Chemical Logistics Market Outlook:

Chemical Logistics Market size was valued at USD 291.71 billion in 2025 and is expected to reach USD 427.67 billion by 2035, registering around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chemical logistics is evaluated at USD 301.95 billion.

The primary growth driver of the chemical logistics market is the increasing demand for chemicals across various industries including industrial and manufacturing, pharmaceutical and healthcare, and agriculture and agrochemicals.

Growth in sectors such as automotive, aerospace, electronics, and consumer goods drives the need for raw chemicals and specialty chemicals used in manufacturing processes. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), total production of automobiles in the U.S. was 10.6 million in 2023, contributing to significant growth in the automotive sector. Moreover, rising demand for pharmaceutical products and biochemical, including active pharmaceutical ingredients (APIs) and vaccines, fuels the need for specialized logistics solutions that ensure safe and compliant handling.

Key Chemical Logistics Market Insights Summary:

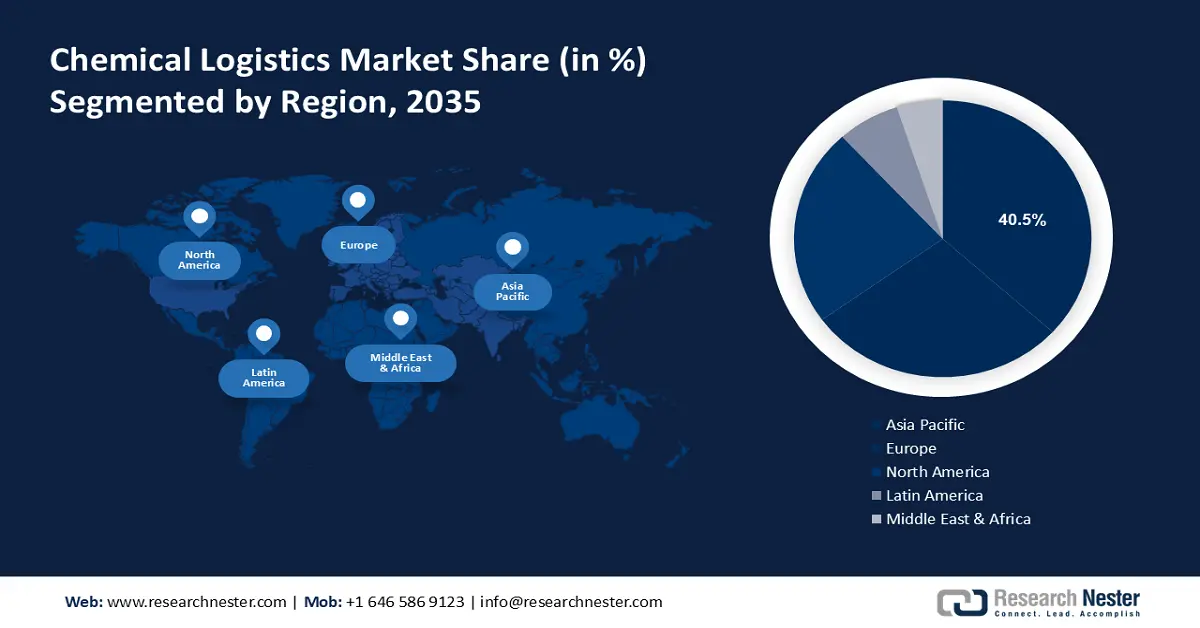

Regional Highlights:

- Asia Pacific chemical logistics market is anticipated to capture 40.50% share by 2035, driven by the rapid rise in chemical manufacturing.

Segment Insights:

- The transportation and distribution segment in the chemical logistics market is expected to see substantial growth till 2035, fueled by rising global trade of chemical products.

- The roadway segment in the chemical logistics market is expected to secure a 45.20% share by 2035, driven by the flexibility of road transport for chemical delivery.

Key Growth Trends:

- Implementation of digital technologies

- Growing adoption of green logistics

Major Challenges:

- Transportation complexities

- Unavailability of advanced logistic infrastructure

Key Players: DHL Supply Chain, Agility Logistics, C.H. Robinson Worldwide, Inc., DB Schenker, Kuehne+Nagel International AG, CEVA Logistics, FedEx Corporation, United Parcel Service, Inc. (UPS), XPO Logistics, Inc., Nippon Express Co., Ltd.

Global Chemical Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 291.71 billion

- 2026 Market Size: USD 301.95 billion

- Projected Market Size: USD 427.67 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Chemical Logistics Market Growth Drivers and Challenges:

Growth Drivers

- Implementation of digital technologies: The chemical logistics market is witnessing increasing adoption of digital technologies and automation to boost operational efficiency. Some of the advanced technologies are automated warehousing, RFID/tracking systems, the Internet of Things (IoT), predictive analysis, cloud computing, artificial intelligence (AI), and cognitive computing. For instance, a study by the Gulf Petrochemicals & Chemicals Association estimates digital technologies are emerging as a game changer in the chemical logistics sector and around 40% of the leading market players have implemented artificial intelligence in their supply chains. The same source also revealed that the companies with advanced logistics witnessed better financial performance scoring revenue growth and profitability of 42% and 68%, respectively, in 2022.

- Growing adoption of green logistics: The increasing adoption of sustainability practices by every organization and the growing emphasis on green logistics are some latest market trends. Green supply chain management aims to reduce waste and preserve energy, meeting the regulatory requirements. Some examples of green logistics are the adoption of electric vehicles for transportation resulting in less carbon emission, the use of biodegradable material for packaging, and IoT-enabled sensors for product tracking.

Challenges

- Transportation complexities: Navigating a complex web of local, national, and international regulations for transporting hazardous materials can be challenging. Compliance with various safety and environmental standards increases operational complexity and costs. Transporting chemicals, especially hazardous ones, involves significant safety risks. Ensuring proper handling, containment, and emergency response measures adds complexity and can increase insurance and liability costs.

- Unavailability of advanced logistic infrastructure: Inadequate infrastructure for the safe transportation and storage of chemicals is one of the major factors hampering the chemical logistics market growth. Many countries in the developing region lack purpose-built facilities designed to handle hazardous chemicals. Specialized equipment and containments measure aid in preventing leaks, spills, or any accidents, unavailability of such solutions can hamper the supply chain process.

Chemical Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 291.71 billion |

|

Forecast Year Market Size (2035) |

USD 427.67 billion |

|

Regional Scope |

|

Chemical Logistics Market Segmentation:

Mode of Transportation Segment Analysis

Roadway segment is set to capture around 45.2% chemical logistics market share by the end of 2035. Road transport provides flexible routing and direct access to various locations, including those not served by rail or sea. This flexibility is crucial for delivering chemicals to diverse industrial sites, warehouses, and distribution centers.

The use of specialized road vehicles, such as tankers and container transport, allows for the safe and compliant handling of various types of chemicals, including hazardous materials. The tank container fleet keeps expanding on the back of global chemical demand. The International Tank Container Organization (ITCO) 2023 reports that the global tank container fleet grew by 8.65% in 2022 to 801,800 units in 2023.

Services Segment Analysis

Transportation and distribution segment in the chemical logistics market is expected to hold a share of 50.1% by 2035. The rising global trade of chemical products is driving a high demand for efficient transportation and distribution services. Advanced and reliable logistics handle international chemical shipments effectively by complying with environmental regulations. Furthermore, transportation and distribution services equipped with advanced technologies such as IoT, real-time GPS tracking, and automated inventory management systems are widely employed by end users as they streamline operations smoothly.

Our in-depth analysis of the chemical logistics market includes the following segments:

|

Mode of Transportation |

|

|

Services |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chemical Logistics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 40.5% by 2035. The chemical companies are targeting the region and building their manufacturing units to earn high profits. The swift rise in the chemical industry is anticipated to directly boost the demand for logistics services. India, China, Australia, Japan, and South Korea are some of the high-earning marketplaces in the region.

India holds 6th position as a chemical producer across the world and 3rd in Asia Pacific, contributing 7% to the country’s GDP. The rapidly expanding chemical sector is directly fuelling the demand for logistics services in the country. As per the estimations by the India Brand Equity Foundation, the chemical sector of India is projected to reach USD 300 billion by 2030.

Europe Market Insights

Europe chemical logistics market is set to exhibit substantial CAGR till 2035 owing to the strong presence of chemical manufacturers such as BASF, INEOS, and Shell Chemicals. DSV is one of the trusted chemical logistic solution and transport service providers in the region. The rising exports of petrochemicals are anticipated to augment the demand for logistics services in the coming years. Countries such as the UK, France, and Germany are significant marketplaces for petrochemicals such as ethylene.

The UK is leading in the research and manufacturing of zero-carbon vehicles, which is directly driving the supply chain prospects for chemicals required in developing automobiles. Croda International Plc. and Johnson Matthey Plc. are leading chemical companies in the country.

Chemical Logistics Market Players:

- C.H. Robinson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GEODIS

- Brenntag

- Kuehne + Nagel

- Maersk Logistics

- UPS Supply Chain Solutions

- XPO Logistics

- Rhenus Logistics

- Sinotrans

- DB Schenker

- DHL Global Forwarding

- FedEx

- Leschaco

The leading companies in the chemical logistics market are adopting several organic and inorganic strategies such as the integration of advanced technologies, collaborations, mergers, and regional expansions to reach a wider consumer base. Industry giants are tapping into high-potential chemical markets such as Asia Pacific, Latin America, and MEA to earn more. The chemical logistics market players are also collaborating with technology companies and local logistic service providers to increase their market reach.

Some of the key players include:

Recent Developments

- In March 2024, Leschaco constructed its new chemical warehouse in Moerdijk, the Netherlands. The warehouse is well connected to major seaports and is equipped with advanced technologies.

- July 2024, C.H. Robinson announced the launch of an enhanced load-matching platform with data science and AI algorithms. This technology offers real-time, hyper-customized recommendations to carriers via text or email.

- July 2024, C.H. Robinson announced that it had sold its European Surface Transportation business (EST) to sennder Technologies GmbH. This is a strategic move by the company to concentrate more on its other projects.

- Report ID: 6424

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chemical Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.