Cell Line Development Market Outlook:

Cell Line Development Market size was valued at USD 6.8 billion in 2025 and is projected to reach USD 17.5 billion by the end of 2035, rising at a CAGR of 10.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cell line development is evaluated at USD 7.4 billion.

The global market is gaining immense exposure, effectively fueled by the accelerating demand for biologics, gene therapies, and personalized medicine. The presence of the patient pool is readily expanding owing to the increasing instances of cancer, autoimmune disorders, and rare genetic disorders where biologics and cell-based therapies are utilized extensively. Nearly 2,001,140 new cancer cases were diagnosed in the U.S. in 2024, as stated in the NLM report published in January 2024. Surging disease prevalence fuels the investments in advancements in cell culture technologies to aid scalable and high-quality biologics manufacturing.

Furthermore, the market is driven by the rising investment in biologic drug development due to the growing chronic disease rates across the world. Recently, in 2024 FDA report 2024 states that CDER approved 18 biosimilars for 8 reference products in 2024. These approvals impact the significance of biologics in the pharmaceutical sector. Moreover, the rising demand for the innovative manufacturing of new vaccines is boosting the market growth. For instance, based on the report from IFPMA announced in December 2021, the production of COVID-19 vaccines in 2021 was nearly 11 billion, where half of the world's population is vaccinated. This huge production was achieved using cell culture-related vaccine development, based on cell lines.

Key Cell Line Development Market Insights Summary:

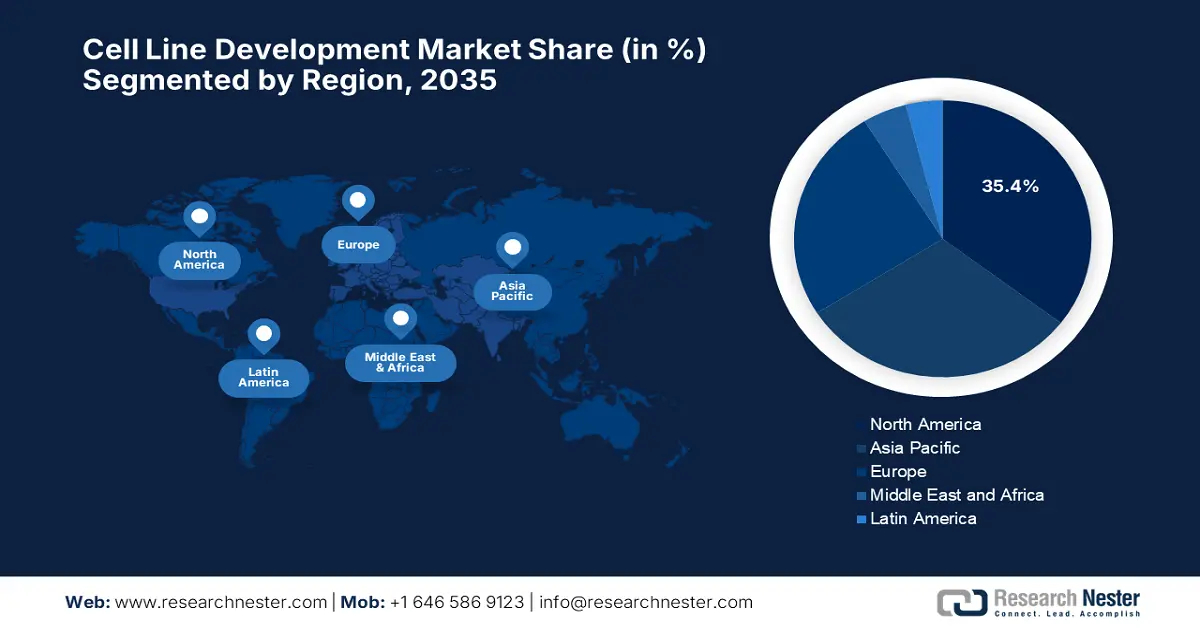

Regional Highlights:

- By 2035, North America is forecast to secure a 35.4% share of the cell line development market, upheld by substantial federal funding and strong regulatory support.

- Asia Pacific is expected to capture a 30.6% share while registering the fastest CAGR of 9.3%, strengthened by biologics localization policies and a rising chronic disease burden.

Segment Insights:

- By 2035, the mammalian cell lines segment is projected to capture a 65.5% share of the Cell Line Development Market, propelled by their ability to conduct complex post-translational modifications for human therapeutics.

- The biopharmaceutical production segment is expected to hold a 42.6% share, underpinned by the escalating demand for biosimilars and mRNA vaccination.

Key Growth Trends:

- Rising disease incidence

- Strategic industry collaborations

Major Challenges:

- Lack of affordability in emerging regions

Key Players: Thermo Fisher Scientific, Merck KGaA, Lonza Group, Sartorius AG, WuXi Biologics, Charles River Laboratories, Samsung Biologics, Cytiva, Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim, Catalent, Bio-Techne, Sumitomo Pharma, Kaneka Corporation, Shionogi, Takara Bio, JCR Pharmaceuticals, Takeda Pharmaceutical, Daiichi Sankyo, Ajinomoto Co.

Global Cell Line Development Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.8 billion

- 2026 Market Size: USD 7.4 billion

- Projected Market Size: USD 17.5 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Canada

Last updated on : 22 August, 2025

Cell Line Development Market - Growth Drivers and Challenges

Growth Drivers

- Rising disease incidence: The cell line development market is increasing due to the expanded patient pool owing to the increased disease prevalence. As per the NLM report released in January 2025, the prevalence of autoimmune disease worldwide on average ranges from 15.87 to 108.92 per 100,000 people based on the genetic background and geographic region, reflecting a measurable increase compared to earlier survey cycles. This upward trend highlights the growing need for advanced biologics and cell-based therapies for global market growth.

- Strategic industry collaborations: This is yet another effective growth driver in the cell line development sector. As per the NIH report in October 2021, the Bespoke Gene Therapy Consortium was launched, which is a part of the NIH Accelerating Medicines Partnership (AMP) program focusing on optimizing and streamlining the gene therapy development process to aid the unmet medical needs of people with rare diseases. These collaborative strategies and capacity-building efforts strengthen the infrastructure requirement for scalable cell line development, directly aiding market growth.

- Rising public and private R&D investment: Federal funding continues to accelerate technology development. The NIH announced a budget allocation of $47.7 billion in June 2025, with substantial portions directed toward cell and gene therapy research. The Advanced Research Projects Agency for Health (ARPA-H) received $2.5 billion from Congress for high-impact health innovations in oncology, including scalable cell line manufacturing, as stated in the Friends of Cancer Research Report released in October 2023. These funds, combined with corporate investments, are expanding high-throughput screening, CRISPR engineering, and cell bank quality assurance.

Role of Cell Line Development - 2023 FDA-Approved Enzymes/Proteins

|

Drug (Brand) |

Class & Administration |

Cell Line / Expression System |

Authoritative Source (.gov / .org) |

|

Lamzede (velmanase alfa) |

Recombinant human enzyme (intravenous) |

Chinese hamster ovary (CHO) cells |

FDA BLA 761179 – Lamzede Approval Documents |

|

Elfabrio (pegunigalsidase alfa) |

Hydrolytic lysosomal enzyme (intravenous) |

Plant cell culture (ProCellEx carrot cells) |

FDA Label – Elfabrio |

|

Ngenla (somatrogon-ghla) |

Human growth hormone analog (fusion protein, subcutaneous) |

Chinese hamster ovary (CHO) cells |

EMA Public Assessment Report – Ngenla |

|

Pombiliti (cipaglucosidase alfa) |

Recombinant human acid α-glucosidase (intravenous) |

Chinese hamster ovary (CHO) cells |

FDA BLA 761227 – Pombiliti Approval Documents |

|

Ryzneuta (efbemalenograstim) |

G-CSF recombinant fusion protein (subcutaneous) |

E. coli expression system |

FDA Label – Ryzneuta |

Source: NLM

Challenges

- Lack of affordability in emerging regions: Pricing challenges in emerging markets limit the accessibility to advanced therapies, including those reliant on cell line development. High manufacturing costs, import duties, and limited insurance coverage can place such treatments out of reach for a portion of the patient population. These constraints limit the adoption rates and market penetration in clinical benefits. This gap is addressed by regional manufacturers as they are actively introducing low-cost alternatives to reduce pricing and enhance accessibility in emerging regions.

Cell Line Development Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 6.8 billion |

|

Forecast Year Market Size (2035) |

USD 17.5 billion |

|

Regional Scope |

|

Cell Line Development Market Segmentation:

Source Segment Analysis

Under the source segment, mammalian cell lines lead the segment and is poised to hold the share value of 65.5% by 2035. The segment is fueled based on their capability to perform complex post-translational modifications for human therapeutics. The WHO report states that mammalian cell culture remains the gold standard for therapeutic protein manufacturing based on its safety, efficacy, and regulatory familiarity. Further, USITC DataWeb shows strong trade in mammalian cell culture media and bioprocess equipment, indicating continued investment.

Application Segment Analysis

In terms of application, the biopharmaceutical production segment is anticipated to grab a considerable share of 42.6% in the cell line development market during the forecast timeline. The growth in the segment originates from the tremendous demand for biosimilars and mRNA vaccination. In this regard, Pfizer and Moderna necessitate HEK293 cells for plasmid DNA production for mRNA vaccines, hence creating a huge market opportunity, stated in NLM article published in May 2022. Besides, the GaBi report published in May 2025 depicts that FDA has approved 75 biosimilars till date, almost all relying on mammalian cell lines; thus, this is evidence for a wider segment’s scope.

End user Segment Analysis

In the end user segment, the biopharmaceutical companies dominate the segment and are anticipated to share significant value by 2035. The segment is led by increasing demand for superior biologics, monoclonal antibodies, and vaccines. According to the October 2023 report from Cancer Research Journals, the NCI-60 human tumor cell line has been utilized for screening more than 100,000 chemical compounds in terms of anticancer activity. Moreover, according to the National Center for Biotechnology Information, stable cell lines are increasingly utilized by biopharma companies for cost-effective mass production of biologics, positioning the industry for continued growth in the market up to 2035.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Product |

|

|

Source |

|

|

End User |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Line Development Market - Regional Analysis

North America Market Insights

The North America cell line development market is set to dominate, capturing the largest share of 35.4%, rising at a CAGR of 8.9% by the end of 2035. The region benefits from regulatory agencies and funding grants. According to the Council on Strategic Risk report in July 2024, the U.S. Department of Defense (DoD) spends $12.6 billion in 2025 on biodefense-related medical countermeasures to support biomanufacturing and cell-based research capabilities. The Canada government report of March 2025 indicates that the federal government spent $2.3 billion over five years on vaccines, therapeutics, and biomanufacturing capacity for large-scale bioproduction plants.

The U.S. is steadily consolidating its position in the regional cell line development market due to expanded federal investments and the accelerated approval pathway. As per the CMS report in December 2022, the FDA approved monoclonal antibodies to treat Alzheimer’s disease under the Medicare Part B coverage. Besides the U.S. FDA’s enhanced approval pathway for cell-line-based therapies, timelines are reduced, grabbing the interest of domestic manufacturers. FDA has approved nearly 9 biosimilar products from January 2025 to date, including the latest oncology and autoimmune disease treatments, further reinforcing the country’s leadership in advanced biologics development.

Biologics Approved by the FDA in 2023

|

Trade Name |

Active Ingredient |

Class |

Indication |

|

Beyfortus |

Nirsevimab-alip |

mAb |

Respiratory syncytial virus (RSV) |

|

Bimzelx |

Mimekizumab |

mAb |

Moderate to severe plaque psoriasis |

|

Columvi |

Glofitamab-gxbm |

mAb |

Diffuse large B-cell lymphoma |

|

Elfabrio |

Pegunigalsidase alfa-iwxj |

Enzyme |

Fabry disease |

|

Elrexfio |

Elranatamab-bcmm |

mAb |

Relapsed or refractory multiple myeloma |

Source: NLM, January 2024

Asia Pacific Market Insights

The cell line development market in the Asia Pacific is growing at the fastest rate, efficiently capturing 30.6% of the global share. The market is anticipated to rise at a CAGR of 9.3% owing to the biologics localization policies and the growing burden of chronic diseases. The presence of emerging countries such as Japan, China, and China and their progressive approaches are driving adoption in the region. Besides, APAC has taken the lead in cell and gene therapy clinical trials, and holds the largest share of all new trials globally in the first half of 2022, according to the 2023 DIA-CoRE Singapore Annual Meeting, showing over 2,000 ongoing trials by June 2022 and 32 US FDA-approved cell, tissue, and gene therapy products.

The market in India is holding a considerable share in the Asia Pacific region and is driven by robust government investment in biotech research and innovation. BIG Scheme, a flagship programme of BIRAC, offering a funding grant worth INR 5 million to develop and refine ideas to proof-of-concept related to biosimilars and other departments. Further, the Department of Biotechnology (DBT) within the Ministry of Science & Technology is also making significant investments in infrastructure like cell repository complexes and GMP-approved manufacturing. All these activities are aimed at reducing the import dependence, enhancing clinical research capacity, and making India a competitive destination for biologics manufacture in Asia.

Europe Market Insights

The cell line development market in Europe is projected to grow at a rapid rate and is driven by the rising demand for gene therapies, biologics, and precision medicine. The UK, Germany and France dominate the region by holding the maximum share value by 2035. As per the European Commission report announced in July 2025, the EU will invest up to €100 million (Horizon Europe 2026–27) in the microbiome-based solutions and €250 million on cross-sectoral life sciences technologies, surging the industrial innovation and sustainability. This plan aids multi-country clinical trials, strengthening the research infrastructure, and advances new molecules, materials, and biomanufacturing methods.

Germany's market is supported by robust biomanufacturing capabilities, cutting-edge infrastructure, and strategic acquisitions. For example, Cytiva acquired Cologne's CEVEC Pharmaceuticals, a high-performance cell line development and viral vector manufacturing industry leader, in October 2022, strengthening its bioprocessing and gene therapy capabilities. This action not only consolidated Cytiva's position in the biopharmaceutical supply chain globally but also put Germany on the map as an innovation hub, attracting investment and driving growth in leading-edge biologics and advanced therapies manufacturing.

Key Cell Line Development Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Lonza Group

- Sartorius AG

- WuXi Biologics

- Charles River Laboratories

- Samsung Biologics

- Cytiva

- Fujifilm Diosynth Biotechnologies

- Boehringer Ingelheim

- Catalent

- Bio-Techne

- Sumitomo Pharma

- Kaneka Corporation

- Shionogi

- Takara Bio

- JCR Pharmaceuticals

- Takeda Pharmaceutical

- Daiichi Sankyo

- Ajinomoto Co.

The worldwide cell line development market is readily dominated by the presence of notable organizations, such as Thermo Fisher, Merck, and Lonza, capturing the highest global revenue by implementing vertical integration. Eventually, these global players are leveraging CRISPR partnerships with public organizations, domestic production initiatives, and the adoption of single-use technology, thereby creating progressive transformations in the merchandise. Therefore, the presence of all of these factors will effectively drive business upliftment across different nations.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2025, WuXi Biologics launched HEK 293, which is a stable cell line platform WuXia293 used for the development and manufacturing of difficult-to-express molecules. The platform has generated over 1000 cell lines expressing monoclonal and bispecific antibodies, fusion proteins, and enzymes.

- In June 2025, STEMCELL Technologies, announced the acquisition of Cellular Highways Ltd from TTP Group Ltd. Cellular Highways is specialized in advanced cell sorting technologies with applications in cell and gene therapy, drug discovery, and general cell research.

- Report ID: 713

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Line Development Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.