which makes it an advanced technology in the rapidly evolving healthcare industry across the globe.

- Advancements in flexible display technologies: Flexible displays for consumer electronics and automotive applications have transformed the chip-on-flex technology in recent years. Flexible displays that enable bending, folding, or rolling require components with limited dimensions, and the ability to provide resistance to mechanical stress to maintain efficiency. COF technology which incorporates chips onto flexible substrates perfectly fits into these demands, allowing for seamless integration in innovative designs. In consumer electronics applications, COF has a pivotal contribution to foldable mobile phones, tablets, and wearable applications. These products rely on the COF technology for their high reliability, and lightweight construction, which enables manufacturers to create thinner and more versatile devices.

Challenges

- Complex manufacturing process: The manufacturing of chips on flex is a complex process that requires high precision as the chips must be accurately placed onto the flexible substrates without causing any damage to the delicate materials. Such steps consist of positioning as well as attaching the components ensuring proper electrical connectivity, and preserving substrate integrity. Substantial yield loss and device defects such as misaligned chips or cracks in bonds may result from even small variations. The need for specialized equipment and expertise further increases the production costs. These challenges with scalability and profitability, especially when dealing with large-scale production, make it crucial for manufacturers to enhance yield management, and continuously refine processes to remain competitive.

- Competition from alternative packaging technologies: The chip-on-flex faces strong competition from alternative technologies such as flip chip, and chip on board, particularly in applications where flexibility is not a primary necessity. The chip on board offers simpler manufacturing processes and is cost-effective as compared to the chip-on-flex technology, making it a preferred choice for rigid designers.

Chip-on-Flex Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.81 billion |

|

Forecast Year Market Size (2035) |

USD 2.84 billion |

|

Regional Scope |

|

Chip-on-Flex Market Segmentation:

Type (Single Sided Chip, Others)

Based on the type, the single sided chip segment is projected to hold chip-on-flex market share of more than 59% by 2035, owing to their continually rising demand from various industries, particularly from consumer electronics. The high demand is attributed to their cost-effectiveness, simplicity, and proven reliability in static applications including display panels. These designs are optimized for low-power devices. The segment's dominance is attributed to its widespread application in high-demand products including touch panels and wearable devices, where consistent performance and compact form factors are essential. Single-sided COF solutions also align well with high-volume manufacturing processes, making them an ideal choice for emerging chip-on-flex (COF) markets where scalability and cost optimization are paramount.

Application (Static, Dynamic)

By application the static segment in chip-on-flex market is expected to register rapid revenue growth during the forecast period. This segment comprises products that have limited motion and bending, including display panel, touch screen and other products for consumer electronics. Such applications are particularly valued as they ensure a high degree of stable reliability and long-life duration of cycles at constant loads that are essential for demanding products including mobile devices and consumer electronics.

In particular, the need for increasingly cost-effective, more energy efficient and reliable for high-volume manufactured electronic devices, static chip-on-flex solutions provide a better option compared to traditional approaches. The COF technology enables the smaller, lightweight, and more compact device designs without compromising performance or reliability. With industries emphasizing more on reducing energy consumption and improving environmental concerns, the COF technology’s efficiency in power conversion and heat management has become a demanded solution.

Our in-depth analysis of the global chip-on-flex market includes the following segments:

|

Type |

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chip-on-Flex Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in chip-on-flex market is anticipated to dominate over 60.2% revenue share by 2035, owing to the region’s focus on electronics manufacturing in China, Japan, and South Korea. These countries are at the forefront of the research and production of the new generation of consumer electronics. The expanded usage of flexible displays has enormously stimulated the chip-on-flex (COF) market solutions driving industry trends for compactness, lightweight, and efficiency in energy consumption. For instance, in November 2024, LG Innotek, a South Korean giant announced its plans to invest USD 268 million in its Haiphong factory. The investment is aimed at enhancing the production of optical solutions and is expected to double the production by 2025, supporting advanced camera modules and stabilizing supply chains.

The chip-on-flex market in China is projected to experience robust growth during the forecast period, attributed to the development of the electronics manufacturing industry and the application of miniaturized and lightweight components. China is a world powerhouse in electronics manufacturing and these leading tech giants including Huawei, Xiaomi, and Oppo have been adopting COF technology. Various policies and supportive capital from the government regarding the high-tech industries are further propelling the growth of the chip-on-flex market in China. China is expected to account for more than 60% of new global capacity for legacy chips by the end of the decade. This can be attributed to China’s “Made in China 2025” plan that currently emphasizes the electronics and innovation of advanced manufacturing.

In India, the chip-on-flex industry is anticipated to expand at a robust CAGR throughout the forecast period. This growth can be attributed to the increasing base of consumer electronics and the need for miniaturized flexible chips. The demand for smartphones wearable devices and other related electronics in India has significantly increased. As per the report by India Brand Equity Foundation (IBEF), India is emerging as the fastest-growing major market in the technical consumer goods sector, valued at USD 23.83 billion, with over 125 million units sold in the first half of 2024, representing an 11% increase in offline sales.

Miniature gadgets without losing performance depend on COF technology in manufacturing lightweight energy-efficient devices. COF has emerged as a solution of choice to improve product reliability hence its uptake by Indian manufacturers of devices sold in high volumes markets. The increasing IoT market and the investment in 5G technology also support the chip-on-flex market are necessary to build flexible and reliable components for telecommunications and industrial applications.

North America Market

The chip-on-flex market in North America is driven by innovations in consumer electronics, the automotive industry, and the Internet of Things (IoT). The strong focus of the region on innovation has accelerated the demand for flexible and compact components in wearable devices. The adoption of COF is supported by U.S. policies in R&D tax credits and Canada’s Digital Technology Adoption Program, as well as policies supporting manufacturing and COF deployment in various industries.

In the U.S., the key driver to the rapid implementation of COF is support from the U.S. government in technological development other than the consumer electronics industry. Owing to the telecommunication policies set by federal defense for enhanced development of 5G, smart cities, and IoT technologies, the prospects for usage of COFs in the country are highly significant, especially in telecommunications, automotive and industrial applications.

Canada is experiencing a significant rise in the adoption of wearable devices, smart home solutions, and other compact electronic products that benefit from COF technology. The ability to integrate chips on flexible substrates enables smaller, lighter devices with enhanced durability and performance, which is crucial for the growing chip-on-flex market of portable and energy-efficient products. The country’s emphasis on smart technologies and digital transformation is further propelling the demand for chip-on-flex technology. Canada’s focus on sustainable technology and energy-efficient products, coupled with the continually expanding industries including telecommunication, automotive, and healthcare underscore lucrative avenues for chip-on-flex market growth in the country.

Key Chip-on-Flex Market Players:

- LGIT Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stemko Group

- Flexceed

- Chipbond Technology Corporation

- CWE

- Danbond Technology Co. Ltd.

- AKM Industrial Company Ltd.

- Compass Technology Company Limited

- Compunetics

- Stars Microelectronics Public Company Ltd.

The competitive landscape of the chip-on-flex market is rapidly evolving as established key players, automotive giants and new entrants are investing in new technologies, and R&D to enhance automotive and healthcare sectors. Key players in the chip-on-flex (COF) market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global chip-on-flex market:

Recent Developments

- In September 2024, Pragmatic Semiconductor launched Flex-RV, the first 32-bit microprocessor to integrate the IGZO technology and RISC-V instruction set architecture, which is an open-source instruction set. Built with integrated machine learning flexibility at a lower cost than conventional flexible circuits, Flex-RV is durable, operable while bent, and cost-effective solution.

- In May 2023, Molex introduced the industry’s first chip-to-chip 224G product portfolio, with a new generation of cables, backplane, board-to-board connectors and near-ASIC connector-to-cable. Implemented at 224 Gbps-PAM4, the portfolio powers generative AI, machine learning and 1.6T networking applications.

- Report ID: 6983

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chip-on-Flex Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.