Cesium Hydroxide Market Outlook:

Cesium Hydroxide Market size was over USD 347.8 million in 2025 and is poised to exceed USD 588.49 million by 2035, witnessing over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cesium hydroxide is estimated at USD 364.7 million.

The cesium hydroxide market is primarily expanding due to its extensive use in producing photomultiplier tubes (PMTs), used in various electronic devices, including particle detectors, medical imaging systems, and night vision goggles. Also, artificial intelligence (AI) advancements often require high-performance hardware, including semiconductors. Cesium hydroxide is used in the manufacturing of specialized glass and materials essential for electronic components, indirectly increasing its demand.

Additionally, the increased investments in medical imaging, night vision technologies, and particle physics research are expected to enhance the market for PMTs in the future years significantly. This increase in PMT use will result in a rise in the demand for cesium hydroxide. For instance, in a Series B+ round, Subtle Medical Inc., the industry leader in AI-powered medical image acquisition, raised over USD 30 million to develop its AI imaging enhancement solutions and over USD 50 million in total in its latest funding round. Top U.S. and international investors including EnvisionX Capital, BRV Capital, Ignite Innovation, and Samsung Ventures are among the investors, as are current shareholders like Fusion Fund. The funds will mostly go toward speeding up sales campaigns in the U.S. and abroad and launching new AI-powered products.

Further, Bain Capital Life Sciences leads HeartFlow, a leader in transforming precision heart care, in closing USD 215 million in series F funding. Moreover, the top AI-powered disease identification and care coordination platform, Viz.ai, has raised USD 100 million in investment at a valuation of USD 1.2 billion. Tiger Global and Insight Partners lead the Series D financing, which coincides with the Viz Platform exceeding 1,000 hospitals and serving millions of patients. This expansion is influenced by technological advancements and the increasing prevalence of chronic diseases, necessitating improved imaging solutions.

A range of cesium compounds and metals are made from cesium minerals as feedstocks. By gross weight, cesium is mostly utilized in cesium formate brines for high-temperature, high-pressure well drilling in oil and gas exploration manufacturing. Since cesium is not widely available, many applications have turned to cesium mineral alternatives. Below are the various applications of several cesium compounds:

|

Cesium Compounds |

Applications |

|

Cesium Metal |

|

|

Cesium Bromide |

|

|

Cesium Carbonate |

|

|

Cesium Chloride |

|

|

Cesium Hydroxide |

|

|

Cesium Iodide |

|

|

Cesium Nitrate |

|

|

Cesium Sulfates |

|

|

Cesium isotopes |

|

Source: U.S. Geological: Survey’s Mineral Commodity Summaries

Key Cesium Hydroxide Market Insights Summary:

Regional Highlights:

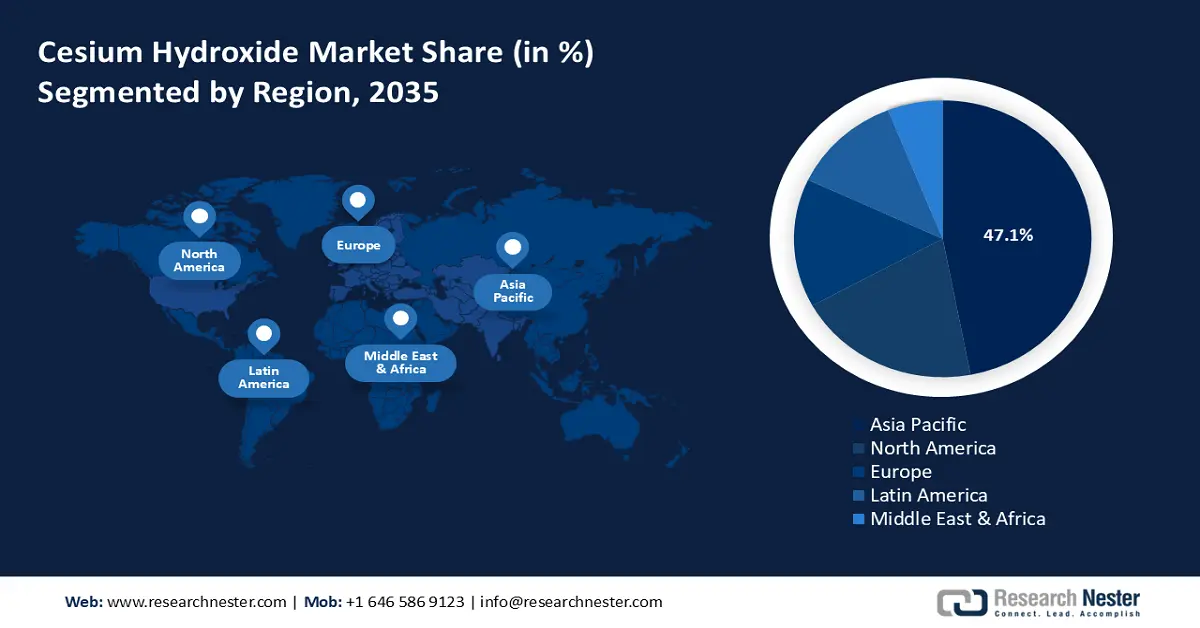

- By 2035, Asia Pacific is projected to command over 47.1% of the cesium hydroxide market owing to the rising demand across electronics, glassmaking, and pharmaceutical industries.

- North America is anticipated to secure a notable share through 2026-2035, bolstered by the region’s strong presence of major manufacturers and an advancing medical research ecosystem.

Segment Insights:

- The electronics segment in the cesium hydroxide market is set to capture more than 54.5% share by 2035, propelled by the escalating production of LEDs, LCDs, and other electronic devices.

- The lepidolite segment is expected to garner a notable share through 2026-2035, supported by the expanding use of cesium-derived materials in modern electronics, semiconductors, and energy-storage technologies.

Key Growth Trends:

- Discovery of new reserves

- Technological advancements

Major Challenges:

- Rarity of cesium

- Availability of substitutes

Key Players: Power Metals Corp., Cascadero Copper Corporation, Merck KGaA, Thermo Fisher Scientific, ESPICorp Inc., American Elements, Blue Lie Corporation, Adtran, Inc., Fluorochem Ltd., ProChem, Inc.

Global Cesium Hydroxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 347.8 million

- 2026 Market Size: USD 364.7 million

- Projected Market Size: USD 588.49 million by 2035

- Growth Forecasts: 5.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 2 December, 2025

Cesium Hydroxide Market - Growth Drivers and Challenges

Growth Drivers

-

Discovery of new reserves: Cesium hydroxide market key players are concentrating on uncovering high-quality cesium deposits, which is expected to boost global supply and help ease some of the shortages linked to this rare element. Exploration and drilling efforts by major players help maintain a reliable supply chain for cesium hydroxide production. For instance, in May 2024, Cascadero Copper Corporation completed its Preliminary Economic Assessment (PEA) for its Taron Cesium Project in Salta, Argentina. The PEA reveals that the drilled area of the Taron site has 23.85 Mt of Cesium at a grade of 2,131 ppm.

Also, in June 2024, Power Metals Corp. revealed high-grade cesium and lithium results for the remaining exploration drill hole assays from the winter 2024 drill program at its 100% owned Case Lake property in northeastern Ontario. Exploration drilling at the world-class West Joe Prospect has yielded shallow high-grade cesium mineralization up to 24.70% (PWM24-198) contained in pollucite. -

Technological advancements: Cesium hydroxide is increasingly recognized for its diverse applications, particularly with ongoing research and development. It finds use in energy conversion and storage systems, such as batteries and fuel cells. The cesium hydroxide market can further benefit from improvements in production techniques that make it simpler and more affordable to manufacture.

Additionally, advancements in drilling technologies and completion methods significantly influence current market trends. As the oil and gas sector adopts more advanced drilling practices, especially HPHT drilling, the demand for chemicals like CsOH is expected to rise. Strict regulations in the industry push producers to focus on delivering high-quality CsOH, contributing to the overall growth of the cesium hydroxide market. Thus, these factors play a crucial role in driving revenue for cesium hydroxide market. -

Growing application in various industries: Cesium hydroxide catalyzes the production of additional cesium compounds, the synthesis of organic compounds, and the production of expert glassware. For instance, several industries, including electronics, construction, and the automobile sector, use specialty glasses. Since fused calcium hydroxide dissolves glass by attacking its silica structure, it can be used to dissolve glass samples in a solution for analytical reasons in the commercial glass industry as well as in defense waste processing facilities.

Challenges

-

Rarity of cesium: Cesium hydroxide is a relatively rare chemical; therefore, a scarcity of cesium ore may impede production. Additionally, raw materials can be relatively expensive, and the synthesis of cesium hydroxide may necessitate specialized techniques. This can impact cesium hydroxide's overall cost-effectiveness in comparison to other chemicals.

-

Availability of substitutes: Rubidium, potassium, and sodium are alternatives for cesium in decreasing order of acceptability. In the production of MHD power, potassium has almost or entirely replaced cesium. Since they are photosensitive, germanium, rubidium, selenium, silicon, tellurium, and several other elements and compounds can be used instead of cesium. Therefore, the availability of these alternatives will impede the cesium hydroxide market from expanding.

Cesium Hydroxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 347.8 million |

|

Forecast Year Market Size (2035) |

USD 588.49 million |

|

Regional Scope |

|

Cesium Hydroxide Market Segmentation:

End use Segment Analysis

The electronics segment is set to capture over 54.5% cesium hydroxide market share by 2035. The need for cesium hydroxide is rising as more light-emitting diodes (LEDs), liquid crystal displays (LCDs), and other electronic gadgets are manufactured. Also, cesium atoms serve as the reference for time measurement in atomic clocks. The resonant frequency is the frequency at which the cesium atoms are exposed to microwave radiation. After absorbing the radiation, the atoms change their energy states. The atomic clock measures time precisely by keeping track of the number of transitions that take place.

Additionally, cesium is utilized in ion thrusters and other spacecraft propulsion systems. Electric fields are used in ion thrusters to accelerate ions and produce thrust. Furthermore, due to its low ion mass and strong ionization potential, cesium is utilized as the propellant in these thrusters. Moreover, cesium is also utilized in the manufacture of glass and optics. Glass formulations can benefit from the addition of cesium compounds to increase their refractive index and optical performance.

Source Segment Analysis

The lepidolite in cesium hydroxide market will garner a notable share in the forecast period. Lepidolite is a simple source of cesium and an almost common mineral. Lepidolite mining is increasingly aligned with sustainable practices, enhancing its appeal as an environmentally responsible source of cesium. This aligns with the global push for sustainable industrial growth, further driving its adoption. The demand for lepidolite as a fuel is directly driven by the expansion of modern electronics, semiconductors, and energy storage devices such as batteries, all of which depend on cesium hydroxide generated from lepidolite.

Our in-depth analysis of the global cesium hydroxide market includes the following segments:

|

Source |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cesium Hydroxide Market - Regional Analysis

APAC Market Insights

Asia Pacific in cesium hydroxide market is set to hold more than 47.1% revenue share by 2035. The main driver of the market's growth in the region is the growing need for cesium hydroxide in industries including electronics, glassmaking, and pharmaceuticals. Also, the region witnesses increasing energy demands which has seen substantial investments in oil and gas exploration and production activities. According to the International Renewable Energy Agency, over half of the world's energy is consumed in this region, and fossil fuels provide 85% of that consumption. Over the last ten years, electrification rates have significantly increased, and in 2019, the regional electrification rate hit 96.6%. Furthermore, the expanding healthcare infrastructure and a focus on advanced medical treatments in developing nations such as India and China have boosted the demand for cesium hydroxide.

Due to its capacity to absorb neutrons, cesium is employed extensively in nuclear energy and reactors for power generation in China. Cesium-137 is a byproduct of nuclear fission in nuclear reactors. It can be disposed of as radioactive waste or a gamma source for industrial radiography. Also, due to its lengthy half-life of roughly 30 years, cesium-137 is radioactive for a considerable time. According to the China Atomic Energy Authority, 440,000 gigawatt-hours of nuclear power were generated on the Chinese mainland in 2023, making up about 5% of the country's total electrical output. A safe and steady supply of nuclear fuel is guaranteed by China's self-sufficient and extensive nuclear industry chain structure. China has established a strong basis for the superior development of nuclear energy by developing skills in engineering, construction, and operation, as well as the capacity to build numerous nuclear power units at the same time.

India has made the deliberate choice to use vitrified cesium as an irradiation source. The only nation with the technology is India of HLLW partitioning and 137Cs production in vitrified form. The state of art production of vitrified cesium pencils has been achieved through the mastery of vitrification technology. It has been demonstrated that radiocesium can be immobilized in the vitreous matrix using a sodium borosilicate (NaBS) formulation.

Furthermore, the nation has set ambitious plans to expand its oil exploration sectors, fueling demand for cesium hydroxide. For instance, in July 2024, by 2030, there will be USD 100 billion in investment opportunities in the exploration and production (E&P) sector. Also, the region is one of the major importers of cesium due to its increasing demand. For instance, from March 2023 to February 2024 (TTM), 693 shipments of cesium were imported into India. 54 Indian consumers purchased these items from 92 foreign exporters, representing a 1% increase over the previous 12 months. India purchased 51 shipments of cesium during this time, in February 2024 alone. This represents a 55% sequential increase from January 2024 and a -20% year-over-year growth from February 2023.

North America Market Insights

North America cesium hydroxide market will gain a substantial share in the forecast period. The market growth can be attributed to the presence of major manufacturers and suppliers, making it easier for companies to access the product. Moreover, the U.S. has a robust medical research sector to find applications of cesium in medical equipment and cancer treatment. Also, the price of cesium compounds in the U.S. is deeply dependent on factors such as purity, production costs, demand, and supply chain logistics. As the isotope 133Cs, cesium is the rarest of the naturally occurring alkali metals. As a result, its compounds are uncommon, reflecting their limited availability and their expensiveness.

U.S. statistics on component pricing of cesium compounds in 2022-2023

|

Cesium Compound |

Quantity |

Price in 2022 |

Price in 2023 |

Percentage Increase |

|

Cesium Metal |

1 gram |

USD 76.97 |

USD 91.60 |

19% |

|

Cesium Metal |

1 gram |

USD 97.86 |

USD 117.00 |

20% |

|

Cesium Acetate |

50 grams |

USD 131.20 |

USD 142.00 |

8% |

|

Cesium Bromide |

50 grams |

USD 75.90 |

USD 98.10 |

29% |

|

Cesium Carbonate |

50 grams |

USD 110.20 |

USD 127.80 |

16% |

|

Cesium Chloride |

50 grams |

USD 112.00 |

USD 143.40 |

28% |

|

Cesium Iodide |

50 grams |

USD 127.60 |

USD 163.80 |

28% |

|

Cesium Formate |

25 grams |

USD 46.10 |

USD 49.40 |

7% |

|

Cesium-Plasma Standard Solution |

50 milliliters |

USD 84.53 |

USD 89.80 |

6% |

|

Cesium-Plasma Standard Solution |

100 milliliters |

USD 129.15 |

USD 137.00 |

6% |

Source: U.S. Geological: Survey’s Mineral Commodity Summaries

Furthermore, Canada has the largest deposits of cesium positioning it as a major supplier. The sole active cesium deposit is the Tanco mine in Manitoba, Canada, which has more than 60% of the world's known reserves. The mine was purchased by Sinomine Resource Group Co., Ltd. in 2021. Sinomine (Hong Kong) Rare Metals Resource Co. owns the North American Business Division, which includes Tantalum Mining Corporation of Canada, Limited (Tanco), which is its sole subsidiary. Sinomine Resources Group published the 2022 Annual Report for the Hong Kong-based Shenzhen Stock Exchange in 2023, which reported 116,400 tons of material containing 16,100 tons of Cs2O metal with a grade of 13.83%.

Cesium Hydroxide Market Players:

- Power Metals Corp.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cascadero Copper Corporation

- Merck KGaA

- Thermo Fisher Scientific

- ESPICorp Inc.

- American Elements

- Blue Lie Corporation

- Adtran, Inc.

- Fluorochem Ltd.

- ProChem, Inc.

The cesium hydroxide market is dispersed around the world. The industry's top market participants offer a range of goods to meet the demands of their customers. New launches, agreements, mergers and acquisitions, and partnerships with other businesses are a few strategies implemented by cesium hydroxide market players to increase their visibility.

Recent Developments

- In November 2024, Power Metals Corp. reported a sustained success from its 2024 Phase II drill program at the Company's 100%-owned Case Lake Project (CLP) in northeastern Ontario.

- In September 2023, Adtran announced that one of the world's foremost metrology institutions completed a three-month examination of its OSA 3300-HP high-performance optical cesium atomic clock. Based in Central Europe, the national laboratory evaluated Adtran's industry-first solution for scientific measurement and calibration applications that demand accurate synchronization.

- Report ID: 6980

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cesium Hydroxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.