Chip Antenna Market Outlook:

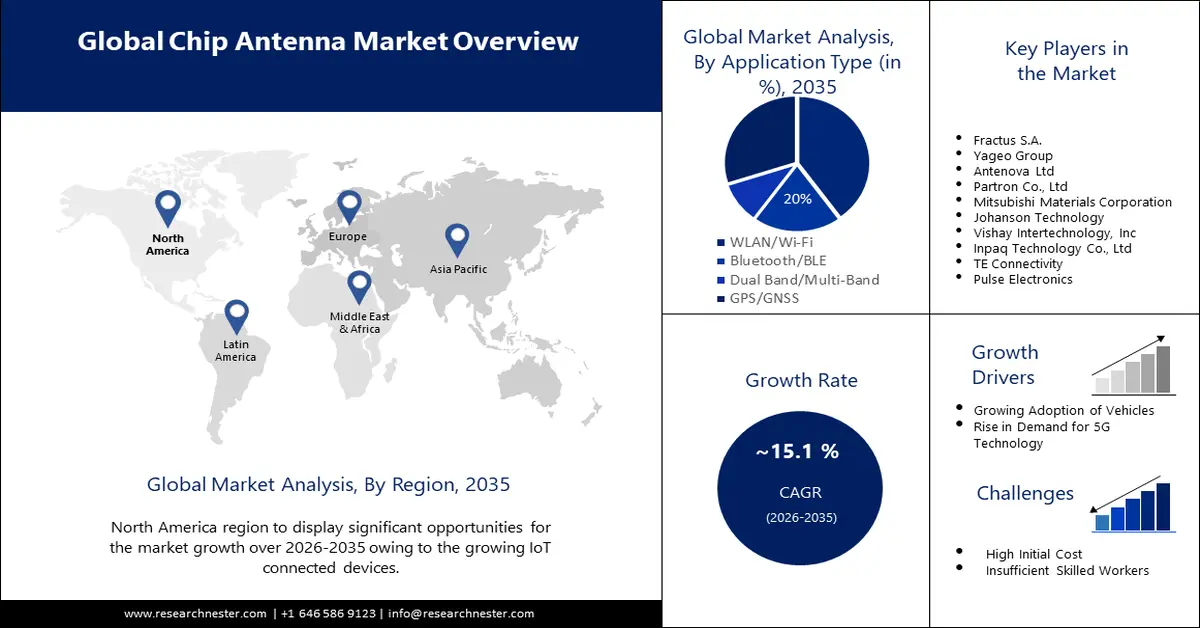

Chip Antenna Market size was valued at USD 2.75 billion in 2025 and is expected to reach USD 11.22 billion by 2035, expanding at around 15.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chip antenna is evaluated at USD 3.12 billion.

This growth of the market is set to be dominated by the growth in adoption of smartphones. The number of people using smartphones as of 2023 around the globe is estimated to be about 5 billion. This means around 85% of the global population is a smartphone user. Further, almost every smartphone purchased contains a chip antenna. The chip antenna in mobile phones plays a significant role in transferring signals through various devices and networks when connected to the internet or during phone calls without any interference.

Additionally, the size of every electronic gadget has decreased over the decades. This could be due to the growing demand from industries that prefer electronics with greater speed, power, and weight. This has further influenced the adoption of chip antennas, which are also increasing the efficiency of the products.

Key Chip Antenna Market Insights Summary:

Regional Highlights:

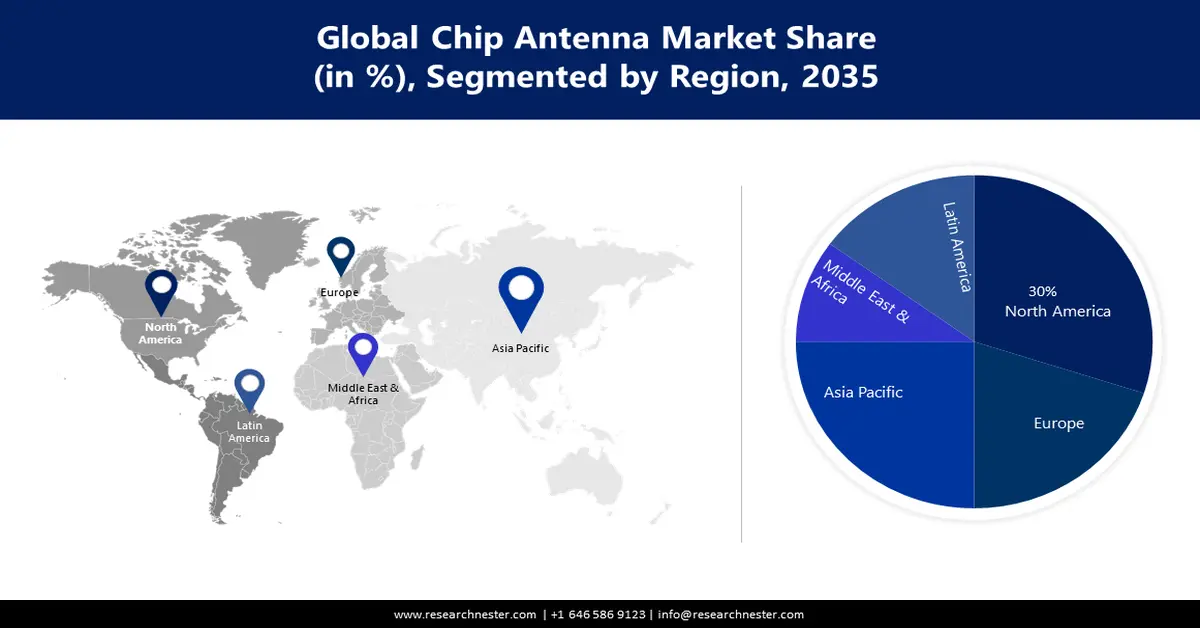

- The North America chip antenna market is projected to capture a 39% share by 2035, driven by the rising IoT connections and surging automobile manufacturing.

Segment Insights:

- The consumer electronics segment in the chip antenna market is expected to experience noted growth through 2035, driven by rising purchasing power and demand for miniaturized electronics.

- The wlan/wi-fi segment in the chip antenna market is projected to hold the largest share by 2035, driven by Wi-Fi’s secure communication and ability to connect many devices simultaneously.

Key Growth Trends:

- Growing Adoption of Vehicles

- Rise in Demand for 5G Technology

Major Challenges:

- Insufficient Skilled Workers

- Inefficiency in Functioning

Key Players: Fractus S.A., Yageo Group, Antenova Ltd, Partron Co., Ltd, Mitsubishi Materials Corporation, Johanson Technology, Vishay Intertechnology, Inc., Inpaq Technology Co., Ltd, TE Connectivity, Pulse Electronics.

Global Chip Antenna Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.75 billion

- 2026 Market Size: USD 3.12 billion

- Projected Market Size: USD 11.22 billion by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 23 April, 2025

Chip Antenna Market Growth Drivers and Challenges:

Growth Drivers

- Growing Adoption of Vehicles In 2022, the number of cars all around the globe was about 2 billion. These automobiles consist of chip antenna. They have been designed to integrate quickly with wireless communication systems. Chip Antennas of varying bandwidths are used in the automotive environment to provide connectivity within the vehicle and from the vehicle to the infrastructure.

- Rise in Demand for 5G Technology Offering more bandwidth and lower latency over current 4G networks, 5G already offers significant enhancements in user experience. Users would be able to access services including high-resolution video streaming, smartphone gaming, and video calling without interruption. Hence, owing to its benefits the preference of customers for 5G technology is growing. Hence, a large number of organizations are working on the launch of a 5G technology chip antenna in order to satisfy the user.

- Surge in the Application of Chip Antennas in the Healthcare Industry WiFi/BT chip antennas are special solutions for equipment designed to let medical personnel monitor patients wirelessly from a secure distance. For instance, Bluetooth sends health information from smart monitoring devices for instance smart watches or glucose meters to a WiFi-enabled internet of things device that transmit diagnostic data to a healthcare practitioner through the Cloud.

Challenges

- High Initial Cost – Even though the chip antenna market is expanding quickly, there are still barriers in the way of this sector's expansion owing to chip antennas' high beginning costs. Due to the high cost of the ceramic chip antenna and the other components required for this technology to function efficiently, its initial cost is very high.

- Insufficient Skilled Workers

- Inefficiency in Functioning

Chip Antenna Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 2.75 billion |

|

Forecast Year Market Size (2035) |

USD 11.22 billion |

|

Regional Scope |

|

Chip Antenna Market Segmentation:

Application Type Segment Analysis

Chip antenna market from the WLAN/Wi-Fi segment is expected to generate the largest revenue by the end of 2035. This is since, Wi-Fi is considered to be more secure than any other network. Moreover, it enables simultaneous communication between a large number of people and devices. Wi-Fi creates a wireless network that allows radio waves to be utilized for communication between computers and other devices that have the necessary wireless capabilities. Furthermore, the installation of a chip antenna, offers selective and improved efficiency.

End-User Industry Segment Analysis

The consumer electronics segment in the chip antenna market is set to have noteworthy growth over the forecast period. The steady rise in purchasing power and rising demand for technologically sophisticated goods among consumers worldwide speed up the deployment of chip antennas. In addition, as miniaturized consumer electronics become more and more popular, there is a tremendous need for compact chip antennas since this technology is the best fit for these goods.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application Type |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chip Antenna Market Regional Analysis:

North American Market Insights

North America industry is expected to dominate majority revenue share of 39% by 2035. It is projected that there would be about 4 billion Internet of Things (IoT) connections collectively in North America by 2025. Hence, the adoption of chip antennal is also slated to rise. An antenna is needed for Internet of Things (IoT) devices. The frequency spectrum and the complexity of the IoT antenna design increase with decreasing IoT device space. Moreover, the manufacturing of automobiles is surging in this region, where Canada and United Nations have high auto production activities.

APAC Market Insights

The chip antenna market in the Asia Pacific is projected to have significant growth till 2035. Regional expansion is mainly motivated by reasons such as increased smartphone demand, an increase in mobile internet users, and the quick construction of the 5G network. Furthermore, due to its low manufacturing costs and widespread accessibility of raw resources such as copper and gold, China accounts for a sizeable portion of this region.

Chip Antenna Market Players:

- Fractus S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Yageo Group

- Antenova Ltd

- Partron Co., Ltd

- Mitsubishi Materials Corporation

- Johanson Technology

- Vishay Intertechnology, Inc.

- Inpaq Technology Co., Ltd

- TE Connectivity

- Pulse Electronics

Recent Developments

- For small IoT devices, Antenova Ltd has created the Lama FPC antenna. Compared to other FPC antennas, this flexible PCB/FPC antenna is different as it is smaller (35x10x0.15mm) and offers superior dual band performance in the 863-870MHz and 902-928MHz frequencies. Lama may be easily incorporated into devices in both Europe and North America as it performs well in these two frequency bands.

- Johanson Technology has created an Integrated Passive Device (IPD) for Semtech's LoRa transceivers SX1261, SX1262 and LLCC68 in response to the development of the next generation of low-power wireless IoT devices. The design objective is to provide outstanding radio frequency (RF) signal range and stability while also adhering to ETSI (868MHz) and FCC (902-928MHz) rules.

- Report ID: 5049

- Published Date: Apr 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chip Antenna Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.