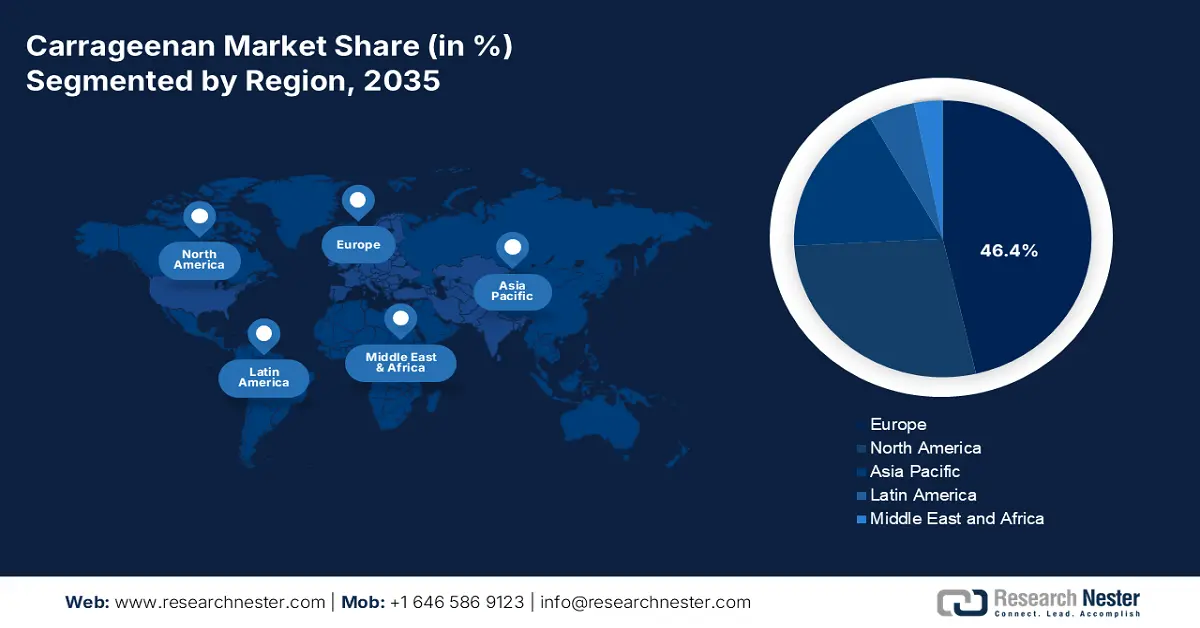

Carrageenan Market - Regional Analysis

Europe Market Insights

Europe is dominating the carrageenan market and is expected to hold the market share of 46.4% by 2035. The market operates within one of the world’s most stringent regulatory frameworks governed by the European Food Safety Authority for food use and the European Medicines Agency for pharmaceutical applications. The primary driver of the carrageenan market in Europe is the strong consumer and regulatory push for natural plant-based ingredients, positioning carrageenan as a key texturizer in the growing plant-based food sector. However, this growth is tempered by the ongoing scientific reevaluations of its safety that can influence the market perception and regulatory status. The trend towards the clean label products presents both an opportunity, as carrageenan is a natural extract, and a challenge, as some consumer groups advocate for its removal.

Germany’s carrageenan market is the largest in Europe and is driven by its advanced food processing and pharmaceutical industries. The demand is concentrated in the meat processing, dairy products, and as an excipient in pharmaceutical gels and tablets. The key driver is the Bioeconomy policy, which aims to replace the fossil-based products with sustainable, renewable materials such as seaweed-derived hydrocolloids. The ACT Health and Nutrition is the leading company in Germany and produces carrageenan under the category of Hydrocolloids with a stability greater than 120 degrees Celsius. Germany has exported seaweeds of 1,332 tonnes, based on the Government of Netherlands February 2022 report, highlighting the demand for the seaweed-derived inputs across European food, pharmaceutical, and industrial manufacturing supply chains.

France’s carrageenan market is defined by the high demand from its prestigious dairy, processed meat, and bakery sectors, alongside growing applications in organic and clean-label products. The consumers in the country and the retailers exert strong pressure for the natural, traceable ingredients, influencing the carrageenan sourcing. The government support is channeled via the France 2030 investment plan that targets agricultural and food innovation. The report from the Government of the Netherlands in February 2022 states that France has increased the seaweed imports by 5% from 2,869 tonnes to 3,034 tonnes. Further, the small volume import price is expected to be high, from USD 4.00/kg to USD 6.00/kg. This growth reflects the tight domestic supply and sustained industrial demand, mainly from the regulated food processors prioritizing consistent quality inputs.

APAC Market Insights

The Asia Pacific is the fastest growing carrageenan market and is expected to grow at a CAGR of 6.5% during the forecast period 2022 to 2035. The market is driven by the dominant raw material suppliers and the fastest-growing consumption hub. The primary growth drivers are the massively expanding food processing industries in China and India, driven by the rising disposable incomes, urbanization, and the proliferation of packaged and convenience foods. The key trend is the rapid rise of the plant-based protein sector, where carrageenan is essential in texturizing dairy and meat alternatives. The region benefits from the significant government investment in marine biotechnology and sustainable aquaculture, enhancing the supply chain security. However, the market faces price volatility of raw seaweed and competition from alternative hydrocolloids in cost-sensitive applications.

China’s carrageenan market is defined by its dual role as the world’s largest consumer and a leading processor of refined carrageenan. Domestic demand is driven by the massive modernizing food manufacturing sector, mainly in dairy, instant noodles, and processed meats. The key growth vector is the state-backed push for food security and technological self-sufficiency in ingredients. This is supported by the significant R&D funding. Further, the People’s Government of Fujian Province in April 2025 reported that in 2024, seaweed production exceeded 1.6 million metric tons. This scale ensures the cost-efficient upstream integration supporting large volume carrageenan refining and export competitiveness. The provincial investment incentives further encourage the processing automation and capacity expansion aligned with the national food security goals.

India’s carrageenan market is defined by the explosive growth potential driven by the rapid urbanization, a young population, and government policies incentivizing domestic food processing to reduce imports and create jobs. The key driver is the expansion of organized retail and demand for packaged foods diary products, and meat analogues. The PIB March 2025 report shows that the Ministry of Food Processing Industries has allocated ₹10,900 crore for the Production Linked Incentive Scheme for the Food Processing. This supports the creation of the global food manufacturing champions. This scheme fosters large-scale manufacturing that inherently increases the demand for the functional ingredient, such as carrageenan. The PIB March 2025 has reported that the total seaweed production in India reached 72,385 tonnes in 2023, highlighting the rise in demand for seaweed.

Seaweed-Focused Budgetary Allocations under PMMSY

|

Budget Component |

Approval / Allocation |

Central Share |

Coverage / Location |

Purpose |

|

Total PMMSY Outlay (Fisheries Sector) |

₹20,050 crore |

— |

National |

Overall fisheries development with seaweed as a priority activity |

|

Seaweed-Specific Projects (Approved) |

₹194.09 crore |

₹98.97 crore |

Multiple States & UTs |

Promotion of seaweed cultivation and ecosystem development |

|

Infrastructure Support to Beneficiaries |

Included in ₹194.09 crore |

Included |

Coastal States & UTs |

Installation of rafts, monolines, and tubenets |

Source: PIB March 2025

North America Market Insights

The North America carrageenan market is a mature and value-driven segment defined by the robust regulatory oversight and demand for the high purity functional ingredients. The growth is primarily driven by the robust processed food industry, increasing consumer adoption of plants based diary and meat alternatives, and clean label reformulation trends where carrageenan replaces the synthetic stabilizers. The region’s advanced R&D capabilities foster demand for the specialized pharmaceutical-grade carrageenan in drug delivery systems. The key challenges include price sensitivity and competition from the alternative hydrocolloids. However, the innovation in sustainable sourcing and application-specific blends from suppliers, such as CP Kelco and DuPont, supports steady demand. The U.S. dominates the regional share, with Canada representing a smaller but stable market influenced by similar health and wellness trends.

The U.S. carrageenan market is the leading one and is driven by the large-scale food processing and innovation in plant-based alternatives. The demand is concentrated in dairy substitutes, processed meats, and pharmaceutical applications, with the suppliers competing on technical service and sustainable sourcing. The U.S. FDA GRAS status governs its use. The growth is supported by the consumer trends toward the clean label and natural ingredients. A key demand is the government-backed research into alternative proteins. Carrageenan remains authorized for use under FDA regulation 21 CFR §172.620, allowing continued procurement by dairy, meat, and beverage manufacturers supplying national retail and institutional channels, based on the ECFR December 2025 report. Further, the USDA May 2025 report notes that the food and beverage sector is the largest and made sales of 26.2% in 2021, reflecting the production base that relies on the approved stabilizing and gelling inputs.

Canada’s carrageenan market is defined by the robust quality demands and alignment with the health-focused consumer trends within its robust dairy and functional food sectors. Health Canada regulates carrageenan as a food additive. The demand is stable for the applications in the dairy products, beverage stabilization, and nutraceutical gummies. The government programs supporting agricultural innovation are key drivers. For instance, the Agriculture and Agri-Food Canada’s report in November 2023 committed over USD 250 million to support the research, including the novel food ingredients and bioproducts, boosting an environment for the development and use of specialty ingredients such as carrageenan in value-added food products in Canada.