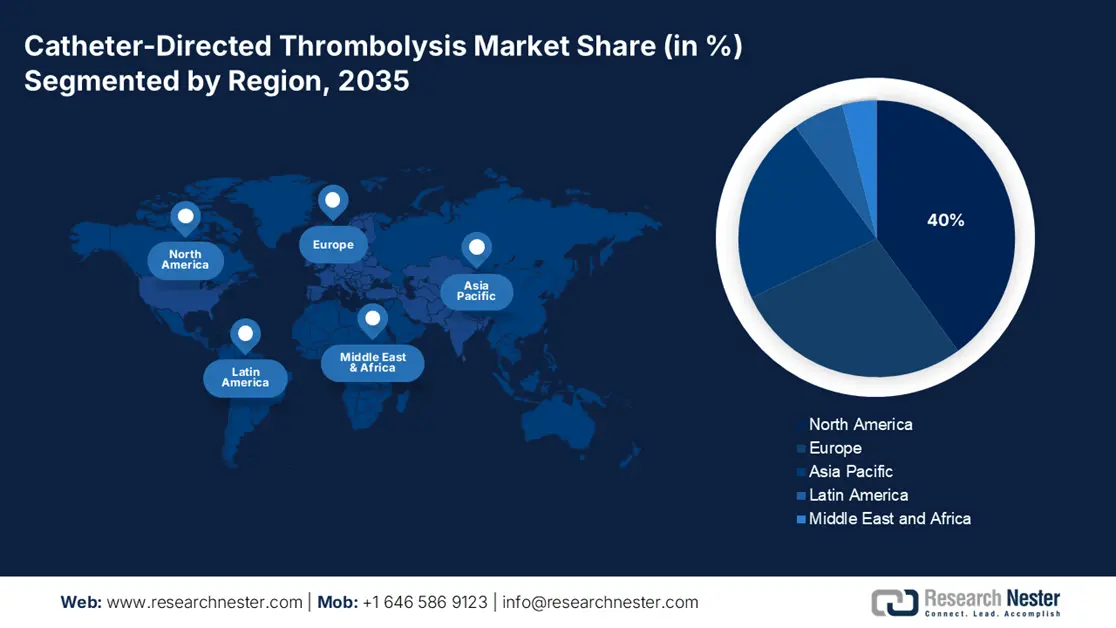

Catheter-Directed Thrombolysis Market - Regional Analysis

North America Market Insights

The North America catheter-directed thrombolysis market is anticipated to grow steadily and is expected to have a market share of 40% by 2035. The market is strongly driven by strong healthcare infrastructure, positive reimbursement policy, and increased rates of thrombotic disorders. The NLM report in March 2022 depicts that IVT use in acute ischemic stroke patients in North America increased steadily from 2.8% to 7.7%, with recent trends indicating continued adoption through 2025, though disparities in access persist by race, age, and hospital type. Canada came next, financing growth in interventional radiology facilities.

Numerous factors, including strong federal funding, advantageous reimbursement, and sophisticated interventional infrastructure, are driving the catheter-directed thrombolysis market in the U.S. The country is dominating the North America region and is expected to hold the maximum share by 2035. Medicaid spending increased from USD 871.7 billion in 2023, increasing 7.9% from the prior year, reflecting general healthcare expenditure growth, including coverage for vascular interventions like thrombolysis, as per CMS data in June 2025. Government actions have also focused on quality-of-care enhancements through AHRQ's guideline suggestions for minimally invasive treatments in lowering readmissions and cost pressures.

A single-payer system drives the Canada market, with uptake controlled by cost-effectiveness evaluations via agents such as CADTH. Access tends to be more limited than in the US, with use often restricted to major tertiary care hospitals. Interest in efficient treatment options is sparked by the Public Health Agency of Canada's identification of [VTE] as a country with a substantial health burden.. A key trend in Canadian provinces is the ongoing and gradual expansion of provincial funding for CDT, following positive health technology assessments. Further, harmonizing access to interventional radiology services across provinces to reduce regional differences.

Catheter-Directed Thrombolysis Trials

|

Catheter Name |

Delivery Method |

Thrombolytic Dose |

Thrombolytic Duration |

|

Cragg-McNamara |

Multi-sidehole infusion |

Lower than systemic (12-24 mg) |

24 hours |

|

EKOSonic (Ultrasound-assisted Thrombolysis) |

Multi-sidehole infusion with ultrasound |

Lower than systemic ULTIMA: dosing 10-20 mg OPTALYSE 4-12 mg, SEATTLE II 24mg ) |

ULTIMA: 12 to 15 hours OPTALYSE 2 to 6 hours SEATTLE II 12 to 24 hrs |

|

Bashir Endovascular Catheter |

Pharmacomechanical |

Lower than systemic (7-14 mg) |

5 hours |

Source: NLM May 2024

Asia Pacific Market Insights

The Asia-Pacific catheter-directed thrombolysis market is the fastest-growing region and is expected to hold a significant market share by 2035. The market is experiencing growth with increased cases of thrombotic disorders, government-sponsored infrastructure developments, and the embracement of minimally invasive treatments among key economies. Japan, China, India, South Korea, and Malaysia are spending on interventional radiology suites, domestic catheter manufacturing, and public-private research initiatives. multinational players are localizing catheter assembly to minimize cost and align with regional procurement preferences. In the APAC market, China and Japan combined hold the maximum of the regional market share by 2035.

The catheter-directed thrombolysis market in China is projected to lead in 2035. The market is expanding due to its large patient pool and healthcare modernization efforts. As per the NLM data in December 2024, the incidence of pulmonary embolism (PE) in China was 14.2 per 100,000 population in 2021, with approximately 200,000 PE patients recorded across 5101 hospitals. Strategic collaborations among local manufacturers and public hospitals have brought down the cost of treatments, speeding up adoption across Tier 2 and Tier 3 cities.

The advanced healthcare system and aging population are responsible for the growth of Japan's catheter-directed thrombolysis market. There is considerable government spending through the Ministry of Health, Labour and Welfare (MHLW) to address the challenges due to the high burden of vascular disease. Japan's MHLW has set up the Japanese National Plan for Promotion of Measures Against Cerebrovascular and Cardiovascular Disease (CVD) to increase the healthy life expectancy by 3 years by 2040 compared to the healthy life expectancy over the past decade and to lower the age-adjusted mortality of CVD.

Europe Market Insights

The Europe catheter-directed thrombolysis market is expected to have a significant market share by 2035. The EU market is fueled by the strong public investment in vascular health infrastructure, increasing adoption of minimally invasive procedures across leading economies and rising thrombotic disease prevalence. Research and development, as well as cross-border clinical cooperation, have been expedited by government-led efforts and EU financing schemes. Germany holds the largest share spent in 2024. The France and UK are investing highly in device procurement and procedural capacity. The market in Europe is steadily rising with the support of reimbursement structures, integrated care models, and centralized procurement.

Germany has the largest market for catheter-directed thrombolysis in Europe, which is also expected to have the largest market share in 2035. This is due to its best hospital infrastructure, a reimbursement environment that is innovation-friendly via the G-BA, and a high prevalence of vascular disease with the rising aging population. The DSTATIS data in April 205 depicts that healthcare expenditure in 2023 valued at approximately €489 billion, representing about 12.6% of the country's GDP. The nation has a robust national medical device industry, supported by federal research grants, ensures rapid adoption of advanced technologies like ultrasound-enhanced thrombolysis systems. The Federal Institute for Drugs and Medical Devices (BfArM) assures a predictable regulatory path, making Germany the central market for medtech in Europe.

France is the second largest market due to the stability of its public healthcare system that delivers wide access to patients. Growth in the market is driven by targeted funding through national programs aimed at improving outcomes for strokes and cardiovascular care, where CDT is an essential treatment. The Ministry of Solidarity and Health has made reducing regional access to high-tech medicine a priority, which includes bringing additional interventional radiology services that are needed for CDT to scale. In addition, data from the Haute Autorité de Santé (HAS) indicating advancing treatment for PTS will be critical evidence for sustaining and expanding future public funding for CDT care.