Cardless ATM Market Outlook:

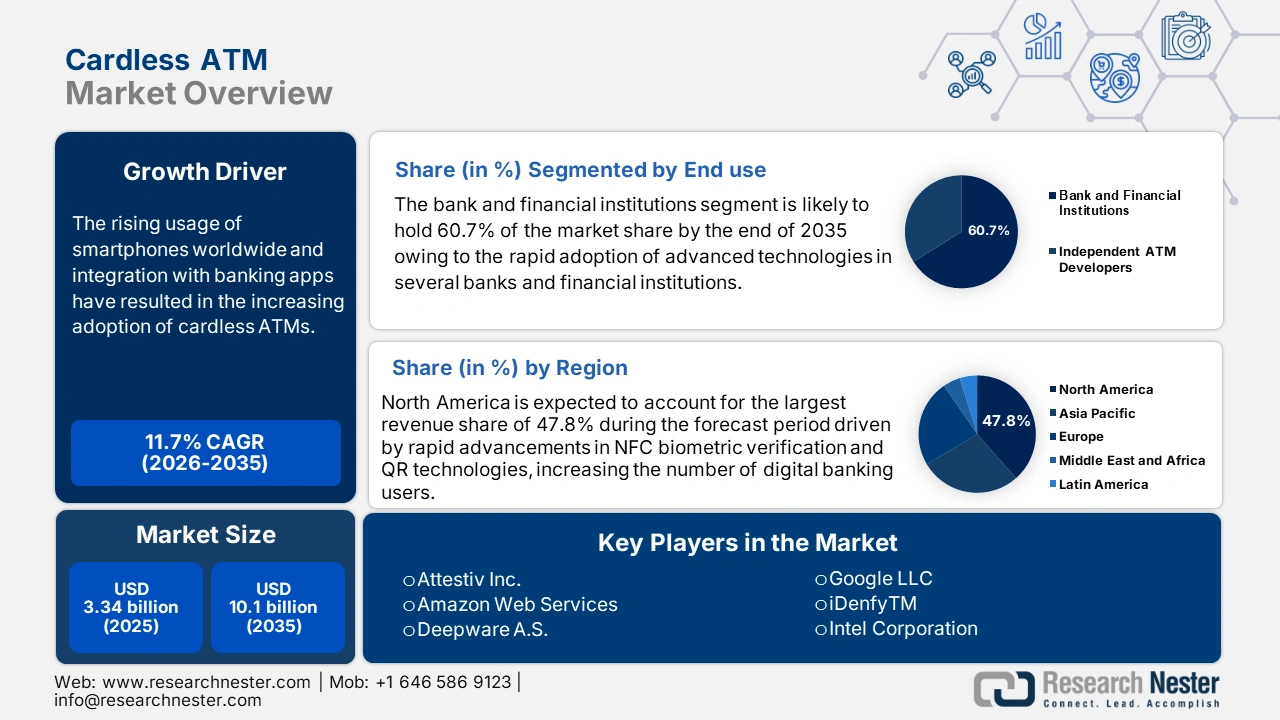

Cardless ATM Market size was over USD 3.34 billion in 2025 and is poised to exceed USD 10.1 billion by 2035, growing at over 11.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardless ATM is estimated at USD 3.69 billion.

The rising usage of smartphones globally and integration with banking apps have resulted in the increasing adoption of cardless ATMs. As of 2024, there are more than 4.88 billion mobile users worldwide, which is expected to reach 6.3 billion by 2029. With rapid advancements in technology, mobile banking has become easily accessible. Several banks worldwide are integrating cardless withdrawal features in their apps. For instance, in 2022, the Reserve Bank of India (RBI) introduced cardless cash withdrawals at ATMs using smartphones. Initiatives like these are expected to fuel cardless ATM market growth during the forecast period.

Many governments are driving digital payment adoption to reduce the reliance on cash. Initiatives such as India’s Digital India campaign and Europe’s PSD2 directive are some key examples of global efforts promoting digital economies. Governments have incentivized digital payments through tax benefits, subsidies, or reduced transaction fees. This, in turn, boosts the adoption of cardless ATMs.

Key Cardless ATM Market Insights Summary:

Regional Highlights:

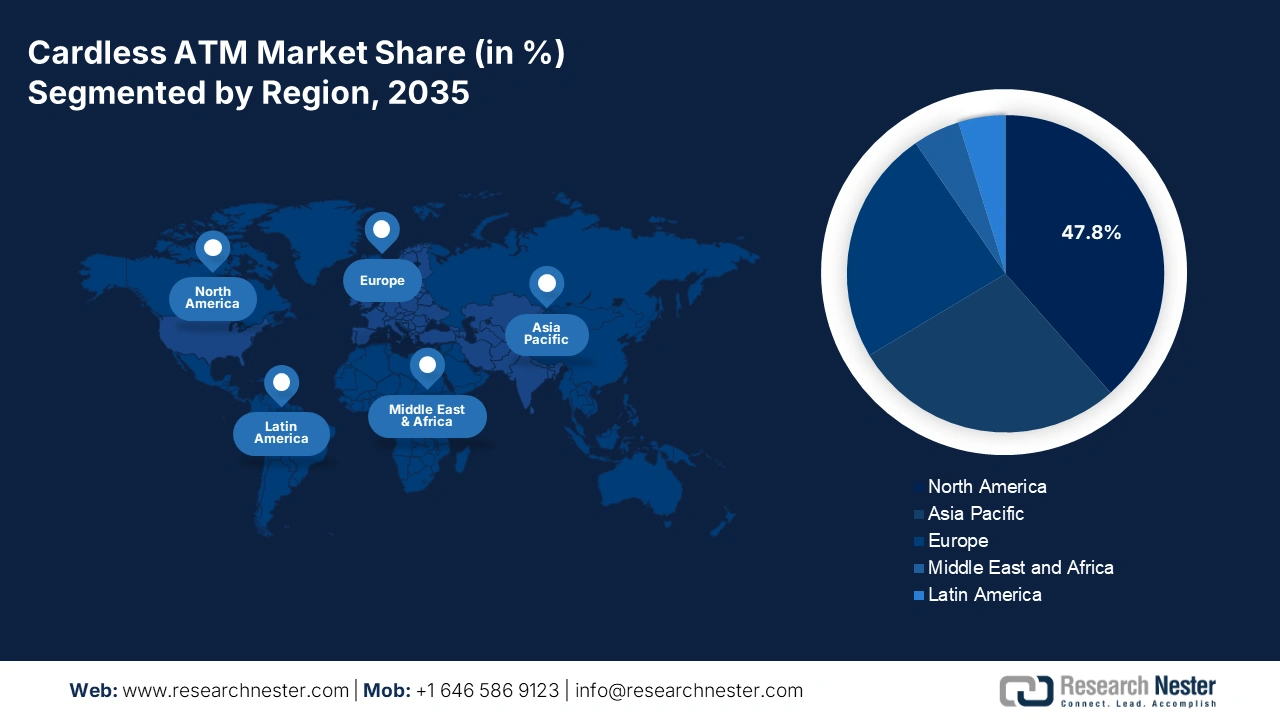

- North America cardless ATM market will account for 47.80% share by 2035, driven by rapid advancements in NFC biometric verification, QR technologies, and rising digital banking users.

- Asia Pacific market will grow rapidly during the forecast period 2026-2035, attributed to rapid adoption of mobile banking, biometric authentication, and government support for digital payments.

Segment Insights:

- The bank and financial institutions segment in the cardless atm market is expected to hold a 60.70% share by 2035, driven by increasing use of contactless ATM technologies by banks to enhance security and convenience.

- The quick response (qr) codes segment in the cardless atm market is anticipated to achieve the largest share by 2035, driven by the widespread adoption of QR-based cardless ATM withdrawals integrated with mobile banking apps.

Key Growth Trends:

- Increasing investments by financial institutions and banks to deploy advanced infrastructure

- Rising adoption of cardless ATM solutions post-COVID-19 Pandemic

Major Challenges:

- Rising concerns about cybersecurity and compliance issues

- High implementation costs

Key Players: NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu Limited, GRG Banking Equipment Co., Ltd., Hitachi-Omron Terminal Solutions, Corp., Hyosung TNS Inc., Triton Systems of Delaware, LLC, KAL ATM Software GmbH, Euronet Worldwide, Inc., Nautilus Hyosung America, Inc.

Global Cardless ATM Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.34 billion

- 2026 Market Size: USD 3.69 billion

- Projected Market Size: USD 10.1 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Cardless ATM Market Growth Drivers and Challenges:

Growth Drivers

- Increasing investments by financial institutions and banks to deploy advanced infrastructure: The growing adoption of cardless ATM technology has led to significant investments by financial institutions and banks to modernize and expand their existing ATM infrastructures. These enterprises are investing in ATMs equipped with advanced biometric authentication such as fingerprints and facial recognition along with mobile banking apps, enabling NFC technology, OTP authentication, and QR-code-based withdrawals.

Many banks are introducing advanced cardless ATMs to attract and retain their tech-savvy customers. One such example is the launch of Aadhaar-based biometric authentication for cardless ATM transactions by DCB Bank in October 2023. Moreover, some cardless ATMs support international transactions, making them appealing to global banking networking. This is expected to further fuel cardless ATM market growth. - Rising adoption of cardless ATM solutions post-COVID-19 Pandemic: Cardless transactions encrypt sensitive user data, offering higher security than conventional methods. Cardless ATMs use advanced security protocols such as OTPs, QR codes, and biometric authentication that help reduce the risks associated with card fraud. The demand for these cardless ATM solutions saw a sharp peak post-COVID-19 pandemic as a larger audience was introduced to digital banking. One such example is the launch of a cardless cash withdrawal facility through ATMs in August 2020 by Kotak Mahindra Bank.

Challenges

- Rising concerns about cybersecurity and compliance issues: Though cardless ATMs are rapidly gaining traction, issues associated with cybersecurity and compliance are expected to hamper overall market growth during the forecast period. The cardless ATMs are vulnerable to cyberattacks such as phishing, SIM-swapping, and unauthorized access to mobile banking accounts. In addition, different regions have different regulations concerning digital payments and banking security. This can slow the rollout of cardless ATM systems.

- High implementation costs: Transitioning to cardless ATM technology and system involves several cost-intensive factors which can be challenging for small to medium banks and financial institutions. This can limit the adoption of cardless ATM technology to a certain extent during the forecast period. In addition, many banks operate on legacy systems which can be incompatible with modern cardless technology. Thus, ensuring interoperability among banks and payment networks can add to the overall costs.

Cardless ATM Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.7% |

|

Base Year Market Size (2025) |

USD 3.34 billion |

|

Forecast Year Market Size (2035) |

USD 10.1 billion |

|

Regional Scope |

|

Cardless ATM Market Segmentation:

Technology Segment Analysis

Based on technology, the quick response (QR) codes segment is expected to account for the largest revenue share in cardless ATM market during the forecast period as QR codes are steadily becoming a crucial aspect of mobile payment technology. Rising demand for contactless payments, high adoption of smartphones that support QR code scanning and banking apps, and increasing integration of mobile banking apps with QR-based cardless withdrawals are expected to support segment growth between 2026 and 2035. Several banks and financial institutions across the globe are adopting seamless and innovative services to enhance user experience. For instance, in September 2023, the Bank of Baroda (BoB) announced the launch of a UPI ATM facility, enabling seamless QR-based cash withdrawals without the need to carry a card to withdraw cash.

End use Segment Analysis

In cardless ATM market, bank and financial institutions segment is set to account for revenue share of around 60.7% by 2035 owing to the rapid adoption of advanced technologies in several bank and financial institutions, increasing trend of contactless and cardless transactions post COVID-19 pandemic, and rising preference for cardless ATMs for improving customer convenience, security, and cost optimization. Several financial giants are integrating UPI, QR codes, and mobile baking apps to enable cardless cash withdrawals. One such example is the partnership between City Union Bank Limited and the National Payments Corporation of India (NPCI) in October 2023, to implement Interoperable Cardless Cash Withdrawal (ICCW) from ATM UPI in all NCR-branded ATMs.

Our in-depth analysis of the global cardless ATM market includes the following segments:

|

Type |

|

|

Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardless ATM Market Regional Analysis:

North America Market Insights

North America cardless ATM market is anticipated to hold revenue share of more than 47.8% by 2035. This growth can be significantly driven by rapid advancements in NFC biometric verification and QR technologies, increasing number of digital banking users, and the presence of robust infrastructure. Moreover, the presence of leading financial giants and tech companies and rising investments in developing advanced and innovative products and solutions are expected to boost growth of the cardless ATM market going ahead.

The integration of advanced technologies such as NFC, QR codes, and biometric authentication has made cardless ATMs secure and immensely popular among leading banks in the U.S. such as JPMorgan Chase, Bank of America, U.S. Bank, and Wells Fargo. In May 2016, Bank of America became the first major bank in North America to launch cardless ATMs and has over 500 cardless ATMs that work through the Android Pay smartphone app.

In Canada, rising adoption of mobile and digital payment methods, increasing investments in cardless ATM solutions by banks and financial institutions and rising installations of NFC and QR-code-enabled ATMs.

Asia Pacific Market Insights

The cardless ATM market in Asia Pacific is expected to register rapid revenue CAGR throughout the forecast period owing to the rapid adoption of mobile banking and payment solutions, increasing advancements in biometric authentication, NFC-enabled ATMS, and rising incorporation of cardless ATM solutions across banks and financial institutions. In addition, several governments in the region are supporting the cardless ATM market growth with digital payments and partnerships among banks and technology providers.

In India, the rising usage of the UPI system has become a major enabler for cardless ATM usage. Banks such as ICICI and HDFC have started offering cardless cash withdrawal options through mobile apps. In addition, the rapid adoption of digital payments across the country, government initiatives to support cardless ATMs, and rising investments in developing advanced products and solutions are expected to drive market growth in India.

The cardless ATM market in China is likely to account for significant growth during the forecast period owing to the rapid adoption of digital payments, rising integration with mobile payment platforms, and increasing consumer preference for cashless solutions. One such product launch is Hong Kong’s first cross-bank cardless withdrawal service by Joint Electronic Teller Services Limited (JETCO) in June 2020. This feature allows customers to withdraw cash instantly from any JETCO ATM by scanning the QR code.

Cardless ATM Market Players:

- Citigroup Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JPMorgan Chase & Co.

- Santander Group

- GRG Banking

- NCR Corporation

- HSBC Bank A.S.

- Wells Fargo

- Barclays Bank PLC

- ICICI Bank Ltd.

The cardless ATM market is quite competitive and to uplift their positions in the crowded space, leading companies are employing various organic and inorganic strategies. Technological innovations and new product launches are aiding them in marking a presence and standing out. Industry giants are collaborating with tech firms to integrate digital technologies. This aids them in attracting a wider consumer base and earning high profits. These key players are also adopting strategies such as mergers and acquisitions, product launches, joint ventures, and license agreements to enhance their product base and sustain their market position. Some of the key players operating in the cardless ATM market include:

Recent Developments

- In September 2024, Axis Bank announced the launch of a first-of-its-kind UPI-ATM for cardless cash withdrawals and deposits using UPI.

- In September 2023, Hitachi Payment Services in collaboration with the NPCI launched India’s first UPI-ATM at the Global Fintech Fest, enabling customers to withdraw cash without a card.

- Report ID: 6855

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cardless ATM Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.