Catheter-Directed Thrombolysis Market Outlook:

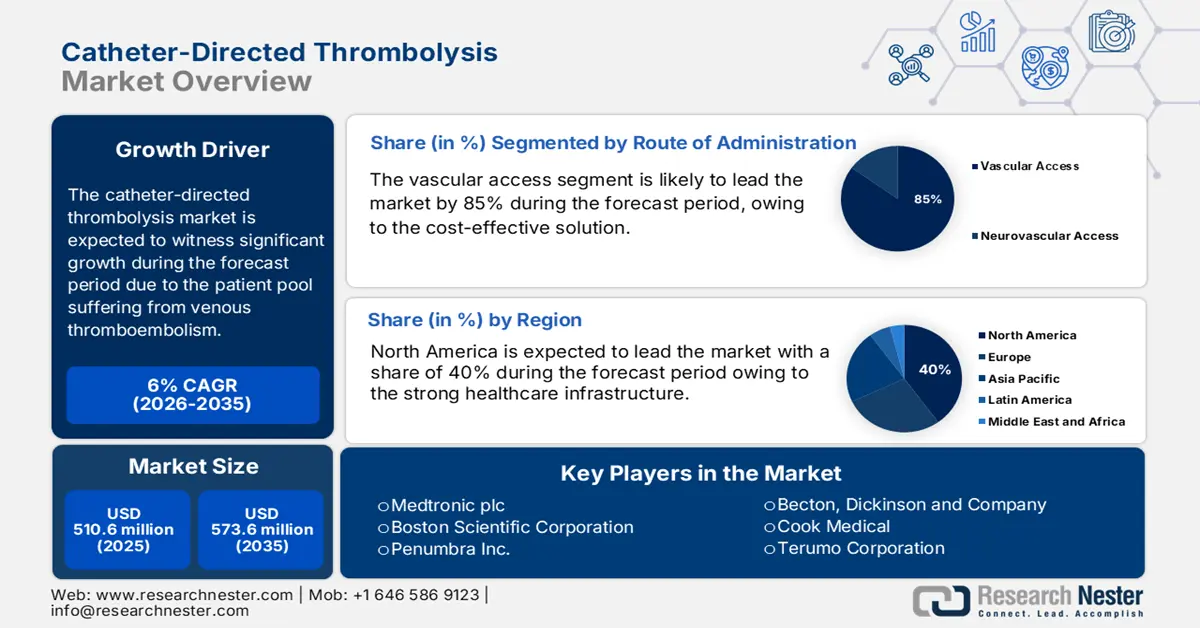

Catheter-Directed Thrombolysis Market size was valued at USD 510.6 million in 2025 and is projected to reach USD 573.6 million by the end of 2035, growing at a CAGR of 6% during the forecast period 2026-2035. In 2026, the industry size of catheter-directed is assessed at USD 541.2 million.

The catheter-directed thrombolysis market is experiencing a steady rise and is driven by the patient pool suffering from venous thromboembolism (VTE), including pulmonary embolism and deep vein thrombosis. As per the U.S. Centers for Disease Control and Prevention data in May 2024, nearly 900,000 cases of venous thromboembolism are registered every year in the U.S., including pulmonary embolism. As per the NLM study in May 2021, VTE affects more than 500,000 individuals each year, highlighting the clinical need for catheter-based treatments. On the supply chain side, the production pipeline involves complex logistics for both interventional radiology devices and drug APIs, and they mainly depend on medical-grade polymers, imaging-compatible microcatheters, and biocompatible alloys.

Investment in research, development, and deployment (RDD) is substantial, focusing on improving drug efficacy, reducing bleeding complications, and enhancing device precision for targeted drug delivery. Public and private grants through the National Institutes of Health (NIH) fund clinical trials to expand CDT indications. The majority of the pharmaceuticals used in catheter-directed thrombolysis are thrombolytic (fibrinolytic) agents, which break up blood clots. These drugs are directly delivered into the clot via a catheter, reducing systemic exposure and bleeding risk compared to systemic administration. The global trade of pharmaceutical products reached USD 853 billion, as per the OEC data in 2023, including the pharmaceutical agents that are used in CDT.