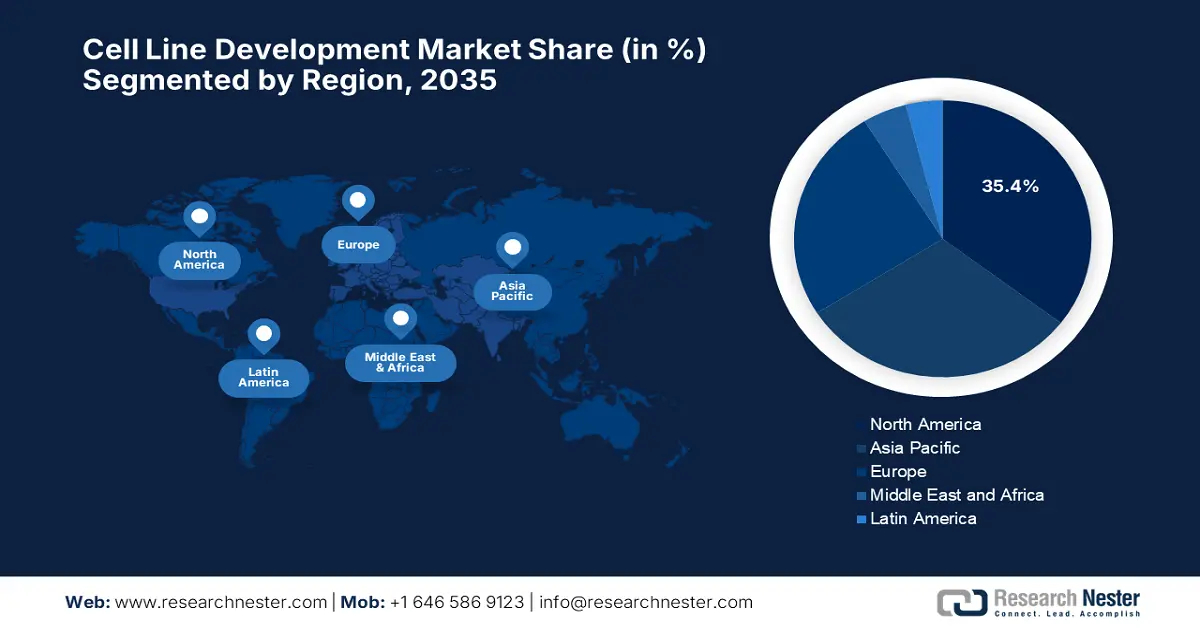

Cell Line Development Market - Regional Analysis

North America Market Insights

The North America cell line development market is set to dominate, capturing the largest share of 35.4%, rising at a CAGR of 8.9% by the end of 2035. The region benefits from regulatory agencies and funding grants. According to the Council on Strategic Risk report in July 2024, the U.S. Department of Defense (DoD) spends $12.6 billion in 2025 on biodefense-related medical countermeasures to support biomanufacturing and cell-based research capabilities. The Canada government report of March 2025 indicates that the federal government spent $2.3 billion over five years on vaccines, therapeutics, and biomanufacturing capacity for large-scale bioproduction plants.

The U.S. is steadily consolidating its position in the regional cell line development market due to expanded federal investments and the accelerated approval pathway. As per the CMS report in December 2022, the FDA approved monoclonal antibodies to treat Alzheimer’s disease under the Medicare Part B coverage. Besides the U.S. FDA’s enhanced approval pathway for cell-line-based therapies, timelines are reduced, grabbing the interest of domestic manufacturers. FDA has approved nearly 9 biosimilar products from January 2025 to date, including the latest oncology and autoimmune disease treatments, further reinforcing the country’s leadership in advanced biologics development.

Biologics Approved by the FDA in 2023

|

Trade Name |

Active Ingredient |

Class |

Indication |

|

Beyfortus |

Nirsevimab-alip |

mAb |

Respiratory syncytial virus (RSV) |

|

Bimzelx |

Mimekizumab |

mAb |

Moderate to severe plaque psoriasis |

|

Columvi |

Glofitamab-gxbm |

mAb |

Diffuse large B-cell lymphoma |

|

Elfabrio |

Pegunigalsidase alfa-iwxj |

Enzyme |

Fabry disease |

|

Elrexfio |

Elranatamab-bcmm |

mAb |

Relapsed or refractory multiple myeloma |

Source: NLM, January 2024

Asia Pacific Market Insights

The cell line development market in the Asia Pacific is growing at the fastest rate, efficiently capturing 30.6% of the global share. The market is anticipated to rise at a CAGR of 9.3% owing to the biologics localization policies and the growing burden of chronic diseases. The presence of emerging countries such as Japan, China, and China and their progressive approaches are driving adoption in the region. Besides, APAC has taken the lead in cell and gene therapy clinical trials, and holds the largest share of all new trials globally in the first half of 2022, according to the 2023 DIA-CoRE Singapore Annual Meeting, showing over 2,000 ongoing trials by June 2022 and 32 US FDA-approved cell, tissue, and gene therapy products.

The market in India is holding a considerable share in the Asia Pacific region and is driven by robust government investment in biotech research and innovation. BIG Scheme, a flagship programme of BIRAC, offering a funding grant worth INR 5 million to develop and refine ideas to proof-of-concept related to biosimilars and other departments. Further, the Department of Biotechnology (DBT) within the Ministry of Science & Technology is also making significant investments in infrastructure like cell repository complexes and GMP-approved manufacturing. All these activities are aimed at reducing the import dependence, enhancing clinical research capacity, and making India a competitive destination for biologics manufacture in Asia.

Europe Market Insights

The cell line development market in Europe is projected to grow at a rapid rate and is driven by the rising demand for gene therapies, biologics, and precision medicine. The UK, Germany and France dominate the region by holding the maximum share value by 2035. As per the European Commission report announced in July 2025, the EU will invest up to €100 million (Horizon Europe 2026–27) in the microbiome-based solutions and €250 million on cross-sectoral life sciences technologies, surging the industrial innovation and sustainability. This plan aids multi-country clinical trials, strengthening the research infrastructure, and advances new molecules, materials, and biomanufacturing methods.

Germany's market is supported by robust biomanufacturing capabilities, cutting-edge infrastructure, and strategic acquisitions. For example, Cytiva acquired Cologne's CEVEC Pharmaceuticals, a high-performance cell line development and viral vector manufacturing industry leader, in October 2022, strengthening its bioprocessing and gene therapy capabilities. This action not only consolidated Cytiva's position in the biopharmaceutical supply chain globally but also put Germany on the map as an innovation hub, attracting investment and driving growth in leading-edge biologics and advanced therapies manufacturing.