Change Management Software Market Outlook:

Change Management Software Market size was over USD 3.5 billion in 2025 and is estimated to reach USD 8.1 billion by the end of 2035, expanding at a CAGR of 9.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of change management software is assessed at USD 3.8 billion.

The supply chain system for the market has encompassed a wide range of services, which include continuous maintenance, deployment, and software development. These activities are essential components of the wider manufacturing ecosystem. According to an article published by the MCRHRDI Government in 2022, the concept of change management in e-governance caters to 4% of technology, 4% of business process reengineering, and 92% of people management. Besides, as per the August 2025 Department of Science and Technology article, an outlay of Rs. 1 Lakh has been suitable for catalyzing private sector participation in research and development (R&D) to strengthen India’s technological self-reliance and tactical technologies, thus making it suitable for the market’s upliftment.

Gross Domestic Expenditure on R&D Across Different Countries (2023)

|

Countries |

% of GDP |

|

Israel |

6.3 |

|

Korea |

5.0 |

|

Sweden |

3.6 |

|

U.S., Japan |

3.4 |

|

Belgium, Austria |

3.3 |

|

Switzerland |

3.2 |

|

Germany, Finland, Denmark |

3.1 |

|

UK |

2.7 |

|

Iceland |

2.6 |

|

Netherlands |

2.3 |

Source: OECD

Moreover, the technological advancement continues to remain as one of the pillars of value creation and productivity in the overall manufacturing landscape, which is positively impacting the change management software market development. Besides, the aspect of operational efficacy achieved by technological progress is also driving the market’s demand. In this regard, as stated in the 2025 Business of Government Organization data report, based on AI technology adoption, McKinsey & Company reported an approximate federal savings between USD 285 billion to USD 295 billion yearly for productivity optimization, along with USD 725 billion to USD 765 billion for local and state government. Therefore, all these savings denote an optimistic outlook for the market’s upliftment globally.

Key Change Management Software Market Insights Summary:

Regional Highlights:

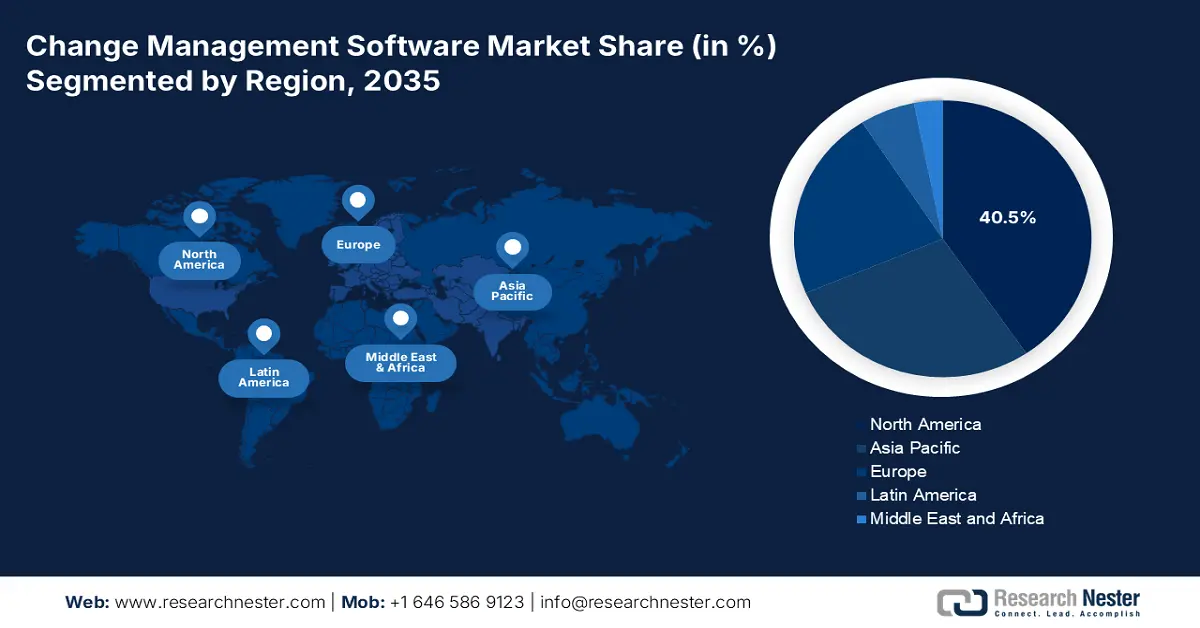

- By 2035, North America is anticipated to command a 40.5% share in the change management software market, supported by advanced ICT infrastructure and substantial government funding for digital initiatives.

- Europe is projected to be the fastest-growing region by 2035, spurred by strict digital regulations and an accelerated push for digital transformation across key industries.

Segment Insights:

- By 2035, the subscription-based (SaaS) segment in the change management software market is forecast to capture a 75.8% share, propelled by predictable recurring revenue models and enhanced consumer accessibility with flexible upgrades.

- By 2035, the cloud-based segment is set to secure the second-largest share, owing to its scalability, flexibility, and cost-efficient resource utilization.

Key Growth Trends:

- Digital transformation across industries

- Rising demand for agile and scalable solutions

Major Challenges:

- Integrating complexity across legacy systems

- Demonstrating and measuring tangible ROI

Key Players: ServiceNow (U.S.), Microsoft (U.S.), Atlassian (Australia), IBM (U.S.), BMC Software (U.S.), Broadcom (U.S.), Ivanti (U.S.), Freshworks (India), SolarWinds (U.S.), ManageEngine (India), Cherwell Software (U.S.), Micro Focus (U.K.), SAP (Germany), Oracle (U.S.), EasyVista (France), Axios Systems (U.K.), Zoho Corporation (India), Jira Service Management (Atlassian – Australia), NinjaOne (U.S.).

Global Change Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.8 billion

- Projected Market Size: USD 8.1 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, United Arab Emirates

Last updated on : 3 November, 2025

Change Management Software Market - Growth Drivers and Challenges

Growth Drivers

- Digital transformation across industries: An increase in the implementation of digitalized technologies across telecommunication, manufacturing, healthcare, and finance sectors readily serves as a suitable catalyst for the change management software market. For instance, according to an article published by the Carnegie Endowment Organization in September 2023, with digital transformation, financial services grew from 35% back in 2011 to 78% over the past 4 years. Therefore, change management software significantly facilitates a seamless shift by permitting stakeholder and training management, along with real-time collaboration and combating resistance.

- Rising demand for agile and scalable solutions: In the current fast-forward business environment, organizations demand flexible and agile software to rapidly adapt to modified market conditions and administrative changes. Besides, as per an article published by Technological Forecasting and Social Change in November 2024, based on digital transformation, the E-Government Development Index in China has increased from 0.4 in 2003 to 0.8 in 2022, which further reflects a 3.7% yearly growth rate. Therefore, the need for scalable platforms that can support enterprise-wide change programs, from small teams to global operations, is fueling market expansion.

- Increased focus on risk mitigation and compliance: As regulatory requirements and governance standards continue to tighten globally, particularly in highly regulated industries such as finance and healthcare, change management software plays an important role in ensuring compliance by providing audit trails, documentation, and risk assessment tools. This focus on risk mitigation encourages organizations to adopt software solutions that systematically manage change processes, reducing the likelihood of non-compliance penalties and operational risks.

Challenges

- Integrating complexity across legacy systems: One of the primary challenges faced by the market is the complicated integration with legacy IT systems. Many organizations, especially in sectors such as manufacturing, healthcare, and finance, operate on outdated infrastructure that lacks compatibility with modern change management platforms. This leads to high integration costs, extended deployment timelines, and increased risk of operational disruptions. As companies upgrade and modernize, incorporating new software with fragmented legacy ecosystems remains a critical hurdle to achieving smooth digital transformation.

- Demonstrating and measuring tangible ROI: One of the challenges readily inhibiting the change management software market adoption is the inefficiency in quantifying direct return on investment. For instance, decision-makers, especially in cost-sensitive companies, significantly struggle to justify the substantial investment in software licenses. This is readily exacerbated by the expense of not constituting effective change management, which is either poorly tracked or frequently hidden, thereby negatively impacting the market’s development across different nations.

Change Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 8.1 billion |

|

Regional Scope |

|

Change Management Software Market Segmentation:

Pricing Model Segment Analysis

The subscription-based (SaaS) segment in the market is projected to account for the largest share of 75.8% by the end of 2035. The segment’s upliftment is highly attributed to its ability to offer recurring and predictable revenue for businesses, while providing consumers with low upfront expenses, continuous accessibility, and flexibility to upgraded software. For instance, according to an article published by the IBEF Organization in July 2023, the SaaS market in India is projected to cater to nearly 7% to 10% of the global SaaS market from 2% to 4%. Additionally, the SaaS business in the country gathered USD 2 billion across 93 transactions, which positively impacts the change management software.

Deployment Mode Segment Analysis

The cloud-based segment in the market is expected to cater to the second-largest during the projected period. The segment’s growth is highly fueled by its importance for flexibility, scalability, and cost savings, permitting businesses to pay only for usability and scale resources. In this regard, the February 2025 International Journal of Public Administration in the Digital Age article indicated that the e-government services success rate accounts for 35% across developed nations and 15% in developing economies. In addition, through cloud computing, the U.S. General Services Administration has gained 72% in cost savings, along with 99.9% less downtime by focusing on cloud services, thus boosting the segment’s growth.

Component Segment Analysis

The software/solution segment in the change management software market is predicted to garner the third-largest share by the end of the forecast timeline. The segment’s development is fueled by the crucial demand for automated, scalable, and standardized workflows to increasingly manage complicated digital transformation. Organizations have prioritized these approaches to successfully replace additional methods, ensure administrative compliance, enhance project success rates, and minimize disruption risks. The segment is also continuously evolving and adopting innovative features, such as predictive analysis, along with AI-based impact analysis to proactively recognize potential bottlenecks.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Pricing Model |

|

|

Deployment Mode |

|

|

Component |

|

|

Organization Size |

|

|

Function |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Change Management Software Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the largest share of 40.5% by the end of 2035. The market’s growth in the region is highly attributed to advanced ICT infrastructure and high government funding for digital initiatives. According to an article published by the NTIA Government in 2023, there has been an increase in the federal broadband funding, amounting to USD 62.6 billion between financial years 2020 and 2022, denoting a rise from USD 1.7 billion in 2020 to USD 64.3 billion in 2022. Besides, as per the January 2025 NTIA Government article, the USD 1.5 billion Wireless Innovation Fund readily supports the upliftment of interoperable and open wireless networks, thus suitable for boosting the market in the region.

The U.S. change management software market is expected to hold a dominant revenue share throughout the forecast period, driven by notable federal investments in broadband and digital infrastructure. As stated in the Broadband USA NTIA Government article, at the beginning of 2022, the Broadband Equity Access and Deployment Program (BEAD) Program is considered a USD 42.4 billion federal grant program, with the intention to connect every person to high-speed internet. Besides, the Federal Communications Commission (FCC) has provided generous funding to different states and territories in the country to ensure cost-effective internet service, which is also driving the market.

FCC 2022 Digital Inclusion Funding in Different Cities

|

State/Country |

State/Territory |

Funding Amount |

Number Associated with Measure |

|

Alabama |

State |

USD 41,209,928.0 |

230,495 |

|

Alaska |

Territory |

USD 3,594,632.0 |

9.314 |

|

California |

State |

USD 260,902,393.9 |

1,464,933 |

|

Delaware |

State |

USD 3,848,678.6 |

25,234 |

|

Florida |

State |

USD 149,953,952.6 |

853,744 |

|

Georgia |

State |

USD 72,013,838.4 |

430,451 |

Source: NTIA Government

The market in Canada is also growing significantly, owing to the provision of generous public sector investments and nationwide digitalized transformation approaches in modernizing severe facilities. Besides, according to an article published by the Government of Canada in February 2025, online services in the country comprised 54% of the population utilizing websites as the ultimate method of contact, 34% use telephone as one of the main channels, and 4% visited kiosks, service counters, and offices. Therefore, there is a huge scope for bolstering the market’s exposure in the overall country.

Europe Market Insights

Europe in the change management software market is expected to emerge as the fastest-growing region during the projected period. The market’s upliftment in the region is driven by the strict regional digital regulations, along with a robust push for digitalized transformation across different industries, such as the financial and manufacturing sectors. In addition, the demand for compliance with standard frameworks, including the Digital Operational Resilience Act (DORA) and the Data Governance Act, has compelled companies to adopt format modification management processes for IT systems.

UK market is gaining increased exposure, owing to the existence of administrative requirements, including the Bank of England's operational resilience and stress testing frameworks, which have mandated stringent change control processes. According to an article published by the UK Government in October 2022, there has been a surge in private capital flow to the country, amounting to £27.4 billion for the technology field. In addition, it has been estimated that the support received from the government can strengthen the digital economy, with an increase in the yearly gross value added (GVA) of £41.5 billion by the end of 2025, along with the provision of 678,000 employment opportunities.

The change management software market in Germany is also developing due to its leadership in the Industry 4.0 and manufacturing initiatives. The country has readily focused on the Internet of Things (IoT) as well as smart factories to develop a complex IT/OT landscape that demands meticulous modification management to combat security breaches and expensive downtime. As per an article published by the Trade Government in May 2025, the country comprises more than 500 operational data centers, and the revenue for the IT market is expected to increase to USD 25.3 billion by the end of 2029 at a 6.2% growth rate. In addition, the cloud data infrastructure expansion is playing a crucial role in this development, displaying a 45% growth of the market, thus suitable for change management software.

APAC Market Insights

The market in the Asia Pacific is projected to grow steadily by the end of the forecast period due to accelerated digital transformation across sectors such as manufacturing, telecommunications, and healthcare. Governments in countries such as India, Japan, and South Korea are prioritizing ICT infrastructure and cybersecurity investments, fostering a conducive environment for adoption. The increase of cloud-based platforms and the growing demand for automation tools are driving software deployments. Additionally, increased enterprise focus on compliance and operational agility in the face of rapid regulatory changes supports market growth. The region's growing SME base is also turning to scalable change management tools for streamlined operations.

The change management software market in China is gaining increased traction due to huge investments in AI, 5G, and digital governance under its Digital China strategy. The Ministry of Industry and Information Technology (MIIT) is promoting industrial digitalization, with a focus on smart manufacturing and modernizing enterprises. Besides, as stated in the China Organization article, in September 2025, Beijing Data Group (BDG) has been launched to readily drive digitalized economy ambitions in the country. The ultimate purpose was to adopt the latest quality productive forces, along with a standard approach to sharpen Beijing’s competitive edge, thereby boosting the market’s development.

The change management software market in India is also developing, owing to the government’s generous expenditure on the Digital India initiative, which has resulted in a huge demand for IT governance tools. The focus of the initiative is to develop a digital public facility, which has indirectly spurred upliftment in the market, since both private and public industrial projects need these solutions for successful integration. According to the August 2025 PIB Government report, the digitalized economy contributed to 11.7% of the national income as of 2022 and 2023, which was expected to surge to 13.4% between 2024 and 2025, highly fueled by digital infrastructure, cloud computation, and artificial intelligence.

Key Change Management Software Market Players:

- ServiceNow (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft (U.S.)

- Atlassian (Australia)

- IBM (U.S.)

- BMC Software (U.S.)

- Broadcom (U.S.)

- Ivanti (U.S.)

- Freshworks (India)

- SolarWinds (U.S.)

- ManageEngine (India)

- Cherwell Software (U.S.)

- Micro Focus (U.K.)

- SAP (Germany)

- Oracle (U.S.)

- EasyVista (France)

- Axios Systems (U.K.)

- Zoho Corporation (India)

- Jira Service Management (Atlassian - Australia)

- NinjaOne (U.S.)

- SysAid (Israel)

- ServiceNow is one of the market leaders, well-known for its strong and ITIL-based change management module within the Now Platform that automates and centralizes enterprise IT operations. Its contribution caters to settling the industrial standard for adopting change management with wide-ranging IT Service Management (ITSM). Besides, as per its 2024 annual report, the company achieved almost USD 11 billion in revenue by maintaining standard profitability, thus proving to continue its contributions.

- Microsoft has successfully leveraged its massive enterprise footprint by embedding change management capabilities into its Power Platform and Azure cloud services, thus promoting seamless integration and low-code automation with its productivity suite. This approach has democratized change management, thus making it accessible for firms to deeply embed in the organization’s ecosystem.

- Atlassian dominates the DevOps-based and agile segment with Jira Service Management, providing a suitable change management solution, which is highly implemented with project and development tracking tools. Its contribution has popularized a more collaborative, developer-friendly, and flexible way to modify control, which differentiates from rigid and conventional ITIL models. Based on this, the company’s 2024 annual report indicated USD 4.4 billion in revenue, along with USD 2.7 billion in cloud revenue, and 45,842 customers in CloudARR.

- IBM makes the provision of enterprise-based change management through its Watson AIOps and Turbonomic offerings, readily focusing on application source management, analytics, and AI-based automation. The organization’s contribution is also advancing the market to cognitive and predictive operations, wherein AI actively optimizes performance and assesses change risks.

- BMS Software is regarded as the long-lasting leader with its Helix ITSM platform, providing robust and enterprise-specific change management that has excelled in hybrid and complex IT settings. The organization’s notable contribution is providing high-level control, customization, and governance, demanded by regulated and large international enterprises.

Here is a list of key players operating in the global market:

The worldwide change management software market is highly dominated by a combination of regional experts and international firms. Notable organizations, such as Oracle, IBM, and Microsoft, account for a significant market share, owing to widespread global presence and extended product launches. Besides, firms in Europe, such as Software AG and SAP SE, readily utilize their software expertise to maintain competitive benefits. In addition, Atlassian has made an expansion steadily with agile-centric and user-friendly solutions. Besides, in March 2025, Accenture and Siemens effectively made advancements in their long-lasting alliance-based partnership to assist clients in transforming and reinventing manufacturing and engineering, which is positively impacting the market growth.

Corporate Landscape of the Market:

Recent Developments

- In February 2025, BD declared that its board of directors has successfully authorized BD management to adopt the plan to separate the company’s Biosciences and Diagnostic Solutions business, with the intention of focusing on growth-based investment and capital allocation.

- In January 2025, EY introduced the newest global integrated marketing campaign, known as Transformation, which comprises 30-second and 60-second television commercials, along with digital out-of-home and online advertisements, thus driving business transformation and innovation.

- In January 2025, Microsoft Corp. notified a tactical collaboration to address the global challenge, which is skilling for the AI era. This partnership focused on offering employees, learners, and workers with the newest AI-based products and services to prepare both present and future workforces.

- Report ID: 3656

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Change Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.