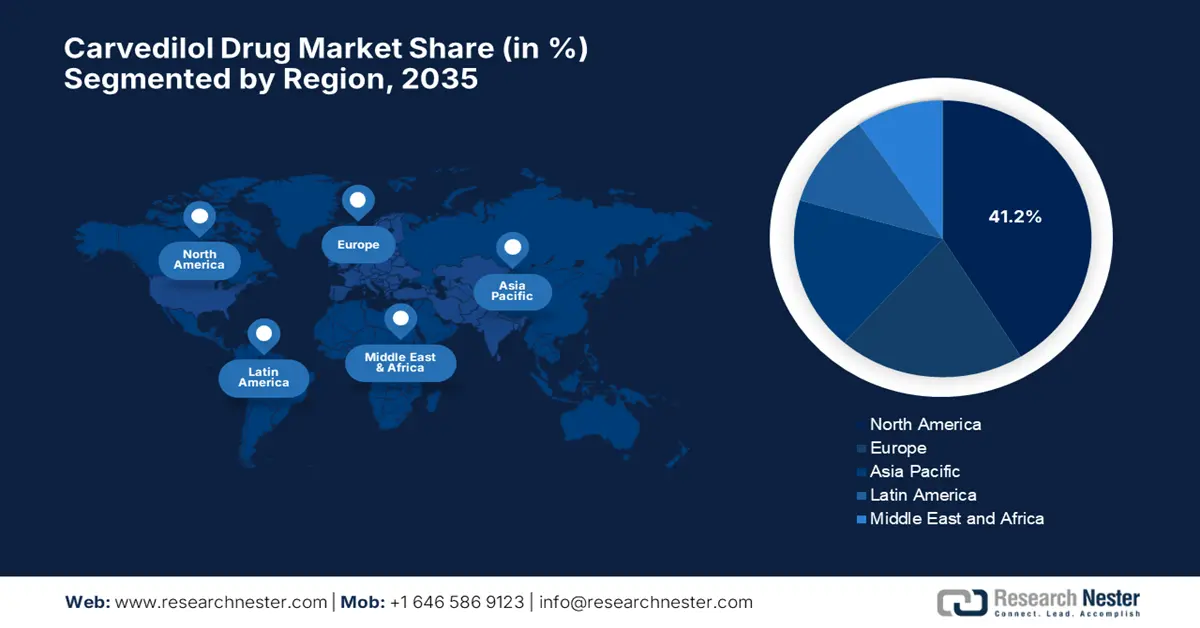

Carvedilol Drug Market - Regional Analysis

North America Market Insights

North America carvedilol drug market is set to dominate globally by capturing the largest share of 41.2% over the discussed tenure. The landscape witnesses such leadership on account of the amplifying burden of associated ailment-affected patients and optimized formulary coverage. As evidence, the 2025 CDC report notes that over 119.9 million adults in the U.S. are affected by hypertension. Besides, there is an improved adoption of fixed-dose combinations in Medicare Part D, reflecting the amplified volume of adoption in this sector. Besides, the efforts to localize the supply chain aim to diminish import risks, creating a promising scope of expansion.

The U.S. is estimated to be the primary contributor to revenue generation in the North America market. The country benefits from an increasing patient base, where only 1 in 4 residents with high BP have their condition under control, as per the 2023 NLM article. Another NLM study predicted the occurrence of HF in the U.S. to increase by 46% from 2012 to 2030, with a corresponding increase in healthcare costs of about 127%. Besides, the HFSA revealed that the lifetime risk of HF rose to 24% nationwide in 2024, with 24-34% of the U.S. population being at the pre-HF stage. These figures indicate the presence of a sustainably growing consumer volume in this sector.

Asia Pacific Market Insights

The Asia Pacific carvedilol drug market is expected to grow at the fastest rate, grabbing a considerable share by the end of 2035. The landscape is largely fueled by the growing volume of unmet needs and the middle-class population. Besides, the rapid aging among residents across Japan, China, and Australia is also contributing to the demographic expansion in this sector. Moreover, the high CVD burden and a strong emphasis on generic production make the region an epitome of both a continuously enlarging source of cash inflow and innovation for the merchandise.

China is the major exporter in the market, which is attributed to its exceptional API manufacturing capacity and a large proportion of hypertension in total CVD-related deaths, accounting for 54.5%, as per the statistics published by the NLM in 2024. In response to this epidemic, the notable increase in government healthcare spending is securing a greater capital influx in this field. Further, the domestic manufacturers such as CSPC Pharmaceutical dominate the market with a predominant position in terms of APIs.

Feasible Opportunities Present in APAC Countries

|

Country |

Key Notes |

Timeline |

|

Australia |

More than USD 611 million of the net annual cost of hypertension belongs to pharmacy fees for dispensing and handling medications |

2021-2022 |

|

India |

The government launched the 75/25 initiative to screen and provide standard of care for 75 million individuals with hypertension and diabetes |

2023-2025 |

|

China |

Sets major targets to manage 110 million hypertension patients, aiming to achieve a standardized management rate of 70% |

2017-2025 |

Source: The George Institute for Global Health, PIB, and NLM

Europe Market Insights

In Europe, the carvedilol drug market is well-established, empowered by rapid aging and advances in formulations. The region also sets its significance in this sector as one of the largest suppliers of branded APIs for manufacturers. Currently, the emergence of generics is also gaining traction in this field due to stringent cost-containment policies and widespread reimbursement systems. Tablets remain the preferred dosage form in the Europe landscape in support of upgraded clinical guidelines and physician familiarity. Moreover, enhanced harmonization between regulatory frameworks across the region enables consistency in progress.

The ongoing innovation in medical sciences, particularly revolutionary discoveries in affordable CVD-related care, continues to shape the market in the UK. The country’s focus is currently concentrating on evidence-based prescribing and centralized procurement, which contributes to stable demand and comprehensive pricing. This environment is further backed by massive public funding, which can be exemplified by the USD 171.1 million allocation to cardiovascular disease and stroke research under the research programmes of the National Institute of Health and Care Research (NIHR) from 2020 to 2024.

Country-wise Prescription Rates of Carvedilol Drugs for Hypertensive Patients (2024)

|

Country |

Hypertension |

Hypertension with CVD Comorbidity |

Hypertension with Diabetes Comorbidity |

|

Itay |

16% |

18% |

16% |

|

Poland |

11% |

15% |

13% |

|

Tyrkey |

20% |

22% |

22% |

Source: NLM