Catheter-Directed Thrombolysis Market Outlook:

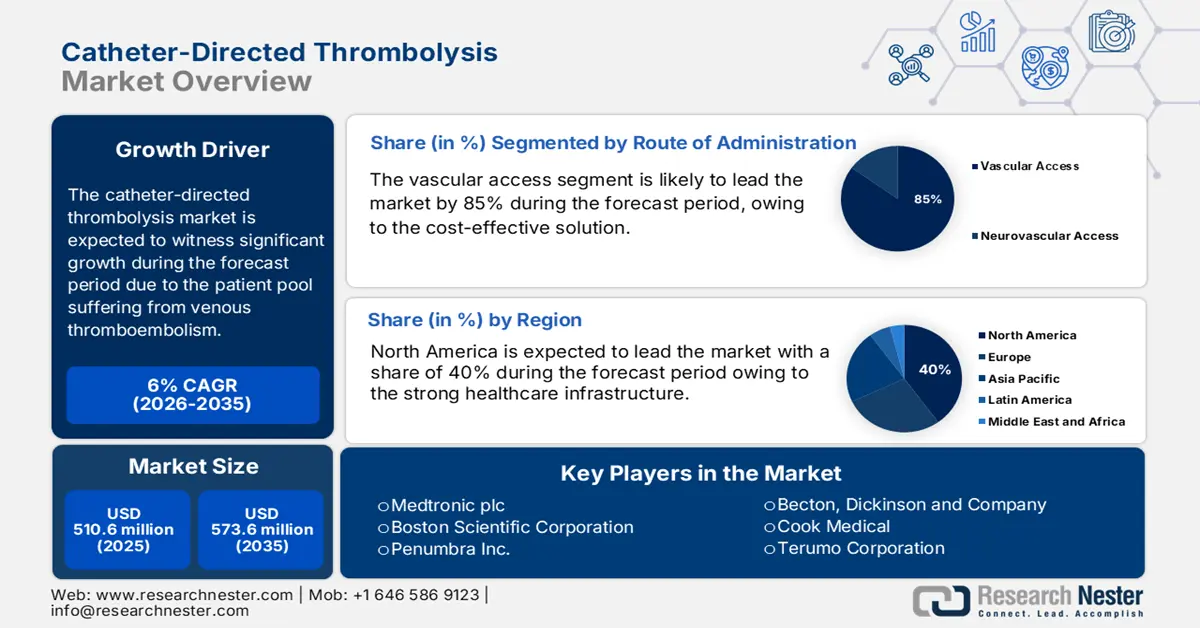

Catheter-Directed Thrombolysis Market size was valued at USD 510.6 million in 2025 and is projected to reach USD 573.6 million by the end of 2035, growing at a CAGR of 6% during the forecast period 2026-2035. In 2026, the industry size of catheter-directed is assessed at USD 541.2 million.

The catheter-directed thrombolysis market is experiencing a steady rise and is driven by the patient pool suffering from venous thromboembolism (VTE), including pulmonary embolism and deep vein thrombosis. As per the U.S. Centers for Disease Control and Prevention data in May 2024, nearly 900,000 cases of venous thromboembolism are registered every year in the U.S., including pulmonary embolism. As per the NLM study in May 2021, VTE affects more than 500,000 individuals each year, highlighting the clinical need for catheter-based treatments. On the supply chain side, the production pipeline involves complex logistics for both interventional radiology devices and drug APIs, and they mainly depend on medical-grade polymers, imaging-compatible microcatheters, and biocompatible alloys.

Investment in research, development, and deployment (RDD) is substantial, focusing on improving drug efficacy, reducing bleeding complications, and enhancing device precision for targeted drug delivery. Public and private grants through the National Institutes of Health (NIH) fund clinical trials to expand CDT indications. The majority of the pharmaceuticals used in catheter-directed thrombolysis are thrombolytic (fibrinolytic) agents, which break up blood clots. These drugs are directly delivered into the clot via a catheter, reducing systemic exposure and bleeding risk compared to systemic administration. The global trade of pharmaceutical products reached USD 853 billion, as per the OEC data in 2023, including the pharmaceutical agents that are used in CDT.

Key Catheter-Directed Thrombolysis Market Insights Summary:

Regional Highlights:

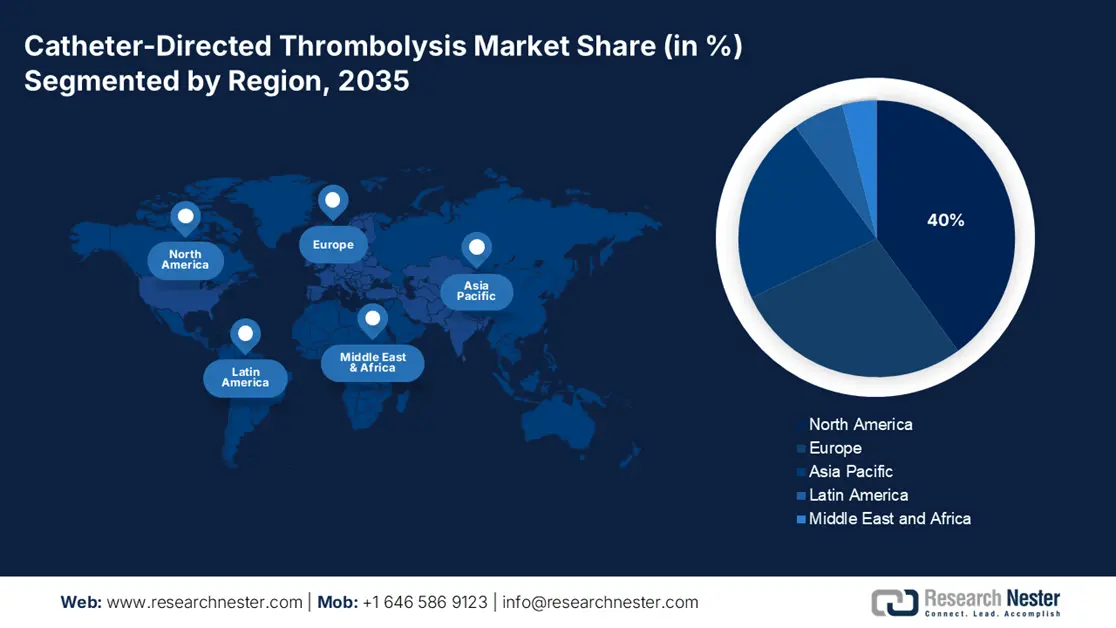

- The North America catheter-directed thrombolysis market is projected to hold a 40% share by 2035, impelled by robust healthcare infrastructure, favorable reimbursement policies, and increasing incidences of thrombotic disorders.

- The Asia Pacific region is set to witness the fastest growth through 2035, fueled by expanding healthcare infrastructure, surging thrombotic cases, and the growing adoption of minimally invasive treatments across major economies.

Segment Insights:

- The vascular access segment is projected to account for 85% share by 2035 in the Catheter-Directed Thrombolysis Market, propelled by the rising incidence of Deep Vein Thrombosis (DVT) and Peripheral Arterial Occlusion requiring extensive peripheral vascular interventions.

- The hospitals segment is expected to capture a significant share by 2035, supported by the growing need for advanced infrastructure and multidisciplinary expertise in performing complex CDT procedures.

Key Growth Trends:

- Favorable government and reimbursement policies

- Clinical evidence showing better outcomes and cost-saving

Major Challenges:

- Patient affordability remains low in emerging markets

- Complex and fragmented reimbursement pathways

Key Players: Boston Scientific Corporation, Medtronic plc, Johnson & Johnson (Cordis), Bayer AG, Penumbra, Inc., Cook Medical LLC, Becton, Dickinson and Company (BD), Terumo Corporation, Abbott Laboratories, Siemens Healthineers AG, iVascular SLU, Cardinal Health, Inc., B. Braun SE, Stryker Corporation, AngioDynamics, Inc., Asahi Intecc Co., Ltd., NIPRO Corporation, Koninklijke Philips N.V., Kaneka Corporation, Tokai Medical Products Inc.

Global Catheter-Directed Thrombolysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 510.6 million

- 2026 Market Size: USD 541.2 million

- Projected Market Size: USD 573.6 million by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Malaysia, Canada, France

Last updated on : 24 September, 2025

Catheter-Directed Thrombolysis Market - Growth Drivers and Challenges

Growth Drivers

- Favorable government and reimbursement policies: Government spending mainly via Medicare is the critical determinant of market access. Reimbursement codes for CDT procedures in hospital outpatient departments influence the adoption rate directly. On the other hand, the specific annual spending on CDT devices is not related to public reports, its utilization is captured with broader diagnostic group payment for venous thrombectomy or thrombolysis. Stable or expanding reimbursement signals market stability and encourages hospital investment in the necessary equipment and training, making the procedure financially viable for healthcare providers and accessible to a larger patient pool.

- Clinical evidence showing better outcomes and cost-saving: Strong clinical evidence is a key driver, showing that CDT has better long-term vascular patency and reduces the risk of post-thrombotic syndrome compared with anticoagulation therapy. This forms a strong value proposition for payers. For example, research by NLM in February 2025 reports that the price of catheter-directed thrombolysis is USD 22,353. Although the initial cost is high, preventing its use for chronic conditions such as PTS in the short term is expensive, it saves a large amount in the long term through prevention of disability, rehospitalization, and the cost of continued care. This evidence is important to persuade healthcare systems to invest in CDT technology.

- Rising cases of venous thromboembolism: The increasing patient pool fuels the market. On the other hand, the demographic factors such as an aging population, obesity rates, and enhanced survival from cancer and invasive surgery are responsible for the growing incidences of deep vein thrombosis (DVT) and pulmonary embolism (PE). For instance, the CDC puts the number of deaths in the U.S. due to DVT/PE at 60,000 to 100,000 yearly. This increasing incidence directly increases the size of the addressable market for CDT since a segment of these advanced cases can only be treated with advanced interventional therapy beyond anticoagulation.

Global Prevalence of Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE)

|

Condition |

Prevalence Range (per 100,000 person-years) |

Key Notes |

|

Deep Vein Thrombosis (DVT) |

45 to 117 |

Higher incidence among older adults; varies by region |

|

Pulmonary Embolism (PE) |

29 to 48 |

Estimated 1%-7% prevalence in pregnant women subgroup |

Source: NLM February 2024

Challenge

- Patient affordability remains low in emerging markets: In emerging countries like India and some parts of Southeast Asia, the cost for catheter-directed thrombolysis is high, which is more than half the average annual income. As per the WHO report, the cost burdens result that only eligible patients being treated in low and middle-income countries. These limitations demand that manufacturers offer a low-cost alternative for the specific drugs. Some organizations, such as Terumo, are developing simple catheter kits to meet the affordability challenge.

- Complex and fragmented reimbursement pathways: Overcoming the reimbursement challenge is a major hurdle. In the U.S., CDT has separate payments for the device, the thrombolytic drug, and the procedure, also each with its own CMS code. Gaps in this procedure can create financial disincentives for hospitals to adopt the latest technology for enhanced results. For instance, if the DRG payment for a venous thrombectomy does not fully cover the cost of a premium-priced catheter, hospitals will be reluctant to stock it. Manufacturers must actively work with payers to establish new, appropriate codes that accurately reflect the total cost of care.

Catheter-Directed Thrombolysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 510.6 million |

|

Forecast Year Market Size (2035) |

USD 573.6 million |

|

Regional Scope |

|

Catheter-Directed Thrombolysis Market Segmentation:

Route of Administration Segment Analysis

Under the route of administration segment, vascular access leads the segment and is poised to hold the share value of 85% by 2035. The dominance is encompassed by the treatment of conditions in the peripheral vasculature, primarily Deep Vein Thrombosis (DVT) and Peripheral Arterial Occlusion. More than one-third of VTE cases require hospital care, and the majority involve DVT in the peripheral vessels, based on the CDC report in January 2025. The patient pool for these conditions is vastly larger than for neurovascular cases. Procedures for iliofemoral DVT, for example, are a primary growth driver for the entire CDT market. The high prevalence of venous thromboembolism, as documented by the CDC, ensures that vascular access remains the predominant route of administration, requiring a wide range of catheters designed for navigation in larger peripheral veins and arteries.

End user Segment Analysis

Hospitals are fueling the end user segment and will be expected to hold significant share value by 2035. Hospitals serve a significant role in CDT procedures because of the complex infrastructure requirements, high cost of equipment, and immediate access to multidisciplinary care teams. CDT is an acute care procedure typically performed in either emergency room settings or on hospital patients. It requires advanced imaging suites, critical care support to monitor potential incidents such as bleeding, and the presence of specialist interventional radiologists or cardiologists.

Drug Type Segment Analysis

Tissue plasminogen activator is leading the drug segment and remains as the pharmacological gold standard based on its high fibrin specificity and strong clinical history. The NLM report in August 2025 depicts that alteplase has a safety profile of a standard drug, with symptomatic intracranial hemorrhage occurring in about 8% of acute ischemic stroke patients treated, consistent across multiple clinical trials. Its dominance is supported by its status as the primary agent studied in major clinical trials and its inclusion in treatment guidelines. While other drugs like urokinase are used, tPA's efficacy and the clinical familiarity established through its use in ischemic stroke protocols solidify its position. Regulatory approvals for CDT devices and treatment protocols are most commonly referenced for use with tPA, making it the first-choice agent for clinicians.

Our in-depth analysis of the catheter-directed thrombolysis market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Drug Type |

|

|

End user |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Catheter-Directed Thrombolysis Market - Regional Analysis

North America Market Insights

The North America catheter-directed thrombolysis market is anticipated to grow steadily and is expected to have a market share of 40% by 2035. The market is strongly driven by strong healthcare infrastructure, positive reimbursement policy, and increased rates of thrombotic disorders. The NLM report in March 2022 depicts that IVT use in acute ischemic stroke patients in North America increased steadily from 2.8% to 7.7%, with recent trends indicating continued adoption through 2025, though disparities in access persist by race, age, and hospital type. Canada came next, financing growth in interventional radiology facilities.

Numerous factors, including strong federal funding, advantageous reimbursement, and sophisticated interventional infrastructure, are driving the catheter-directed thrombolysis market in the U.S. The country is dominating the North America region and is expected to hold the maximum share by 2035. Medicaid spending increased from USD 871.7 billion in 2023, increasing 7.9% from the prior year, reflecting general healthcare expenditure growth, including coverage for vascular interventions like thrombolysis, as per CMS data in June 2025. Government actions have also focused on quality-of-care enhancements through AHRQ's guideline suggestions for minimally invasive treatments in lowering readmissions and cost pressures.

A single-payer system drives the Canada market, with uptake controlled by cost-effectiveness evaluations via agents such as CADTH. Access tends to be more limited than in the US, with use often restricted to major tertiary care hospitals. Interest in efficient treatment options is sparked by the Public Health Agency of Canada's identification of [VTE] as a country with a substantial health burden.. A key trend in Canadian provinces is the ongoing and gradual expansion of provincial funding for CDT, following positive health technology assessments. Further, harmonizing access to interventional radiology services across provinces to reduce regional differences.

Catheter-Directed Thrombolysis Trials

|

Catheter Name |

Delivery Method |

Thrombolytic Dose |

Thrombolytic Duration |

|

Cragg-McNamara |

Multi-sidehole infusion |

Lower than systemic (12-24 mg) |

24 hours |

|

EKOSonic (Ultrasound-assisted Thrombolysis) |

Multi-sidehole infusion with ultrasound |

Lower than systemic ULTIMA: dosing 10-20 mg OPTALYSE 4-12 mg, SEATTLE II 24mg ) |

ULTIMA: 12 to 15 hours OPTALYSE 2 to 6 hours SEATTLE II 12 to 24 hrs |

|

Bashir Endovascular Catheter |

Pharmacomechanical |

Lower than systemic (7-14 mg) |

5 hours |

Source: NLM May 2024

Asia Pacific Market Insights

The Asia-Pacific catheter-directed thrombolysis market is the fastest-growing region and is expected to hold a significant market share by 2035. The market is experiencing growth with increased cases of thrombotic disorders, government-sponsored infrastructure developments, and the embracement of minimally invasive treatments among key economies. Japan, China, India, South Korea, and Malaysia are spending on interventional radiology suites, domestic catheter manufacturing, and public-private research initiatives. multinational players are localizing catheter assembly to minimize cost and align with regional procurement preferences. In the APAC market, China and Japan combined hold the maximum of the regional market share by 2035.

The catheter-directed thrombolysis market in China is projected to lead in 2035. The market is expanding due to its large patient pool and healthcare modernization efforts. As per the NLM data in December 2024, the incidence of pulmonary embolism (PE) in China was 14.2 per 100,000 population in 2021, with approximately 200,000 PE patients recorded across 5101 hospitals. Strategic collaborations among local manufacturers and public hospitals have brought down the cost of treatments, speeding up adoption across Tier 2 and Tier 3 cities.

The advanced healthcare system and aging population are responsible for the growth of Japan's catheter-directed thrombolysis market. There is considerable government spending through the Ministry of Health, Labour and Welfare (MHLW) to address the challenges due to the high burden of vascular disease. Japan's MHLW has set up the Japanese National Plan for Promotion of Measures Against Cerebrovascular and Cardiovascular Disease (CVD) to increase the healthy life expectancy by 3 years by 2040 compared to the healthy life expectancy over the past decade and to lower the age-adjusted mortality of CVD.

Europe Market Insights

The Europe catheter-directed thrombolysis market is expected to have a significant market share by 2035. The EU market is fueled by the strong public investment in vascular health infrastructure, increasing adoption of minimally invasive procedures across leading economies and rising thrombotic disease prevalence. Research and development, as well as cross-border clinical cooperation, have been expedited by government-led efforts and EU financing schemes. Germany holds the largest share spent in 2024. The France and UK are investing highly in device procurement and procedural capacity. The market in Europe is steadily rising with the support of reimbursement structures, integrated care models, and centralized procurement.

Germany has the largest market for catheter-directed thrombolysis in Europe, which is also expected to have the largest market share in 2035. This is due to its best hospital infrastructure, a reimbursement environment that is innovation-friendly via the G-BA, and a high prevalence of vascular disease with the rising aging population. The DSTATIS data in April 205 depicts that healthcare expenditure in 2023 valued at approximately €489 billion, representing about 12.6% of the country's GDP. The nation has a robust national medical device industry, supported by federal research grants, ensures rapid adoption of advanced technologies like ultrasound-enhanced thrombolysis systems. The Federal Institute for Drugs and Medical Devices (BfArM) assures a predictable regulatory path, making Germany the central market for medtech in Europe.

France is the second largest market due to the stability of its public healthcare system that delivers wide access to patients. Growth in the market is driven by targeted funding through national programs aimed at improving outcomes for strokes and cardiovascular care, where CDT is an essential treatment. The Ministry of Solidarity and Health has made reducing regional access to high-tech medicine a priority, which includes bringing additional interventional radiology services that are needed for CDT to scale. In addition, data from the Haute Autorité de Santé (HAS) indicating advancing treatment for PTS will be critical evidence for sustaining and expanding future public funding for CDT care.

Key Catheter-Directed Thrombolysis Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Johnson & Johnson (Cordis)

- Bayer AG

- Penumbra, Inc.

- Cook Medical LLC

- Becton, Dickinson and Company (BD)

- Terumo Corporation

- Abbott Laboratories

- Siemens Healthineers AG

- iVascular SLU

- Cardinal Health, Inc.

- B. Braun SE

- Stryker Corporation

- AngioDynamics, Inc.

- Asahi Intecc Co., Ltd.

- NIPRO Corporation

- Koninklijke Philips N.V.

- Kaneka Corporation

- Tokai Medical Products Inc.

The global catheter-directed thrombolysis market is dominated by American multinational companies, including Medtronic, Boston Scientific, and Penumbra, which collectively hold a market share of more than 35.6%. These companies are heavily investing in R&D, AI image integration, and combination therapy of drugs and devices. European companies like Philips and Biotronik are developing image-guided CDT platforms, while Asian players (e.g., Terumo, MicroPort, and Meril) are increasing regional presence with cost-effective technologies. Strategic partnerships with .gov programs' regulatory acceleration programs, clinical trials, and public health systems are facilitating broader access to CDT, particularly in high-burden areas like APAC and Europe.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2024, Penumbra launched Lightning Flash 2.0, which is the next-generation computer-assisted vacuum thrombectomy system to remove venous thrombus and treat pulmonary emboli. The device is designed to increase speed and sensitivity to thrombus and blood flow.

- In January 2024, Thrombolex, Inc. announced the new BASHIR .035 endovascular catheters, now compatible with a 0.035 guidewire for the treatment of acute pulmonary embolism. The BASHIR catheters resolve thrombus via pharmacomechanical lysis.

- Report ID: 4220

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.