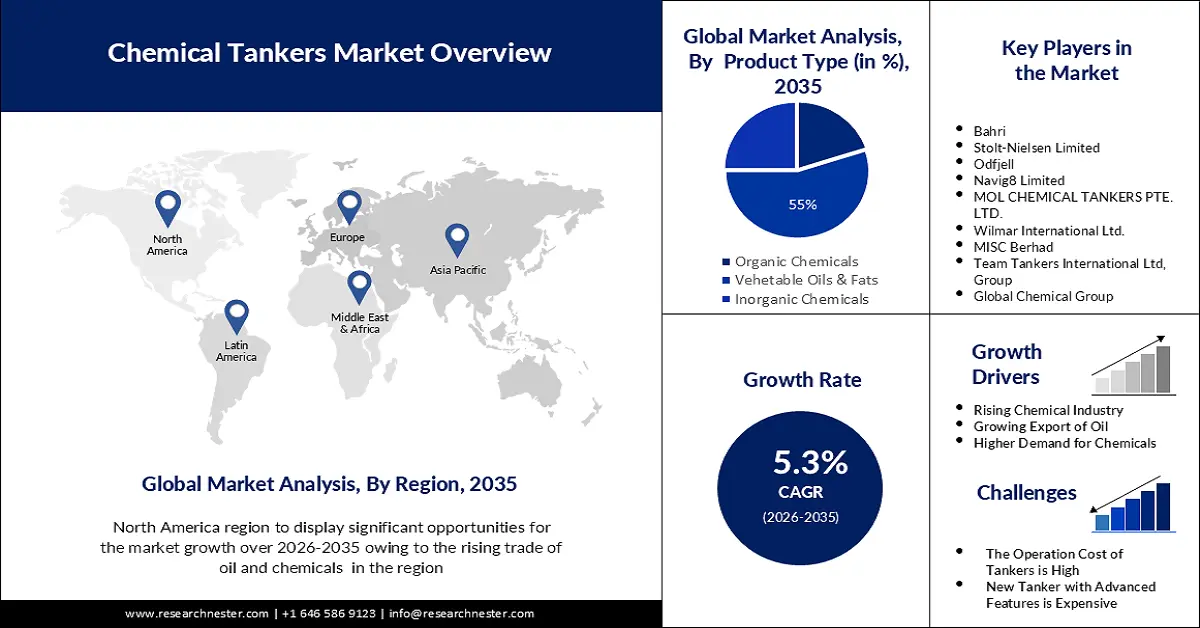

Chemical Tankers Market Outlook:

Chemical Tankers Market size was valued at USD 31.38 billion in 2025 and is set to exceed USD 52.59 billion by 2035, registering over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chemical tankers is estimated at USD 32.88 billion.

The growth of the market can be attributed to the rising demand for vegetable oils. In the international trade, vegetable/palm oil is typically transported in segmented packages on board chemical tankers with stainless steel or coated tanks. India is the world's largest importer of edible oil, with import amounts ranging from 6,600 to 14,100 million. The country's edible oil demand would rise from around 27 million tons in 2021-22 to 30 million tons in 2030-31. However, edible oil production in India is likely to increase from nearly 13 million tons to around 23 million tons during the same time period, leaving around 7 million tons deficit.

In addition to these, factors that are believed to fuel the market growth of chemical tankers include the rise in global trade, there has been a greater need for chemical tankers to transport chemicals between regions. This has been particularly significant in the region, such as Asia and Europe, where chemical production and demand are growing rapidly. Besides this, the ageing of the existing fleet is also attributed to the market growth. With the rising age, the need for replacing the old fleets with new ones has increased the demand for advanced chemical tankers that are much safer, and efficient.

Key Chemical Tankers Market Insights Summary:

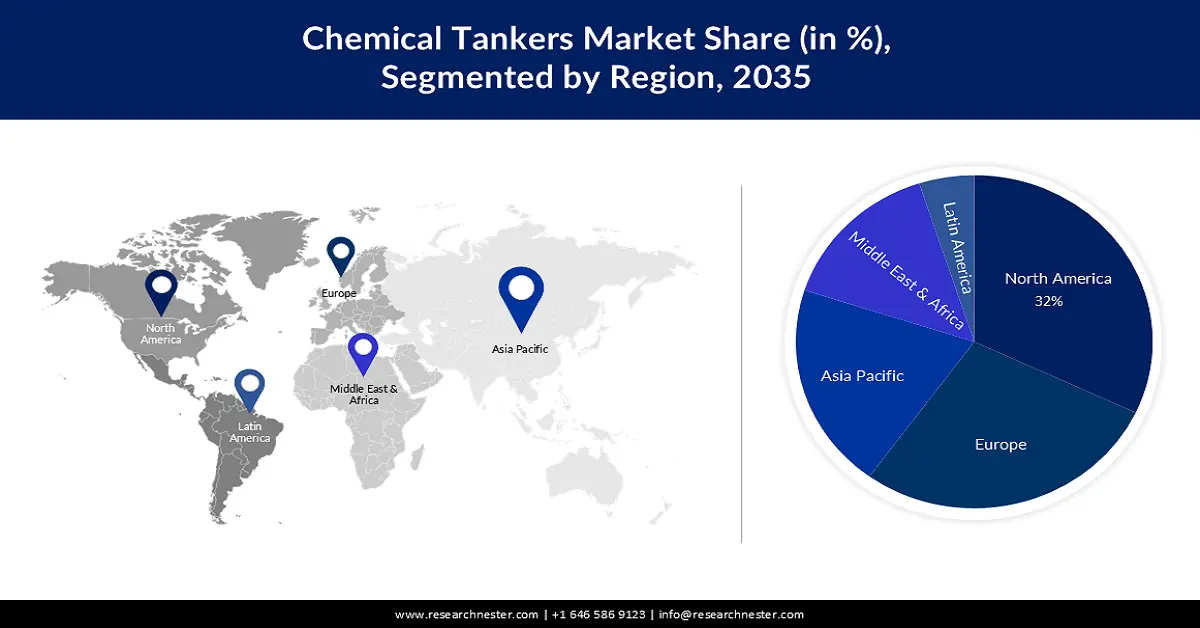

Regional Highlights:

- The North America chemical tankers market is projected to capture a 32% share by 2035, attributed to rising crude oil and chemical exports, as well as production in the U.S.

- The Europe market is expected to secure a 28% share by 2035, attributed to the rising export of chemicals, especially from Germany and Belgium.

Segment Insights:

- The vegetable oils & fats segment in the chemical tankers market is forecasted to achieve a 55% share by 2035, fueled by rising demand for vegetable oils such as palm oil, coconut oil, and soybean oil.

- The IMO 2 segment in the chemical tankers market is projected to achieve a 46% share by 2035, driven by better safety features and specialized tank coatings that prevent contamination and corrosion.

Key Growth Trends:

- Growing Trade of Oils

- Increasing Chemical Industry

Major Challenges:

- High cost of operation

- Volatility of chemical markets

Key Players: Hafnia Group, Bahri, Stolt-Nielsen Limited, Odfjell, Navig8 Limited, MOL CHEMICAL TANKERS PTE. LTD, Wilmar International Ltd, MISC Berhad, Team Tankers International Ltd, Global Chemical Group.

Global Chemical Tankers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.38 billion

- 2026 Market Size: USD 32.88 billion

- Projected Market Size: USD 52.59 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 11 September, 2025

Chemical Tankers Market Growth Drivers and Challenges:

Growth Drivers

- Growing Trade of Oils – Chemical tankers transport a variety of industrial chemicals and can also clean petroleum products if configured as oil and chemical tankers. Global oil consumption is expected to reach 104.1 million barrels per day by 2026. This would imply a 4.4 mb/d rise over 2019 levels.

- Rising Production of Chemicals - Chemical tankers are specially designed to transport a wide range of liquid chemical cargoes. The bulk liquid chemicals, acids, edible oils, alcohols, biofuels, and clean petroleum products handled are the most complex. Owing to the complexities of these compounds, zinc-coated or stainless-steel tanks, advanced vessels, and qualified personnel capable of handling sometimes hazardous, combustible, or corrosive ingredients are required. Ammonia, the building block of all synthetic nitrogen fertilizers, has grown at a pace of 1.6 % yearly over the last decade, globally. Today, China is the top producer that accounts 28% of global output.

- Increasing Chemical Industry –The chemical industry is growing rapidly, driven by rising demand for chemicals and chemical-based products. These products are used in various sectors, including, pharmaceutical, plastics, consumer goods, and agriculture. Owing to this demand, the need for chemical tankers is also increasing. According to the European Chemical Industry Council, the industry rose from around USD 2 trillion to nearly USD 4 trillion between 2009 and 2019, and it was in good form prior to the epidemic. The chemical industry experienced a 0.4% dip in 2020, and the following year enjoyed a fast comeback that lasted until the commencement of Russia's conflict in Europe.

- Growing Export of Chemicals –When exporting chemical products, chemical tankers are used to transport these substances from the country of origin to the destination country. In response to rising pricing, EU chemical (including pharmaceutical) extra-EU exports hit a record high of USD 550 billion in 2022. This represented a more than 21% rise over the value of exports in 2021 which is USD 450 billion.

Challenges

- High cost of operation- the transport of chemicals, especially that are hazardous are subjected to string environmental regulation, which is likely to increase the operational cost of these chemical tankers. Moreover, these regulation changes frequently and depend from nation to nation, therefore sticking to these, regulation becomes difficult, and non-adherence to these regulations can also lead to hefty fines.

- Volatility of chemical markets

- High cost of advanced chemical fleets

Chemical Tankers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 31.38 billion |

|

Forecast Year Market Size (2035) |

USD 52.59 billion |

|

Regional Scope |

|

Chemical Tankers Market Segmentation:

Product Type Segment Analysis

The global chemical tankers market is segmented and analyzed for demand and supply by product type into organic chemicals, inorganic chemicals, and vegetable oils & fats. Out of the three product types carried in chemical tankers, the vegetable oils & fats segment is estimated to gain the largest market share of about 55% in the year 2035. The growth of the segment can be attributed to the rising demand for vegetable oils, such as virgin coconut oil, palm oil, mustard oil, and others. In the crop year 2021/22, global vegetable oil output hit around 200 million metric tons. Palm oil has the biggest volume of production among the various categories of vegetable oil, with nearly 73 million metric tons produced during that time period. In addition to this, soybean oil is the most popular type of edible oil in the United States. It's common in fried dishes, tinned fish, salad dressings, and margarine. In 2022, Americans consumed approximately 12 million metric tons of soybean oil. Moreover, the rising consumption of healthy oil is also expected to drive the growth of the segment.

Fleet Type Segment Analysis

The global market is also segmented and analyzed for demand and supply by fleet type into IMO 1, IMO 2, and IMO 3. Amongst these three segments, the IMO 2 segment is expected to garner a significant share of around 46% in the year 2035. IMO 2 chemical tankers provide better safety than other two tankers, as they are designed to carry moderately hazardous chemicals. IMO 2 has multiple cargo tanks, that allows the segregation of different types of chemical and thus many chemicals can be carried together without any risk of contamination. IMO 2 chemical tankers have specialized tank coatings that provide resistance to corrosion and chemical attack, ensuring that the cargo remains intact during transport. The safety of chemicals and fleet in the IMO 2 tanker is the primary reason for the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Fleet Type |

|

|

By Fleet Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chemical Tankers Market Regional Analysis:

North American Market Insights

North America industry is expected to account for largest revenue share of 32% by 2035. The growth of the market can be attributed majorly to the rising export and import of oils. Crude oil imports into the United States grew by around 235,000 barrels per day in 2021, reaching over 6.1 million barrels per day. In 2021, net crude oil imports were estimated to be around 3.1 million b/d. Imports of petroleum products (excluding crude oil) in the United States climbed by 19% in 2021, while exports increased by 7%. On the other hand, the rising production of chemicals is also expected to drive the market growth in the region. The United States is one of the world's largest national producers of chemical products, with about 770 billion US dollars in chemical shipments in 2021, and over 438 billion US dollars in value added by U.S. chemistry in that same year.

Europe Market Insights

The European market for chemical tankers is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the rising export of chemicals. Europe is home to a large and growing chemical industry which is boosting the need for chemical tankers for transporting chemicals between countries and other nations. In 2022, Germany was the top exporter of chemicals in the European Union, which made an export worth USD 157 billion, followed by Belgium, which exported chemicals worth USD 90 billion. Moreover, the European Union has some of the strictest regulations when it comes to the trade of hazardous substances. This factor is increasing the demand for specialized chemical tankers that comply with transport safety regulations.

APAC Market Insights

Asia Pacific region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the significant increase in demand for chemicals, driven by urbanization, industrialization, and a growing population. This demand is creating a need for chemical tankers to transport chemicals to meet the demand. Moreover, the Asia Pacific region has become a major producer of chemicals, with Japan, India, and China being one of the top three producers of the chemicals which is likely to drive market growth in the region.

Chemical Tankers Market Players:

- Hafnia Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bahri

- Stolt-Nielsen Limited

- Odfjell

- Navig8 Limited

- MOL CHEMICAL TANKERS PTE. LTD

- Wilmar International Ltd

- MISC Berhad

- Team Tankers International Ltd

- Global Chemical Group

Recent Developments

- Hafnia Group announced the agreement with Chemical Tankers, Inc. to acquire 21 modern and fuel-efficient IMO II chemical tankers. The CTI fleet is made up entirely of high-spec ECO design vessels built at major shipyards.

- Odfjell announced the addition of a newbuilt stainless steel chemical tanker, Bow Cheetah into their fleet. The fleet, which is equipped with steam/hot water heating and thermal oil, is ideal for transporting a wide range of sensitive commodities.

- Report ID: 4923

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chemical Tankers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.