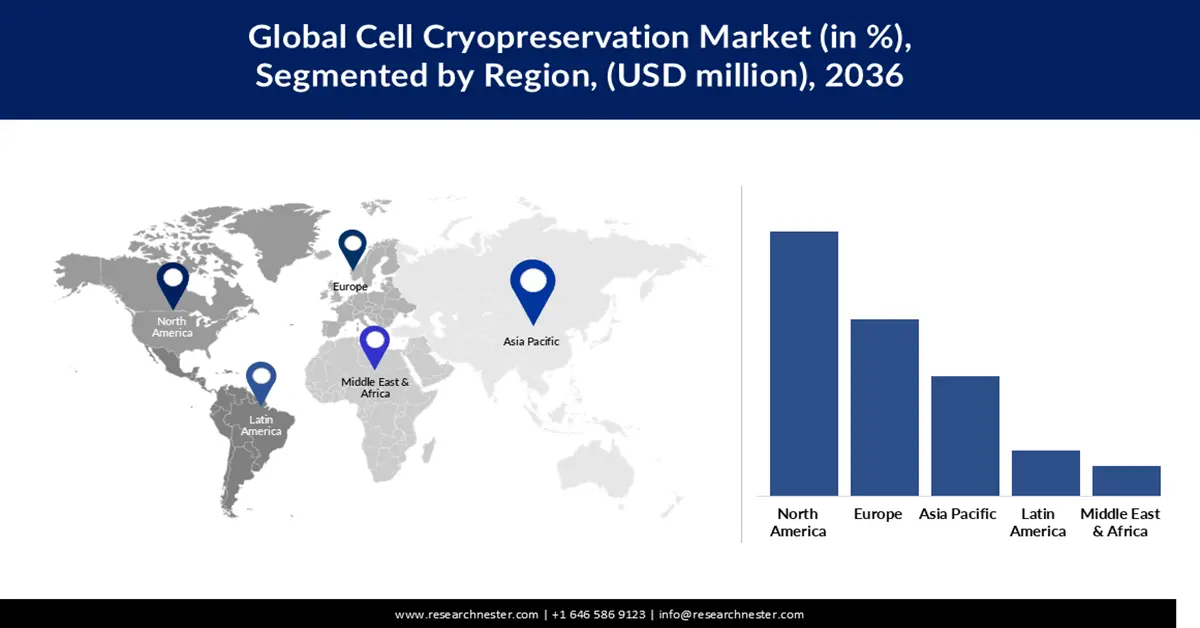

Cell Cryopreservation Market - Regional Analysis

North America Market Insights

North America will continue to dominate the global cell cryopreservation market, accounting for about 40.35% of the global share by 2036. This leadership is supported by the region’s well-established biotech infrastructure, strong regulatory frameworks, and deep investments in regenerative medicine from both public and private sectors. Over 1,200 clinical trials involving cell therapies are active in North America, representing a large and growing base of demand for reliable cryopreservation systems. Additionally, collaboration between academia and industry is widespread, enabling rapid translation of cryopreservation innovations into clinical and commercial applications. Key life-science companies (like Thermo Fisher and BioLife) further strengthen regional dominance by continually advancing freezing technology.

The U.S. drives the cell cryopreservation market through its leadership in cell and gene therapy research, supported by one of the world’s strongest biomedical R&D ecosystems. The NIH invests over US$48 billion annually in medical research, a portion of which supports cell-based therapy development and biobanking infrastructure. As of July 2021, the ClinicalTrials.gov database listed 1,014 clinical trials involving mesenchymal stem cells (MSCs), either completed or ongoing. FDA regulatory pathways such as RMAT designations and updated CBER guidelines facilitate streamlined development of advanced cell therapies, reinforcing the need for robust cryostorage. Extensive GMP manufacturing facilities and national biospecimen repositories (e.g., NCI’s Biorepositories & Biospecimen Research Branch) further position the U.S. as the central engine of innovation and adoption in cell cryopreservation technology.

Canada is strengthening its role in the cell cryopreservation market by expanding national investments in regenerative medicine research and biomanufacturing capacity. The Stem Cell Network (SCN) recently allocated CA$33 million to support clinical trials and translational research across more than 240 investigators nationwide, directly increasing demand for high-quality cryostorage. The Canadian government also invested CA$49.9 million in STEMCELL Technologies to enhance domestic production of tools used in cell and gene therapy development, improving the country’s self-sufficiency in advanced bioprocessing inputs. Canada ranks second globally in biomedical R&D cost competitiveness, according to CCRM, making it an attractive location for companies developing cell-based products that require large-scale cryopreservation. Strong academic industry partnerships and national biobanking programs further accelerate the adoption of cryopreservation technologies across research and clinical sectors.

Europe Market Insights

Europe’s cell cryopreservation market holds strong regulatory pipeline, coordinated research funding, and extensive biobanking networks are major engines for the cell cryopreservation market, because increasing numbers of ATMPs and academic translation projects require validated long-term storage and cold-chain logistics. The European Medicines Agency’s recent activity and ATMP oversight highlight steady regulatory throughput and inspections for advanced therapies, which support clinical/commercial scale-up. Pan-European research funding under Horizon Europe continues to prioritize health, regenerative medicine, and biomanufacturing, providing grants that upgrade laboratory and biobank capacity across member states. Meanwhile, BBMRI-ERIC’s federated biobanking infrastructure makes large, well-characterized sample collections discoverable to researchers across Europe, increasing the volume of materials that must be cryopreserved and tracked to GMP-compatible standards. These combined drivers, regulatory activity, targeted EU funding, and searchable biobank inventories translate into sustained demand for controlled-rate freezers, validated cryovials/media, and certified cold-chain services across the region.

Germany in the cell cryopreservation market advanced life-science ecosystem and mission-driven industrial policy accelerate demand for cryopreservation by supporting translational research, biomanufacturing, and clinical trials that rely on dependable biobanking. Federal strategies (e.g., Germany’s High-Tech Strategy and bioeconomy programs) explicitly back mission-oriented research in areas such as cancer and regenerative medicine, helping finance infrastructure upgrades in academic and industry laboratories. German national nodes of European biobank networks (e.g., BBMRI-IT/BBMRI links) and numerous university hospital biobanks expand sample inventories that require GMP-grade storage and traceability, raising demand for high-quality cryopreservation systems. Strong industry–university partnerships and inspection/QA activity tied to manufacturing for ATMPs further push the adoption of validated freezing equipment, monitoring platforms, and emergency-backup systems in Germany’s clinical and commercial facilities.

France drives regional cryopreservation demand through active regulatory engagement with ATMPs, growing clinical trial activity, and public-sector support for innovation—each increasing requirements for robust sample storage and chain-of-identity controls. The French regulatory authority (ANSM) reported notable increases in ATMP-related dossiers and clinical-trial applications in recent years, reflecting a rising pipeline that depends on cryostorage capacity. National research centres, university hospitals, and dedicated translational programmes are scaling biobanking and GMP-compatible facilities, which in turn create recurring demand for controlled-rate freezers, validated cryomedia, and certified cold-chain logistics. France’s active role in EU research consortia and growing clinical submissions for cell therapies mean that both public biorepositories and private developers are investing more heavily in cryopreservation infrastructure to meet regulatory and clinical standards.

Asia Pacific Market Insights

The cell cryopreservation market in the Asia Pacific region is expected to grow with a CAGR of 19.87% by 2036. The rapid expansion of laboratory capacity, national biobanking, and clinical-trial activity across the Asia-Pacific is increasing demand for validated cryopreservation and cold-chain infrastructure to support both research and clinical use of cell therapies. WHO / IARC programs and publications show growing regional investment in laboratory support and biobanking services (including training, specimen repositories, and regional biobank meetings), which enable larger, better-characterized sample collections that must be cryopreserved. National clinical-trial registries and the WHO-ICTRP network report substantial and rising registration activity from APAC countries (for example, the Chinese and Indian primary registries are among the largest partner registries to WHO-ICTRP), indicating a larger pipeline of studies that rely on specimen storage. Together with city- and national-level industrial policies that explicitly prioritise cell/gene therapy and biomanufacturing, these trends are translating into higher regional demand for controlled-rate freezers, GMP-grade consumables, and certified cold-chain logistics.

China’s rapid scaling of clinical research and government support for biotech innovation is a major driver of cryopreservation demand: the Chinese Clinical Trial Registry (ChiCTR) shows over 110,945 trials registered historically, reflecting a very active clinical-research environment that includes numerous cell- and stem-cell studies. National regulatory bodies (NMPA) have issued targeted guidance and technical documents to support clinical development and lifecycle regulation of advanced therapies, while municipal policies (e.g., Shanghai, Beijing) explicitly fund gene- and cell-therapy R&D and biomanufacturing, accelerating local capacity for ATMP development. China also hosts regional cryobiology and biobanking symposia (IARC/WHO–linked and national conferences) that disseminate best practice on specimen handling and long-term storage, raising technical standards and further increasing demand for validated cryostorage solutions. As investigators and hospitals expand investigator-initiated trials and translational programs, the need for GMP-quality freezing media, controlled-rate freezers, and secure biobanking grows across both public and private sectors.

In cell cryopreservation market, India is expanding national research ecosystem, driven by the Department of Biotechnology (DBT), the Institute for Stem Cell Science and Regenerative Medicine (inStem/ISRM), and other government initiatives, is increasing demand for cryopreservation infrastructure to support translational work and clinical trials. The Clinical Trials Registry-India (CTRI) now lists roughly 97,910 total registered trials (reflecting broad and growing clinical research activity), and DBT/PIB press releases document targeted funding for regenerative-medicine research and infrastructure that generates more biospecimens requiring long-term storage. India also supports dedicated institutes (e.g., inStem) and regular calls for proposals in cell and regenerative biology, which translate into increased biobanking and investments in controlled-rate freezers, validated storage workflows, and cold-chain logistics for multi-site trials. As academic–industry partnerships scale manufacturing and clinical translation, demand for GMP-grade cryomedia and certified cryobanking services is rising across research hospitals and biotech firms.