Cervical Cancer Diagnostics Market Outlook:

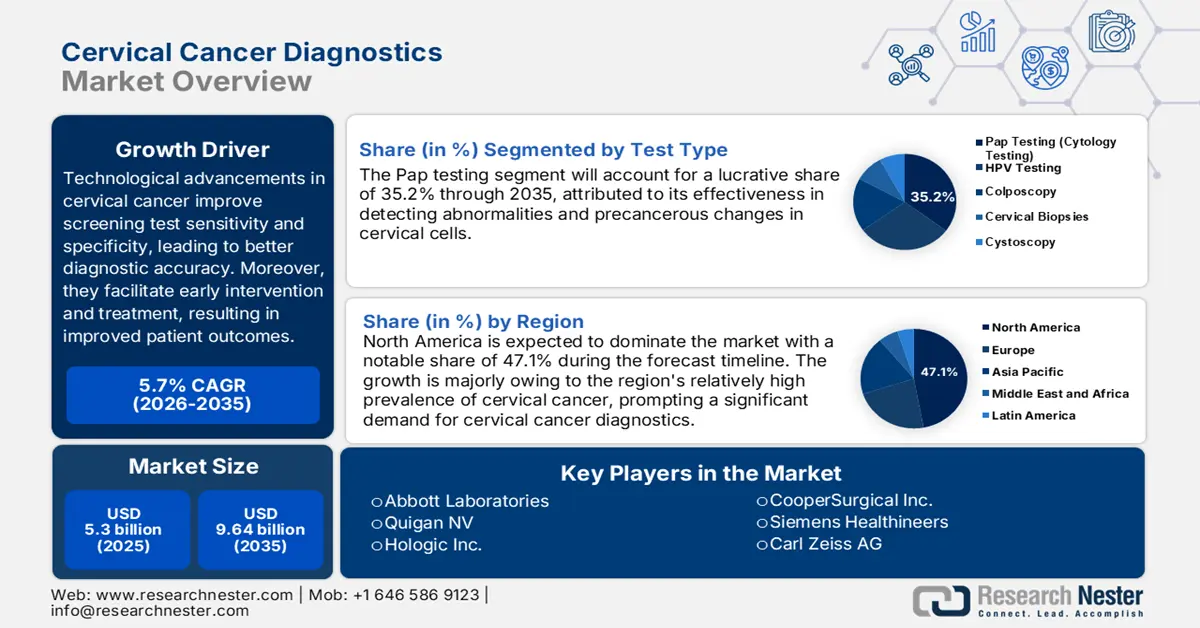

Cervical Cancer Diagnostics Market size was over USD 5.54 billion in 2025 and is projected to reach USD 9.64 billion by 2035, witnessing around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cervical cancer diagnostics is evaluated at USD 5.82 billion.

Cervical cancer diagnostics market is being transformed by the inclusion of artificial intelligence (AI), as the severe limitations of traditional screening techniques is being eradicated. Traditional cytology and visual inspection are plagued with inter-observer variation and resource availability, especially in developing countries. Hence, AI-based solutions are being introduced in an attempt to achieve maximum accuracy and efficacy of cervical cancer diagnosis. For instance, in September 2024, in partnership with engineers from NSV Incorporated, scientists from the International Agency for Research on Cancer (IARC) have created a ground-breaking new artificial intelligence (AI) tool that can precisely identify cervical precancers and cancers.

Furthermore, the increasing prevalence of cervical cancer in middle-aged women and the concomitant increase in screening and diagnostics tests are projected to enhance the market over the forecast period. For instance, in March 2024, as per WHO statistics, approximately 6,60,000 new cases and 3,50,000 deaths from cervical cancer occurred in 2022, making it the 4th most frequent malignancy among women worldwide. Moreover, lifestyle factors such as smoking, using oral contraceptives, and having unclean genitalia can raise a woman's risk of developing cervical cancer and serve as catalysts for the market's expansion.

Key Cervical Cancer Diagnostics Market Insights Summary:

Regional Highlights:

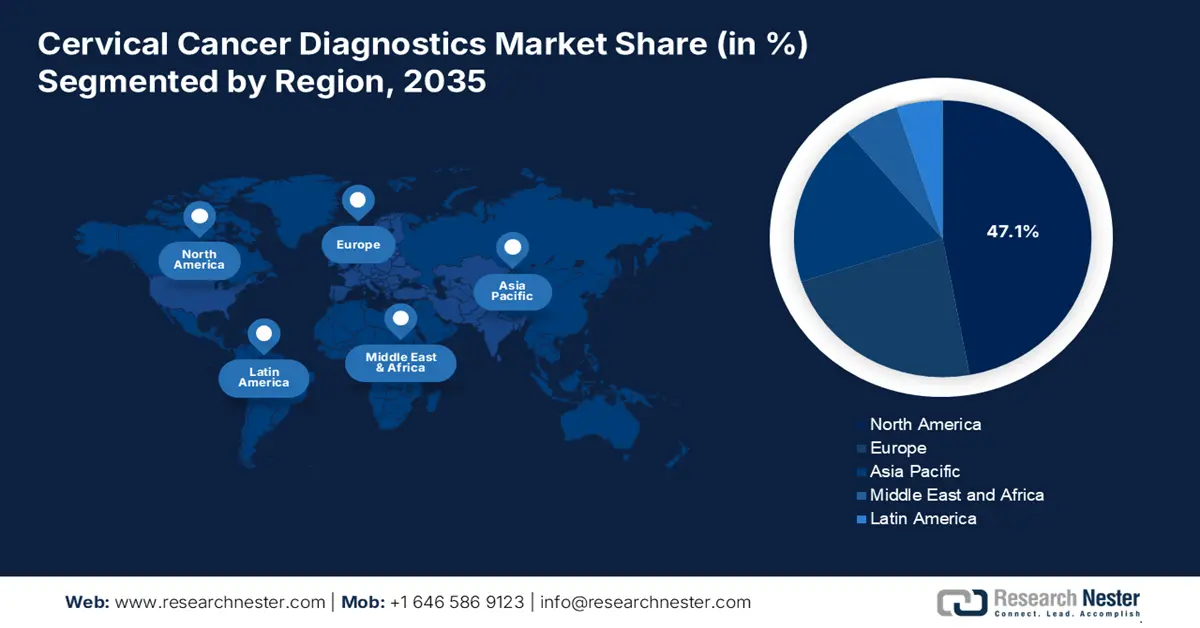

- North America commands the Cervical Cancer Diagnostics Market with a 47.1% share, driven by increased government programs, public awareness, and screening tests, ensuring strong growth through 2026–2035.

- Asia Pacific's Cervical Cancer Diagnostics Market is set for rapid growth from 2026–2035, fueled by rising cervical cancer incidence and public-private partnerships.

Segment Insights:

- Pap Testing segment is anticipated to maintain a strong market share through 2035, propelled by newer technologies and its cost-effectiveness and familiarity.

Key Growth Trends:

- Increasing prevalence of HPV infections

- Rising focus on preventive healthcare

Major Challenges:

- Cultural and social barriers

- Logistical challenges in sample collection and transportation

- Key Players: Quigan NV, Thermo Fisher Scientific Inc, Carl Zeiss AG, Dickinson and Company, Hologic Inc, CooperSurgical Inc, Siemens Healthineers and more.

Global Cervical Cancer Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.54 billion

- 2026 Market Size: USD 5.82 billion

- Projected Market Size: USD 9.64 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Cervical Cancer Diagnostics Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing prevalence of HPV infections: The surge in infection rate due to human papillomavirus (HPV) is the key driver in the growth of the cervical cancer diagnosis market. For instance, in May 2024, 1045 samples were chosen for routine cervical exams in this cross-sectional investigation. 159 patients (15%) out of 1045 had HPV infection, with 50.3% having LSIL by frequent HPV types 6, 18, 16, and 11, 19.4% having HSIL by frequent HPV types 16, 18, and 30.1% having ASCUS by frequent HPV types 6, 11, respectively. The highest frequency of HPV infection was seen in the 30- to 40-year-old (p-value = 0.6) and people with mixed genotype in 21.4% of cases.

-

Rising focus on preventive healthcare: The trend of moving towards proactive health care has witnessed greater levels of screening practice being adopted hence, spurring the market demand. For instance, in December 2024, National Library of Medicine revealed that between 1975 and 2020, 1 million deaths from breast cancer, 3.45 million from lungs cancer, out of 370,000 fatalities from cervical cancer, 160,000 in the case of colorectal cancer, screening and excision of precancerous polyps accounted for 79% of the 940,000 deaths, 360,000 fatalities prevented from prostate cancer. PSA testing contributed 56% and advancements in treatment contributed 44%.

Challenges

- Cultural and social barriers: The biggest hindrance to the successful implementation of cervical cancer diagnostics market is social psychology and taboo. The socio-cultural taboo against gynecological tests, rooted in deeply ingrained cultural practices, results in rebellion among women against the procedures for obtaining the sought-after screening. It is also because of the taboo on sexual and reproductive health, which can create a culture of shame and humiliation, deterring women from making use of themselves in medical facilities. These compound together to produce late diagnoses, low rates of screening, and ultimately a higher percentage of advanced-stage cervical cancer, for targeted interventions in such socio-cultural barriers.

- Logistical challenges in sample collection and transportation: One of the biggest barriers to effective roll-out of cervical cancer diagnosis market is logistical challenge, especially in geographically remote and resource-poor settings. Sophistication of technology in sample integrity maintenance during transportation, in areas of the country with inadequate transportation facilities and cold storage, poses a real danger to diagnostics accuracy. Transport mismanagement and delay result in sample degradation, rendering test results invalid and making repeated testing mandatory. Insufficiency of SOPs for the transportation and collection of samples and trained staff at rural sites makes it worse, thus hindering mass operation of immediate and precise cervical cancer screening programs.

Cervical Cancer Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 5.54 billion |

|

Forecast Year Market Size (2035) |

USD 9.64 billion |

|

Regional Scope |

|

Cervical Cancer Diagnostics Market Segmentation:

Test Type (Pap Testing (Cytology Testing), HPV Testing, Colposcopy, Cervical Biopsies, Cystoscopy)

Pap testing (cytology testing) segment is predicted to capture over 35.2% cervical cancer diagnostics market share by 2035. With newer technologies available, the Pap test remains a cornerstone of cervical cancer prevention and is cost-effective and familiar to health care providers. For instance, in January 2024, Techcyte and BD (Becton, Dickinson and Company) announced a strategic partnership to provide an AI-based system that helps pathologists and cytologists quickly and accurately detect cervical cancer and precancer signs using whole-slide imaging. Through the arrangement, BD is able to provide a comprehensive solution that attempts to increase throughput and decrease the possibility of human mistake in a Pap test.

Age Group (20-40 Years, above 40 Years)

The 20-40 age group female population is rightfully spearheading the cervical cancer diagnostics market because the same age group makes the highest cervical precancerous lesion and invasive carcinoma presentations. For instance, in November 2020, In November 2020, WHO launched the global strategy to accelerate the elimination of cervical cancer. The strategy included achieving 90% coverage of the human papillomavirus (HPV) vaccine among girls by the age of 15 years, 70% coverage of twice lifetime cervical screening with a high-performance test by age 45 years, and 90% delivery of treatment needed for cervical cancer and precancer by 2030. Diagnostics testing and screening services are therefore accorded the highest priority by this population group, culminating in exceptionally high rates of diagnostics testing for this specific population group.

Our in-depth analysis of the global market includes the following segments:

|

Test Type |

|

|

Age Group |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cervical Cancer Diagnostics Market Regional Analysis:

North America Market Statistics

North America cervical cancer diagnostics market is anticipated to dominate revenue share of over 47.1% by 2035, characterized by the effects on hormones and reproductive health, early menarche and late menopause beyond a typical age can also increase the risk of cervical cancer in women. Screening methods such as pap and HPV tests are becoming more and more popular in the region. Furthermore, the rise is being witnessed in government programs for cervical cancer diagnosis and treatment as well as increased public awareness of the disease. In addition, increase in the number of screening tests throughout the projection period is the existence of attractive reimbursement policies in the region.

The most significant growth driver in the U.S. market due to the collaboratives efforts made by market participants within the country. For instance, in March 2024, to eradicate cervical cancer, governments, donors, multilateral organizations, and partners announced significant new financial, programmatic, and policy commitments, including fresh investment of around USD 600 million. In order to spur national and international momentum to eradicate this preventable disease, these pledges: advancing the Call to Action in Cartagena de Indias, Colombia, were made at the inaugural Global Cervical Cancer Elimination Forum.

In Canada the growth in the cervical cancer diagnostics market is growing rapidly due to the rising adoption of early diagnosis and screenings. For instance, in January 2025, according to a recent survey conducted by BD, 74% of Canadian women have postponed a gynecology visit, and 83% of them want easier access to less invasive cervical cancer testing options, such as at-home self-collection for human papillomavirus (HPV) tests. In addition to this, more than 500 Canadian adult women participated in an online study by The Harris Poll, which revealed that although 69% of them are aware that routine screenings might prevent cervical cancer, more than half (58%) put off seeing a gynecologist out of discomfort or fear. Furthermore, 62% of those surveyed said they were unclear about the frequency of cervical cancer screenings.

Asia Pacific Market Analysis

The Asia Pacific cervical cancer diagnostics market is expanding at a rapid pace owing to the rising incidence of cervical cancer, especially in low- and middle-income nations. The market is also being given possibilities by the numerous government and private partnerships, the rise in R&D efforts, and the strategic objectives of market participants. The goal of cervical cancer diagnostics testing is to find precancerous alterations in tissues and cells and prepare better treatment schedules and aware the prone population of early discovery.

In India, the market is revolutionizing due to the initiatives implemented by companies to disseminate early screening and diagnostics measures. For instance, in March 2025, the Cancer Awareness Prevention and Early Detection Trust (CAPED) and Roche Diagnostics India signed a Memorandum of Understanding. The two organizations collaborated for working together to fight cervical cancer. As part of the collaboration, CAPED will contact businesses in major cities to hold about 100 awareness seminars to empower female employees to take control of their health and educate them about the advantages of HPV DNA testing.

In China, the cervical cancer diagnostics market is witnessing substantial growth owing to the evolving need of the government to take immediate steps in preventing cancer and framing combating strategies. For instance, in January 2025, Brunei unveiled the most recent iteration of the BruHealth app, which includes a national cervical cancer screening program. The Ministry of Health of Brunei launched the National Cervical Cancer Screening Program in collaboration with Borneo Genomics Innovations, a joint venture with the Chinese biotech behemoth BGI Genomics in Brunei.

Key Cervical Cancer Diagnostics Market Players:

-

Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Quigan NV

- Thermo Fisher Scientific Inc

- Carl Zeiss AG

- Dickinson and Company

- Hologic Inc

- CooperSurgical Inc

- Siemens Healthineers

The creation and introduction of innovative, cutting-edge goods based on various technologies is one of the primary market strategies in the competitive market. This is spurred by the strategic moves by companies and their partnerships. For instance, in May 2024, BD (Becton, Dickinson and Company) announced a strategic alliance with Healthians to promote cervical cancer screening by providing a cutting-edge way for Indian women to obtain a sample on their own in the comfort of their own homes.

Here's the list of some key players:

Recent Developments

- In February 2025, Metropolis Healthcare Limited announced that it would be launching a self-sampling human papillomavirus (HPV) DNA test for cervical cancer screening in partnership with Roche Diagnostics India and neighboring markets.

- In September 2024, Unitaid's technology landscape report unveiled at the World Cancer Congress in Geneva, offered a thorough overview of technologies and promising tools that can improve early detection and treatment of precancerous lesions.

- Report ID: 7472

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cervical Cancer Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.