Carrageenan Market Outlook:

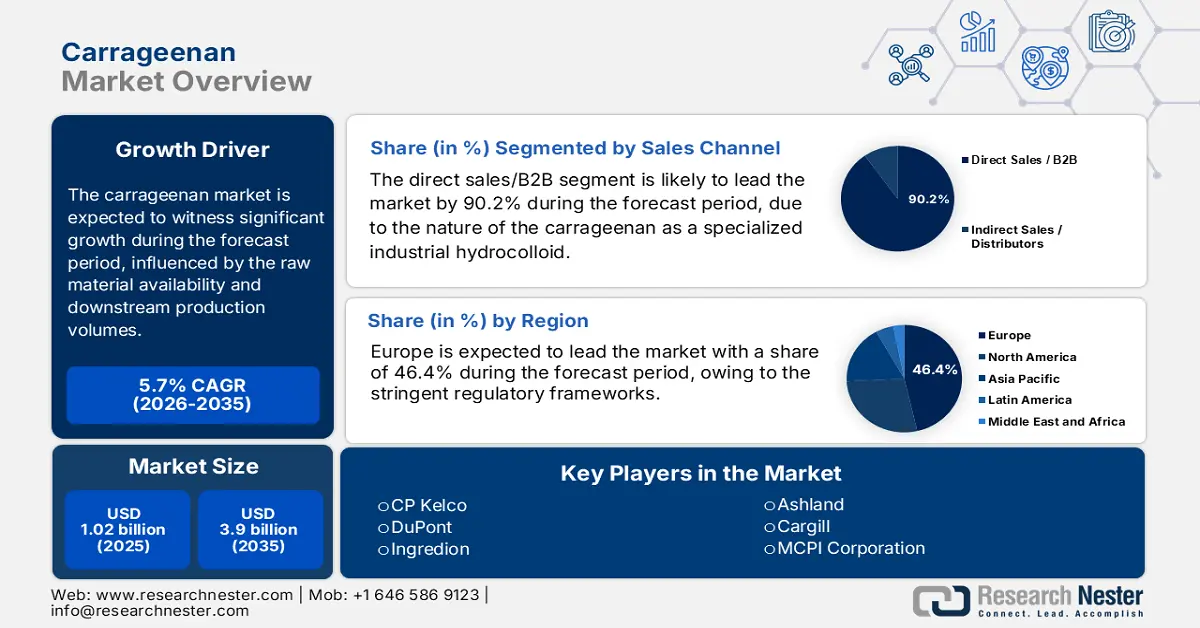

Carrageenan Market size was valued at USD 1.02 billion in 2025 and is projected to reach USD 3.9 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of carrageenan is estimated at USD 1.08 billion.

The carrageenan market is primarily shaped by institutional demand from the food processing, pharmaceutical formulation, and regulated industrial applications, where the usage is influenced by the raw material availability, regulatory acceptance, and downstream production volumes rather than consumer-facing branding. The global supply is closely tied to red seaweed cultivation, with Southeast Asia dominating the harvest volumes. According to the NLM study in July 2022, the global seaweed and aquatic plants production reached 1,083,242 tonnes. Red seaweeds represent a material share due to their role in the hydrocolloid extraction, including carrageenan. Indonesia and the Philippines are expected to produce a high volume of seaweed output, making the supply chain highly concentrated and sensitive to climate variability, labor availability, and coastal aquaculture policy decisions.

Wild Seaweed and Aquatic Plants Production Worldwide

|

Country |

Brown Seaweed |

Red Seaweed |

Green Seaweed |

Seaweed Nei |

Aquatic Plants Nei |

Total |

|

Chile |

288,486.00 |

115,973.00 |

- |

- |

467.00 |

404,926.00 |

|

China |

- |

- |

- |

- |

174,450.00 |

174,450.00 |

|

Norway |

162,824.00 |

- |

128.00 |

- |

- |

162,952.00 |

|

Japan |

46,500.00 |

- |

- |

- |

20,300.00 |

66,800.00 |

|

France |

51,141.92 |

158.12 |

- |

0.01 |

- |

51,300.05 |

Source: NLM July 2022

Further, the carrageenan market is also driven by its role as a critical functional ingredient in the supply chain of processed food. Its primary application is as a gelling, thickening, and stabilizing agent, with the food and beverage industry accounting for the dominant share of consumption. The demand is closely tied to the production volumes of the key end-use products, such as the meat diary and plant-based alternatives. The global supply chain originates with the cultivation of the specific seaweed species, such as the Kappaphycus and Eucheuma, with the Philippines and Indonesia serving as the world’s primary production regions, with the Philippines being in the third position in the world’s seaweed production, based on the BFAR 2022 to 2026 data. This geographical concentration introduces considerations regarding supply security, environmental impact, and socio-economic factors for the farming communities.