Ceiling Tiles Market Outlook:

Ceiling Tiles Market size was valued at USD 9.23 Billion in 2025 and is expected to reach USD 22.26 Billion by 2035, registering around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ceiling tiles is evaluated at USD 9.99 Billion.

The growth of the market is primarily attributed to the major growth in the construction industry, followed by the radically increasing consumer focus on the aesthetics of office and home buildings. Furthermore, ceiling tiles are used to conceal wires, which is expected to drive market growth. For instance, as of May 2022, India has the most infrastructure construction projects totaling more than USD 25 million in planning or operation.

With rapid urbanization and industrialization, more people are propelled to shift towards urban areas and cities. Hence, more infrastructures are estimated to be manufactured, and the increased commercial construction activities to build hospitals, clinics, offices, educational institutions, and industrial complexes across the world are estimated to drive market growth in the forecast period. In the residential real estate sector, massive investments are made to construct residential complexes, buildings, and homes, which are also projected to increase the utilization rate of ceiling tiles market in the upcoming years. The growing need for thermal and acoustic insulation, along with the rising demand for aesthetic looks in offices and home buildings, are expected to augment the demand for ceiling tiles, thus expanding the market size. In addition, the rising concerns regarding environmental protection have shifted the population to opt for innovative and sustainable construction methods along with eco-friendly materials for ceilings. This recent trend is also expected to benefit market growth.

Key Ceiling Tiles Market Insights Summary:

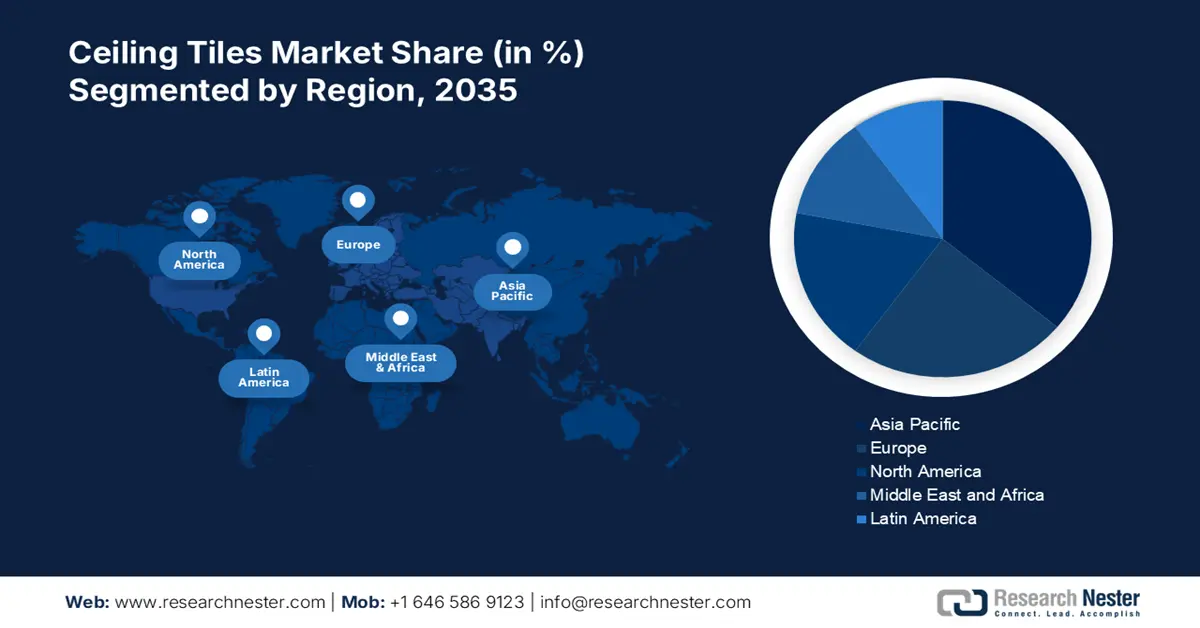

Regional Highlights:

- Asia Pacific ceiling tiles market, the largest share by 2035, is fueled by rising disposable income and surge in sustainable construction activities.

Segment Insights:

- The mineral wool segment in the ceiling tiles market is expected to maintain the largest share by 2035, fueled by its thermal insulation properties, lightweight nature, and high recyclability.

- The non-residential segment in the ceiling tiles market is projected to hold the largest share by 2035, fueled by growing non-residential construction activities and rapid urbanization.

Key Growth Trends:

- Growing Urbanization

- Rising Population

Major Challenges:

- High Cost of Ceiling Tiles

- Negative Effect on Human Health

Key Players: USG Corporation, Knauf Digital GmbH, Rockwool A/S, Odenwald Faserplattenwerk GmbH, Saint-Gobain Gyproc, SAS International, Byucksan, HIL Limited, Hunter Douglas, KET Ceilings.

Global Ceiling Tiles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.23 Billion

- 2026 Market Size: USD 9.99 Billion

- Projected Market Size: USD 22.26 Billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 10 September, 2025

Ceiling Tiles Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Urbanization – Presently, a huge number of people are residing in urban areas, and more people have been shifting towards urban cities on account of getting better job opportunities, better education, as well as better healthcare services. Thus, the ratio of urbanization has been increasing in a more dramatic way, which is leading the growth of construction activities throughout the world. Such a factor is fueling up the utilization rate of ceiling tiles in buildings and infrastructures, subsequently positively contributing towards the growth of the market over the forecast period. For instance, in 2018, 55% of the world's inhabitants lived in cities; by 2050, that number is projected to rise to 68%.

- Rising Population – With the burgeoning population, the demand for construction processes for buildings is also expected to rise. As a result, the need for ceiling tiles is forecasted to increase in the next few years. Recent statistics revealed that the world population is estimated to increase by 2 billion people during the next 30 years, from 7.7 billion people today, and reach approximately 9.7 billion in 2050. This number is further anticipated to reach around 11 billion people around the year 2100.

- Increasing Disposable Income - As the economies are growing, so does the disposable income of the people. As a result, individuals have more spending capacity to spend on the appearance and looks of the rooms by adopting modern products such as ceiling tiles. Hence, the high adoption rate of ceiling tiles among the high-income population is projected to expand the market size in the assessment period. The disposable personal income in the US rose by about 1 percent in August 2022 compared to the same month the previous year.

- Increasing Residential & Non-Residential Construction Activities – For instance, according to short-term projections, the non-residential building market in the United States is expected to expand by more than 5% in 2023.

- Rise in Spending on Home Remodeling – As a result of quick urbanization, people are shifting toward the remodeling of their homes. Hence, there is a high requirement for ceiling tiles in renovation processes which are anticipated to create a positive outlook for market growth in the future. About 50% of respondents to a study taken in 2020 stated that they had remodeled their homes, and the median amount spent on renovations by a household increased to more than USD 13,000 in 2020 across the globe.

Challenges

-

High Cost of Ceiling Tiles - Ceiling tiles are only being utilized in limited business settings and residential rooms owing to their exorbitant cost. As the addition of ceiling tiles increases the overall cost of the infrastructure, people with low incomes are not able to afford it. Therefore, the high cost of ceiling tiles is considered to be a major obstacle to their expansion in residential buildings.

- Negative Effect on Human Health – Some of the ceiling tiles are manufactured using harmful ingredients, including formaldehyde, microbes, antimicrobial coatings, flame retardants, and others. The addition of these components makes ceiling tiles harmful to human health and the environment.

- Lowering Installation Costs

Ceiling Tiles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 9.23 Billion |

|

Forecast Year Market Size (2035) |

USD 22.26 Billion |

|

Regional Scope |

|

Ceiling Tiles Market Segmentation:

Application Segment Analysis

The global ceiling tiles market is segmented and analyzed for demand and supply by application into residential, non-residential, and industries. Out of these, the non-residential segment is anticipated to garner the largest revenue by the end of 2035. The growth of the segment is attributed to growing non-residential construction activities in developed as well as emerging economies such as China, India, Brazil, and South Korea, along with rapidly increasing urbanization. For instance, over 499 billion dollars were spent on new private non-residential buildings in the United States in 2019. Moreover, ceiling tiles are being utilized in various commercial spaces, including retail infrastructures, hospitality and healthcare industries, industrial complexes, and others. As ceiling tiles are used for enhancing overall aesthetics, the interiors of non-residential buildings, and improving insulation in indoor settings, it is estimated to bring lucrative growth opportunities for market expansion.

Product Segment Analysis

The global ceiling tiles market is also segmented and analyzed for demand and supply by product into metal, mineral wool, and gypsum. Out of these three segments, the mineral wool is estimated to hold the largest share during the assessment period. Mineral wool has various advantages over other products such as thermal insulation along with its lightweight nature, and high recyclability power, which has resulted in the high penetration of ceiling tiles made with mineral wool in the market. On the other hand, gypsum is attributed to holding the second-largest share. The ceiling tiles made with gypsum products including gypsum boards that reduces the weight on the metal grid and are easy to install, maintain, and repair, making them an ideal option in the construction industry. Also, gypsum ceiling tiles are being used in modern offices in developed economies to enhance the appearance by adding aesthetic features of colored gypsum tiles. The gypsum segment growth is expanding due to increased mining consumption, improved technologies, and emerging economies. For instance, based on the International Trade Administration, a US-based government department, mining generated nearly 10% of total GDP in 2020, making it a significant stakeholder to Australia's economy.

Our in-depth analysis of the global ceiling tiles market includes the following segments:

|

By Application |

|

|

By Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ceiling Tiles Market Regional Analysis:

APAC Market Insights

The Asia Pacific ceiling tiles market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, backed by growing disposable income, along with the massive surge in construction activities using sustainable and innovative products in the region. For instance, Singapore's anticipated disposable income per capita within the ASEAN accounted to more than USD 25.0 thousand in the year 2021. Additionally, the escalation in population and increasing economic development are some further factors that are driving the growth of the global ceiling tiles market in the region. Furthermore, the rising disposable incomes of consumers, along with the rise in renovation activities, are also expected to boost the demand for ceiling tiles in the next few years of the forecast period.

North American Market Insights

On the other hand, the ceiling tiles market in the North America region is also attributed to holding a significant share during the assessment period. Massive investments in the construction industry, along with the rising focus on building single-family housing, are major factors that will bring growth opportunities to the market. Moreover, the presence of major key players and strict government regulations over particulate emissions is estimated to drive the market in the forecast period.

Ceiling Tiles Market Players:

- USG Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Knauf Digital GmbH

- Rockwool A/S

- Odenwald Faserplattenwerk GmbH

- Saint-Gobain Gyproc

- SAS International

- Byucksan

- HIL Limited

- Hunter Douglas

- KET Ceilings

Recent Developments

-

USG Corporation joined the Knauf group, the biggest producer of gypsum in the world. With the recent introduction of three exciting new products to the USG line of ceiling products—USG DanolineTM Perforated Gypsum Panels, USG HeradesignTM Wood Wool Panels, and USG Acoustic SFTM Accessible Reveal Ceiling Tile—the company is now better positioned to serve its customers with new products.

-

SAS International is actively advertising its Open Grid ceiling solutions, which is opening up a brand-new realm of imaginative ceiling design.

- Report ID: 4556

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ceiling Tiles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.