Chelated Selenium Market Outlook:

Chelated Selenium Market size was over USD 1.1 billion in 2025 and is projected to reach USD 1.97 billion by 2035, witnessing around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chelated selenium is evaluated at USD 1.16 billion.

Selenium an antioxidant and immune defense ingredient is finding widespread applications in nutraceuticals and dietary supplements. The health and wellness trends are set to augment the consumption of chelated selenium-based nutritional products in the coming years. The growing focus of individuals on personal health and fitness is significantly driving the sales of health supplements. In the years ahead, growing awareness of selenium and celebrity endorsement tactics in high-potential economies such as Asia Pacific, Latin America, and the MEA are anticipated to offer lucrative opportunities for chelated selenium manufacturers.

|

Country |

Selenium Value in Exports (USD Million) |

Country |

Selenium Value in Imports (USD Million) |

|

Japan |

17.3 |

China |

28.5 |

|

Philippines |

16.8 |

U.S. |

11.9 |

|

Hong Kong |

14.0 |

Hing Kong |

11.6 |

|

U.S. |

8.01 |

Japan |

10.0 |

|

China |

7.09 |

India |

8.21 |

Source: OEC World

The Observatory of Economic Complexity (OEC) report reveals that selenium is the 4035th most traded product across the world, totaling USD 226.0 million worth of trade. The selenium trade increased by 4.25% from 2021 to 2022. The product complexity index of selenium ranked 2492nd in 2022, and Japan and China held top positions as the top exporters and importers of selenium, respectively. The market concentration using Shannon Entropy was 4.1, reflecting the export dominance of 17 countries. The trade value delta of Japan and Russia amounted to USD 7.25 million and USD 4.9 million, in 2022, respectively.

Key Chelated Selenium Market Insights Summary:

Regional Highlights:

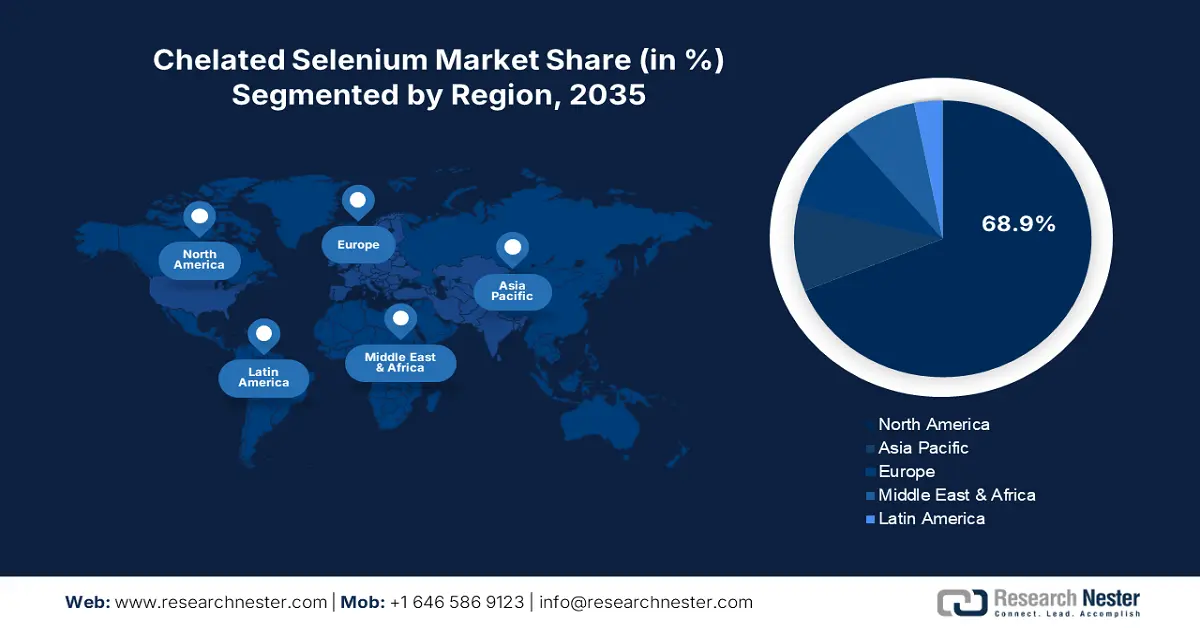

- North America dominates the Chelated Selenium Market with a 68.9% share, driven by rising demand for nutraceuticals, a growing fitness industry, and innovations in animal feed and food & beverages, ensuring robust growth by 2035.

- The Asia Pacific chelated selenium market is expected to grow rapidly through 2035, fueled by a booming pharma sector, rising F&B trade, and livestock industry growth.

Segment Insights:

- The Glycine segment is expected to capture a significant share by 2035, fueled by its popularity among fitness enthusiasts and health-conscious consumers.

- The Powder segment of the Chelated Selenium Market is expected to achieve substantial growth from 2026 to 2035, fueled by its versatility, long shelf life, and increased use in skincare products.

Key Growth Trends:

- Boom in chelated selenium-based animal feed demand

- Selenium deficiency

Major Challenges:

- Regulatory complexities

- Lack of awareness

- Key Players: IBSA USA, American Regent, Inc., Hebei Welcome Pharmaceutical Co. Ltd., and Nutreco N.V.

Global Chelated Selenium Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.16 billion

- Projected Market Size: USD 1.97 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (68.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Chelated Selenium Market Growth Drivers and Challenges:

Growth Drivers

-

Boom in chelated selenium-based animal feed demand: The animal husbandry sector is substantially driving the sales of chelated selenium products. The consumers’ increasing focus on the source of meat products is necessitating the rancher or farmer to add chelated selenium in animal feed. On the other hand, to boost the immune system, health, and reproduction of livestock, the farmers are shifting their animals to chelated selenium-based feeds. For instance, the International Feed Industry Federation (IFIF) estimates that annually more than 1.0 billion tons of compound animal feed is produced, globally. Also, the same source anticipates that the worldwide annual commercial feed manufacturing turnover is more than USD 400.0 billion. The growth in animal husbandry and livestock production directly augments the consumption of chelated selenium. For instance, in October 2024, the U.S. Department of Agriculture (USDA) revealed that Brazil is anticipated to dominate the global chicken meat exports in 2025. The global chicken meat exports are anticipated to increase by 2.0% in 2025 and total 13.8 million tons.

-

Selenium deficiency: The rising number of selenium deficiency cases, leading to health conditions such as infertility, cardiovascular diseases, cognitive decline, and myodegenerative disorders are boosting the sales of chelated selenium solutions. Doctor’s recommendations and digital marketing strategies by key producers are not only contributing to the increasing awareness of selenium benefits but also to their sales. The National Institutes of Health (NIH) report reveals that around 17.0% to 19.0% of U.S. individuals consume selenium-based dietary supplements. Furthermore, in September 2024, the Agriculture, Nutrition, and Health Academy (ANH) study revealed that 1 in 7 individuals have low dietary selenium intake, globally, and around 0.5 to 1 billion people are estimated to be selenium deficient.

Challenges

-

Regulatory complexities: The stringent and time-consuming regulatory procedures are hampering the sales of chelated selenium solutions. Manufacturers are often deterred from trending opportunities due to slower approval procedures, which further hampers their revenue growth. Key players also witness high operational costs owing to late chelated selenium market entries of the products.

-

Lack of awareness: The lack of awareness of selenium and its use is a major factor in their lower consumption rates. This drawback is often observed in some economies of underdeveloped regions. The high costs of chelated selenium products are also expected to hamper their sales in underdeveloped markets.

Chelated Selenium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 1.97 billion |

|

Regional Scope |

|

Chelated Selenium Market Segmentation:

Chelating Agent (Glycine, Methionine, Yeast, Sodium Selenite)

By the end of 2035, glycine segment is estimated to hold chelated selenium market share of over 54%. Glycine being an amino acid and protein builder is gaining traction among fitness enthusiasts. Health-conscious consumers are heavily pushing the sales of glycine-based supplements. The rapidly expanding fitness industry is estimated to generate high-earning opportunities in the coming years. Studies estimate that glycine is witnessing an eastern-to-western trade. For instance, in November 2024, the U.S. International Trade Commission (USITC) revealed that China, India, Japan, and Thailand are the major exporters of glycine. China holds the top position as the global exporter of glycine and other amino acids, in 2023, Chinese exports totaled 994.5 million pounds. India records the 8th position as a glycine exporter with a 21.2 million pounds trade, in 2023.

Form (Powder, Liquid, Granular)

By 2035, powder segment is set to capture chelated selenium market share of over 59.1%. The versatility, long shelf life, and easy combining nature are augmenting the sales of powder-based chelated selenium. The toxic nature of chelated selenium peptides is boosting its use in cosmetic production. The boom in skincare products such as lotions, creams, and serums is set to directly propel the consumption of powder-based chelated selenium. The analysis by Cosmetics Europe reveals that over 500 million individuals in Europe use any kind of cosmetic product every day.

Our in-depth analysis of the global chelated selenium market includes the following segments:

|

Chelating Agent

|

|

|

Application |

|

|

Form |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chelated Selenium Market Regional Analysis:

North America Market Forecast

In chelated selenium market, North America region is predicted to dominate over 68.9% revenue share by 2035. The high demand for nutraceuticals, the swiftly expanding fitness industry, innovations in animal feed production, and increasing use in food and beverages are fueling the demand for chelated selenium in the region. The U.S. and Canada are both high-growth marketplaces for chelated selenium producers.

The U.S. is witnessing a positive export and import trade of selenium owing to high demand from end use industries. The report by the World Integrated Trade Solution (WITS) revealed that the U.S. exported around 150,916 kg of selenium around the globe, in 2023. Whereas the OEC report estimated USD 11.9 million worth of the U.S. selenium import, in 2022. Fitness enthusiasts are playing a vital role in boosting the sales of chelated selenium-based supplements.

Canada’s expanding nutraceutical market is significantly driving the consumption of chelated selenium. The continuous innovations in product formulations are set to offer profitable opportunities for chelated selenium producers. The OEC analysis reveals that Canada exported around USD 7.02 million worth of selenium, in 2022. Furthermore, the health and wellness trends are expected to double the revenue growth of chelated selenium producers in the country.

Asia Pacific Market Statistics

The Asia Pacific chelated selenium market is set to increase at the fastest CAGR between 2026 to 2035. The rapidly expanding pharmaceutical sector, rising trade of food and beverage products, and swiftly increasing livestock industry are augmenting the demand for chelated selenium. China and India are high-growth for chelated selenium market manufacturers. The J- and K-beauty trends are fueling the consumption of chelated selenium in Japan and South Korea.

China is one of the largest importers of selenium and accounted for USD 28.5 million worth of import trade in 2022, according to the OEC analysis. The food & beverage and animal feed companies are substantially driving the consumption of chelated selenium in the country. Key players targeting China are anticipated to witness 2x revenue growth in the coming years.

In India, the supportive government investments in the pharma sector, the shift towards fitness, and innovations in nutraceuticals are driving high sales of chelated selenium. For instance, the India Brand Equity Foundation (IBEF) report reveals that the pharmaceutical market size is set to total USD 450.0 billion by 2047. Up to 100% foreign direct investments (FDI) in pharmaceuticals are also set to propel the chelated selenium market growth in the years ahead. The increasing investments in healthcare infrastructures and boasting pool of skilled medical professionals in both allopathic and homeopathic segments are also anticipated to push the demand for chelated selenium in the country.

Key Chelated Selenium Market Players:

- IBSA USA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Regent, Inc.

- Hebei Welcome Pharmaceutical Co. Ltd.

- Nutreco N.V.

- Lallemand Inc.

- Archer Daniels Midland Company

- Qingdao Kexing Bioengineering Co. Ltd.

- Alltech

- Shandong Boan Biotechnology Co. Ltd.

- Koninklijke DSM N.V.

- Jiangxi Wufeng Biological Technology Co., Ltd.

- Zhejiang NHU Co., Ltd.

- Beijing Soley Biotechnology Co., Ltd.

- Guangdong Haide Biotechnology Co. Ltd.

- Cargill Incorporated

- Zobele Group

The chelated selenium market is characterized by the presence of industry giants and the increasing emergence of new companies. Industry giants are employing various organic and inorganic strategies such as technological innovations, investments in research and development activities, strategic collaborations and partnerships, mergers and acquisitions, and global expansions to earn high profits and reach a wider customer base. Start-ups are heavily investing in R&D to stand out in the crowd and capture a strong market position.

Some of the key players in chelated selenium market:

Recent Developments

- In May 2024, IBSA USA revealed the launch of two new Syrel and Thirodium dietary supplements. Syrel is the combination of selenium and BioPerine, and Thirodium is manufactured using iodine.

- In March 2022, American Regent, Inc. announced the launch of Selenious Acid Injection in a 12 mcg/2 mL single-dose vial. This injection is a source of selenium for adult and pediatric patients experiencing nutrition deficiency.

- Report ID: 6973

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chelated Selenium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.