Cell Lysis & Disruption Market Outlook:

Cell Lysis & Disruption Market size was over USD 5.99 billion in 2025 and is projected to reach USD 13.92 billion by 2035, witnessing around 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell lysis & disruption is evaluated at USD 6.46 billion.

The growing demand for biologics, including monoclonal antibodies, vaccines, and gene therapies, is significantly driving the need for efficient cell lysis techniques. Biopharmaceutical and biotechnology companies rely on advanced cell lysis methods to extract proteins, nucleic acids, and other cellular components critical for drug development, cell-based assays, and therapeutic production. Additionally, there is an increasing focus on personalized medicine and regenerative therapies. Further boosts the demand for high-quality cell-lysis reagents and equipment, supporting market expansion.

Total drug approvals vs. biologics approvals by the FDA. (2023)

|

Year |

Total Drugs Approved |

Biologics Approved |

|

2022 |

37 |

15 (40.5%) |

|

2021 |

50 |

14 (28%) |

|

2020 |

53 |

15 (28.3%) |

Source: NLM

Furthermore, the rising adoption of genomic and proteomic research for personalized medicine, drug discovery, and disease diagnostics is significantly driving the need for effective cell disruption techniques. Researchers and pharmaceutical companies require efficient methods to extract nucleic acids and proteins with high purity for applications such as next-generation sequencing, biomarker discovery, and targeted therapies. As precision medicine advances, the demand for high-quality cell lysis reagents and equipment continues to grow, enabling accurate molecular analysis and therapeutic development.

Key Cell Lysis & Disruption Market Insights Summary:

Regional Highlights:

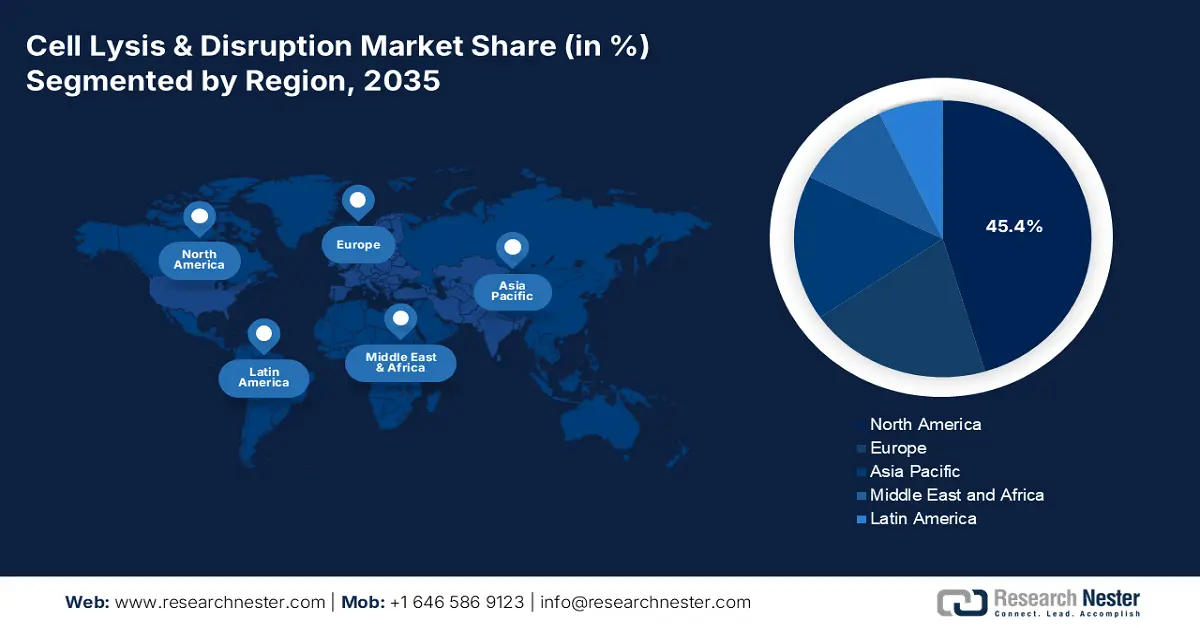

- North America dominates the Cell Lysis & Disruption Market with a 45.4% share, propelled by leadership in genomic and proteomic research, fueling demand for high-quality cell lysis methods through 2026–2035.

Segment Insights:

- The Protein Isolation segment is projected to hold the majority of market share by 2035, driven by increasing demand for high-purity proteins in drug discovery and biopharmaceutical production.

- The mammalian cell segment is projected to maintain a 49.2% share by 2035, driven by its critical role in biopharmaceutical production, including monoclonal antibodies and cell-based therapies.

Key Growth Trends:

- Increasing research in cancer and infectious disease

- Government and private sector investments in life sciences

Major Challenges:

- Risk of sample contamination and degradation

- Complex sample preparation and optimization

- Key Players: Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAGEN.

Global Cell Lysis & Disruption Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.99 billion

- 2026 Market Size: USD 6.46 billion

- Projected Market Size: USD 13.92 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 13 August, 2025

Cell Lysis & Disruption Market Growth Drivers and Challenges:

Growth Drivers

- Increasing research in cancer and infectious disease: The growing focus on cancer biomarker discovery, viral pathogen research, and precision medicine is driving the need for highly effective cell lysis methods. For instance, in May 2024, Denovo Biopharma introduced biomarker-guided trial advances in precision medicine, showcasing BD104's potential for treatment-resistant depression at ASCP and highlighting innovative approaches that could impact oncology research. Advancements in personalized medicine and infectious disease research drive demand for high-quality cell lysis technologies, expanding the cell lysis & disruption market.

- Government and private sector investments in life sciences: Increased funding for life sciences, biotechnology, and healthcare research from governments and private institutions is accelerating innovation in the cell line industry. According to a report released by Research America in January 2022, medical and health research and development (R&D) spending in the U.S. was USD 245.1 billion in 2020. These investments support the development of advanced reagents and equipment essential for extracting nucleic acids and proteins in research and clinical applications. Growing funding fuels demand for advanced cell lysis methods, driving the market expansion in medicine and diagnostics.

Challenges

- Risk of sample contamination and degradation: Improper cell lysis techniques can result in contamination, degradation, or incomplete extraction of nucleic acids and proteins, compromising research accuracy and biopharmaceutical production. Inconsistent lysis conditions may introduce unwanted cellular debris, affecting downstream applications such as drug discovery, diagnostics, and therapeutic manufacturing. Additionally, enzyme activity loss during lysis can hinder protein functionality, impacting research outcomes. Maintaining sterile conditions, optimizing reagent formulations, and implementing stringent quality control measures are essential to overcoming these challenges and ensuring reliable results.

- Complex sample preparation and optimization: Different cell types, such as bacterial, mammalian, and plant cells, require tailored lysis methods to ensure efficient disruption while preserving target molecules. Optimizing these conditions is complex, as factors such as membrane composition, sample volume, and intended downstream applications vary widely. Achieving effective lysis without damaging proteins or nucleic acids is a challenge, impacting reproducibility in research and diagnostics. The lack of standardized protocols further complicates workflows, requiring continuous innovation in reagents, equipment, and methodologies to improve consistency and reliability.

Cell Lysis & Disruption Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 5.99 billion |

|

Forecast Year Market Size (2035) |

USD 13.92 billion |

|

Regional Scope |

|

Cell Lysis & Disruption Market Segmentation:

Cell Type (Mammalian Cell, Bacterial Cell, Yeast/Algae/Fungi, Plant Cell)

Mammalian cell segment is poised to capture over 49.2% cell lysis & disruption market share by 2035. The segment’s growth is attributed to its critical role in biopharmaceutical production, including monoclonal antibodies, recombinant proteins, and cell-based therapies. Mammalian cells require efficient lysis for nucleic acid and protein therapies, driving demand for advanced techniques in research and medicine. For instance, in January 2025, Genethon and Eukarys partnered to cut gene therapy costs by using Eukarys C3P3 mRNA expression technology, enhancing biomanufacturing yields in mammalian cells for rare disease treatments.

Application (Protein Isolation, Downstream Processing, Cell Organelle Isolation, Nucleic Acid Isolation)

By type, the protein isolation segment is slated to garner the majority of the cell lysis & disruption market share over the forecast period. The segment is growing due to increasing demand for high-purity proteins in drug discovery, biopharmaceutical production, and biomedical research. Advances in proteomics, enzyme engineering, and monoclonal antibody development require efficient lysis techniques for accurate protein extraction. Additionally, the rise of personalized medicine and targeted therapies is driving the need for optimized cell disruption methods, ensuring high-yield protein recovery for diagnostics, therapeutic formulations, and structural and functional protein studies.

Our in-depth analysis of the global market includes the following segments:

|

Cell Type |

|

|

Application |

|

|

Technique |

|

|

Product |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Lysis & Disruption Market Regional Analysis:

North America Market Statistics

North America cell lysis & disruption market is estimated to hold revenue share of more than 45.4% by 2035. North America leads in genomic and proteomic research, driving demand for high-quality cell lysis methods to extract nucleic acids and proteins for personalized medicine, drug discovery, and disease diagnostics. Additionally, the region’s focus on cancer biomarker discovery, viral pathogen research, and precision medicine is increasing the need for specialized cell lysis solutions. This surge in demand supports advancements in molecular diagnostics and therapeutic development, fueling cell lysis & disruption market growth.

The rapidly growing U.S. biopharmaceutical sector is driving demand for advanced cell lysis techniques essential for monoclonal antibody production, vaccine development, and gene therapies. According to a report released in November 2024, the pharmaceutical industry's research and development alone contributed USD 227 billion to the worldwide GDP in 2022 or 30% of its direct contribution to the global economy. Efficient cell disruption ensures high-purity protein and nucleic acid extraction, fueling market expansion. Automation, high-throughput disruption, and AI-driven solutions enhance efficiency, reproducibility, and scalability, accelerating biopharmaceutical and diagnostic research applications.

The rapidly growing biotechnology and biopharmaceutical sectors in Canada are driving demand for advanced cell lysis techniques in drug discovery, monoclonal antibody production, and vaccine development. R&D pharmaceutical companies in Canada made USD 33.5 billion in operational revenues in 2021, up 7.0% (USD 2.2 billion) from the year before, according to the Government of Canada in June 2024. The expansion of bioprocessing activities requires efficient cell disruption for extracting proteins, nucleic acids, and other biomolecules. The focus on precision medicine, genomics, and proteomics drives demand for specialized lysis solutions for biomolecule extraction and personalized therapies in the region, in turn driving the market.

APAC Market Analysis

The APAC cell lysis & disruption market is expected to garner the fastest CAGR over the forecast period. The robust expansion of biomanufacturing facilities in Asia Pacific for biosimilars, biologics, and regenerative medicine is driving demand for advanced cell disruption technologies. Companies are investing in innovative lysis techniques to enhance production efficiency, improve biomolecule yield, and ensure purity in biopharmaceutical manufacturing. Additionally, the rising prevalence of chronic diseases and infectious outbreaks is fueling molecular diagnostics, biomarker discovery, and personalized medicine research, increasing the need for high-quality cell lysis methods for nucleic acid and protein extraction.

The increasing focus on infectious disease research and early disease detection in China is driving demand for efficient cell lysis techniques. High-quality biomolecule extraction is essential for accurate diagnostics and therapeutic advancements. Additionally, the rise of precision medicine and next-generation techniques is driving advancements in the cell lysis & disruption market. These approaches enable personalized treatments based on genetic profiles, fostering innovations in diagnostics and targeted therapies. As precision medicine continues to evolve, the demand for efficient cell disruption methods grows, ensuring accurate analysis and improved therapeutic outcomes.

Expanding biopharmaceutical sector in India, especially in biosimilars and vaccine production, is driving demand for advanced cell lysis technologies to enhance protein extraction and optimize large-scale bioprocessing. Pertaining to these changes bio-economy sector in India has expanded from USD 10 billion in 2015 to USD 130 billion in 2024, according to IBEF in November 2024. The rise of biotech startups drives demand for automated, high-throughput cell lysis, enhancing efficiency, scalability, and precision in the market in the region.

Key Cell Lysis & Disruption Market Players:

- Merck KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Danaher

- Miltenyi Biotec

- Claremont BioSolutions, LL..C

- IDEX

- Parr Instrument Company

- Covaris, LLC

- Cell Signaling Technology, Inc.

- Qsonica

- BD

Leading companies in the cell lysis & disruption market are innovating by developing advanced reagents, automated lysis systems, and high-efficiency mechanical disruption technologies. They are integrating microfluidics, ultrasonic disruption, and enzyme-based solutions to enhance cell breakage while preserving target molecules. Additionally, advancements in single-cell analysis and high-throughput workflows are improving research efficiency. Collaborations with biotech firms and research institutions are further driving innovation, ensuring precise and reproducible cell lysis for diagnostics and therapeutic applications. Some of the key companies are:

Recent Developments

- In February 2025, Thermo Fisher launched the Invitrogen EVOS 1000 Spatial Imaging System, which enhances cell lysis research by enabling high-quality, multiplexed imaging, accelerating spatial tissue proteomics, and improving efficiency in biomolecule analysis for diagnostics and biopharmaceutical applications.

- In February 2025, Bio-Rad announced its planned acquisition of Stilla Technologies, expanding its digital PCR portfolio and enhancing cell lysis application in oncology diagnostics, gene therapy, infectious disease testing, and biomolecular analysis, driving market growth.

- Report ID: 7247

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Lysis & Disruption Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.